Looking for the answer for situation 3 as soon as possibe!!

I included the information for situation 1 and 2 just in case it was need to solve situation 3

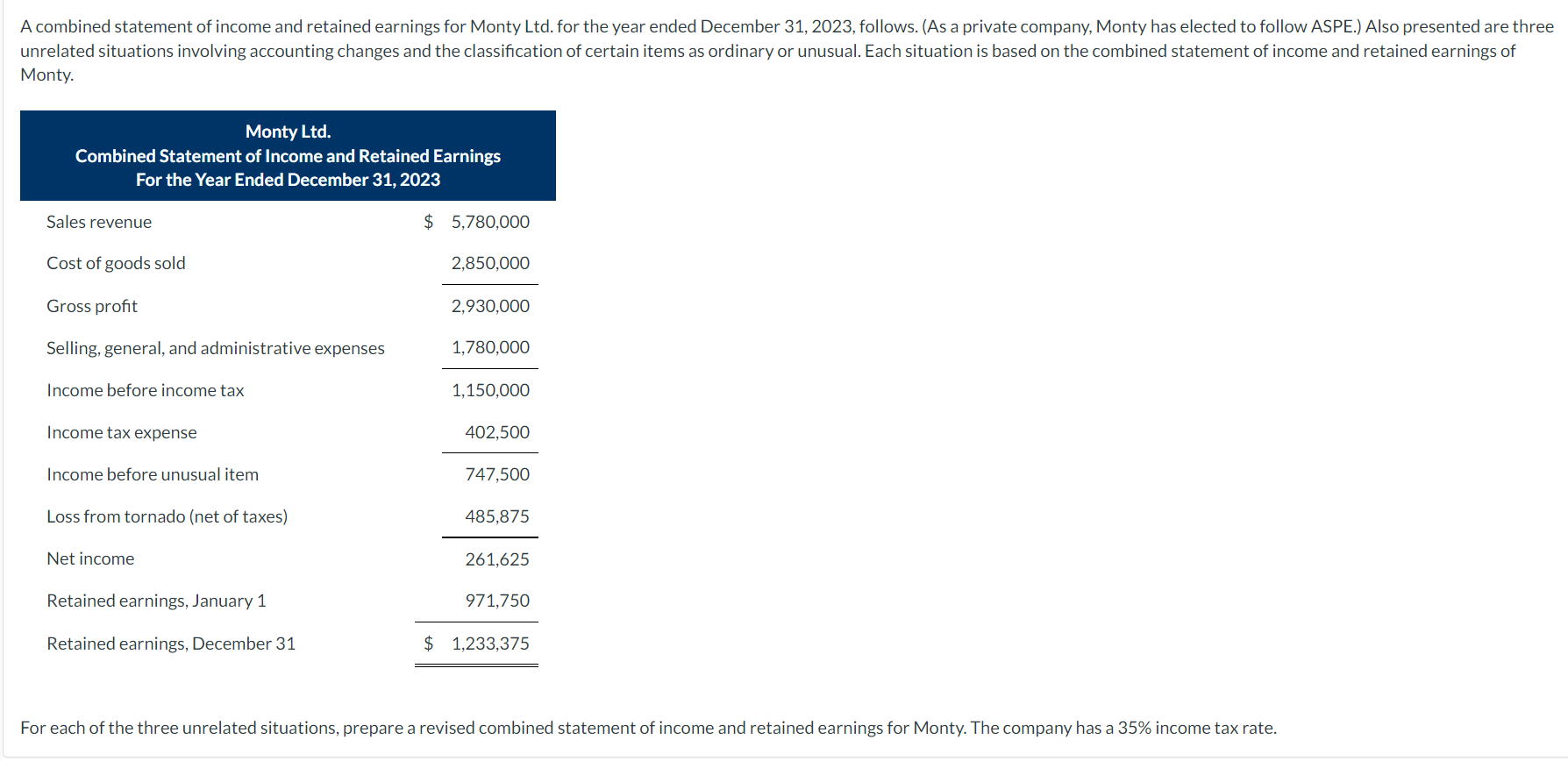

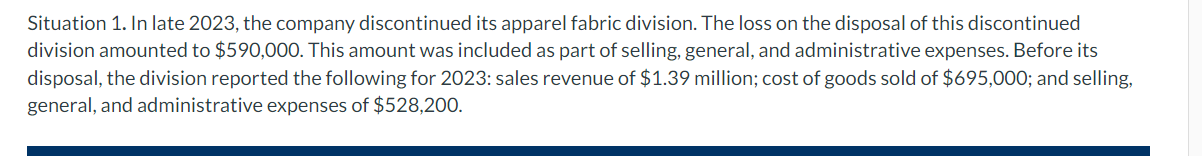

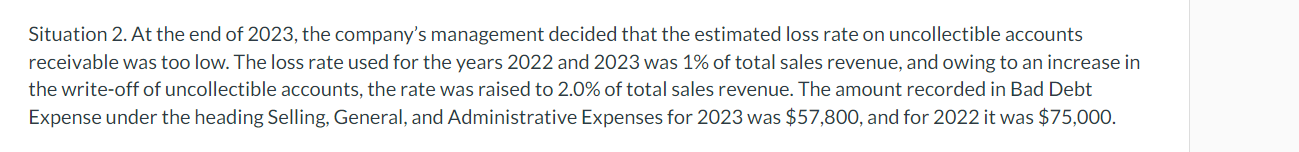

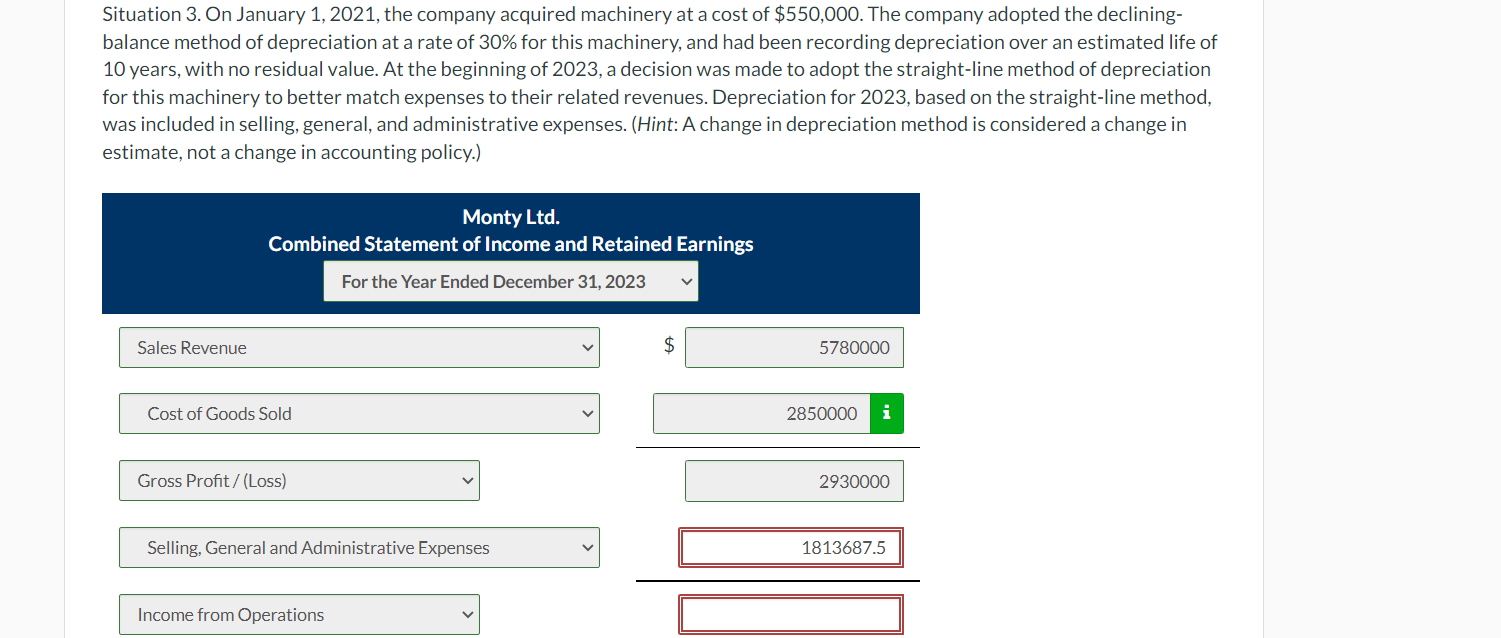

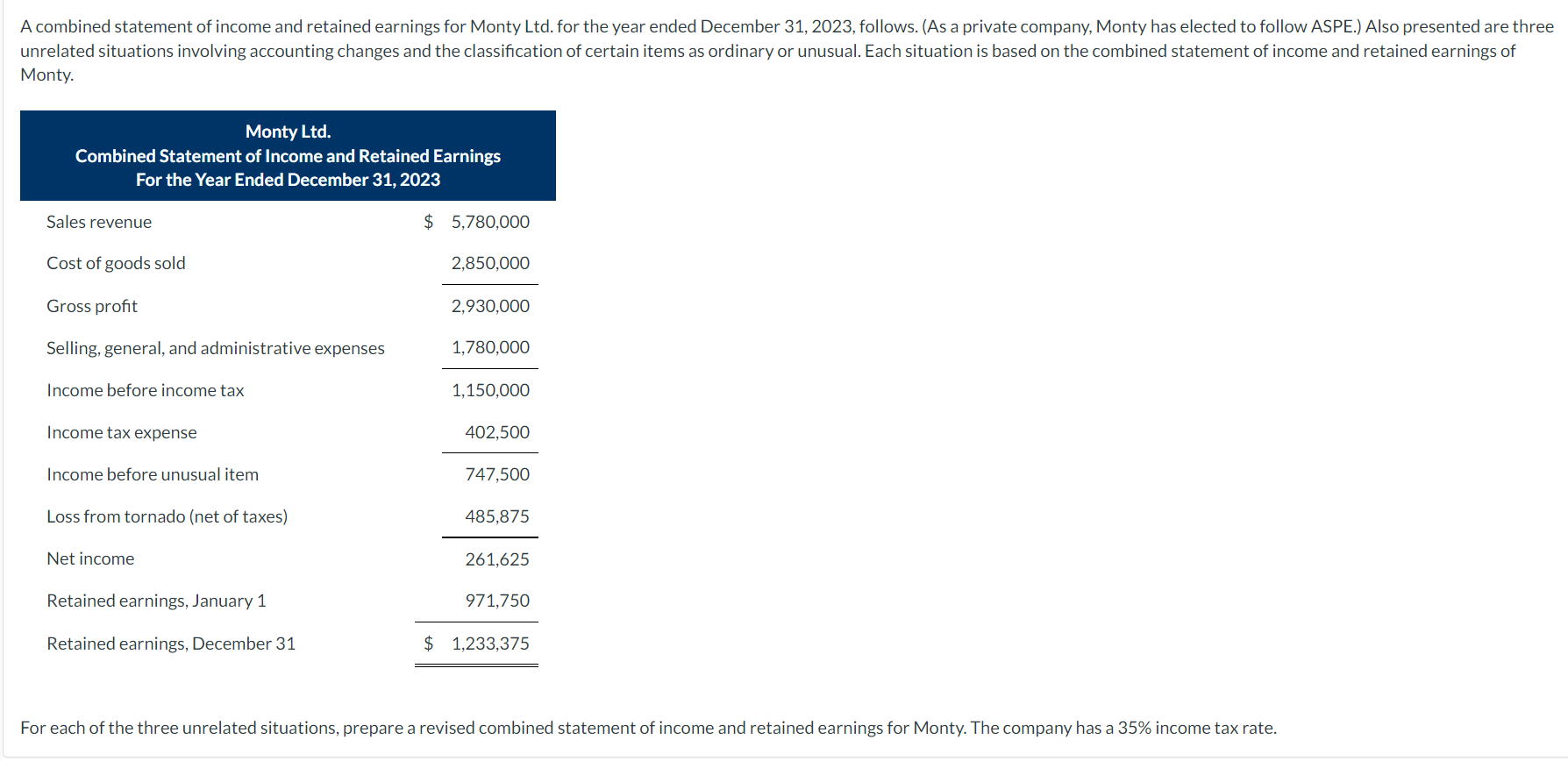

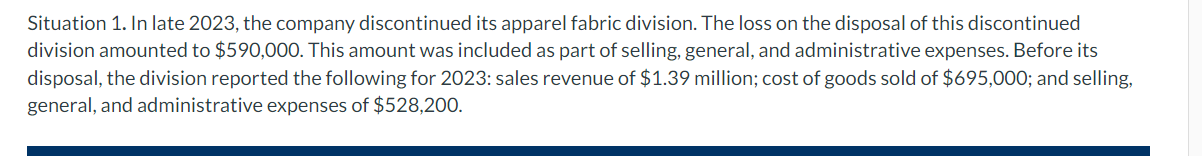

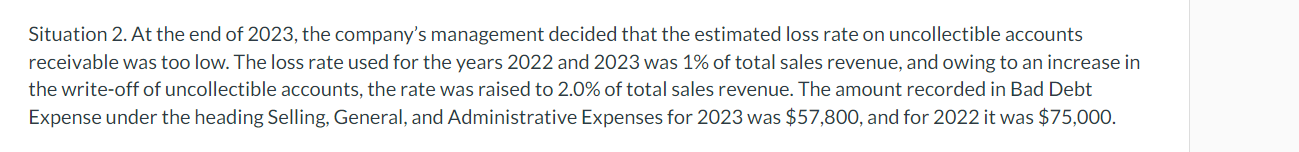

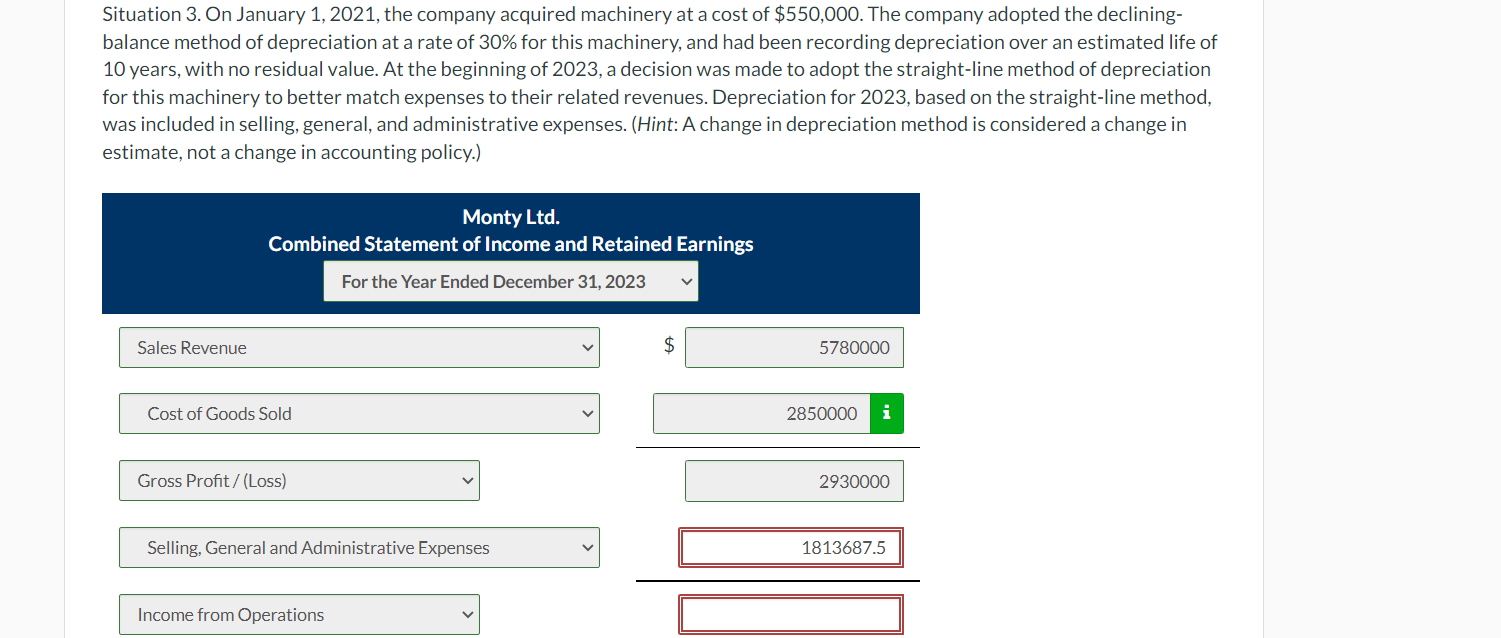

Monty. Situation 1. In late 2023, the company discontinued its apparel fabric division. The loss on the disposal of this discontinued division amounted to $590,000. This amount was included as part of selling, general, and administrative expenses. Before