Answered step by step

Verified Expert Solution

Question

1 Approved Answer

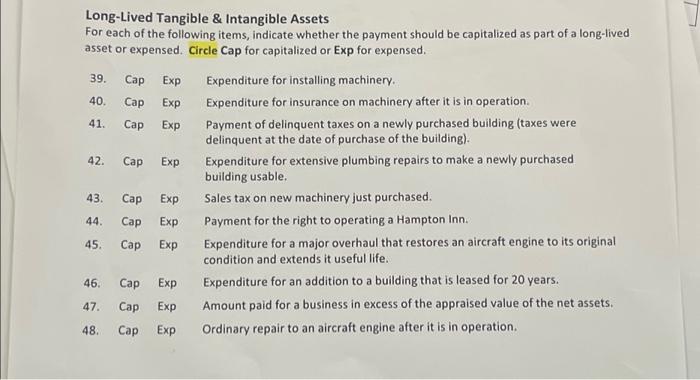

Long-Lived Tangible & Intangible Assets For each of the following items, indicate whether the payment should be capitalized as part of a long-lived asset or

Long-Lived Tangible & Intangible Assets For each of the following items, indicate whether the payment should be capitalized as part of a long-lived asset or expensed. Circle Cap for capitalized or Exp for expensed. 39. Cap Exp 40. Cap Exp 41. Cap Exp 42. Cap Exp 43. 44. 45. 46. 47. 48. Cap Exp Cap Exp Cap Exp Cap Exp Cap Exp Cap Exp Expenditure for installing machinery. Expenditure for insurance on machinery after it is in operation. Payment of delinquent taxes on a newly purchased building (taxes were delinquent at the date of purchase of the building). Expenditure for extensive plumbing repairs to make a newly purchased building usable. Sales tax on new machinery just purchased. Payment for the right to operating a Hampton Inn. Expenditure for a major overhaul that restores an aircraft engine to its original condition and extends it useful life. Expenditure for an addition to a building that is leased for 20 years. Amount paid for a business in excess of the appraised value of the net assets. Ordinary repair to an aircraft engine after it is in operation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started