Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lotsa Pty Ltd Lotsa Pty Ltd (Lotsa) is a privately owned food and beverage production and distribution company. Lotsa produces an extensive range of processed

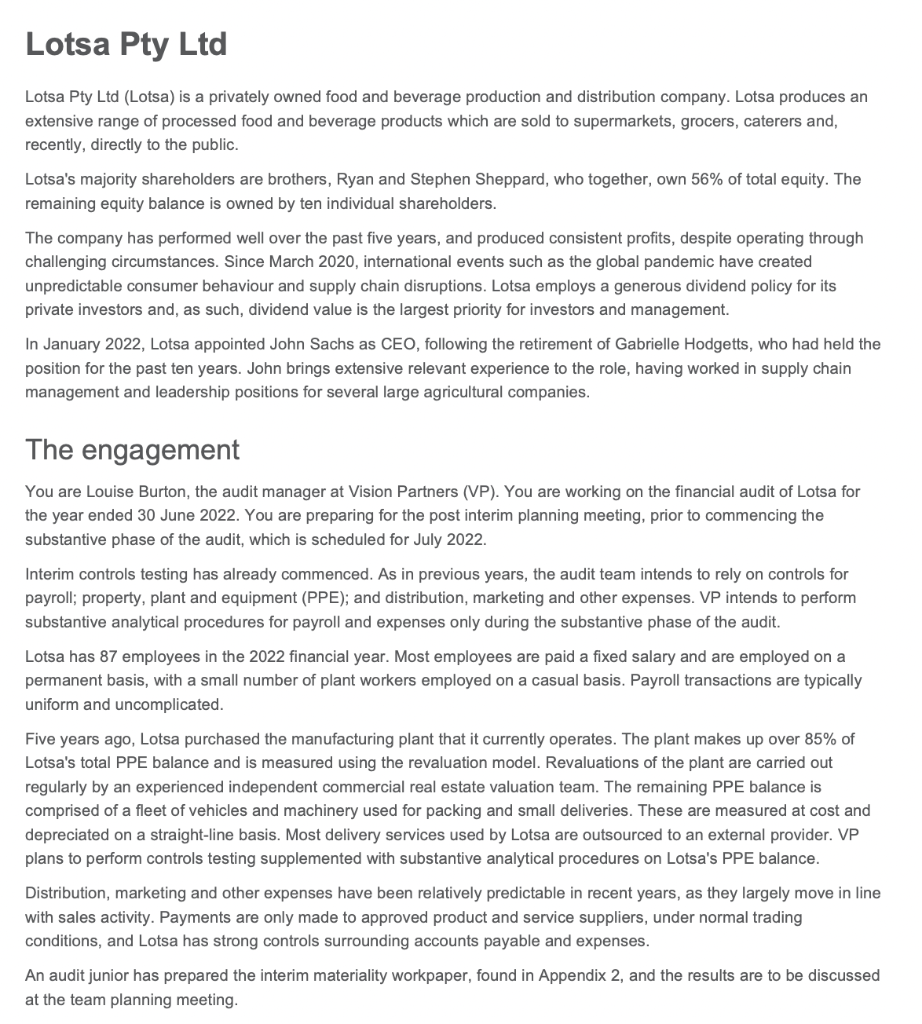

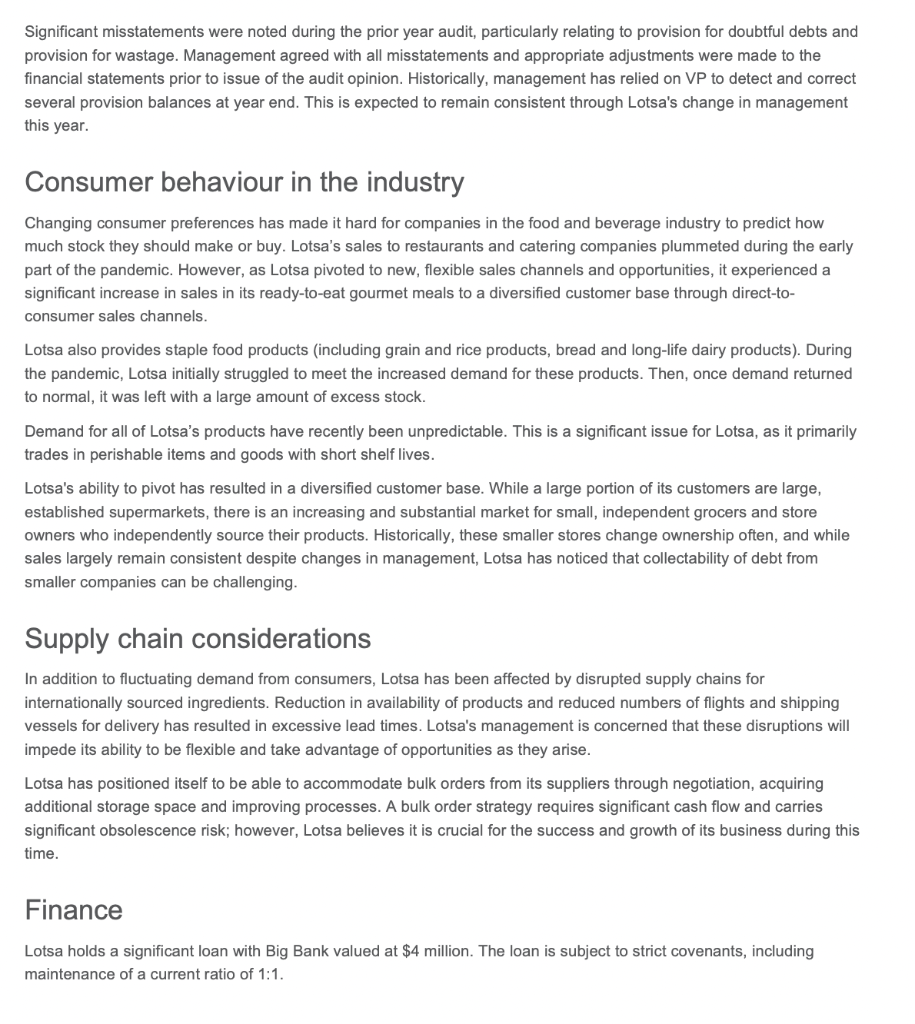

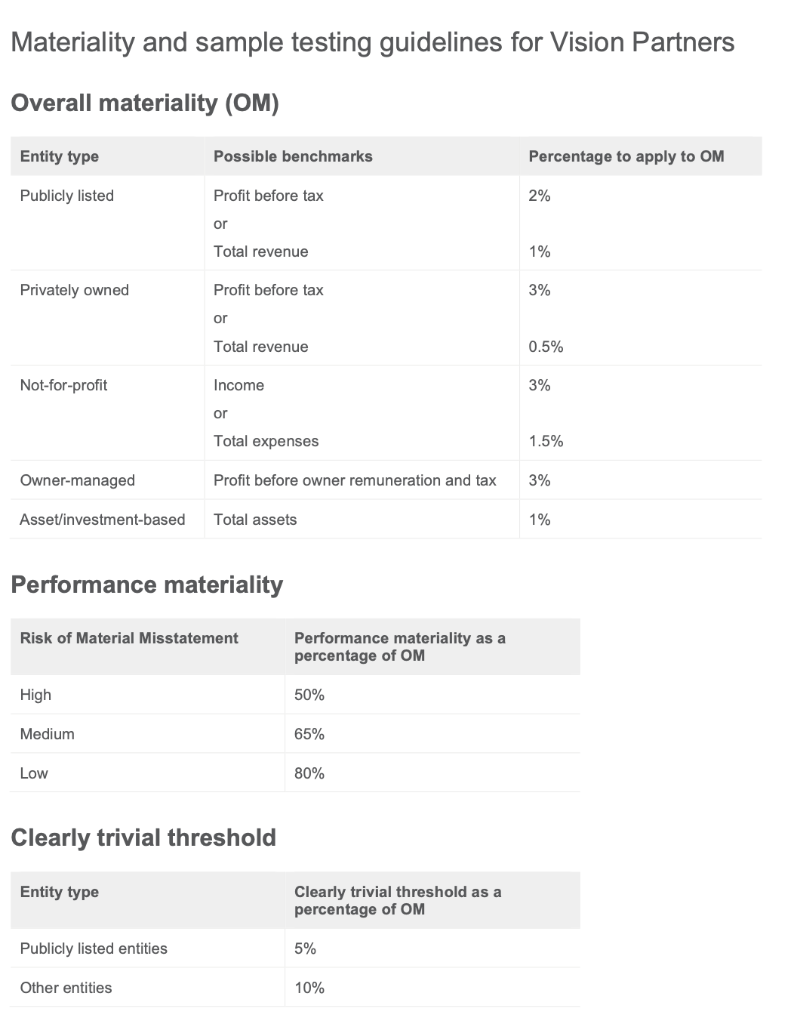

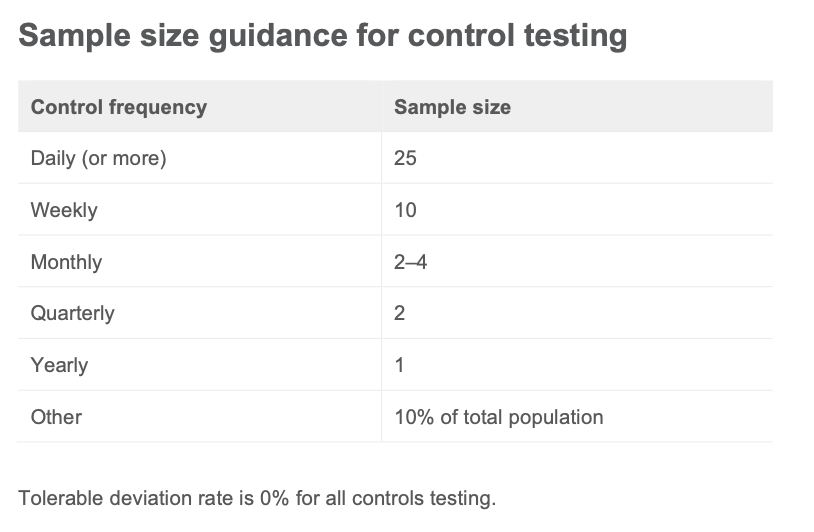

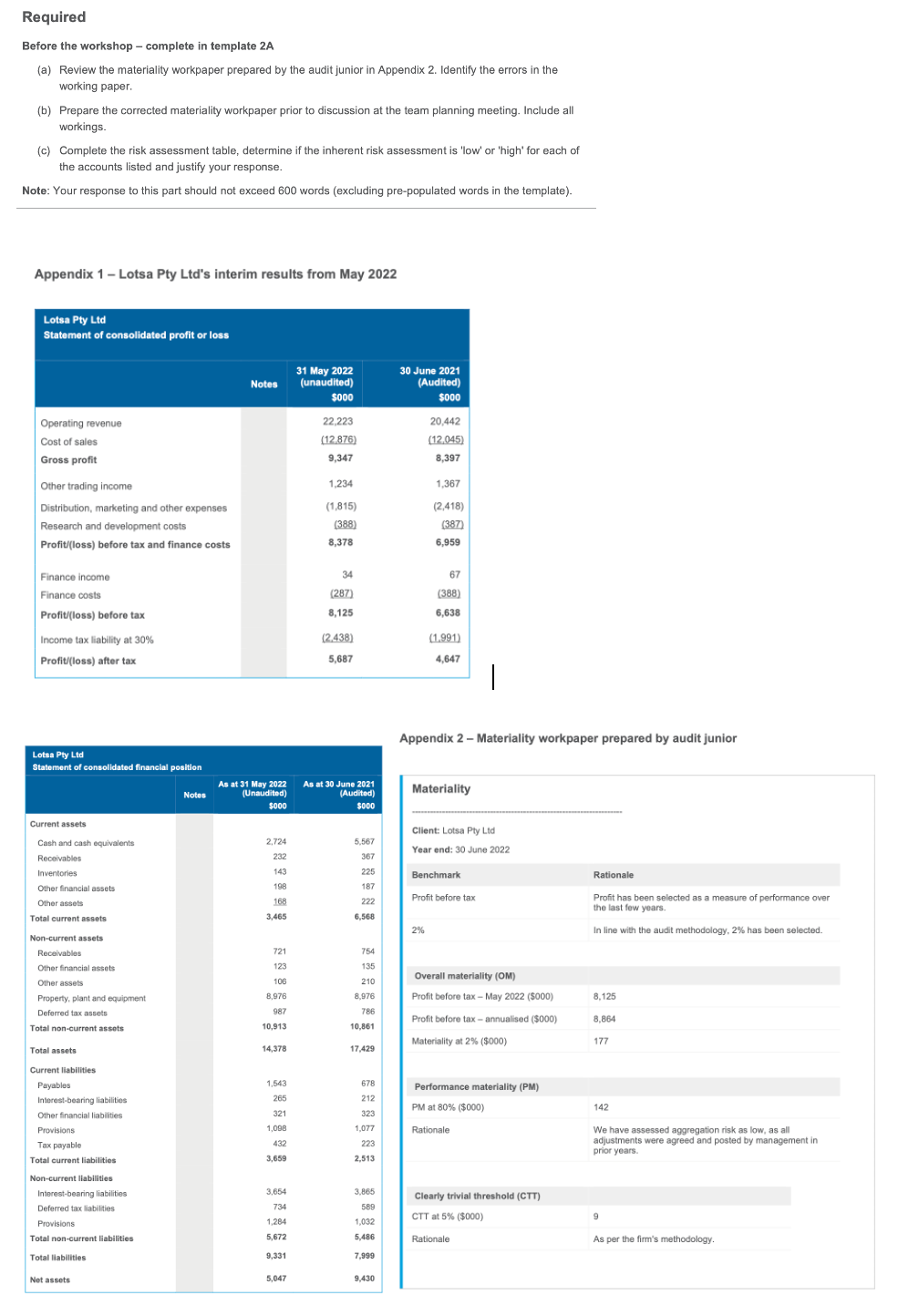

Lotsa Pty Ltd Lotsa Pty Ltd (Lotsa) is a privately owned food and beverage production and distribution company. Lotsa produces an extensive range of processed food and beverage products which are sold to supermarkets, grocers, caterers and, recently, directly to the public. Lotsa's majority shareholders are brothers, Ryan and Stephen Sheppard, who together, own 56% of total equity. The remaining equity balance is owned by ten individual shareholders. The company has performed well over the past five years, and produced consistent profits, despite operating through challenging circumstances. Since March 2020, international events such as the global pandemic have created unpredictable consumer behaviour and supply chain disruptions. Lotsa employs a generous dividend policy for its private investors and, as such, dividend value is the largest priority for investors and management. In January 2022, Lotsa appointed John Sachs as CEO, following the retirement of Gabrielle Hodgetts, who had held the position for the past ten years. John brings extensive relevant experience to the role, having worked in supply chain management and leadership positions for several large agricultural companies. The engagement You are Louise Burton, the audit manager at Vision Partners (VP). You are working on the financial audit of Lotsa for the year ended 30 June 2022. You are preparing for the post interim planning meeting, prior to commencing the substantive phase of the audit, which is scheduled for July 2022. Interim controls testing has already commenced. As in previous years, the audit team intends to rely on controls for payroll; property, plant and equipment (PPE); and distribution, marketing and other expenses. VP intends to perform substantive analytical procedures for payroll and expenses only during the substantive phase of the audit. Lotsa has 87 employees in the 2022 financial year. Most employees are paid a fixed salary and are employed on a permanent basis, with a small number of plant workers employed on a casual