Answered step by step

Verified Expert Solution

Question

1 Approved Answer

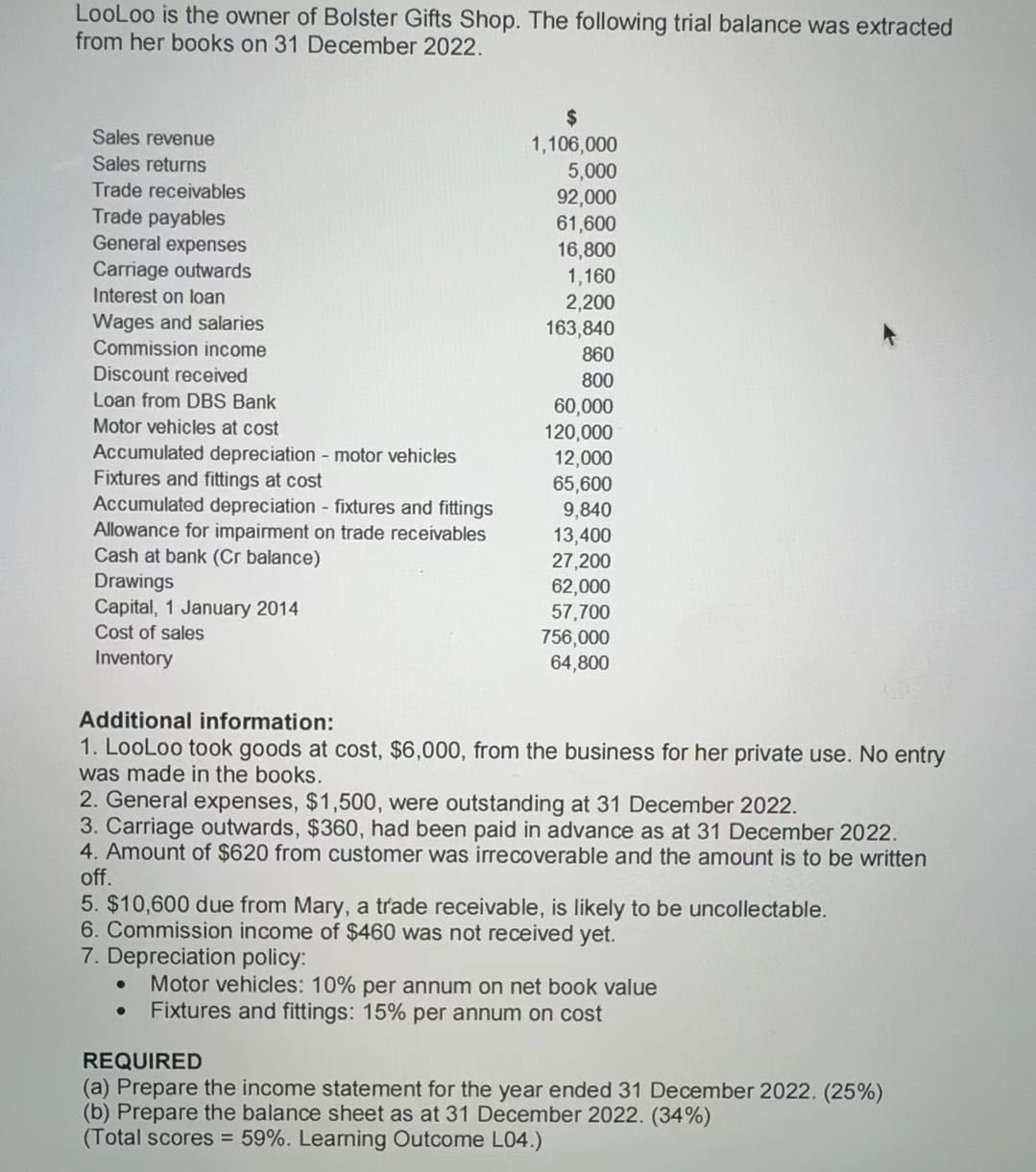

LooLoo is the owner of Bolster Gifts Shop. The following trial balance was extracted from her books on 3 1 December 2 0 2 2

LooLoo is the owner of Bolster Gifts Shop. The following trial balance was extracted

from her books on December

Additional information:

LooLoo took goods at cost $ from the business for her private use. No entry

was made in the books.

General expenses, $ were outstanding at December

Carriage outwards, $ had been paid in advance as at December

Amount of $ from customer was irrecoverable and the amount is to be written

off.

$ due from Mary, a trade receivable, is likely to be uncollectable.

Commission income of $ was not received yet.

Depreciation policy:

Motor vehicles: per annum on net book value

Fixtures and fittings: per annum on cost

REQUIRED

a Prepare the income statement for the year ended December

b Prepare the balance sheet as at December

Total scores Learning Outcome L

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started