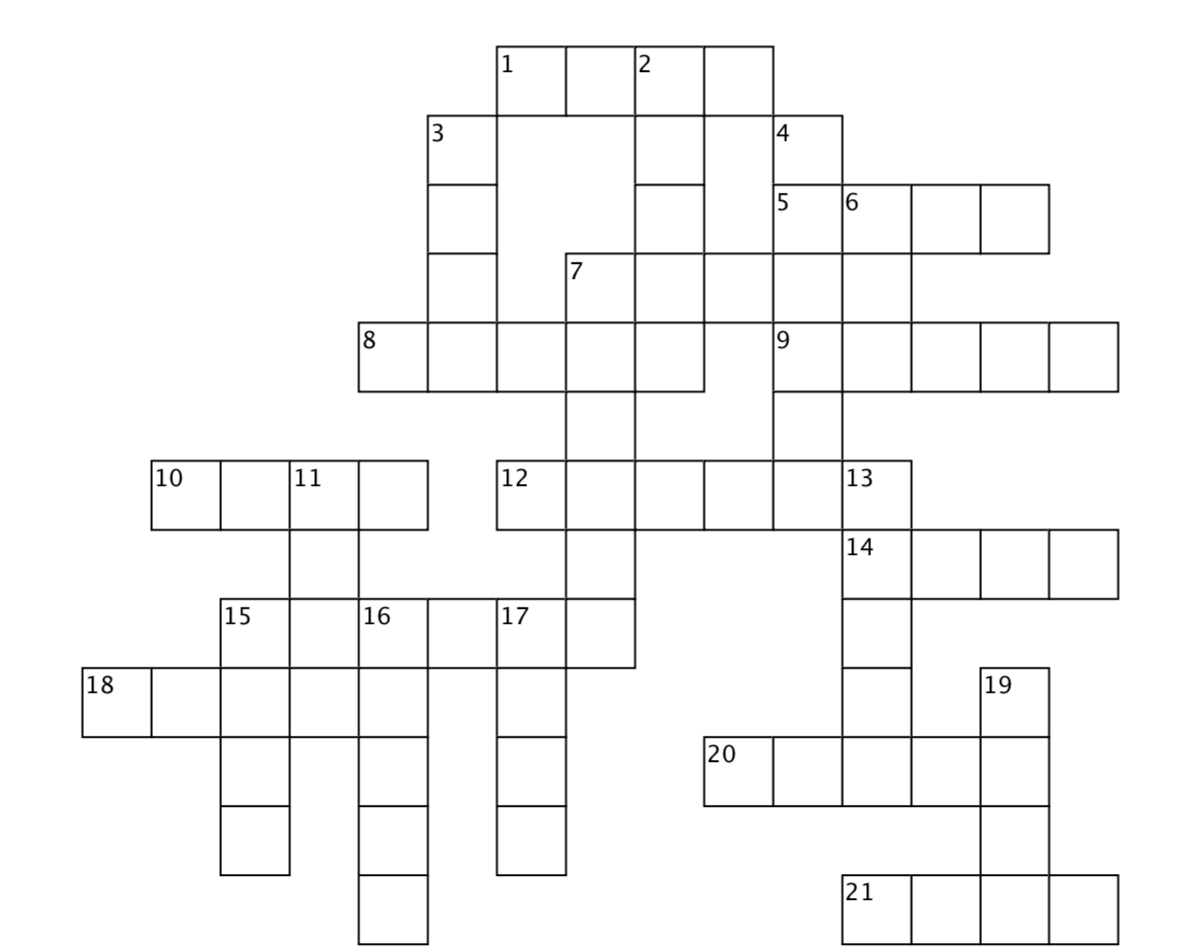

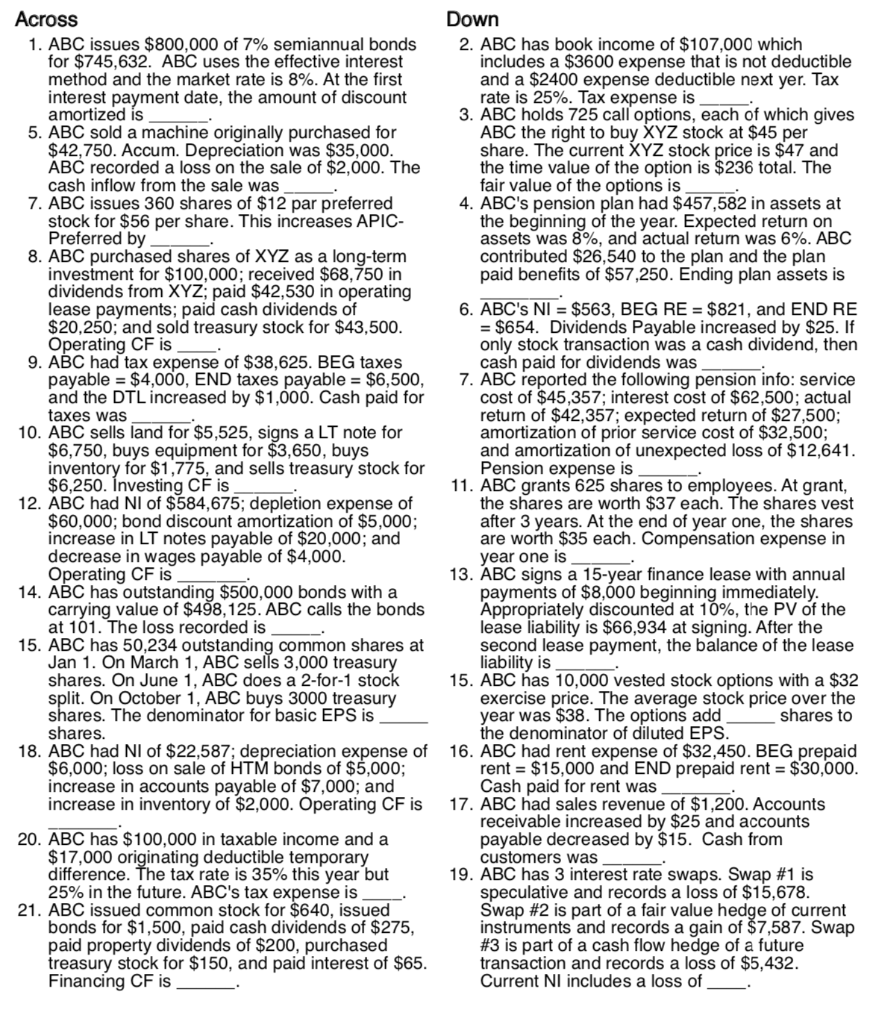

LOOKING FOR ALL SOLUTIONS 1-21 ACROSS AND DOWN

LOOKING FOR ALL SOLUTIONS 1-21 ACROSS AND DOWN

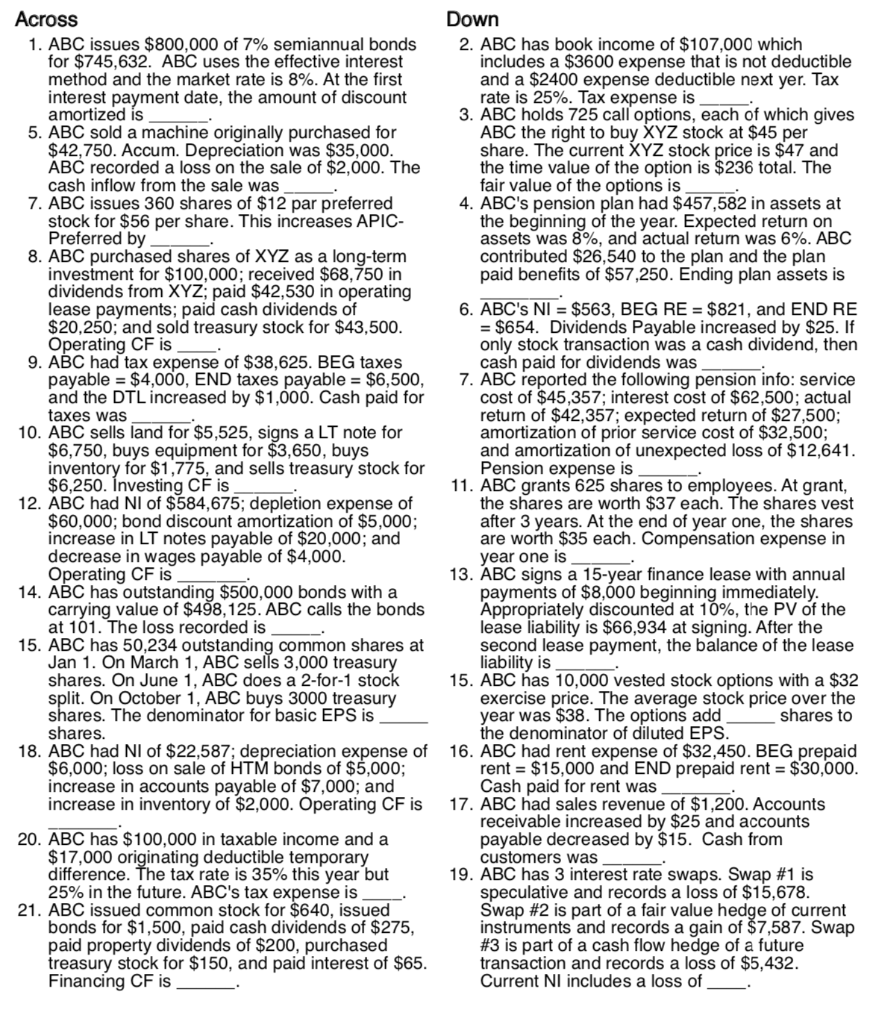

15 | 17 Across Down 1. ABC issues $800.000 of 7% semiannual bonds 2. ABC has book income of $107.000 which for $745,632. ABC uses the effective interest includes a $3600 expense that is not deductible method and the market rate is 8%. At the first and a $2400 expense deductible next yer. Tax interest payment date, the amount of discount rate is 25%. Tax expense is amortized is 3. ABC holds 725 call options, each of which gives 5. ABC sold a machine originally purchased for ABC the right to buy XYZ stock at $45 per $42,750. Accum. Depreciation was $35,000. share. The current XYZ stock price is $47 and ABC recorded a loss on the sale of $2,000. The the time value of the option is $236 total. The cash inflow from the sale was fair value of the options is 7. ABC issues 360 shares of $12 par preferred 4. ABC's pension plan had $457,582 in assets at stock for $56 per share. This increases APIC- the beginning of the year. Expected return on Preferred by assets was 8%, and actual return was 6%. ABC 8. ABC purchased shares of XYZ as a long-term contributed $26,540 to the plan and the plan investment for $100,000; received $68,750 in paid benefits of $57,250. Ending plan assets is dividends from XYZ; paid $42,530 in operating lease payments; paid cash dividends of 6. ABC'S NI = $563, BEG RE = $821. and END RE $20,250; and sold treasury stock for $43,500. = $654. Dividends Payable increased by $25. If Operating CF is only stock transaction was a cash dividend, then 9. ABC had tax expense of $38,625. BEG taxes cash paid for dividends was_ payable = $4,000, END taxes payable = $6,500, 7. ABC reported the following pension info: service and the DTL increased by $1,000. Cash paid for cost of $45,357; interest cost of $62,500; actual taxes was return of $42,357, expected return of $27,500; 10. ABC sells land for $5,525, signs a LT note for amortization of prior service cost of $32,500; $6,750, buys equipment for $3,650, buys and amortization of unexpected loss of $12,641. inventory for $1,775, and sells treasury stock for