Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lorenzo, the owner of a local poster shop, comes to you for help. While his shop has been breaking even for the past two

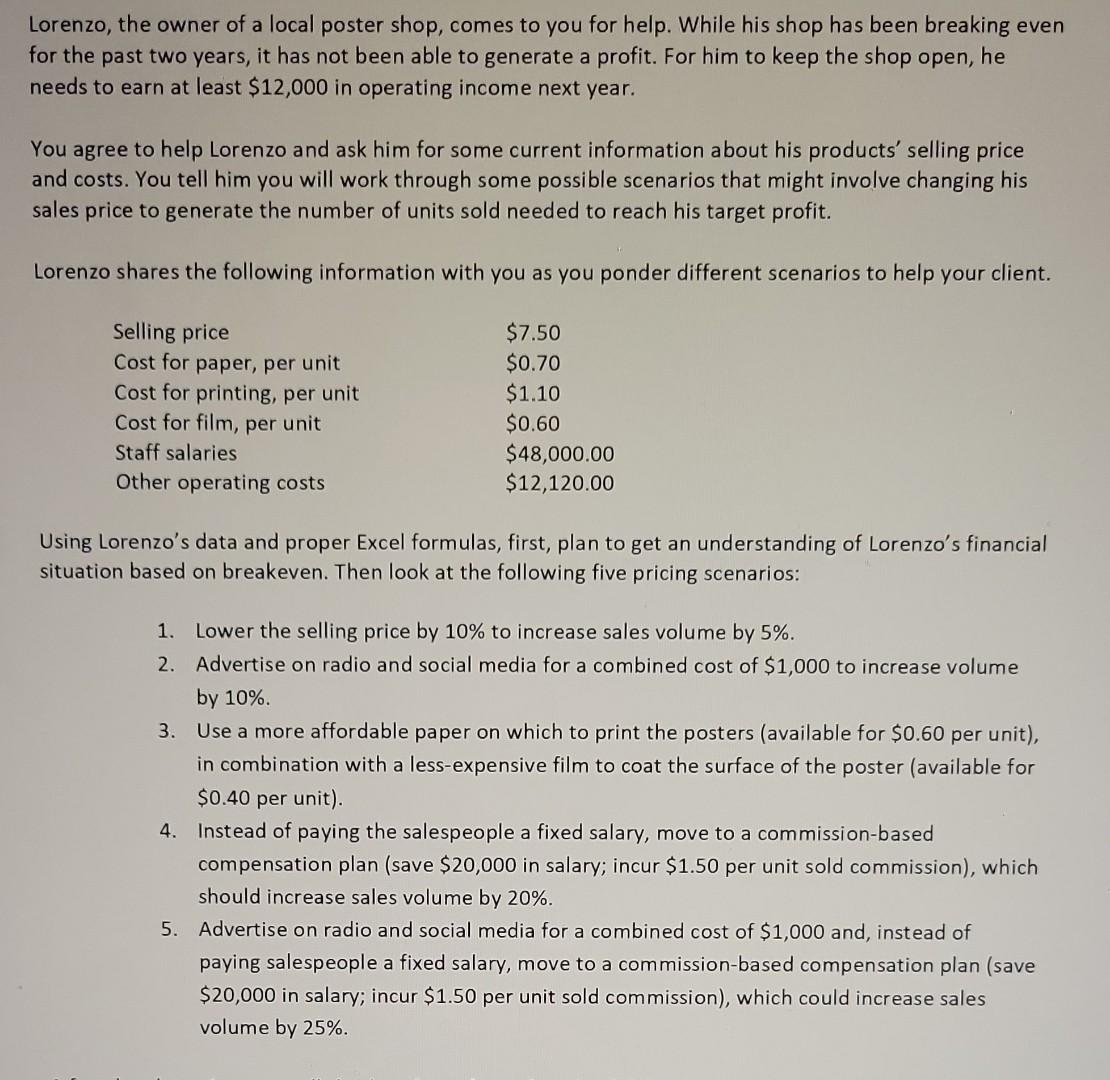

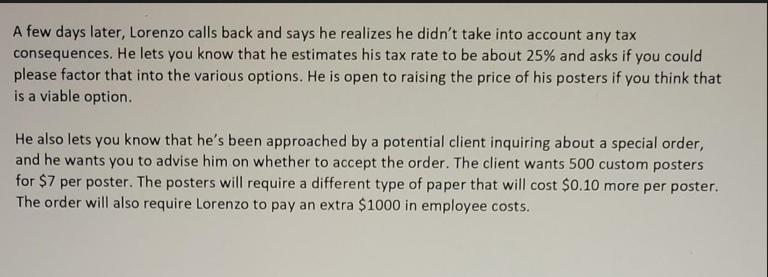

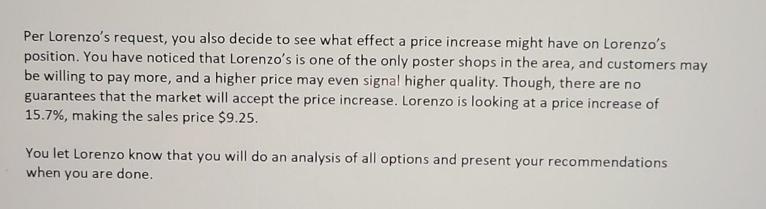

Lorenzo, the owner of a local poster shop, comes to you for help. While his shop has been breaking even for the past two years, it has not been able to generate a profit. For him to keep the shop open, he needs to earn at least $12,000 in operating income next year. You agree to help Lorenzo and ask him for some current information about his products' selling price and costs. You tell him you will work through some possible scenarios that might involve changing his sales price to generate the number of units sold needed to reach his target profit. Lorenzo shares the following information with you as you ponder different scenarios to help your client. Selling price Cost for paper, per unit Cost for printing, per unit Cost for film, per unit Staff salaries Other operating costs $7.50 $0.70 $1.10 $0.60 $48,000.00 $12,120.00 Using Lorenzo's data and proper Excel formulas, first, plan to get an understanding of Lorenzo's financial situation based on breakeven. Then look at the following five pricing scenarios: 1. Lower the selling price by 10% to increase sales volume by 5%. 2. Advertise on radio and social media for a combined cost of $1,000 to increase volume by 10%. 3. Use a more affordable paper on which to print the posters (available for $0.60 per unit), in combination with a less-expensive film to coat the surface of the poster (available for $0.40 per unit). 4. Instead of paying the salespeople a fixed salary, move to a commission-based compensation plan (save $20,000 in salary; incur $1.50 per unit sold commission), which should increase sales volume by 20%. 