basis. Payroll transactions are typically uniform and uncomplicated. Five years ago, Lotsa purchased the manufacturing plant that it currently operates. The plant makes up over 85% of Lotsa's total PPE balance and is measured using the revaluation model. Revaluations of the plant are carried out regularly by an experienced independent commercial real estate valuation team. The remaining PPE balance is comprised of a fleet of vehicles and machinery used for packing and small deliveries. These are measured at cost and depreciated on a straight-line basis. Most delivery services used by Lotsa are outsourced to an external provider. VP plans to perform controls testing supplemented with substantive analytical procedures on Lotsa's PPE balance. Distribution, marketing and other expenses have been relatively predictable in recent years, as they largely move in line with sales activity. Payments are only made to approved product and service suppliers, under normal trading conditions, and Lotsa has strong controls surrounding accounts payable and expenses. An audit junior has prepared the interim materiality workpaper, found in Appendix 2 , and the results are to be discussed at the team planning meeting. Significant misstatements were noted during the prior year audit, particularly relating to provision for doubtful debts and provision for wastage. Management agreed with all misstatements and appropriate adjustments were made to the financial statements prior to issue of the audit opinion. Historically, management has relied on VP to detect and correct several provision balances at year end. This is expected to remain consistent through Lotsa's change in management this year. Consumer behaviour in the industry Changing consumer preferences has made it hard for companies in the food and beverage industry to predict how much stock they should make or buy. Lotsa's sales to restaurants and catering companies plummeted during the early part of the pandemic. However, as Lotsa pivoted to new, flexible sales channels and opportunities, it experienced a significant increase in sales in its ready-to-eat gourmet meals to a diversified customer base through direct-toconsumer sales channels. Lotsa also provides staple food products (including grain and rice products, bread and long-life dairy products). During the pandemic, Lotsa initially struggled to meet the increased demand for these products. Then, once demand returned to