Answered step by step

Verified Expert Solution

Question

1 Approved Answer

looking at above case. can any one please help me with the following. Discuss which costs are relevant for the evaluation of this project and

looking at above case. can any one please help me with the following.

- Discuss which costs are relevant for the evaluation of this project and which costs are not. Your discussion should be justified by a valid argument and supported by references to appropriate sources

- How are possible cannibalization and opportunity costs considered in this analysis?

- Determine the initial investment cash flow.

- Estimate all cash flows associated with the project over 5 years. It is assumed that where relevant, capital expenditures and marketing costs are expended throughout the year, while cash flows relating to revenue and operating costs occur at the end of the year. You will need to broadly describe the method used for determining those cash flows.

- Calculate the projects payback period. Assuming the business could be sold at the end of the five years for $1 million. This figure includes the value of the car fleet, premises and capital gain from the business. Ignore any possible tax consequences of selling the business and also ignore the time value of money for this particular calculation. Briefly comment on your results

- Estimate the Net present value (NPV) of the project, assuming that the initial investment could be sold at the end of the five years for $1 million. This figure includes the value of the car fleet, premises and capital gain from the business. Ignore any possible tax consequences of selling the business. Briefly comment on your results and make appropriate remarks on the assumptions made for these calculations if necessary.

- Using sensitivity analysis, recalculate NPV using the scenario of a decrease in project sales by 10% annually. Briefly comment on your results.

In view of your answer to Point 5 to point 7 above, advise TMRs management as to whether they should go ahead with the investment project. In your recommendations, you may wish to suggest possible refinements in the method used for evaluating this project.

