look at these reports on Capsim and Identify market dependence for each of the competing teams.

look at these reports on Capsim and Identify market dependence for each of the competing teams.

My team is Ferris and competing teams are named: Andrews, Baldwin, Chester, Digby, Erie

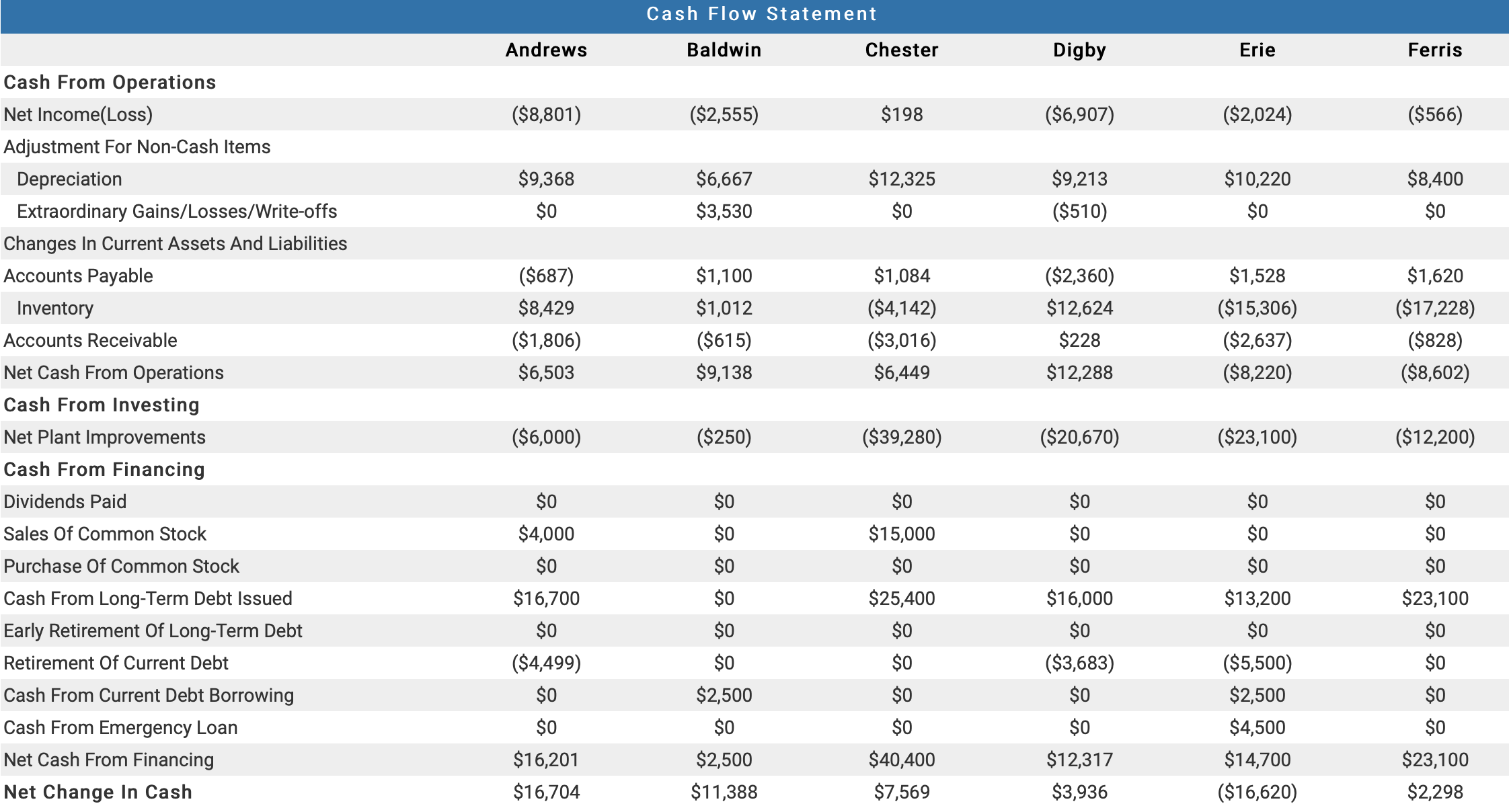

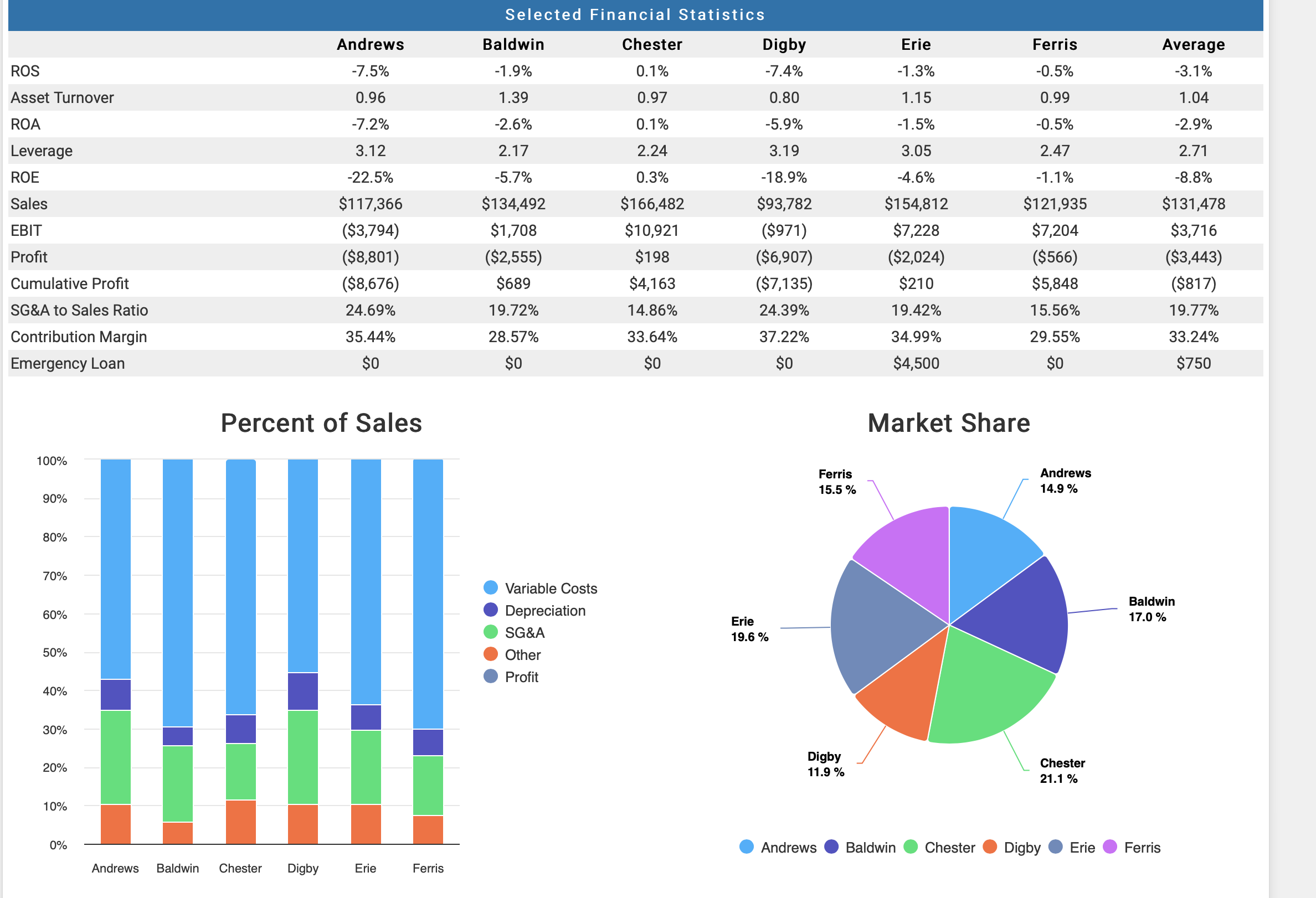

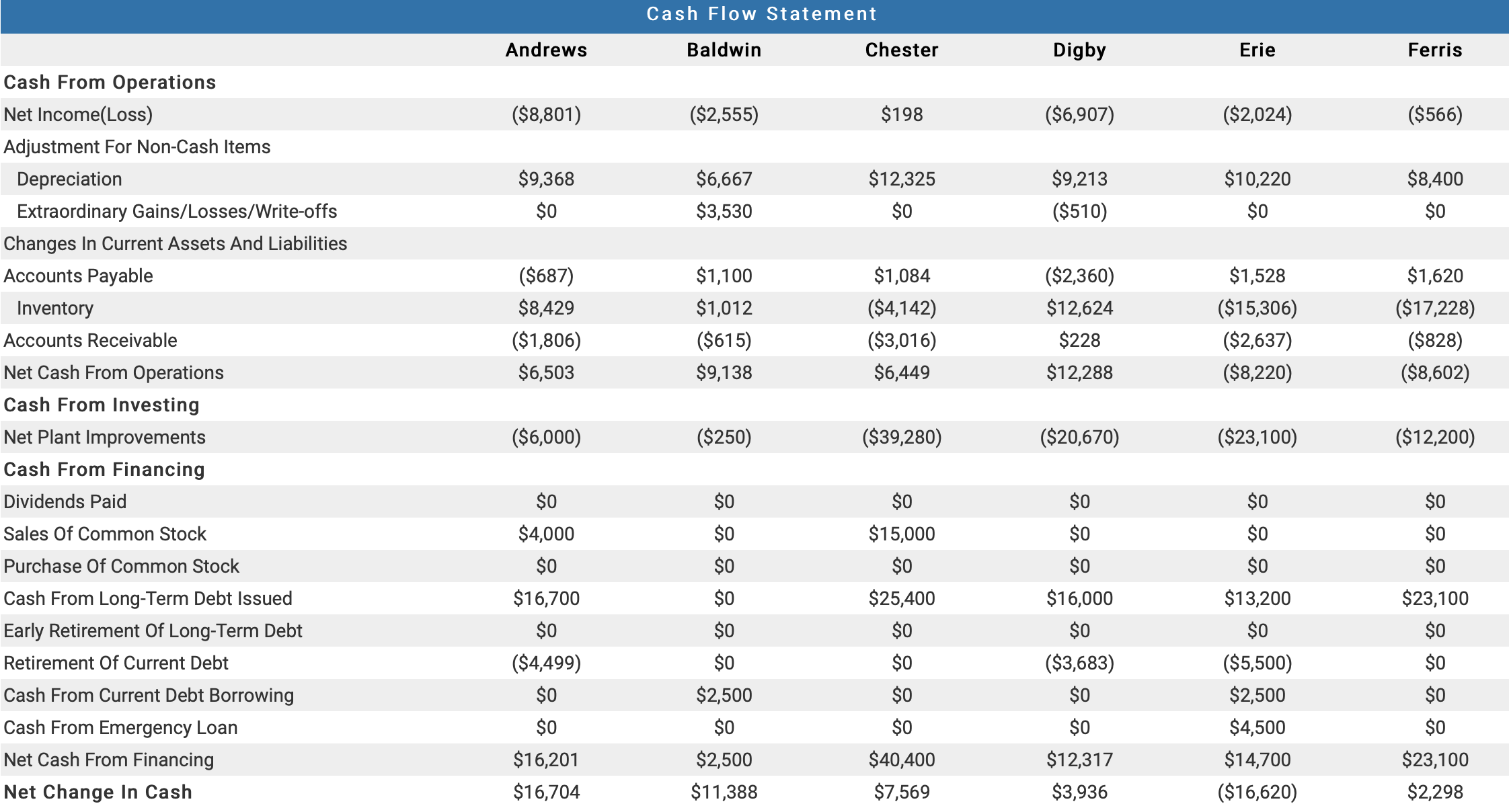

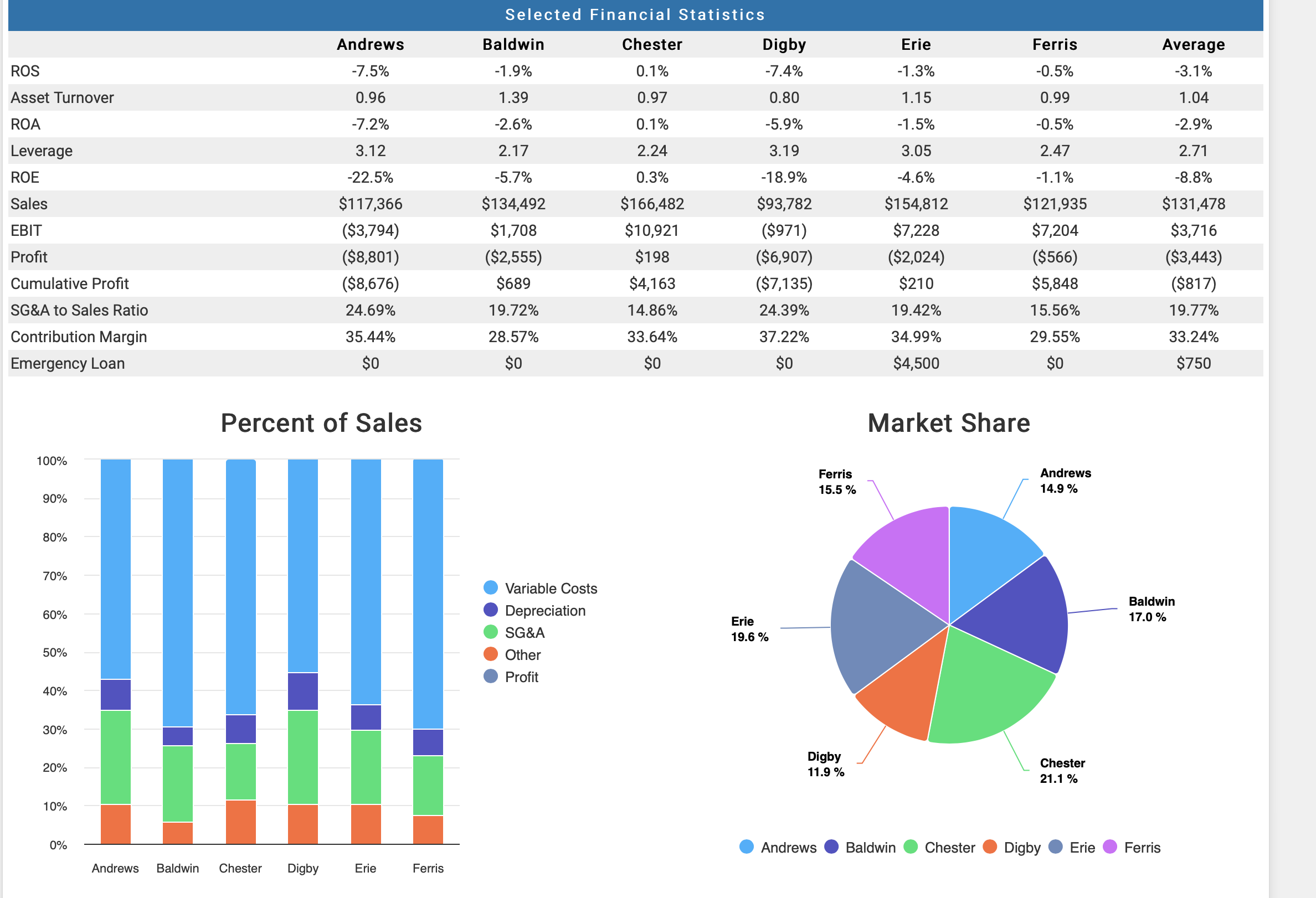

Market Share ssts in Andrews Baldwin Chester Digby Erie Ferris \begin{tabular}{|c|c|c|c|c|c|c|} \hline & Andrews & Baldwin & Chester & Digby & Erie & Ferris \\ \hline \multicolumn{7}{|l|}{ Cash From Operations } \\ \hline Net Income(Loss) & ($8,801) & ($2,555) & $198 & ($6,907) & ($2,024) & ($566) \\ \hline \multicolumn{7}{|l|}{ Adjustment For Non-Cash Items } \\ \hline Depreciation & $9,368 & $6,667 & $12,325 & $9,213 & $10,220 & $8,400 \\ \hline