Answered step by step

Verified Expert Solution

Question

1 Approved Answer

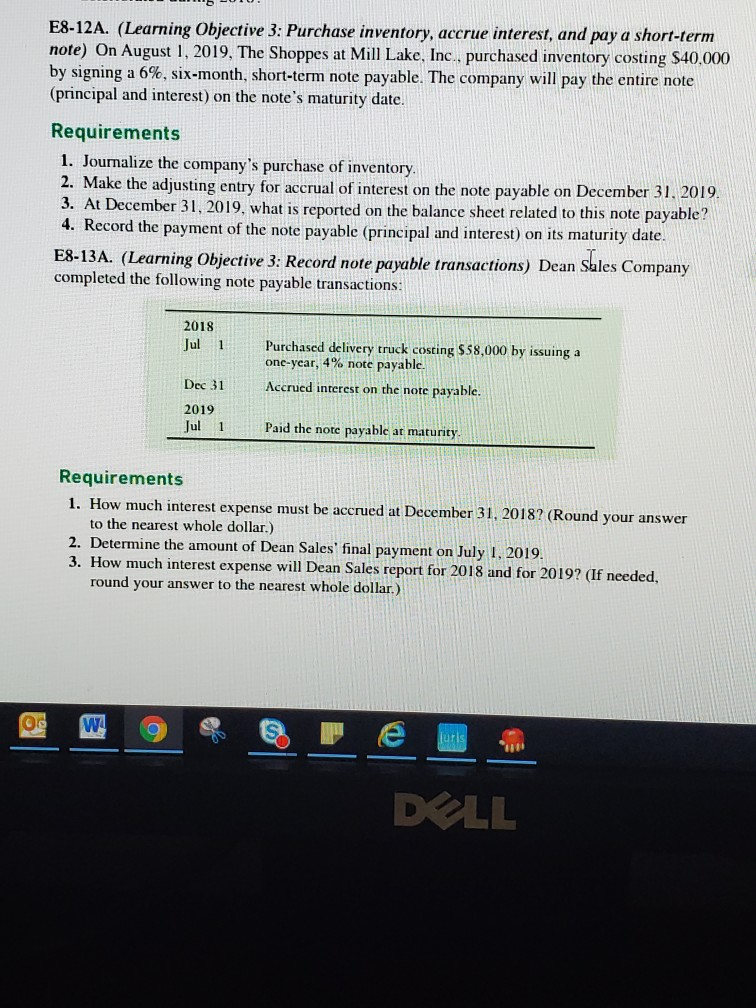

please help with 8-12A, 8-13A & 8-16A E8-12A. (Learning Objective 3: Purchase inventory, accrue interest, and pay a short-term note) On August 1, 2019, The

please help with 8-12A, 8-13A & 8-16A

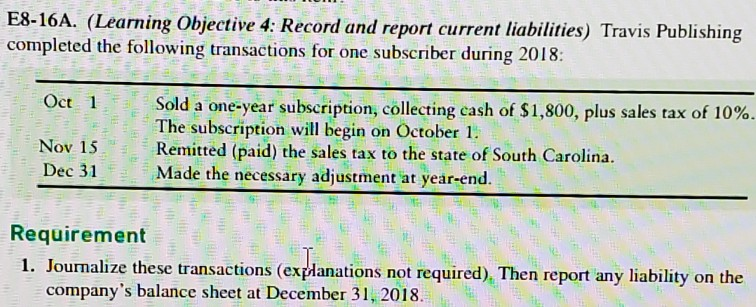

E8-12A. (Learning Objective 3: Purchase inventory, accrue interest, and pay a short-term note) On August 1, 2019, The Shoppes at Mill Lake, Inc., purchased inventory costing $40,000 by signing a 6%, six-month, short-term note payable. The company will pay the entire note (principal and interest) on the note's maturity date. Requirements 1. Journalize the company's purchase of inventory. 2. Make the adjusting entry for accrual of interest on the note payable on December 31, 2019. 3. At December 31, 2019, what is reported on the balance sheet related to this note payable? 4. Record the payment of the note payable (principal and interest) on its maturity date. E8-13A. (Learning Objective 3: Record note payable transactions) Dean Sales Company completed the following note payable transactions: 2018 Jul 1 Purchased delivery truck costing $58,000 by issuing a one-year, 4% note payable. Accrued interest on the note payable. Dec 31 2019 Jul 1 P aid the note payable at maturity Requirements 1. How much interest expense must be accrued at December 31, 2018? (Round your answer to the nearest whole dollar.) 2. Determine the amount of Dean Sales' final payment on July 1. 2019. 3. How much interest expense will Dean Sales report for 2018 and for 2019? (If needed, round your answer to the nearest whole dollar.) wa DALL E8-16A. (Learning Objective 4: Record and report current liabilities) Travis Publishing completed the following transactions for one subscriber during 2018: Oct 1 - Nov 15" Dec 31 Sold a one-year subscription, collecting cash of $1,800, plus sales tax of 10%. The subscription will begin on October 1. Remitted (paid) the sales tax to the state of South Carolina. Made the necessary adjustment at year-end. Requirement 1. Journalize these transactions (explanations not required). Then report any liability on the company's balance sheet at December 31, 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started