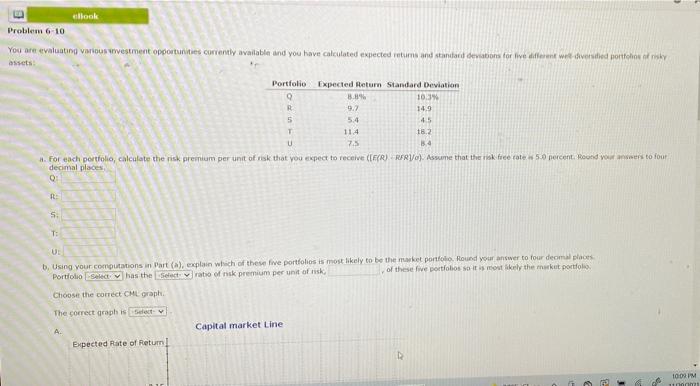

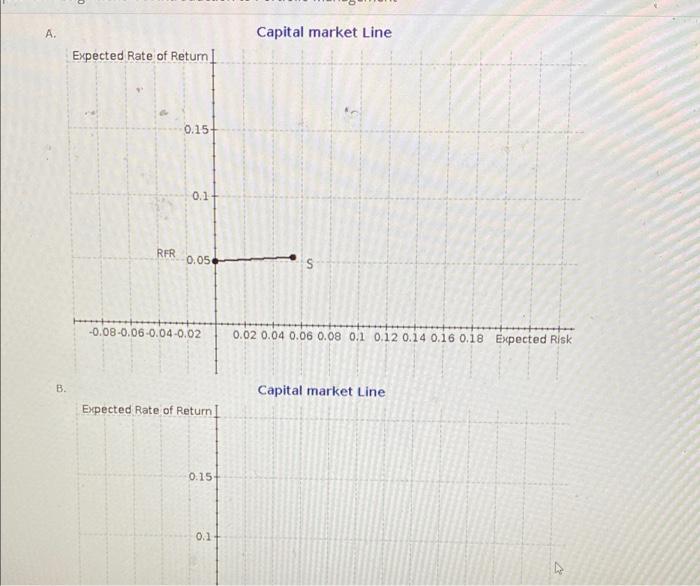

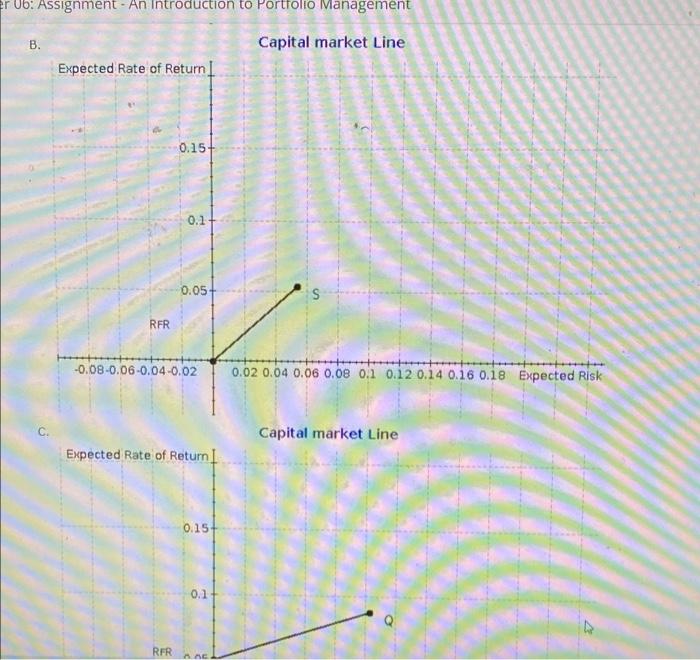

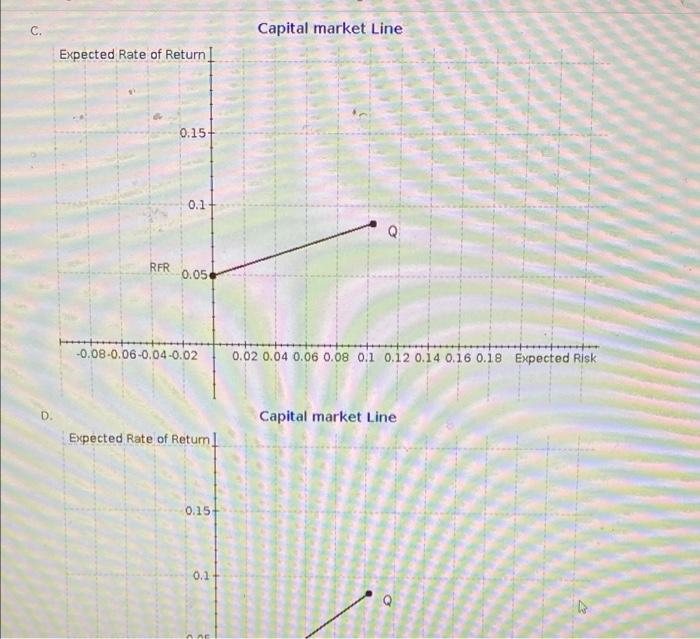

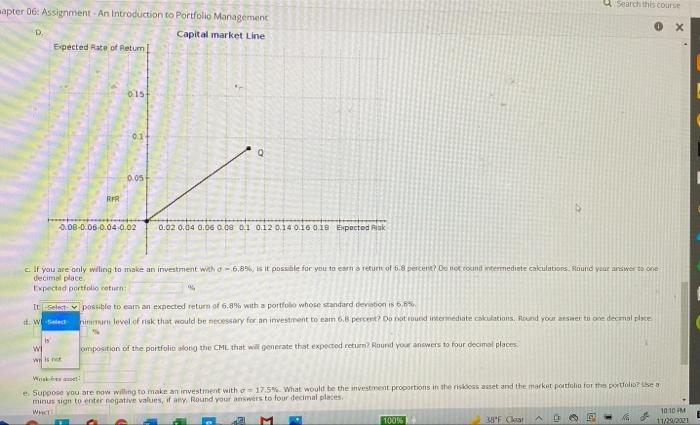

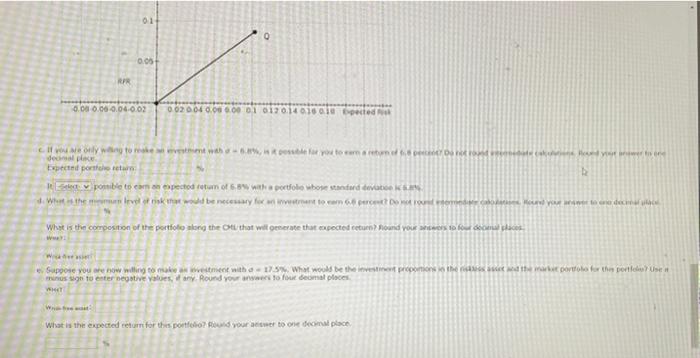

look Problem 6-10 You are evaluating various westment opportunities corrently available and you have calculated expected returns and standard deviations for five different wat versied northos frisky Portfolio Expected Return Standard Deviation 8.8% 10:39 R -9.2 14.9 5 5.4 45 11.4 18.2 U 75 5.4 #. For each portfolio, calculate the risk premium per unit of risk that you expect to receive (CR) WR). Assume that the risk free rate 50 percent. Round your newers to four decimal places 03 It S: T: U b. Using your computations in Part(), explain which of these five portfolios is most likely to be the market portfolio Round your answer to four deomal places Portfolio Select has the select ratio of nisk premium per unit of risk of these five portfolios sritis most likely the market portfolio Choose the correct CML graph The correct graph is see Capital market Line A. Expected Rate of Retum! 100 PM A Capital market Line Expected Rate of Return 0.15 0.1 RFR 0.05 S -0.08-0.06-0.04-0.02 0.02 0.04 0.06 0.08 0.1 0.12 0.14 0.16 0.18 Expected Risk B. Capital market Line Expected Rate of Return 0.15 0.1 er Ub: Assignment - An Introduction to Portfolio Management B. Capital market Line Expected Rate of Return 0.15 0.1 0.05+ RFR -0.08-0.06-0.04-0.02 0.02 0.04 0.06 0.08 0.1 0.12 0.14 0.16 0.18 Expected Risk Capital market Line Expected Rate of Return 0.15 0.1 RFR C. Capital market Line Expected Rate of Return 0.15 0.1 RFR 0.05 -0.08-0.06-0.04-0.02 0.02 0.04 0.06 0.08 0.1 0.12 0.14 0.16 0.18 Expected Risk D. Capital market Line Expected Rate of Return! 