Extraordinary Gains/Losses/Write-offs & $0 & $3,530 & $0 & ($510) & $0 & $0 \\ \hline \multicolumn{7}{|l|}{ Changes In Current Assets And Liabilities } \\ \hline Accounts Payable & ($687) & $1,100 & $1,084 & ($2,360) & $1,528 & $1,620 \\ \hline Inventory & $8,429 & $1,012 & ($4,142) & $12,624 & ($15,306) & ($17,228) \\ \hline Accounts Receivable & ($1,806) & ($615) & ($3,016) & $228 & ($2,637) & ($828) \\ \hline Net Cash From Operations & $6,503 & $9,138 & $6,449 & $12,288 & ($8,220) & ($8,602) \\ \hline \multicolumn{7}{|l|}{ Cash From Investing } \\ \hline Net Plant Improvements & ($6,000) & ($250) & ($39,280) & ($20,670) & ($23,100) & ($12,200) \\ \hline \multicolumn{7}{|l|}{ Cash From Financing } \\ \hline Sales Of Common Stock & $4,000 & $0 & $15,000 & $0 & $0 & $0 \\ \hline Purchase Of Common Stock & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline Cash From Long-Term Debt Issued & $16,700 & $0 & $25,400 & $16,000 & $13,200 & $23,100 \\ \hline Early Retirement Of Long-Term Debt & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline Retirement Of Current Debt & ($4,499) & $0 & $0 & ($3,683) & ($5,500) & $0 \\ \hline Cash From Current Debt Borrowing & $0 & $2,500 & $0 & $0 & $2,500 & $0 \\ \hline Cash From Emergency Loan & $0 & $0 & $0 & $0 & $4,500 & $0 \\ \hline Net Cash From Financing & $16,201 & $2,500 & $40,400 & $12,317 & $14,700 & $23,100 \\ \hline Net Change In Cash & $16,704 & $11,388 & $7,569 & $3,936 & ($16,620) & $2,298 \\ \hline \end{tabular} Market Share ssts in Andrews Baldwin Chester Digby Erie Ferris \begin{tabular}{|c|c|c|c|c|c|c|} \hline & Andrews & Baldwin & Chester & Digby & Erie & Ferris \\ \hline \multicolumn{7}{|l|}{ Cash From Operations } \\ \hline Net Income(Loss) & ($8,801) & ($2,555) & $198 & ($6,907) & ($2,024) & ($566) \\ \hline \multicolumn{7}{|l|}{ Adjustment For Non-Cash Items } \\ \hline Depreciation & $9,368 & $6,667 & $12,325 & $9,213 & $10,220 & $8,400 \\ \hline Extraordinary Gains/Losses/Write-offs & $0 & $3,530 & $0 & ($510) & $0 & $0 \\ \hline \multicolumn{7}{|l|}{ Changes In Current Assets And Liabilities } \\ \hline Accounts Payable & ($687) & $1,100 & $1,084 & ($2,360) & $1,528 & $1,620 \\ \hline Inventory & $8,429 & $1,012 & ($4,142) & $12,624 & ($15,306) & ($17,228) \\ \hline Accounts Receivable & ($1,806) & ($615) & ($3,016) & $228 & ($2,637) & ($828) \\ \hline Net Cash From Operations & $6,503 & $9,138 & $6,449 & $12,288 & ($8,220) & ($8,602) \\ \hline \multicolumn{7}{|l|}{ Cash From Investing } \\ \hline Net Plant Improvements & ($6,000) & ($250) & ($39,280) & ($20,670) & ($23,100) & ($12,200) \\ \hline \multicolumn{7}{|l|}{ Cash From Financing } \\ \hline Sales Of Common Stock & $4,000 & $0 & $15,000 & $0 & $0 & $0 \\ \hline Purchase Of Common Stock & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline Cash From Long-Term Debt Issued & $16,700 & $0 & $25,400 & $16,000 & $13,200 & $23,100 \\ \hline Early Retirement Of Long-Term Debt & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline Retirement Of Current Debt & ($4,499) & $0 & $0 & ($3,683) & ($5,500) & $0 \\ \hline Cash From Current Debt Borrowing & $0 & $2,500 & $0 & $0 & $2,500 & $0 \\ \hline Cash From Emergency Loan & $0 & $0 & $0 & $0 & $4,500 & $0 \\ \hline Net Cash From Financing & $16,201 & $2,500 & $40,400 & $12,317 & $14,700 & $23,100 \\ \hline Net Change In Cash & $16,704 & $11,388 & $7,569 & $3,936 & ($16,620) & $2,298 \\ \hline \end{tabular}

look at these reports on Capsim and Identify market dependence for each of the competing teams.

look at these reports on Capsim and Identify market dependence for each of the competing teams.