Pension expense is $6,250. Investing CF is ABC grants 625 shares to employees. At grant, 12. ABC had Nl of $584,675; depletion expense of the shares are worth $37 each. The shares vest $60.000; bond discount amortization of $5,000; after 3 years. At the end of year one, the shares increase in LT notes payable of $20,000; and are worth $35 each. Compensation expense in decrease in wages payable of $4,000. year one is Operating CF is 13. ABC signs a 15-year finance lease with annual 14. ABC has outstanding $500,000 bonds with a payments of $8,000 beginning immediately. carrying value of $498,125. ABC calls the bonds Appropriately discounted at 10%, the PV of the at 101. The loss recorded is lease liability is $66,934 at signing. After the 15. ABC has 50,234 outstanding common shares at second lease payment, the balance of the lease Jan 1. On March 1, ABC sells 3,000 treasury liability is shares. On June 1, ABC does a 2-for-1 stock 15. ABC has 10,000 vested stock options with a $32 split. On October 1, ABC buys 3000 treasury exercise price. The average stock price over the shares. The denominator for basic EPS is year was $38. The options add s hares to shares. the denominator of diluted EPS. ABC had Nl of $22,587; depreciation expense of 16. ABC had rent expense of $32,450. BEG prepaid $6,000; loss on sale of HTM bonds of $5,000; rent = $15,000 and END prepaid rent = $30,000. increase in accounts payable of $7,000; and Cash paid for rent was increase in inventory of $2,000. Operating CF is 17. ABC had sales revenue of $1,200. Accounts receivable increased by $25 and accounts 20. ABC has $100,000 in taxable income and a payable decreased by $15. Cash from $17,000 originating deductible temporary customers was difference. The tax rate is 35% this year but 19. ABC has 3 interest rate swaps. Swap #1 is 25% in the future. ABC's tax expense is speculative and records a loss of $15,678. 21. ABC issued common stock for $640, issued Swap #2 is part of a fair value hedge of current bonds for $1,500, paid cash dividends of $275, instruments and records a gain of $7,587. Swap paid property dividends of $200, purchased #3 is part of a cash flow hedge of a future treasury stock for $150, and paid interest of $65. transaction and records a loss of $5,432. Financing CF is Current Nl includes a loss of 18. 