normal, it was left with a large amount of excess stock. Demand for all of Lotsa's products have recently been unpredictable. This is a significant issue for Lotsa, as it primarily trades in perishable items and goods with short shelf lives. Lotsa's ability to pivot has resulted in a diversified customer base. While a large portion of its customers are large, established supermarkets, there is an increasing and substantial market for small, independent grocers and store owners who independently source their products. Historically, these smaller stores change ownership often, and while sales largely remain consistent despite changes in management, Lotsa has noticed that collectability of debt from smaller companies can be challenging. Supply chain considerations In addition to fluctuating demand from consumers, Lotsa has been affected by disrupted supply chains for internationally sourced ingredients. Reduction in availability of products and reduced numbers of flights and shipping vessels for delivery has resulted in excessive lead times. Lotsa's management is concerned that these disruptions will impede its ability to be flexible and take advantage of opportunities as they arise. Lotsa has positioned itself to be able to accommodate bulk orders from its suppliers through negotiation, acquiring additional storage space and improving processes. A bulk order strategy requires significant cash flow and carries significant obsolescence risk; however, Lotsa believes it is crucial for the success and growth of its business during this time. Finance Lotsa holds a significant loan with Big Bank valued at $4 million. The loan is subject to strict covenants, including maintenance of a current ratio of 1:1. Materiality and sample testing guidelines for Vision Partners Overall materiality (OM) Performance materiality Clearly trivial threshold Sample size guidance for control testing Tolerable deviation rate is 0% for all controls testing. Required Before the workshop-complete in template 2A (a) Review the materiality workpaper prepared by the audit junior in Appendix 2. Identify the errors in the working paper. (b) Prepare the corrected materiality workpaper prior to discussion at the team planning meeting. Include all workings. (c) Complete the risk assessment table, determine if the inherent risk assessment is 'low' or 'high' for each of the accounts listed and justify your response. Note: Your response to this part should not exceed 