Answered step by step

Verified Expert Solution

Question

1 Approved Answer

L'Oreal (bank account at Alpha Bank) issues $60,000 face value bonds for the price of $56,000; the bonds have a four year maturity and

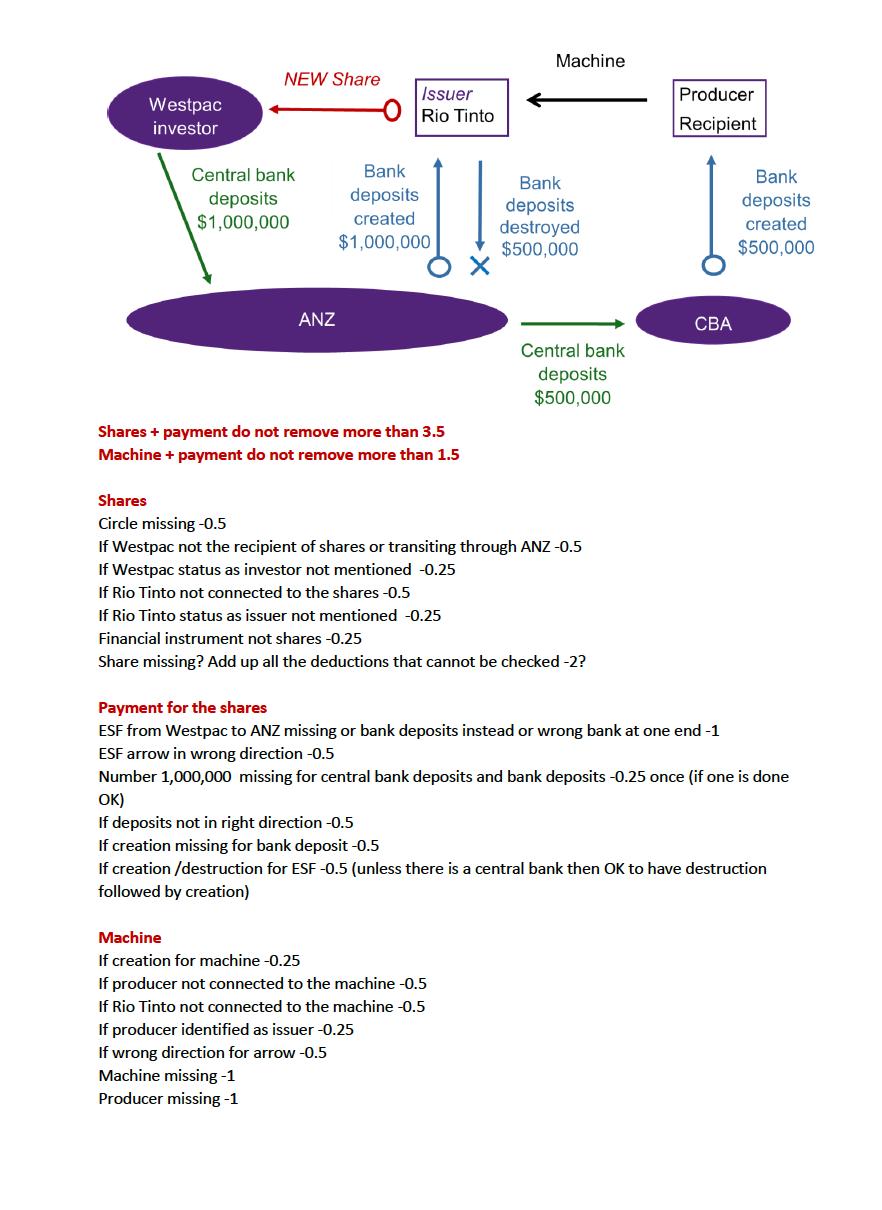

L'Oreal (bank account at Alpha Bank) issues $60,000 face value bonds for the price of $56,000; the bonds have a four year maturity and pay $5,000 coupons once a year. A third of the bonds are bought by Alpha Bank (transaction 1) while the other two thirds are bought by SuperManage, a managed fund banking at Beta bank (transaction 2). a. Draw the variations in Alpha Bank's balance sheet due to the two transactions above. Use only one single balance sheet and indicate the number of the transaction to which it relate at the end of each entry between brackets [example Notes: +700 (1) where (1) refers to transaction 1]. b. Conclude how the stock of bank deposits and the stock of central bank deposits in the financial system have changed as a result of these two transactions. Explain your answers. c. Draw how L'Oreal's balance sheet is changing at the time of the first coupons payment. Clearly distinguish between coupon payment and amortisation. Show the details of your calculation separately. What is the book value of the bonds issued after that transaction? Machine NEW Share Issuer Westpac Rio Tinto investor Central bank Bank Bank deposits deposits deposits $1,000,000 created destroyed $1,000,000 $500,000 ANZ Producer Recipient CBA Central bank deposits $500,000 Bank deposits created $500,000 Shares + payment do not remove more than 3.5 Machine + payment do not remove more than 1.5 Shares Circle missing -0.5 If Westpac not the recipient of shares or transiting through ANZ -0.5 If Westpac status as investor not mentioned -0.25 If Rio Tinto not connected to the shares -0.5 If Rio Tinto status as issuer not mentioned -0.25 Financial instrument not shares -0.25 Share missing? Add up all the deductions that cannot be checked -2? Payment for the shares ESF from Westpac to ANZ missing or bank deposits instead or wrong bank at one end-1 ESF arrow in wrong direction -0.5 Number 1,000,000 missing for central bank deposits and bank deposits -0.25 once (if one is done OK) If deposits not in right direction -0.5 If creation missing for bank deposit -0.5 If creation/destruction for ESF -0.5 (unless there is a central bank then OK to have destruction followed by creation) Machine If creation for machine -0.25 If producer not connected to the machine -0.5 If Rio Tinto not connected to the machine -0.5 If producer identified as issuer -0.25 If wrong direction for arrow -0.5 Machine missing -1 Producer missing -1 Payment for the machine ESF from ANZ to CBA missing or bank deposits instead or wrong bank at one end -1 ESF arrow in wrong direction -0.5 Number 500,000 missing for central bank deposits and bank deposits -0.25 once (if one is done OK) If deposit in wrong direction -0.5 (only once) If creation missing for bank deposit -0.5 If destruction missing for bank deposits -0.5 If creation/destruction for ESF -0.5 (unless there is a central bank then OK to have destruction followed by creation) Bonus if central bank well done with creation/destruction ESF twice +0.25 If answered b that net creation of deposits 1,000,000 +0.25 No creation of central bank money +0.25 Copy paste (keep formatting); stop writing the penalty associated with the mistake when you see you have exceeded the marks available. Shares and payment of shares List of mistakes subtotal ?/3.5 Machine and payment of machine List of mistakes subtotal ?/1.5 Bonus List Total?/5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Alpha Banks balance sheet variations due to the two transactions are as follows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started