Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Loss Co. has net operating loss carryforwards of $10,000,000. It has assets worth $10,000,000 and liabilities of $2,000,000. Profit Co. is a publicly held

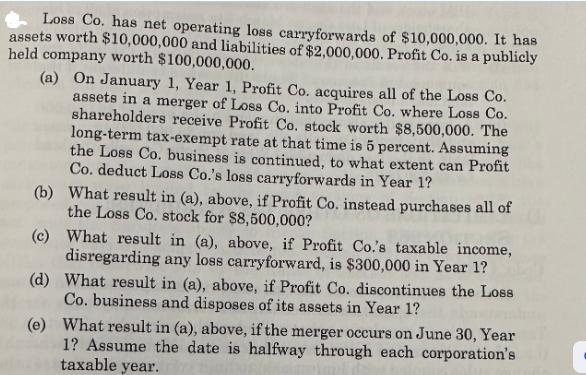

Loss Co. has net operating loss carryforwards of $10,000,000. It has assets worth $10,000,000 and liabilities of $2,000,000. Profit Co. is a publicly held company worth $100,000,000. (a) On January 1, Year 1, Profit Co. acquires all of the Loss Co. assets in a merger of Loss Co. into Profit Co. where Loss Co. shareholders receive Profit Co. stock worth $8,500,000. The long-term tax-exempt rate at that time is 5 percent. Assuming the Loss Co. business is continued, to what extent can Profit Co. deduct Loss Co.'s loss carryforwards in Year 1? (b) What result in (a), above, if Profit Co. instead purchases all of the Loss Co. stock for $8,500,000? (c) What result in (a), above, if Profit Co.'s taxable income, disregarding any loss carryforward, is $300,000 in Year 1? (d) What result in (a), above, if Profit Co. discontinues the Loss Co. business and disposes of its assets in Year 1? (e) What result in (a), above, if the merger occurs on June 30, Year 1? Assume the date is halfway through each corporation's taxable year.

Step by Step Solution

★★★★★

3.60 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The deductibility of Loss Cos net operating loss NOL carryforwards by Profit Co depends on various factors including the nature of the transaction the use of Loss Cos assets and Profit Cos taxable inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started