Answered step by step

Verified Expert Solution

Question

1 Approved Answer

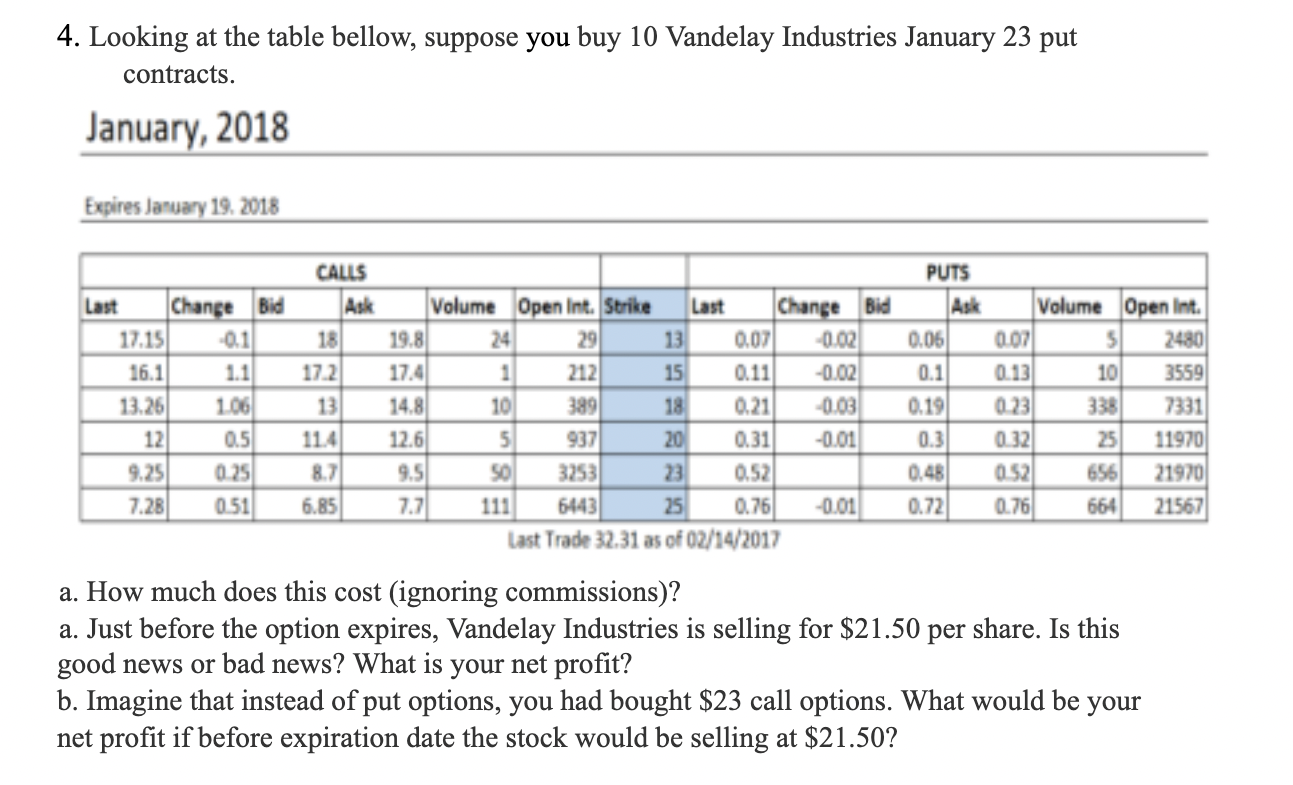

Looking at the table bellow, suppose you buy 10 Vandelay Industries January 23 put contracts. a. How much does this cost (ignoring commissions)? a. Just

Looking at the table bellow, suppose you buy 10 Vandelay Industries January 23 put contracts.

Looking at the table bellow, suppose you buy 10 Vandelay Industries January 23 put contracts.

a. How much does this cost (ignoring commissions)?

a. Just before the option expires, Vandelay Industries is selling for $21.50 per share. Is this good news or bad news? What is your net profit?

b. Imagine that instead of put options, you had bought $23 call options. What would be your net profit if before expiration date the stock would be selling at $21.50?

4. Looking at the table bellow, suppose you buy 10 Vandelay Industries January 23 put contracts. January, 2018 Expires January 19. 2018 a. How much does this cost (ignoring commissions)? a. Just before the option expires, Vandelay Industries is selling for $21.50 per share. Is this good news or bad news? What is your net profit? b. Imagine that instead of put options, you had bought $23 call options. What would be your net profit if before expiration date the stock would be selling at $21.50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started