Answered step by step

Verified Expert Solution

Question

1 Approved Answer

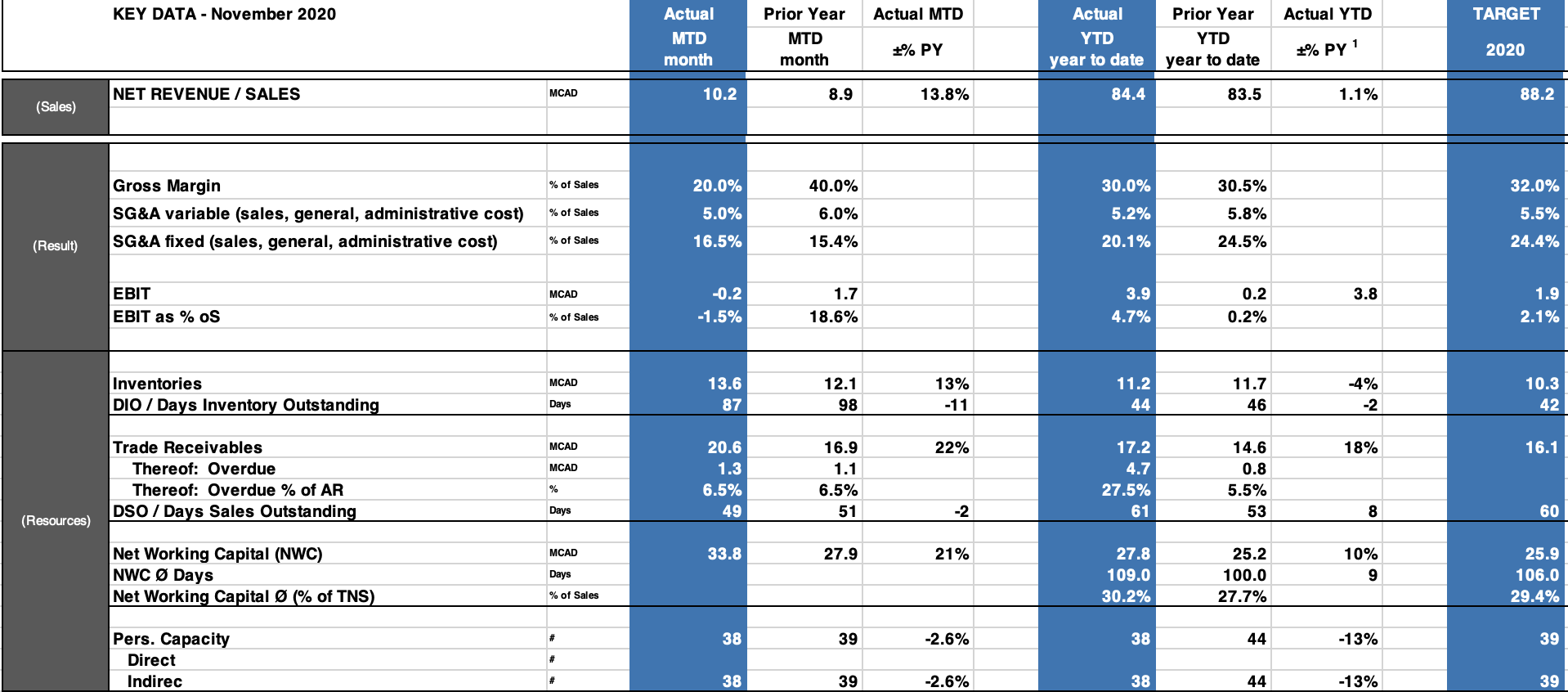

Looking at the presented data, what are your three main takeaways and why? How would you approach further analysis of the performance indicators you identified

Looking at the presented data, what are your three main takeaways and why?

How would you approach further analysis of the performance indicators you identified as most critical above? (KPI)

Is there a key performance metric you are missing or would expect to see in a comprehensive business performance snapshot?

KEY DATA - November 2020 Actual MTD Actual YTD TARGET Actual MTD month Prior Year MTD month Actual YTD year to date Prior Year YTD year to date 1 +% PY +% PY 2020 NET REVENUE / SALES MCAD 10.2 8.9 13.8% 84.4 83.5 1.1% 88.2 (Sales) % of Sales 20.0% 40.0% 30.0% 30.5% 32.0% Gross Margin SG&A variable (sales, general, administrative cost) SG&A fixed (sales, general, administrative cost) % of Sales 5.0% 6.0% 5.2% 5.8% 5.5% (Result) % of Sales 16.5% 15.4% 20.1% 24.5% 24.4% MCAD 3.8 EBIT EBIT as % OS -0.2 -1.5% 1.7 18.6% 3.9 4.7% 0.2 0.2% 1.9 2.1% % of Sales MCAD Inventories DIO / Days Inventory Outstanding 13.6 87 12.1 98 13% -11 11.2 44 11.7 46 -4% -2 10.3 42 Days MCAD 22% 18% 16.1 MCAD Trade Receivables Thereof: Overdue Thereof: Overdue % of AR DSO / Days Sales Outstanding 20.6 1.3 6.5% 49 16.9 1.1 6.5% 51 17.2 4.7 27.5% 61 14.6 0.8 5.5% 53 % Days -2 8 60 (Resources) MCAD 33.8 27.9 21% Net Working Capital (NWC) NWC Days Net Working Capital (% of TNS) 27.8 109.0 30.2% Days 25.2 100.0 27.7% 10% 9 25.9 106.0 29.4% % of Sales 38 39 -2.6% 38 44 -13% 39 Pers. Capacity Direct Indirec # # # 38 39 -2.6% 38 44 -13% 39 KEY DATA - November 2020 Actual MTD Actual YTD TARGET Actual MTD month Prior Year MTD month Actual YTD year to date Prior Year YTD year to date 1 +% PY +% PY 2020 NET REVENUE / SALES MCAD 10.2 8.9 13.8% 84.4 83.5 1.1% 88.2 (Sales) % of Sales 20.0% 40.0% 30.0% 30.5% 32.0% Gross Margin SG&A variable (sales, general, administrative cost) SG&A fixed (sales, general, administrative cost) % of Sales 5.0% 6.0% 5.2% 5.8% 5.5% (Result) % of Sales 16.5% 15.4% 20.1% 24.5% 24.4% MCAD 3.8 EBIT EBIT as % OS -0.2 -1.5% 1.7 18.6% 3.9 4.7% 0.2 0.2% 1.9 2.1% % of Sales MCAD Inventories DIO / Days Inventory Outstanding 13.6 87 12.1 98 13% -11 11.2 44 11.7 46 -4% -2 10.3 42 Days MCAD 22% 18% 16.1 MCAD Trade Receivables Thereof: Overdue Thereof: Overdue % of AR DSO / Days Sales Outstanding 20.6 1.3 6.5% 49 16.9 1.1 6.5% 51 17.2 4.7 27.5% 61 14.6 0.8 5.5% 53 % Days -2 8 60 (Resources) MCAD 33.8 27.9 21% Net Working Capital (NWC) NWC Days Net Working Capital (% of TNS) 27.8 109.0 30.2% Days 25.2 100.0 27.7% 10% 9 25.9 106.0 29.4% % of Sales 38 39 -2.6% 38 44 -13% 39 Pers. Capacity Direct Indirec # # # 38 39 -2.6% 38 44 -13% 39

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started