Answered step by step

Verified Expert Solution

Question

1 Approved Answer

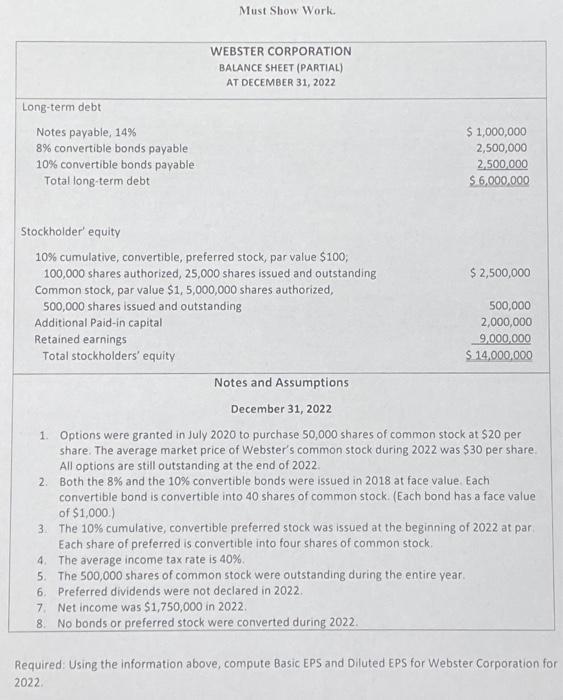

Long-term debt Notes payable, 14% 8% convertible bonds payable 10% convertible bonds payable Total long-term debt Must Show Work. WEBSTER CORPORATION BALANCE SHEET (PARTIAL)

Long-term debt Notes payable, 14% 8% convertible bonds payable 10% convertible bonds payable Total long-term debt Must Show Work. WEBSTER CORPORATION BALANCE SHEET (PARTIAL) AT DECEMBER 31, 2022 Stockholder' equity 10% cumulative, convertible, preferred stock, par value $100, 100,000 shares authorized, 25,000 shares issued and outstanding Common stock, par value $1, 5,000,000 shares authorized, 500,000 shares issued and outstanding Additional Paid-in capital Retained earnings Total stockholders' equity $ 1,000,000 2,500,000 2,500,000 $ 6,000,000 $ 2,500,000 500,000 2,000,000 9,000,000 $ 14,000,000 Notes and Assumptions December 31, 2022 1. Options were granted in July 2020 to purchase 50,000 shares of common stock at $20 per share. The average market price of Webster's common stock during 2022 was $30 per share. All options are still outstanding at the end of 2022. 4. The average income tax rate is 40%. 5. The 500,000 shares of common stock were outstanding during the entire year. 6. Preferred dividends were not declared in 2022. 7. Net income was $1,750,000 in 2022. 8. No bonds or preferred stock were converted during 2022. 2. Both the 8% and the 10% convertible bonds were issued in 2018 at face value. Each convertible bond is convertible into 40 shares of common stock. (Each bond has a face value of $1,000.) 3. The 10% cumulative, convertible preferred stock was issued at the beginning of 2022 at par Each share of preferred is convertible into four shares of common stock. Required: Using the information above, compute Basic EPS and Diluted EPS for Webster Corporation for 2022.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Basic Earnings Per Share EPS Basic EPS is calculated using the weighted average number of common sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started