Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lorraine and Peter are evaluating their life insurance needs. Peter makes $3,500 per month after tax, and Lorraine clears $1,200 per week after tax.

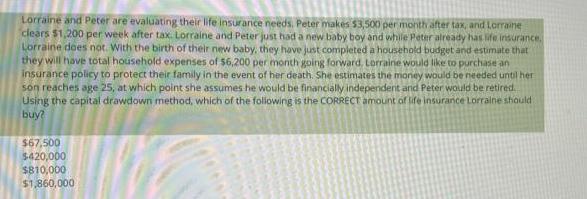

Lorraine and Peter are evaluating their life insurance needs. Peter makes $3,500 per month after tax, and Lorraine clears $1,200 per week after tax. Lorraine and Peter just had a new baby boy and while Peter already has life insurance, Lorraine does not. With the birth of their new baby, they have just completed a household budget and estimate that they will have total household expenses of $6,200 per month going forward, Lorraine would like to purchase an insurance policy to protect their family in the event of her death. She estimates the money would be needed until her son reaches age 25, at which point she assumes he would be financially independent and Peter would be retired. Using the capital drawdown method, which of the following is the CORRECT amount of life insurance Lorraine should buy? $67,500 $420,000 $810,000 $1,860,000

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Monthly ShortFall Monthly Expense Pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started