Answered step by step

Verified Expert Solution

Question

1 Approved Answer

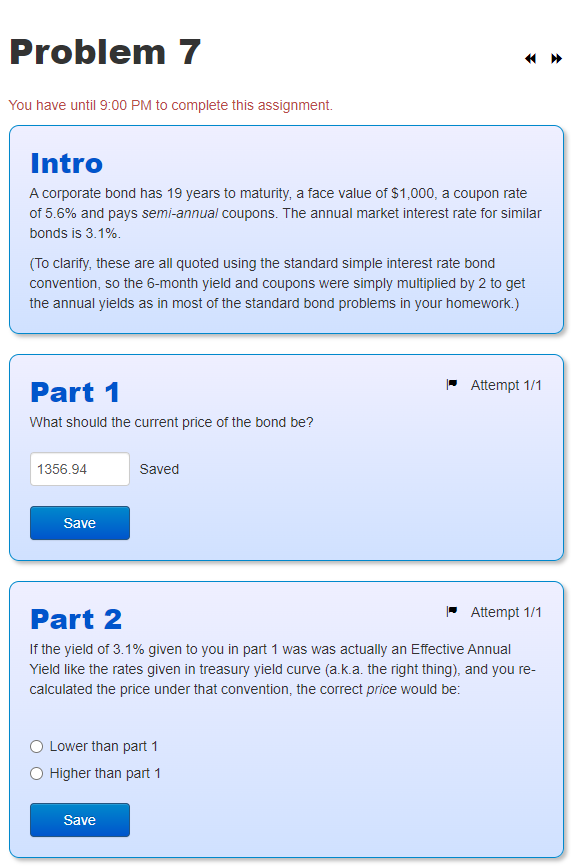

Looking for help with part 2 You have until 9:00 PM to complete this assignment. Intro A corporate bond has 19 years to maturity, a

Looking for help with part 2

You have until 9:00 PM to complete this assignment. Intro A corporate bond has 19 years to maturity, a face value of $1,000, a coupon rate of 5.6% and pays semi-annua/ coupons. The annual market interest rate for similar bonds is 3.1%. (To clarify, these are all quoted using the standard simple interest rate bond convention, so the 6-month yield and coupons were simply multiplied by 2 to get the annual yields as in most of the standard bond problems in your homework.) Part 1 Attempt 1/1 What should the current price of the bond be? Saved Part 2 Attempt 1/1 If the yield of 3.1% given to you in part 1 was was actually an Effective Annual Yield like the rates given in treasury yield curve (a.k.a. the right thing), and you recalculated the price under that convention, the correct price would be: Lower than part 1 Higher thanStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started