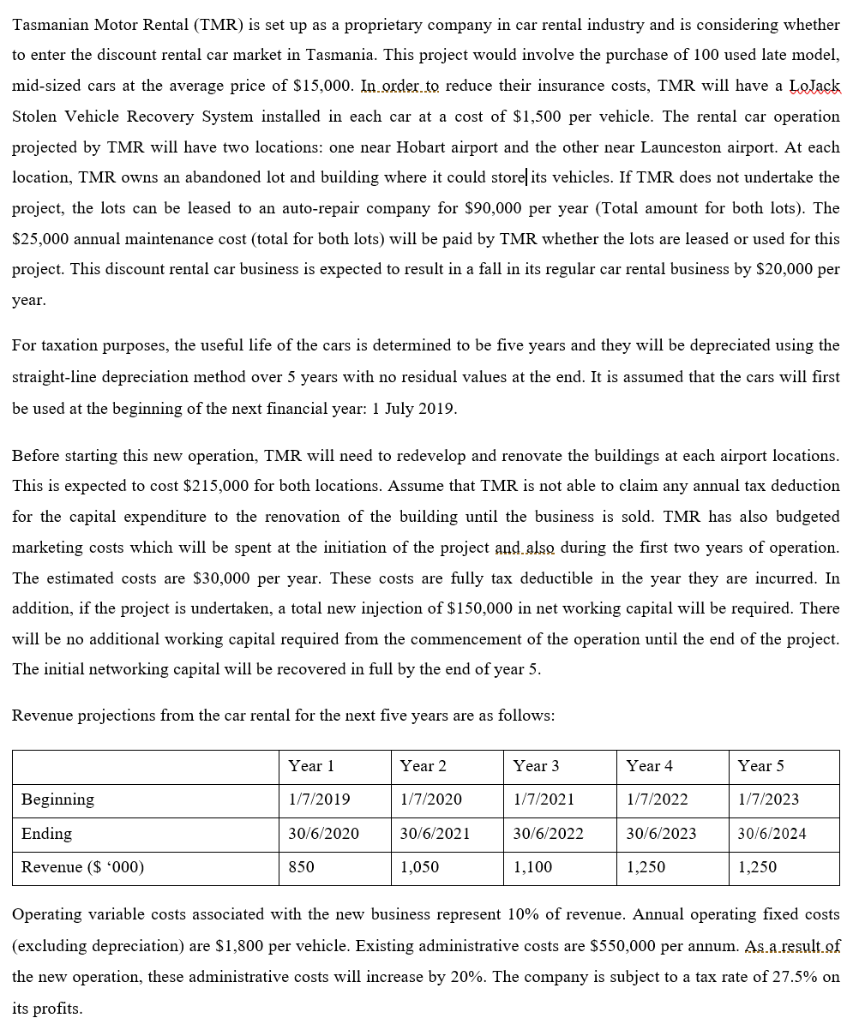

Tasmanian Motor Rental (TMR) is set up as a proprietary company in car rental industry and is considering whether to enter the discount rental car market in Tasmania. This project would involve the purchase of 100 used late model, mid-sized cars at the average price of S15,000. In.order.to reduce their insurance costs, TMR will have a Lolack Stolen Vehicle Recovery System installed in each car at a cost of $1,500 per vehicle. The rental car operation projected by TMR will have two locations: one near Hobart airport and the other near Launceston airport. At each location, TMR owns an abandoned lot and building where it could storel its vehicles. If TMR does not undertake the project, the lots can be leased to an auto-repair company for $90,000 per year (Total amount for both lots). The S25,000 annual maintenance cost (total for both lots) will be paid by TMR whether the lots are leased or used for this project. This discount rental car business is expected to result in a fall in its regular car rental business by $20,000 per vear For taxation purposes, the useful life of the cars is determined to be five years and they will be depreciated using the straight-line depreciation method over 5 years with no residual values at the end. It is assumed that the cars will first be used at the beginning of the next financial year: 1 July 2019 Before starting this new operation, TMR will need to redevelop and renovate the buildings at each airport locations This is expected to cost $215,000 for both locations. Assume that TMR is not able to claim any annual tax deduction for the capital expenditure to the renovation of the building until the business is sold. TMR has also budgeted marketing costs which will be spent at the initiation of the project and also during the first two years of operation. The estimated costs are $30,000 per year. These costs are fully tax deductible in the year they are incurred. In addition, if the project is undertaken, a total new injection of $150,000 in net working capital will be required. There will be no additional working capital required from the commencement of the operation until the end of the project. The initial networking capital will be recovered in full by the end of year 5 Revenue projections from the car rental for the next five years are as follows Year 1 Year 2 Year 3 Year 4 Year 5 1/7/2019 1/7/202 1/7/2021 1/7/2022 1/7/2023 Beginning 30/6/2021 30/6/2022 30/6/2020 30/6/2023 30/6/2024 Ending Revenue (S '000) 850 1,050 1,100 1,250 1,250 Operating variable costs associated with the new business represent 10% of revenue. Annual operating fixed costs (excluding depreciation) are $1,800 per vehicle. Existing administrative costs are $550,000 per annum. As.a.result of the new operation, these administrative costs will increase by 20%. The company is subject to a tax rate of 27.5% on its profits Tasmanian Motor Rental (TMR) is set up as a proprietary company in car rental industry and is considering whether to enter the discount rental car market in Tasmania. This project would involve the purchase of 100 used late model, mid-sized cars at the average price of S15,000. In.order.to reduce their insurance costs, TMR will have a Lolack Stolen Vehicle Recovery System installed in each car at a cost of $1,500 per vehicle. The rental car operation projected by TMR will have two locations: one near Hobart airport and the other near Launceston airport. At each location, TMR owns an abandoned lot and building where it could storel its vehicles. If TMR does not undertake the project, the lots can be leased to an auto-repair company for $90,000 per year (Total amount for both lots). The S25,000 annual maintenance cost (total for both lots) will be paid by TMR whether the lots are leased or used for this project. This discount rental car business is expected to result in a fall in its regular car rental business by $20,000 per vear For taxation purposes, the useful life of the cars is determined to be five years and they will be depreciated using the straight-line depreciation method over 5 years with no residual values at the end. It is assumed that the cars will first be used at the beginning of the next financial year: 1 July 2019 Before starting this new operation, TMR will need to redevelop and renovate the buildings at each airport locations This is expected to cost $215,000 for both locations. Assume that TMR is not able to claim any annual tax deduction for the capital expenditure to the renovation of the building until the business is sold. TMR has also budgeted marketing costs which will be spent at the initiation of the project and also during the first two years of operation. The estimated costs are $30,000 per year. These costs are fully tax deductible in the year they are incurred. In addition, if the project is undertaken, a total new injection of $150,000 in net working capital will be required. There will be no additional working capital required from the commencement of the operation until the end of the project. The initial networking capital will be recovered in full by the end of year 5 Revenue projections from the car rental for the next five years are as follows Year 1 Year 2 Year 3 Year 4 Year 5 1/7/2019 1/7/202 1/7/2021 1/7/2022 1/7/2023 Beginning 30/6/2021 30/6/2022 30/6/2020 30/6/2023 30/6/2024 Ending Revenue (S '000) 850 1,050 1,100 1,250 1,250 Operating variable costs associated with the new business represent 10% of revenue. Annual operating fixed costs (excluding depreciation) are $1,800 per vehicle. Existing administrative costs are $550,000 per annum. As.a.result of the new operation, these administrative costs will increase by 20%. The company is subject to a tax rate of 27.5% on its profitsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started