Answered step by step

Verified Expert Solution

Question

1 Approved Answer

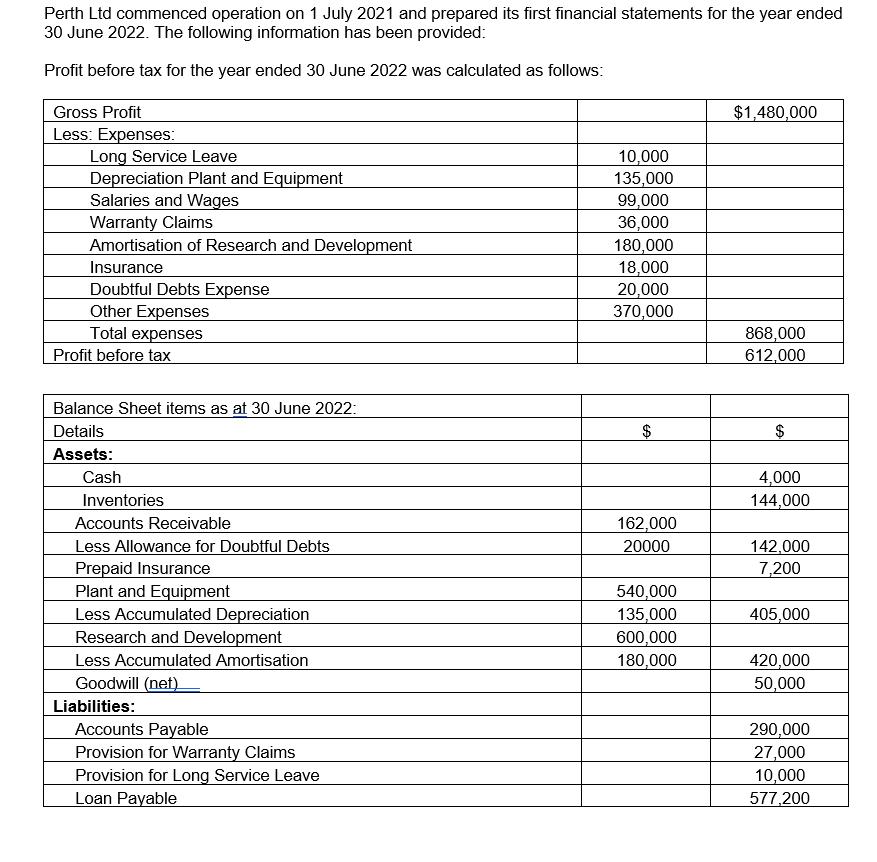

Perth Ltd commenced operation on 1 July 2021 and prepared its first financial statements for the year ended 30 June 2022. The following information

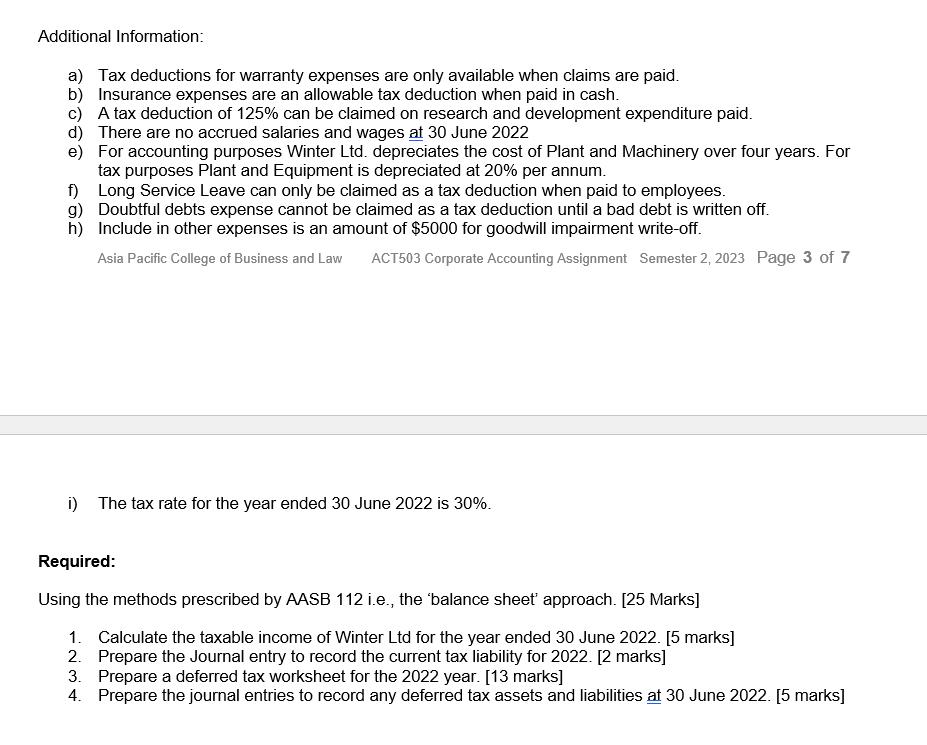

Perth Ltd commenced operation on 1 July 2021 and prepared its first financial statements for the year ended 30 June 2022. The following information has been provided: Profit before tax for the year ended 30 June 2022 was calculated as follows: Gross Profit $1,480,000 Less: Expenses: Long Service Leave 10,000 Depreciation Plant and Equipment 135,000 Salaries and Wages 99,000 Warranty Claims 36,000 Amortisation of Research and Development 180,000 Insurance 18,000 Doubtful Debts Expense 20,000 Other Expenses 370,000 Total expenses Profit before tax 868,000 612,000 Balance Sheet items as at 30 June 2022: Details $ $ Assets: Cash 4,000 Inventories 144,000 Accounts Receivable 162,000 Less Allowance for Doubtful Debts 20000 142,000 Prepaid Insurance 7,200 Plant and Equipment 540,000 Less Accumulated Depreciation 135,000 405,000 Research and Development 600,000 Less Accumulated Amortisation 180,000 420,000 Goodwill (net) Liabilities: 50,000 Accounts Payable Provision for Warranty Claims Provision for Long Service Leave Loan Payable 290,000 27,000 10,000 577,200 Additional Information: a) Tax deductions for warranty expenses are only available when claims are paid. b) Insurance expenses are an allowable tax deduction when paid in cash. c) A tax deduction of 125% can be claimed on research and development expenditure paid. d) There are no accrued salaries and wages at 30 June 2022 e) For accounting purposes Winter Ltd. depreciates the cost of Plant and Machinery over four years. For tax purposes Plant and Equipment is depreciated at 20% per annum. f) Long Service Leave can only be claimed as a tax deduction when paid to employees. g) Doubtful debts expense cannot be claimed as a tax deduction until a bad debt is written off. h) Include in other expenses is an amount of $5000 for goodwill impairment write-off. Asia Pacific College of Business and Law ACT503 Corporate Accounting Assignment Semester 2, 2023 Page 3 of 7 i) The tax rate for the year ended 30 June 2022 is 30%. Required: Using the methods prescribed by AASB 112 i.e., the 'balance sheet' approach. [25 Marks] 1. Calculate the taxable income of Winter Ltd for the year ended 30 June 2022. [5 marks] 2. Prepare the Journal entry to record the current tax liability for 2022. [2 marks] 3. Prepare a deferred tax worksheet for the 2022 year. [13 marks] 4. Prepare the journal entries to record any deferred tax assets and liabilities at 30 June 2022. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started