600 words (excluding pre-populated words in the template). Appendix 1 - Lotsa Pty Ltd's interim results from May 2022 Appendix 2 - Materiality workpaper prepared by audit junior Lotsa Pty Ltd Lotsa Pty Ltd (Lotsa) is a privately owned food and beverage production and distribution company. Lotsa produces an extensive range of processed food and beverage products which are sold to supermarkets, grocers, caterers and, recently, directly to the public. Lotsa's majority shareholders are brothers, Ryan and Stephen Sheppard, who together, own 56% of total equity. The remaining equity balance is owned by ten individual shareholders. The company has performed well over the past five years, and produced consistent profits, despite operating through challenging circumstances. Since March 2020, international events such as the global pandemic have created unpredictable consumer behaviour and supply chain disruptions. Lotsa employs a generous dividend policy for its private investors and, as such, dividend value is the largest priority for investors and management. In January 2022, Lotsa appointed John Sachs as CEO, following the retirement of Gabrielle Hodgetts, who had held the position for the past ten years. John brings extensive relevant experience to the role, having worked in supply chain management and leadership positions for several large agricultural companies. The engagement You are Louise Burton, the audit manager at Vision Partners (VP). You are working on the financial audit of Lotsa for the year ended 30 June 2022. You are preparing for the post interim planning meeting, prior to commencing the substantive phase of the audit, which is scheduled for July 2022. Interim controls testing has already commenced. As in previous years, the audit team intends to rely on controls for payroll; property, plant and equipment (PPE); and distribution, marketing and other expenses. VP intends to perform substantive analytical procedures for payroll and expenses only during the substantive phase of the audit. Lotsa has 87 employees in the 2022 financial year. Most employees are paid a fixed salary and are employed on a permanent basis, with a small number of plant workers employed on a casual basis. Payroll transactions are typically uniform and uncomplicated. Five years ago, Lotsa purchased the manufacturing plant that it currently operates. The plant makes up over 85% of Lotsa's total PPE balance and is measured using the