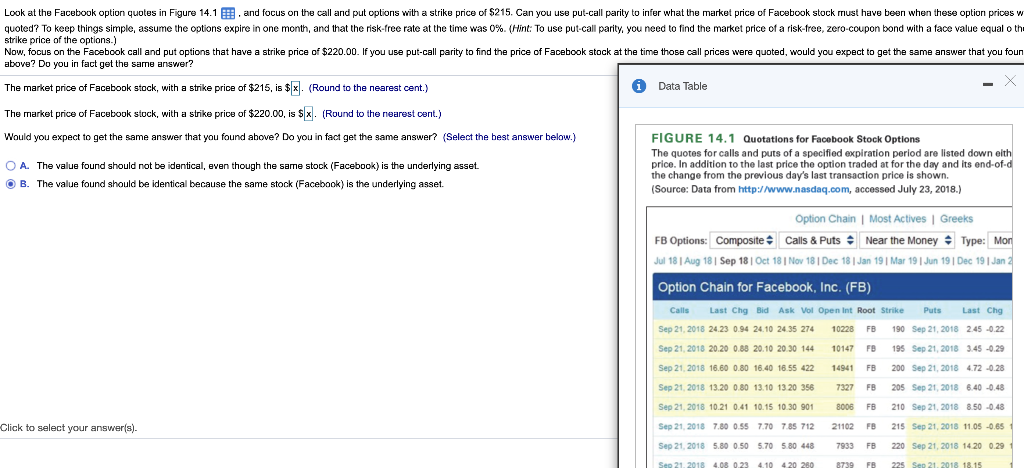

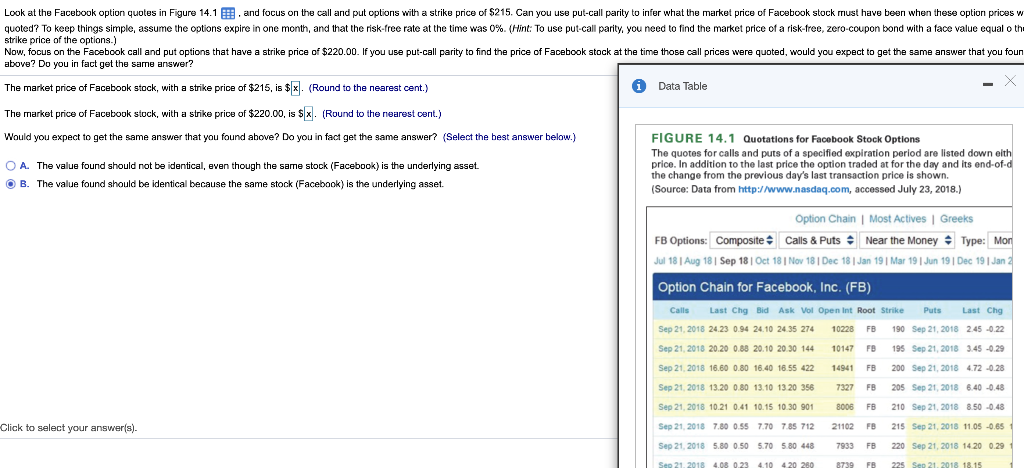

Look at the Facebook option quotes in Figure 14.1 B. and focus on the call and put options with a strike price of $215. Can you use put-call parity to infer what the market price of Facebook stock must have been when these option prices w quoted? To keep things simple, assume the options expire in one month, and that the risk-free rate at the time was 0%(Hint: To use put-call parity, you need to find the market price of a risk-free, zero-coupon bond with a face value equal o th strike price of the options.) Now, focus on the Facebook call and put options that have a strike price of $220.00. If you use put-call parity to find the price of Facebook stock at the time those call prices were quoted, would you expect to get the same answer that you foun above? Do you in fact get the same answer? The market price of Facebook stock, with a strike price of $215, is $x. (Round to the nearest cent.) i Data Table The market price of Facebook stock, with a strike price of $220.00, is $x. (Round to the nearest cent.) Would you expect to get the same answer that you found above? Do you in fact get the same answer? (Select the best answer below.) FIGURE 14.1 Quotations for Facebook Stock Options The quotes for calls and puts of a specified expiration period are listed down eith O A. The value found should not be identical, even though the same stock (Facebook) is the underlying asset price. In addition to the last price the option traded at for the day and its end-of-d the change from the previous day's last transaction price is shown. B. The value found should be identical because the same stock (Facebook) is the underlying asset. (Source: Data from http://www.nasdaq.com, accessed July 23, 2018.) Option Chain Most Actives Greeks FB Options: Composite Calls & Puts Near the Money Type: Mon Jul 18 Aug 18 Sep 18 Oct 18 Nov 18 Dec 18 Jan 19 Mar 19 Jun 19 Dec 19 Jan 2 Option Chain for Facebook, Inc. (FB) Calls Last Chg Bid Ask Vol Open Int Root Strike Puts Last Chg Sep 21, 2018 24.23 0.94 24.10 24 35 274 10228 FB 190 Sep 21, 2018 245 -0.22 Sep 21, 2018 20.20 0.88 20.10 20 30 144 10147 FB 195 Sep 21, 2018 3.45 -0.29 Sep 21, 2018 16.60 0.80 16.40 16.55 422 14941 FB 200 Sep 21, 2018 4.72 -0.28 Sep 21, 2018 13.20 0.80 13.10 13.20 356 7327 FB 205 Sep 21, 2018 6.40 -0.48 Sep 21, 2018 10.21 0.41 10.15 10.30 901 8006 FB 210 Sep 21, 2018 8.50 -0.48 Click to select your answer(s). Sep 21, 2018 7.80 0.55 7.70 7.85 712 21102 FB 215 Sep 21, 2018 11.05 -0.65 Sep 21, 2018 5.80 0.50 5.70 5.80 448 7933 FB 220 Sep 21, 2018 14 20 0.29 Sep 21, 2018 4.08 0.23 4.10 4.20 280 8739 FB 225 Sep 21, 2018 18.15