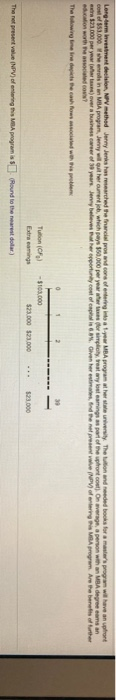

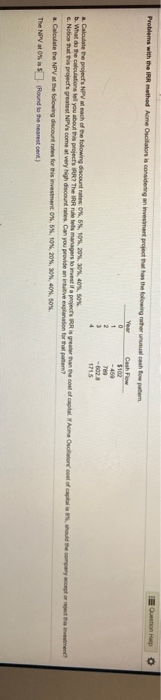

Long-term investment decision, NPV method Jerry Jenks searched the financial pros and cons of entering into your MBA program the state university Theuton and readed books for a master's program will have an upfront cost of $50.000. We are in an MA programs, ev terment which 150.000 per year for simply reatory lost aming part of the front out). On a person with an MBA degree carns an er $23.000 per year wherever a bushes care of yours. Je believes reportinycost of capris. Given here in the net vente y ofrering Arm Are the benefits of further action worth the sido Theewing te ned the chose who O 2 - $100.000 $23.000 $23.000 Extra canings $23.000 The represent Value NPV) of entering the programi (Round to the nearest dollar) Problems with the IRR method Acme Oscillators is considering an investment project that has the following the usual cash flow putem Question Year Cash Flow 0 $102 1 7 3 -6033 1715 a. Calculate the projects NPV teach of the following discount rates 0%, 6%, 10% 20% 30% 40% 50% b. What do the calculations tol you about this projects IR? The IRR tells managers to investir c. Notice that this project's greatest NPVs.com at very high discountries. Can you provide an intuitive explanation for them? Rise than the cost of capital Teme Otors' cost of capital is should the company color this ret? a. Calculate the NPV at the following discount rates for this investment 0.0%, 10% 20% 30% 40% 50% The NPV at 0% (Round to the nearestent) Long-term investment decision, NPV method Jerry Jenks searched the financial pros and cons of entering into your MBA program the state university Theuton and readed books for a master's program will have an upfront cost of $50.000. We are in an MA programs, ev terment which 150.000 per year for simply reatory lost aming part of the front out). On a person with an MBA degree carns an er $23.000 per year wherever a bushes care of yours. Je believes reportinycost of capris. Given here in the net vente y ofrering Arm Are the benefits of further action worth the sido Theewing te ned the chose who O 2 - $100.000 $23.000 $23.000 Extra canings $23.000 The represent Value NPV) of entering the programi (Round to the nearest dollar) Problems with the IRR method Acme Oscillators is considering an investment project that has the following the usual cash flow putem Question Year Cash Flow 0 $102 1 7 3 -6033 1715 a. Calculate the projects NPV teach of the following discount rates 0%, 6%, 10% 20% 30% 40% 50% b. What do the calculations tol you about this projects IR? The IRR tells managers to investir c. Notice that this project's greatest NPVs.com at very high discountries. Can you provide an intuitive explanation for them? Rise than the cost of capital Teme Otors' cost of capital is should the company color this ret? a. Calculate the NPV at the following discount rates for this investment 0.0%, 10% 20% 30% 40% 50% The NPV at 0% (Round to the nearestent)