Looking specifically for help on #8

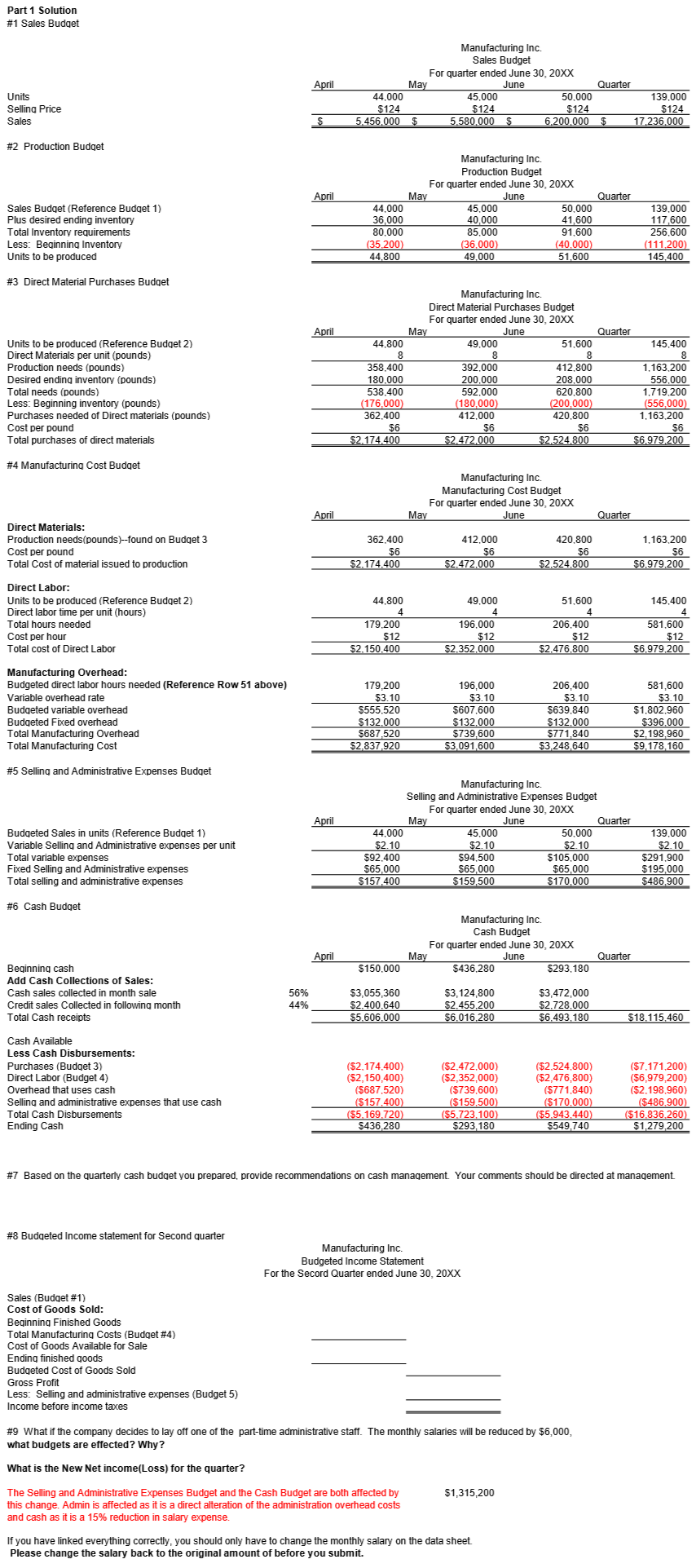

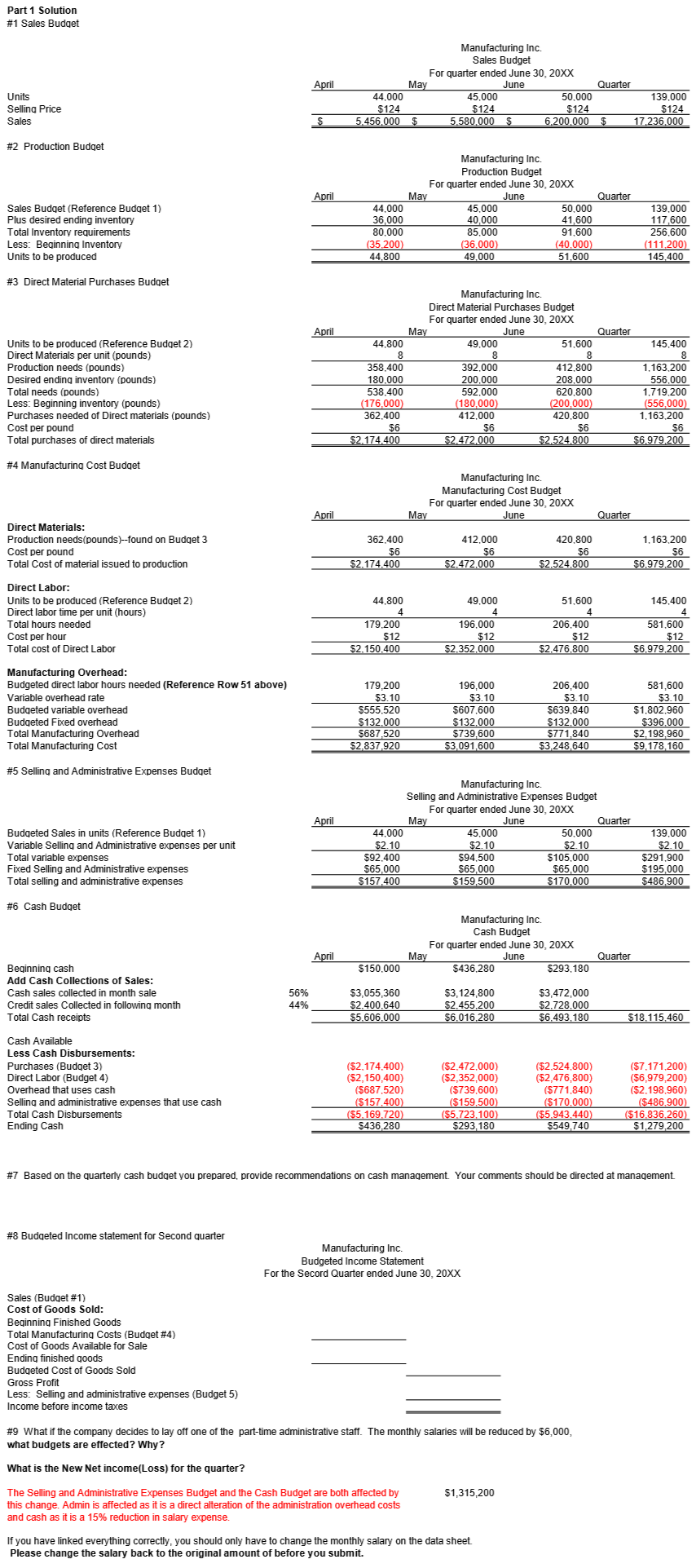

Part 1 Solution #1 Sales Budget April Manufacturing Inc. Sales Budget For quarter ended June 30, 20XX May June Quarter 44,000 45.000 50.000 139.000 $124 $124 $124 $124 5.456.000 5.580,000 $ 6.200.000 $ 17.236.000 Units Selling Price Sales $ #2 Production Budget April Sales Budget (Reference Budget 1) Plus desired ending inventory Total Inventory requirements Less: Beginning Inventory Units to be produced Manufacturing Inc. Production Budget For quarter ended June 30, 20XX May June Quarter 44,000 45,000 50,000 36,000 40.000 41,600 80,000 85.000 91,600 (35,200) (36.000) (40.000) 44.800 49,000 51.600 139.000 117,600 256,600 (111,200) 145,400 #3 Direct Material Purchases Budget April Quarter 145.400 Manufacturing Inc. Direct Material Purchases Budget For quarter ended June 30, 20XX May June 44.800 49,000 51.600 8 8 8 392.000 412,800 180.000 200,000 208,000 538.400 592.000 620.800 (176,000) (180.000) (200,000) 362.400 412.000 420.800 $6 $6 $6 $2.174.400 $2.472.000 $2.524,800 Units to be produced (Reference Budget 2) Direct Materials per unit (pounds) Production needs (pounds) Desired ending inventory (pounds) Total needs (pounds) Less: Beginning inventory (pounds) Purchases needed of Direct materials (pounds) Cost per pound Total purchases of direct materials 358.400 1.163.200 556.000 1.719,200 (556,000) 1.163.200 $6 $6.979,200 #4 Manufacturing Cost Budget Manufacturing Inc. Manufacturing Cost Budget For quarter ended June 30, 20XX May June April Quarter Direct Materials: Production needs(pounds)--found on Budget 3 Cost per pound Total Cost of material issued