Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bill and Ben set up in business together as Flowerpot & Co. in order to provide catering facilities at a series of future trade

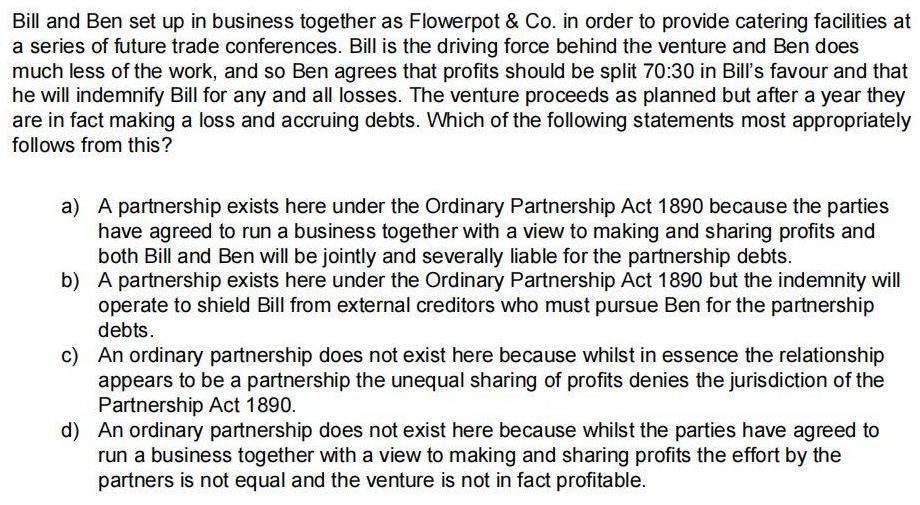

Bill and Ben set up in business together as Flowerpot & Co. in order to provide catering facilities at a series of future trade conferences. Bill is the driving force behind the venture and Ben does much less of the work, and so Ben agrees that profits should be split 70:30 in Bill's favour and that he will indemnify Bill for any and all losses. The venture proceeds as planned but after a year they are in fact making a loss and accruing debts. Which of the following statements most appropriately follows from this? a) A partnership exists here under the Ordinary Partnership Act 1890 because the parties have agreed to run a business together with a view to making and sharing profits and both Bill and Ben will be jointly and severally liable for the partnership debts. b) A partnership exists here under the Ordinary Partnership Act 1890 but the indemnity will operate to shield Bill from external creditors who must pursue Ben for the partnership debts. c) An ordinary partnership does not exist here because whilst in essence the relationship appears to be a partnership the unequal sharing of profits denies the jurisdiction of the Partnership Act 1890. d) An ordinary partnership does not exist here because whilst the parties have agreed to run a business together with a view to making and sharing profits the effort by the partners is not equal and the venture is not in fact profitable.

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

d An ordinary partnership does not exist here because w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started