5. Advertise on radio and social media for a combined cost of $1,000 and, instead of paying salespeople a fixed salary, move to a commission-based compensation plan (save $20,000 in salary; incur $1.50 per unit sold commission), which could increase sales volume by 25%. A few days later, Lorenzo calls back and says he realizes he didn't take into account any tax consequences. He lets you know that he estimates his tax rate to be about 25% and asks if you could please factor that into the various options. He is open to raising the price of his posters if you think that is a viable option. He also lets you know that he's been approached by a potential client inquiring about a special order, and he wants you to advise him on whether to accept the order. The client wants 500 custom posters for $7 per poster. The posters will require a different type of paper that will cost $0.10 more per poster. The order will also require Lorenzo to pay an extra $1000 in employee costs. Per Lorenzo's request, you also decide to see what effect a price increase might have on Lorenzo's position. You have noticed that Lorenzo's is one of the only poster shops in the area, and customers may be willing to pay more, and a higher price may even signal higher quality. Though, there are no guarantees that the market will accept the price increase. Lorenzo is looking at a price increase of 15.7%, making the sales price $9.25. You let Lorenzo know that you will do an analysis of all options and present your recommendations when you are done.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To analyze Lorenzos financial situation and evaluate the different pricing scenarios lets start with the breakeven analysis based on the given information Breakeven Analysis First we calculate the bre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started