Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lopez and Gomez are members in an LLC that reports net income of $130,000. An agreement states that Lopez receives a $20,000 salary allowance and

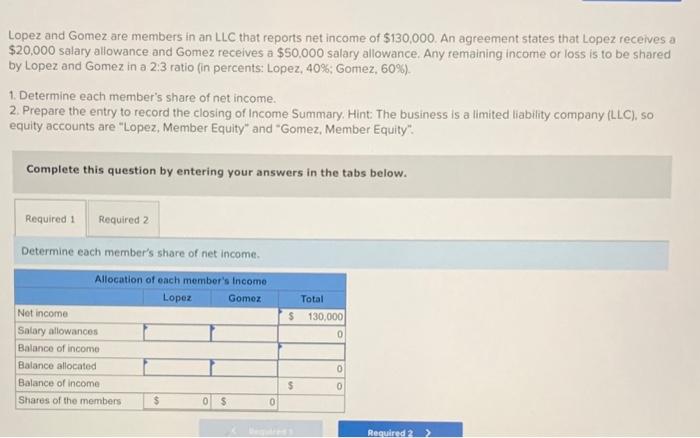

Lopez and Gomez are members in an LLC that reports net income of $130,000. An agreement states that Lopez receives a $20,000 salary allowance and Gomez receives a $50,000 salary allowance. Any remaining income or loss is to be shared by Lopez and Gomez in a 2:3 ratio (in percents: Lopez, 40%; Gomez, 60%)

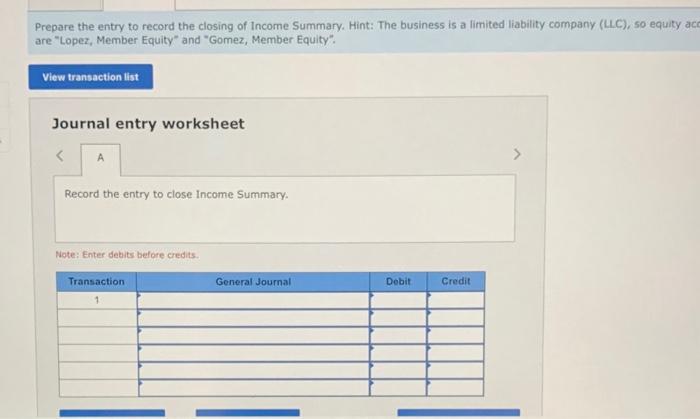

Lopez and Gomez are members in an LLC that reports net income of $130,000. An agreement states that Lopez receives a $20,000 salary allowance and Gomez receives a $50,000 salary allowance. Any remaining income or loss is to be shared by Lopez and Gomez in a 2:3 ratio (in percents: Lopez, 40%; Gomez, 60\%). 1. Determine each member's share of net income. 2. Prepare the entry to record the closing of Income Summary. Hint: The business is a limited liability company (LLC), so equity accounts are "Lopez, Member Equity" and "Gomez, Member Equity". Complete this question by entering your answers in the tabs below. Determine each member's share of net income. Prepare the entry to record the closing of Income Summary. Hint: The business is a limited liability company (LLC), so equity ac are "Lopez, Member Equity" and "Gomez, Member Equity". Journal entry worksheet Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started