revaluation model. Revaluations of the plant are carried out regularly by an experienced independent commercial real estate valuation team. The remaining PPE balance is comprised of a fleet of vehicles and machinery used for packing and small deliveries. These are measured at cost and depreciated on a straight-line basis. Most delivery services used by Lotsa are outsourced to an external provider. VP plans to perform controls testing supplemented with substantive analytical procedures on Lotsa's PPE balance. Distribution, marketing and other expenses have been relatively predictable in recent years, as they largely move in line with sales activity. Payments are only made to approved product and service suppliers, under normal trading conditions, and Lotsa has strong controls surrounding accounts payable and expenses. An audit junior has prepared the interim materiality workpaper, found in Appendix 2 , and the results are to be discussed at the team planning meeting. Significant misstatements were noted during the prior year audit, particularly relating to provision for doubtful debts and provision for wastage. Management agreed with all misstatements and appropriate adjustments were made to the financial statements prior to issue of the audit opinion. Historically, management has relied on VP to detect and correct several provision balances at year end. This is expected to remain consistent through Lotsa's change in management this year. Consumer behaviour in the industry Changing consumer preferences has made it hard for companies in the food and beverage industry to predict how much stock they should make or buy. Lotsa's sales to restaurants and catering companies plummeted during the early part of the pandemic. However, as Lotsa pivoted to new, flexible sales channels and opportunities, it experienced a significant increase in sales in its ready-to-eat gourmet meals to a diversified customer base through direct-toconsumer sales channels. Lotsa also provides staple food products (including grain and rice products, bread and long-life dairy products). During the pandemic, Lotsa initially struggled to meet the increased demand for these products. Then, once demand returned to normal, it was left with a large amount of excess stock. Demand for all of Lotsa's products have recently been unpredictable. This is a significant issue for Lotsa, as it primarily trades in perishable items and goods with short shelf lives. Lotsa's