Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Looking for non excel work. Will upvote, thanks in advance. 1. You are an investor in the 20% tax bracket. You are considering either an

Looking for non excel work. Will upvote, thanks in advance.

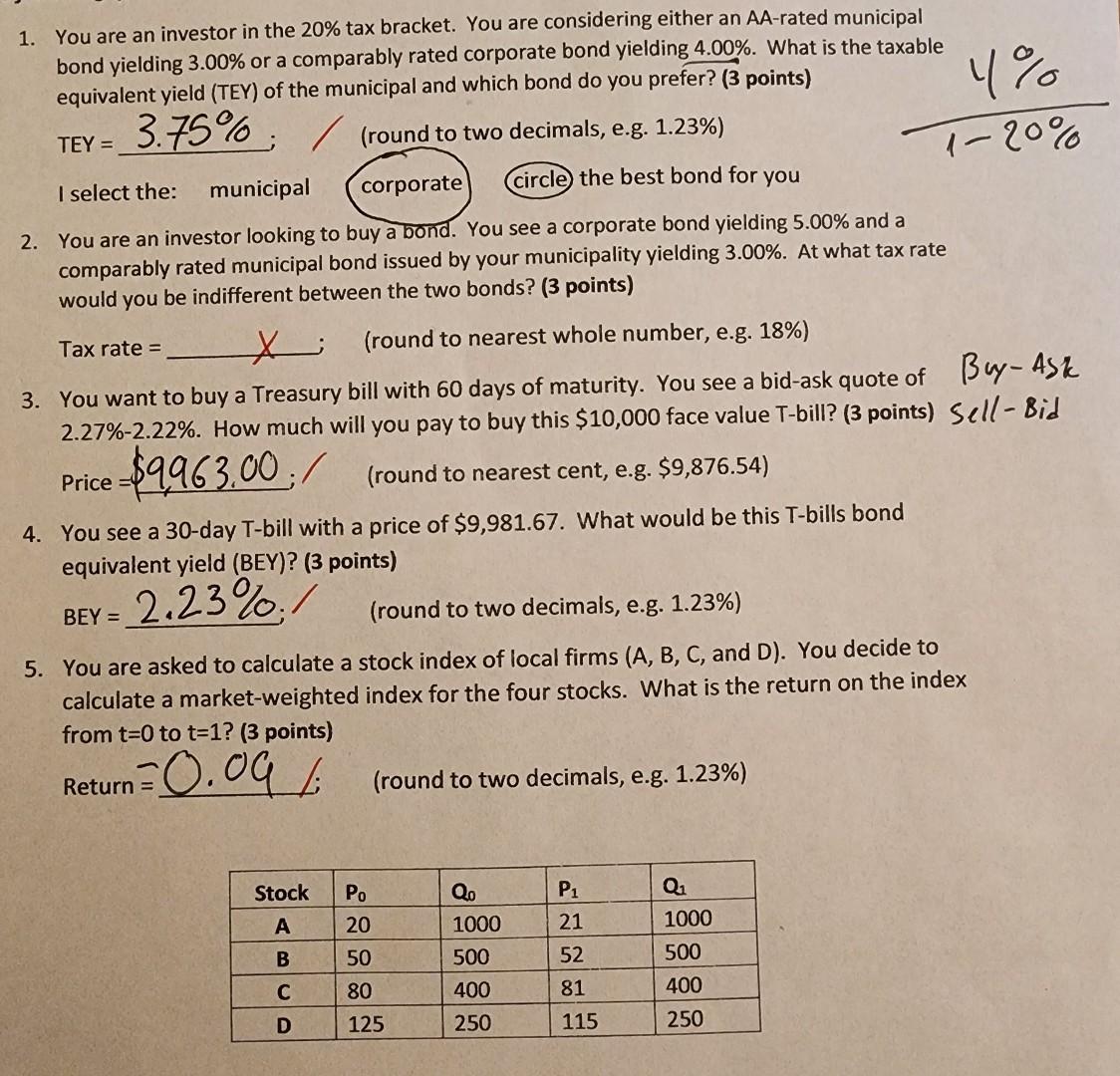

1. You are an investor in the 20% tax bracket. You are considering either an AA-rated municipal bond yielding 3.00% or a comparably rated corporate bond yielding 4.00%. What is the taxable equivalent yield (TEY) of the municipal and which bond do you prefer? ( 3 points) TEY =3.750/0; (round to two decimals, e.g. 1.23% ) 10 comparably rated municipal bond issued by your municipality yielding 3.00%. At what tax rate would you be indifferent between the two bonds? ( 3 points) Tax rate = 3. You want to buy a Treasury bill with 60 days of maturity. You see a bid-ask quote of 3 wy- 45k 2.27\%-2.22\%. How much will you pay to buy this $10,000 face value T-bill? ( 3 points) S ell - Bid Price =$9,463,00; (round to nearest cent, e.g. \$9,876.54) 4. You see a 30-day T-bill with a price of $9,981.67. What would be this T-bills bond equivalent yield (BEY)? ( 3 points) BEY=21230 (round to two decimals, e.g. 1.23\%) 5. You are asked to calculate a stock index of local firms (A, B, C, and D). You decide to calculate a market-weighted index for the four stocks. What is the return on the index from t=0 to t=1 ? ( 3 points) Return = %.0 : % (round to two decimals, e.g. 1.23\%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started