to production 362.400 $6 $2.174.400 412.000 $6 $2.472.000 420.800 $6 $2.524,800 1.163,200 $6 $6.979,200 44,800 51.600 Direct Labor: Units to be produced (Reference Budget 2) Direct labor time per unit (hours) Total hours needed Cost per hour Total cost of Direct Labor 179,200 $12 $2.150,400 49.000 4 196.000 $12 $2.352.000 206,400 $12 $2.476.800 145.400 4 581,600 $12 $6.979,200 Manufacturing Overhead: Budgeted direct labor hours needed (Reference Row 51 above) Variable overhead rate Budgeted variable overhead Budgeted Fixed overhead Total Manufacturing Overhead Total Manufacturing Cost 179,200 $3.10 $555,520 $132.000 $687,520 $2.837.920 196.000 $3.10 $607,600 $132.000 $739,600 $3,091,600 206,400 $3.10 $639.840 $132.000 $771,840 $3,248,640 581,600 $3.10 $1.802.960 $396.000 $2,198,960 $9.178.160 #5 Selling and Administrative Expenses Budget April Budgeted Sales in units (Reference Budget 1) Variable Selling and Administrative expenses per unit Total variable expenses Fixed Selling and Administrative expenses Total selling and administrative expenses Manufacturing Inc. Selling and Administrative Expenses Budget For quarter ended June 30, 20XX May June Quarter 44,000 45,000 50.000 $2.10 $2.10 $2.10 $92.400 $94.500 $105.000 $65.000 $65,000 $65,000 $157,400 $159,500 $170,000 139.000 $2.10 $291,900 $195,000 $486.900 #6 Cash Budget Manufacturing Inc. Cash Budget For quarter ended June 30, 20XX May June $436.280 $293.180 April Quarter $150.000 Beginning cash Add Cash Collections of Sales: Cash sales collected in month sale Credit sales Collected in following month Total Cash receipts $3,055,360 56% 44% $2.400.640 $5.606.000 $3,124,800 $2.455,200 $6.016,280 $3,472,000 $2.728.000 $6.493.180 $18.115,460 Cash Available Less Cash Disbursements: Purchases (Budget 3) Direct Labor (Budget 4) Overhead that uses cash Selling and administrative expenses that use cash Total Cash Disbursements Ending Cash ($2.174.400) ($2,150,400) ($687,520) ($157,400 (55.169.720) $436,280 ($2.472.000) ($2,352,000) ($739.600) (S159.500) ($5.723.100) $293,180 ($2.524.800) ($2,476,800) ($771,840) ($170.000) ($5.943.440) $549,740 ($7.171,200) ($6,979,200) ($2.198.960) ($486.900) ($16.836,260 $1,279,200 #7 Based on the quarterly cash budget you prepared, provide recommendations on cash management. Your comments should be directed at management #8 Budgeted Income statement for Second quarter Manufacturing Inc. Budgeted Income Statement For the Secord Quarter ended June 30, 20XX Sales (Budget #1) Cost of Goods Sold: Beginning Finished Goods Total Manufacturing Costs (Budget #4) Cost of Goods Available for Sale Ending finished goods Budgeted Cost of Goods Sold Gross Profit Less: Selling and administrative expenses (Budget 5) Income before income taxes #9 What if the company decides to lay off one of the part-time administrative staff. The monthly salaries will be reduced by $6,000, what budgets are effected? Why? What is the New Net income(Loss) for the quarter? $1,315,200 The Selling and Administrative Expenses Budget and the Cash Budget are both affected by this change. Admin is affected as it is a direct alteration of the administration overhead costs and cash as it is a 15% reduction in salary expense. If you have linked everything correctly, you should only have to change the monthly salary on the data sheet Please change the salary back to the original amount of before you submit