15 | 17 Across Down 1. ABC issues $800.000 of 7% semiannual bonds 2. ABC has book income of $107.000 which for $745,632. ABC uses the effective interest includes a $3600 expense that is not deductible method and the market rate is 8%. At the first and a $2400 expense deductible next yer. Tax interest payment date, the amount of discount rate is 25%. Tax expense is amortized is 3. ABC holds 725 call options, each of which gives 5. ABC sold a machine originally purchased for ABC the right to buy XYZ stock at $45 per $42,750. Accum. Depreciation was $35,000. share. The current XYZ stock price is $47 and ABC recorded a loss on the sale of $2,000. The the time value of the option is $236 total. The cash inflow from the sale was fair value of the options is 7. ABC issues 360 shares of $12 par preferred 4. ABC's pension plan had $457,582 in assets at stock for $56 per share. This increases APIC- the beginning of the year. Expected return on Preferred by assets was 8%, and actual return was 6%. ABC 8. ABC purchased shares of XYZ as a long-term contributed $26,540 to the plan and the plan investment for $100,000; received $68,750 in paid benefits of $57,250. Ending plan assets is dividends from XYZ; paid $42,530 in operating lease payments; paid cash dividends of 6. ABC'S NI = $563, BEG RE = $821. and END RE $20,250; and sold treasury stock for $43,500. = $654. Dividends Payable increased by $25. If Operating CF is only stock transaction was a cash dividend, then 9. ABC had tax expense of $38,625. BEG taxes cash paid for dividends was_ payable = $4,000, END taxes payable = $6,500, 7. ABC reported the following pension info: service and the DTL increased by $1,000. Cash paid for cost of $45,357; interest cost of $62,500; actual taxes was return of $42,357, expected return of $27,500; 10. ABC sells land for $5,525, signs a LT note for amortization of prior service cost of $32,500; $6,750, buys equipment for $3,650, buys and amortization of unexpected loss of $12,641. inventory for $1,775, and sells treasury stock for Pension expense is $6,250. Investing CF is ABC grants 625 shares to employees. At grant, 12. ABC had Nl of $584,675; depletion expense of the shares are worth $37 each. The shares vest $60.000; bond discount amortization of $5,000; after 3 years. At the end of year one, the shares increase in LT notes payable of $20,000; and are worth $35 each. Compensation expense in decrease in wages payable of $4,000. year one is Operating CF is 13. ABC signs a 15-year finance lease with annual 14. ABC has outstanding $500,000 bonds with a payments of $8,000 beginning immediately. carrying value of $498,125. ABC calls the bonds Appropriately discounted at 10%, the PV of the at 101. The loss recorded is lease liability is $66,934 at signing. After the 15. ABC has 50,234 outstanding common shares at second lease payment, the balance of the lease Jan 1. On March 1, ABC sells 3,000 treasury liability is shares. On June 1, ABC does a 2-for-1 stock 15. ABC has 10,000 vested stock options with a $32 split. On October 1, ABC buys 3000 treasury exercise price. The average stock price over the shares. The denominator for basic EPS is year was $38. The options add s hares to shares. the denominator of diluted EPS. ABC had Nl of $22,587; depreciation expense of 16. ABC had rent expense of $32,450. BEG prepaid $6,000; loss on sale of HTM bonds of $5,000; rent = $15,000 and END prepaid rent = $30,000. increase in accounts payable of $7,000; and Cash paid for rent was increase in inventory of $2,000. Operating CF is 17. ABC had sales revenue of $1,200. Accounts receivable increased by $25 and accounts 20. ABC has $100,000 in taxable income and a payable decreased by $15. Cash from $17,000 originating deductible temporary customers was difference. The tax rate is 35% this year but 19. ABC has 3 interest rate swaps. Swap #1 is 25% in the future. ABC's tax expense is speculative and records a loss of $15,678. 21. ABC issued common stock for $640, issued Swap #2 is part of a fair value hedge of current bonds for $1,500, paid cash dividends of $275, instruments and records a gain of $7,587. Swap paid property dividends of $200, purchased #3 is part of a cash flow hedge of a future treasury stock for $150, and paid interest of $65. transaction and records a loss of $5,432. Financing CF is Current Nl includes a loss of 18

LOOKING FOR ALL SOLUTIONS 1-21 ACROSS AND DOWN

LOOKING FOR ALL SOLUTIONS 1-21 ACROSS AND DOWN