ability to pivot has resulted in a diversified customer base. While a large portion of its customers are large, established supermarkets, there is an increasing and substantial market for small, independent grocers and store owners who independently source their products. Historically, these smaller stores change ownership often, and while sales largely remain consistent despite changes in management, Lotsa has noticed that collectability of debt from smaller companies can be challenging. Supply chain considerations In addition to fluctuating demand from consumers, Lotsa has been affected by disrupted supply chains for internationally sourced ingredients. Reduction in availability of products and reduced numbers of flights and shipping vessels for delivery has resulted in excessive lead times. Lotsa's management is concerned that these disruptions will impede its ability to be flexible and take advantage of opportunities as they arise. Lotsa has positioned itself to be able to accommodate bulk orders from its suppliers through negotiation, acquiring additional storage space and improving processes. A bulk order strategy requires significant cash flow and carries significant obsolescence risk; however, Lotsa believes it is crucial for the success and growth of its business during this time. Finance Lotsa holds a significant loan with Big Bank valued at $4 million. The loan is subject to strict covenants, including maintenance of a current ratio of 1:1. Materiality and sample testing guidelines for Vision Partners Overall materiality (OM) Performance materiality Clearly trivial threshold Sample size guidance for control testing Tolerable deviation rate is 0% for all controls testing. Required Before the workshop-complete in template 2A (a) Review the materiality workpaper prepared by the audit junior in Appendix 2. Identify the errors in the working paper. (b) Prepare the corrected materiality workpaper prior to discussion at the team planning meeting. Include all workings. (c) Complete the risk assessment table, determine if the inherent risk assessment is 'low' or 'high' for each of the accounts listed and justify your response. Note: Your response to this part should not exceed 600 words (excluding pre-populated words in the template). Appendix 1 - Lotsa Pty Ltd's interim results from May 2022 Appendix 2 - Materiality workpaper prepared by audit junior

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started