Answered step by step

Verified Expert Solution

Question

1 Approved Answer

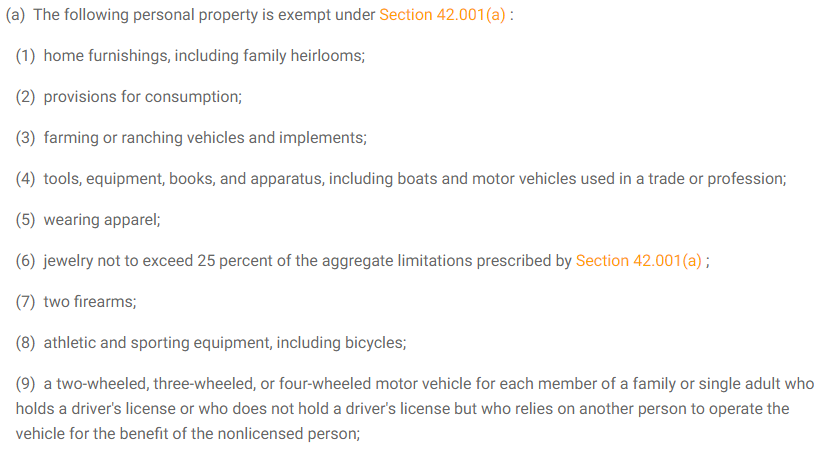

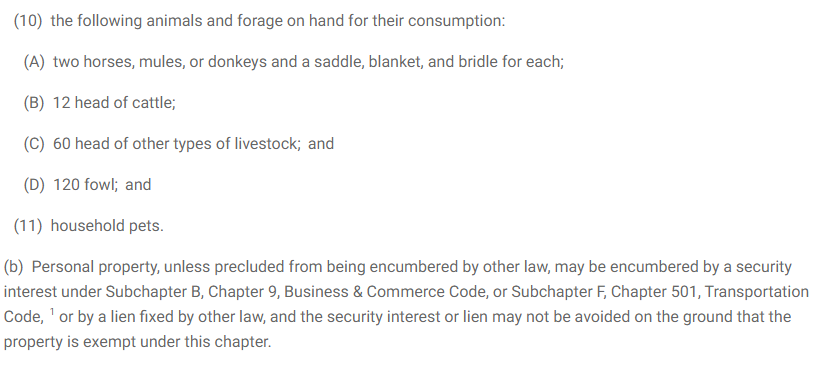

Look under Texas Property Code Section 42.002 (go to findlaw.com to find the Texas statutes). and determine if your answer would change under Texas law.

Look under Texas Property Code Section 42.002 (go to findlaw.com to find the Texas statutes). and determine if your answer would change under Texas law.

I have provided the code down below

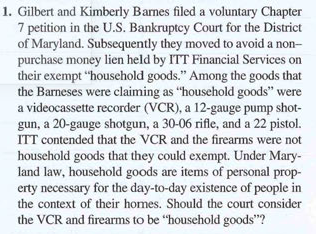

1. Gilbert and Kimberly Bames filed a voluntary Chapter 7 petition in the U.S. Bankruptcy Court for the District of Maryland. Subsequently they moved to avoid a non- purchase money lien held by ITT Financial Services on their exempt "household goods." Among the goods that the Barneses were claiming as "household goods" were a videocassette recorder (VCR), a 12-gauge pump shot- gun, a 20-gauge shotgun, a 30-06 rifle, and a 22 pistol. ITT contended that the VCR and the firearms were not household goods that they could exempt. Under Mary- land law, household goods are items of personal prop- erty necessary for the day-to-day existence of people in the context of their homes. Should the court consider the VCR and firearms to be "household goods"? (a) The following personal property is exempt under Section 42.001(a): (1) home furnishings, including family heirlooms; (2) provisions for consumption; (3) farming or ranching vehicles and implements; (4) tools, equipment, books, and apparatus, including boats and motor vehicles used in a trade or profession; (5) wearing apparel; (6) jewelry not to exceed 25 percent of the aggregate limitations prescribed by Section 42.001(a); (7) two firearms; (8) athletic and sporting equipment, including bicycles; (9) a two-wheeled, three-wheeled, or four-wheeled motor vehicle for each member of a family or single adult who holds a driver's license or who does not hold a driver's license but who relies on another person to operate the vehicle for the benefit of the nonlicensed person; (10) the following animals and forage on hand for their consumption: (A) two horses, mules, or donkeys and a saddle, blanket, and bridle for each; (B) 12 head of cattle; (C) 60 head of other types of livestock; and (D) 120 fowl; and (11) household pets. (b) Personal property, unless precluded from being encumbered by other law, may be encumbered by a security interest under Subchapter B, Chapter 9, Business & Commerce Code, or Subchapter F, Chapter 501, Transportation Code, ' or by a lien fixed by other law, and the security interest or lien may not be avoided on the ground that the property is exempt under this chapter. 1. Gilbert and Kimberly Bames filed a voluntary Chapter 7 petition in the U.S. Bankruptcy Court for the District of Maryland. Subsequently they moved to avoid a non- purchase money lien held by ITT Financial Services on their exempt "household goods." Among the goods that the Barneses were claiming as "household goods" were a videocassette recorder (VCR), a 12-gauge pump shot- gun, a 20-gauge shotgun, a 30-06 rifle, and a 22 pistol. ITT contended that the VCR and the firearms were not household goods that they could exempt. Under Mary- land law, household goods are items of personal prop- erty necessary for the day-to-day existence of people in the context of their homes. Should the court consider the VCR and firearms to be "household goods"? (a) The following personal property is exempt under Section 42.001(a): (1) home furnishings, including family heirlooms; (2) provisions for consumption; (3) farming or ranching vehicles and implements; (4) tools, equipment, books, and apparatus, including boats and motor vehicles used in a trade or profession; (5) wearing apparel; (6) jewelry not to exceed 25 percent of the aggregate limitations prescribed by Section 42.001(a); (7) two firearms; (8) athletic and sporting equipment, including bicycles; (9) a two-wheeled, three-wheeled, or four-wheeled motor vehicle for each member of a family or single adult who holds a driver's license or who does not hold a driver's license but who relies on another person to operate the vehicle for the benefit of the nonlicensed person; (10) the following animals and forage on hand for their consumption: (A) two horses, mules, or donkeys and a saddle, blanket, and bridle for each; (B) 12 head of cattle; (C) 60 head of other types of livestock; and (D) 120 fowl; and (11) household pets. (b) Personal property, unless precluded from being encumbered by other law, may be encumbered by a security interest under Subchapter B, Chapter 9, Business & Commerce Code, or Subchapter F, Chapter 501, Transportation Code, ' or by a lien fixed by other law, and the security interest or lien may not be avoided on the ground that the property is exempt under this chapter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started