Answered step by step

Verified Expert Solution

Question

1 Approved Answer

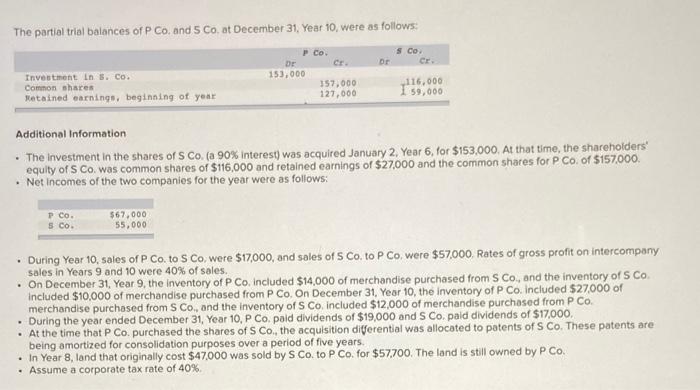

Los balances de prueba parciales de P Co. y S Co. al 31 de diciembre del ao 10, fueron los siguientes: Compaa P. empresa S

Los balances de prueba parciales de P Co. y S Co. al 31 de diciembre del ao 10, fueron los siguientes:

Compaa P. empresa S

Dr cromo Dr cromo

Inversin en S. Co. 153,000

Acciones comunes 157,000 116,000

Utilidades retenidas, comienzo del ao 127,000 59,000

informacin adicional

La inversin en las acciones de S Co. (una participacin del 90 %) se adquiri el 2 de enero del ao 6 por $153 000. En ese momento, el patrimonio de los accionistas de S Co. era acciones ordinarias de $116 000 y ganancias retenidas de $27 000 y las acciones ordinarias de P Co. de $157 000.

Los ingresos netos de las dos empresas para el ao fueron los siguientes:

Compaa P. $67,000

empresa S 55,000

Durante el ao 10, las ventas de P Co. a S Co. fueron de $17 000 y las ventas de S Co. a P Co. fueron de $57 000. Las tasas de utilidad bruta sobre las ventas intercompaa en los aos 9 y 10 fueron del 40% de las ventas.

El 31 de diciembre del ao 9, el inventario de P Co. inclua $14 000 de mercanca comprada a S Co., y el inventario de S Co. inclua $10 000 de mercanca comprada a P Co. El 31 de diciembre del ao 10, el inventario de P Co. inclua $27 000 de mercanca comprada a S Co., y el inventario de S Co. inclua $12 000 de mercanca comprada a P Co.

Durante el ao terminado el 31 de diciembre del ao 10, P Co. pag dividendos de $19,000 y S Co. pag dividendos de $17,000.

En el momento en que P Co. compr las acciones de S Co., el diferencial de adquisicin se asign a las patentes de S Co. Estas patentes se estn amortizando con fines de consolidacin en un perodo de cinco aos.

En el ao 8, S Co. vendi un terreno que originalmente costaba $47 000 a P Co. por $57 700. El terreno sigue siendo propiedad de P Co.

Suponga una tasa de impuesto corporativo del 40%.

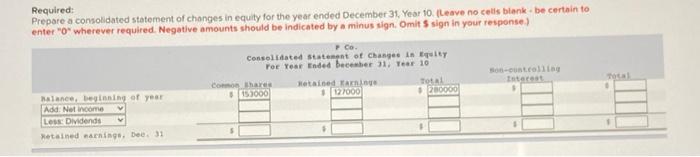

Requerido:

Prepare un estado consolidado de cambios en el patrimonio por el ao terminado el 31 de diciembre del Ao 10.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started