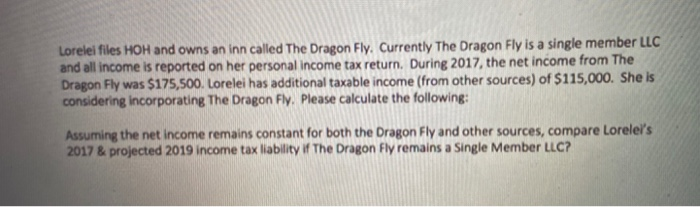

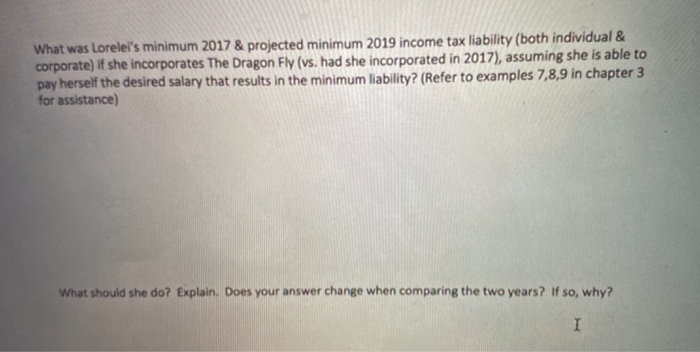

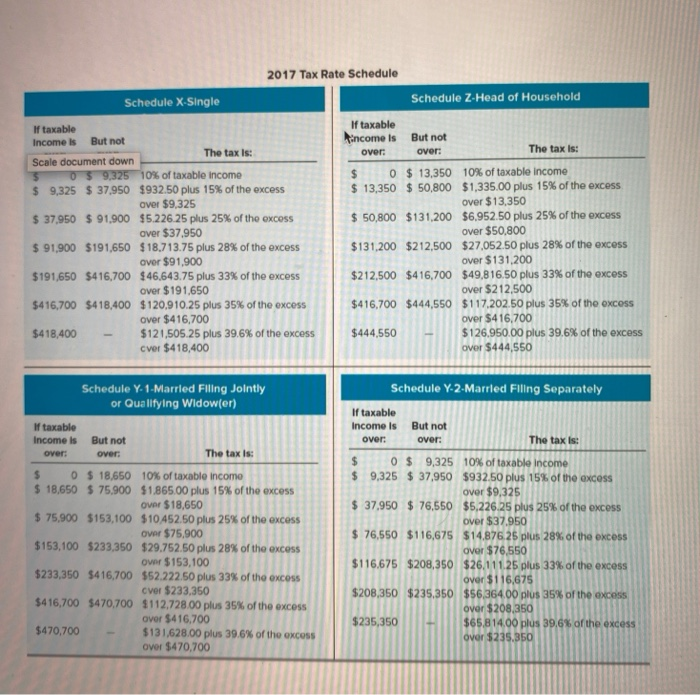

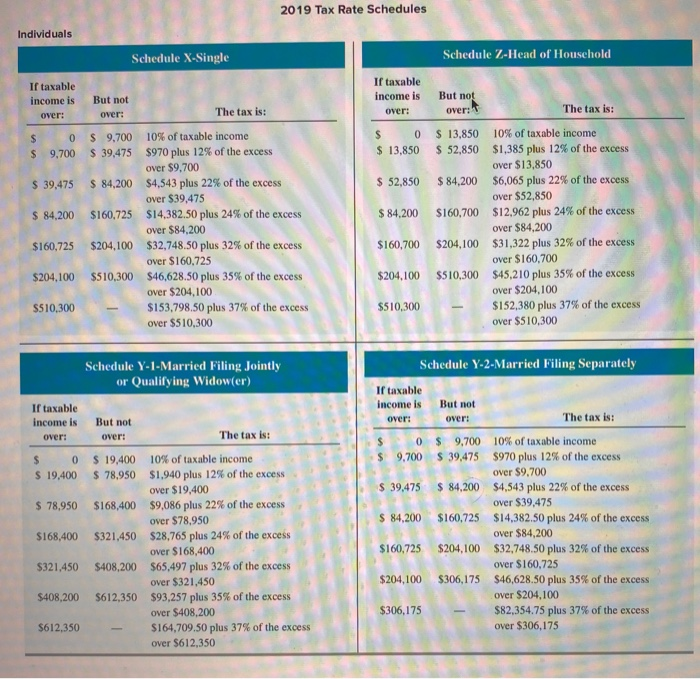

Lorelei files HOH and owns an inn called The Dragon Fly. Currently The Dragon Fly is a single member LLC and all income is reported on her personal income tax return. During 2017, the net income from The Dragon Fly was $175,500. Lorelei has additional taxable income (from other sources) of $115,000. She is considering incorporating The Dragon Fly. Please calculate the following: Assuming the net income remains constant for both the Dragon Fly and other sources, compare Lorelei's 2017 & projected 2019 income tax liability if The Dragon Fly remains a Single Member LLC? What was Lorelei's minimum 2017 & projected minimum 2019 income tax liability (both individual & corporate) if she incorporates The Dragon Fly (vs. had she incorporated in 2017), assuming she is able to pay herself the desired salary that results in the minimum liability? (Refer to examples 7,8,9 in chapter 3 for assistance) What should she do? Explain. Does your answer change when comparing the two years? If so, why? I 2017 Tax Rate Schedule Schedule X-Single Schedule 2 Head of Household If taxable If taxable Income is But not income is But not The tax is: over: over: The tax is: Scale document down 3 05 9,325 10% of taxable income $ 0 $ 13,350 10% of taxable income $ 9,325 $ 37,950 $932.50 plus 15% of the excess $ 13,350 $ 50,800 $1,335.00 plus 15% of the excess over $9,325 over $13,350 $ 37,950 $ 91,900 $5.226.25 plus 25% of the excess $ 50,800 $131,200 $6,952.50 plus 25% of the excess over $37.950 over $50,800 $ 91,900 $191,650 $18.713.75 plus 28% of the excess $131,200 $212,500 $27,052.50 plus 28% of the excess over $91,900 over $131,200 $191,650 $416,700 $46.643.75 plus 33% of the excess $212,500 $416,700 $49,816.50 plus 33% of the excess over $191,650 over $212,500 $416,700 $418,400 $120,910.25 plus 35% of the excess $416,700 $444,550 $117.202.50 plus 35% of the excess over $416,700 over $416,700 $418,400 $121,505 25 plus 39.6% of the excess $444,550 $126.950.00 plus 39.6% of the excess cver $418,400 Over $444,550 Schedule Y-1- Married Filing Jointly or Qualifying Widow(er) Schedule Y-2-Married Filing Separately If taxable Income is But not over: over: The tax is: $ 0 $ 18,650 10% of taxable income $ 18,650 $ 75,900 $1,865,00 plus 15% of the excess over $18,650 $ 75,900 $153,100 $10,452.50 plus 25% of the excess over $75,900 $153,100 $233,350 $29.752.50 plus 28% of the excess over $153,100 $233,350 $416,700 $52.222.50 plus 