0.15 0.1 Search this course apter 06: Assignment - An Introduction to Portfolio Management D Capital market Line Expected Rate of Retum X 0.15 01 0.05 RFR 0.08-0.06 0.04 0.02 0.02 0.04 0.06 0.08 0.1 0.12 0.14 0.16 0.18 Expected Risk cflf you are only willing to make an investment with a -6,8% it possible for you to earn a return of 6.8 percent? Do not cound intermediate calculations. Round your answer to one decimal place Expectad portfolio rotu: IL Select possible to earn an expected return of 6.8% with a portfolio whose standard deviation 16.6% WS umum level of risk that would be necessary for an investment to eam 6.8 percent? Do not found intermediate caktions. Round your answer to one decepce 15 WI Wine omposition of the portfolio Blog the CML that will generate that expected retur Round your answers to four decimal places Wisk e. Suppose you are now willing to make an investment with 17.5%. What would be the investiment proportions in the risks asset and the market portfolio for the portfolio minus sign to enter negative values, if any Round your answers to four decimal places WA 100% 38' Ca . M 10 10 M 11:21 01 0.05 RR 0.00 0.00 0.04.0.02 002 004 0.00 0.00 01 0170.14 015 010 bedied can torbe vehet make you to com a mesma Expected portret w pomible to earn anpecto return of 6,8w with a portfolio Wbor stafard deviato What is the membevel of risk me woud be necessary fox rivestreant to compercent on toonde wow you to decoration What is the composition of the portfolio sborg the Ot that will generate that expected return) Round your earns to God became clocos W Suppose you are now welling to make a westent with a 17. What would be investment proportions with port for the port Us nos sign to enter negative values any. Round your to fout deomal places Web What is the expected return for this portfolio Round your toon doma place