its disposal, the division reported the following for 2023 : sales revenue of $1.39 million; cost of goods sold of $695,000; and selling, general, and administrative expenses of $528,200. Situation 2. At the end of 2023 , the company's management decided that the estimated loss rate on uncollectible accounts receivable was too low. The loss rate used for the years 2022 and 2023 was 1% of total sales revenue, and owing to an increase in the write-off of uncollectible accounts, the rate was raised to 2.0% of total sales revenue. The amount recorded in Bad Debt Expense under the heading Selling, General, and Administrative Expenses for 2023 was $57,800, and for 2022 it was $75,000. Situation 3. On January 1, 2021, the company acquired machinery at a cost of $550,000. The company adopted the decliningbalance method of depreciation at a rate of 30% for this machinery, and had been recording depreciation over an estimated life of 10 years, with no residual value. At the beginning of 2023 , a decision was made to adopt the straight-line method of depreciation for this machinery to better match expenses to their related revenues. Depreciation for 2023, based on the straight-line method, was included in selling, general, and administrative expenses. (Hint: A change in depreciation method is considered a change in estimate, not a change in accounting policy.) Monty. Situation 1. In late 2023, the company discontinued its apparel fabric division. The loss on the disposal of this discontinued division amounted to $590,000. This amount was included as part of selling, general, and administrative expenses. Before its disposal, the division reported the following for 2023 : sales revenue of $1.39 million; cost of goods sold of $695,000; and selling, general, and administrative expenses of $528,200. Situation 2. At the end of 2023 , the company's management decided that the estimated loss rate on uncollectible accounts receivable was too low. The loss rate used for the years 2022 and 2023 was 1% of total sales revenue, and owing to an increase in the write-off of uncollectible accounts, the rate was raised to 2.0% of total sales revenue. The amount recorded in Bad Debt Expense under the heading Selling, General, and Administrative Expenses for 2023 was $57,800, and for 2022 it was $75,000. Situation 3. On January 1, 2021, the company acquired machinery at a cost of $550,000. The company adopted the decliningbalance method of depreciation at a rate of 30% for this machinery, and had been recording depreciation over an estimated life of 10 years, with no residual value. At the beginning of 2023 , a decision was made to adopt the straight-line method of depreciation for this machinery to better match expenses to their related revenues. Depreciation for 2023, based on the straight-line method, was included in selling, general, and administrative expenses. (Hint: A change in depreciation method is considered a change in estimate, not a change in accounting policy.)