33% of the excess cver $233,350 $416,700 $470,700 $112,728.00 plus 35% of the excess over $416,700 $470,700 $131,628.00 plus 39.6% of the excess over $470,700 If taxable Income is But not over over: The tax is: $ 0$ 9,325 10% of taxable income $ 9,325 $ 37,950 $932.50 plus 15% of the excess over $9,325 $ 37,950 $ 76,550 $5,226.25 plus 25% of the excess over $37,950 $ 76,550 $116,675 $14,876.25 plus 28% of the excess Over $76.550 $116,675 $208,350 $26.111.25 plus 33% of the excess over $116,675 $208,350 $235,350 $56,364.00 plus 35% of the excess over $208,350 $235,350 $65,814.00 plus 39.6% of the excess over $235.350 2019 Tax Rate Schedules Individuals Schedule X-Single Schedule Z-Head of Household If taxable income is over: over: S $ 0 $ 13,850 $ 52,850 Ir taxable income is But not over: The tax is: 0 $ 9.700 10% of taxable income $ 9,700 $ 39,475 $970 plus 12% of the excess over $9,700 $ 39,475 $ 84,200 $4,543 plus 22% of the excess over $39,475 $ 84,200 $160,725 $14,382.50 plus 24% of the excess over $84,200 $160,725 $204,100 $32,748.50 plus 32% of the excess over $160,725 $204,100 $510,300 $46,628.50 plus 35% of the excess over $204,100 $510,300 $153,798.50 plus 37% of the excess over $510,300 $ 84.200 But nog over: The tax is: $ 13,850 10% of taxable income $ 52,850 $1,385 plus 12% of the excess over $13,850 $ 84,200 $6,065 plus 22% of the excess over $52,850 $160,700 $12,962 plus 24% of the excess over $84.200 $204,100 $31,322 plus 32% of the excess over $160,700 $510,300 $45,210 plus 35% of the excess over $204,100 $152,380 plus 37% of the excess over $510,300 $160,700 $204,100 $510,300 Schedule Y-2-Married Filing Separately Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: $ 0 $ 19,400 $ 78,950 If taxable income is But not over: over: The tax is: $ 0 $ 9,700 10% of taxable income $ 9,700 S 39,475 $970 plus 12% of the excess over $9,700 $ 39,475 $ 84,200 $4,543 plus 22% of the excess over $39,475 $ 84,200 $160,725 $14,382.50 plus 24% of the excess over $84,200 $160,725 $204,100 $32,748.50 plus 32% of the excess over $160,725 $204,100 $306,175 $46,628.50 plus 35% of the excess over $204,100 $306,175 $82,354.75 plus 37% of the excess over $306,175 But not over: The tax is: $ 19,400 10% of taxable income $ 78,950 $1,940 plus 12% of the excess over $19,400 $168,400 $9,086 plus 22% of the excess over $78,950 $321,450 $28,765 plus 24% of the excess over $168,400 $408,200 $65,497 plus 32% of the excess over $321.450 $612,350 $93,257 plus 35% of the excess over $408.200 $164,709.50 plus 37% of the excess over $612,350 $168,400 $321,450 $408,200 $612,350