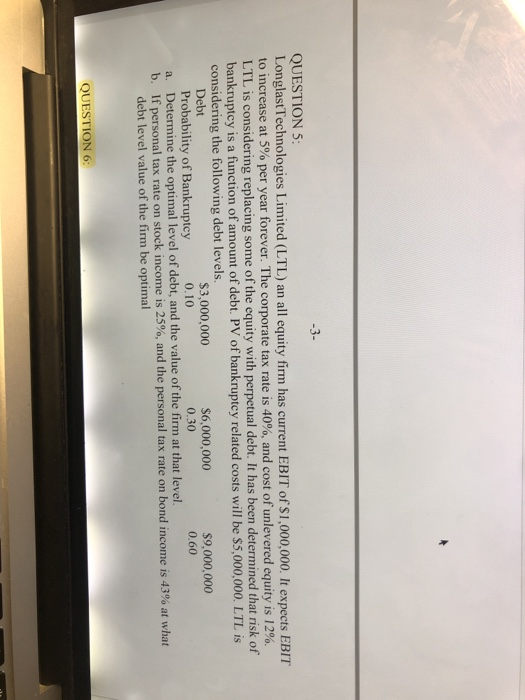

LonglastTechnologies Limited (LTL) an all equity firm has current EBIT of $1,000,000. It expects EBIT to increase at 5% per year forever. The corporate tax rate is 40%, and cost of unlevered equity is 12%.

LTL is considering replacing some of the equity with perpetual debt. It has been determined that risk of bankruptcy is a function of amount of debt. PV of bankruptcy related costs will be $5,000,000. LTL is considering the following debt levels.

Debt $3,000,000 $6,000,000 $9,000,000

Probability of Bankruptcy 0.10 0.30 0.60

a. Determine the optimal level of debt, and the value of the firm at that level.

b. If personal tax rate on stock income is 25%, and the personal tax rate on bond income is 43% at what debt level value of the firm be optimal

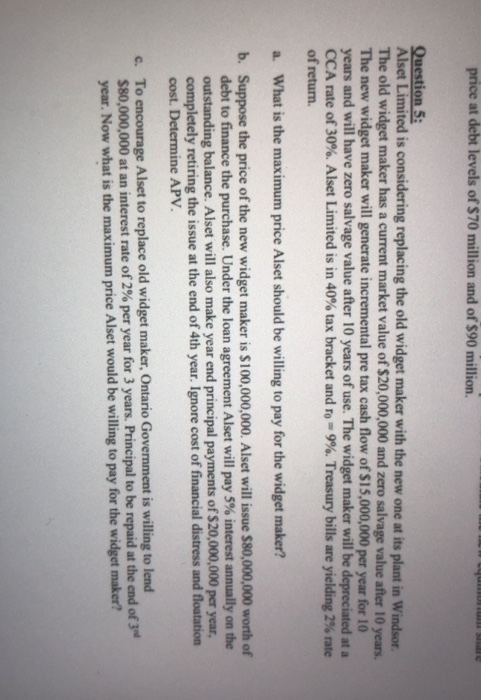

-3- QUESTION 5: Longlast Technologies Limited (LTL) an all equity firm has current EBIT of $1,000,000. It expects EBIT to increase at 5% per year forever. The corporate tax rate is 40%, and cost of unlevered equity is 12%. LTL is considering replacing some of the equity with perpetual debt. It has been determined that risk of bankruptcy is a function of amount of debt. PV of bankruptcy related costs will be $5,000,000. LTL is considering the following debt levels. Debt $3,000,000 $6,000,000 $9,000,000 Probability of Bankruptcy 0.10 0.30 0.60 a. Determine the optimal level of debt, and the value of the firm at that level. b. If personal tax rate on stock income is 25%, and the personal tax rate on bond income is 43% at what debt level value of the firm be optimal QUESTION 6: price at debt levels of $70 million and of $90 million. Question 5: Alset Limited is considering replacing the old widget maker with the new one at its plant in Windsor. The old widget maker has a current market value of $20,000,000 and zero salvage value after 10 years. The new widget maker will generate incremental pre tax cash flow of $15,000,000 per year for 10 years and will have zero salvage value after 10 years of use. The widget maker will be depreciated at a CCA rate of 30%. Alset Limited is in 40% tax bracket and to -9%. Treasury bills are yielding 2% rate of return. a. What is the maximum price Alset should be willing to pay for the widget maker? b. Suppose the price of the new widget maker is $100,000,000. Alset will issue $80,000,000 worth of debt to finance the purchase. Under the loan agreement Alset will pay 5% interest annually on the outstanding balance. Alset will also make year end principal payments of $20,000,000 per year, completely retiring the issue at the end of 4th year. Ignore cost of financial distress and floatation cost. Determine APV. c. To encourage Alset to replace old widget maker, Ontario Government is willing to lend $80,000,000 at an interest rate of 2% per year for 3 years. Principal to be repaid at the end of 30 year. Now what is the maximum price Alset would be willing to pay for the widget maker? -3- QUESTION 5: Longlast Technologies Limited (LTL) an all equity firm has current EBIT of $1,000,000. It expects EBIT to increase at 5% per year forever. The corporate tax rate is 40%, and cost of unlevered equity is 12%. LTL is considering replacing some of the equity with perpetual debt. It has been determined that risk of bankruptcy is a function of amount of debt. PV of bankruptcy related costs will be $5,000,000. LTL is considering the following debt levels. Debt $3,000,000 $6,000,000 $9,000,000 Probability of Bankruptcy 0.10 0.30 0.60 a. Determine the optimal level of debt, and the value of the firm at that level. b. If personal tax rate on stock income is 25%, and the personal tax rate on bond income is 43% at what debt level value of the firm be optimal QUESTION 6: price at debt levels of $70 million and of $90 million. Question 5: Alset Limited is considering replacing the old widget maker with the new one at its plant in Windsor. The old widget maker has a current market value of $20,000,000 and zero salvage value after 10 years. The new widget maker will generate incremental pre tax cash flow of $15,000,000 per year for 10 years and will have zero salvage value after 10 years of use. The widget maker will be depreciated at a CCA rate of 30%. Alset Limited is in 40% tax bracket and to -9%. Treasury bills are yielding 2% rate of return. a. What is the maximum price Alset should be willing to pay for the widget maker? b. Suppose the price of the new widget maker is $100,000,000. Alset will issue $80,000,000 worth of debt to finance the purchase. Under the loan agreement Alset will pay 5% interest annually on the outstanding balance. Alset will also make year end principal payments of $20,000,000 per year, completely retiring the issue at the end of 4th year. Ignore cost of financial distress and floatation cost. Determine APV. c. To encourage Alset to replace old widget maker, Ontario Government is willing to lend $80,000,000 at an interest rate of 2% per year for 3 years. Principal to be repaid at the end of 30 year. Now what is the maximum price Alset would be willing to pay for the widget maker