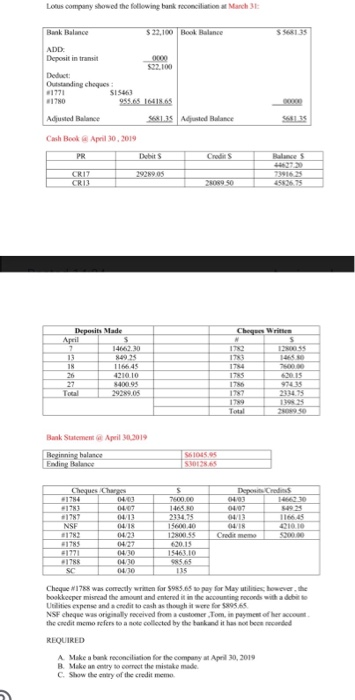

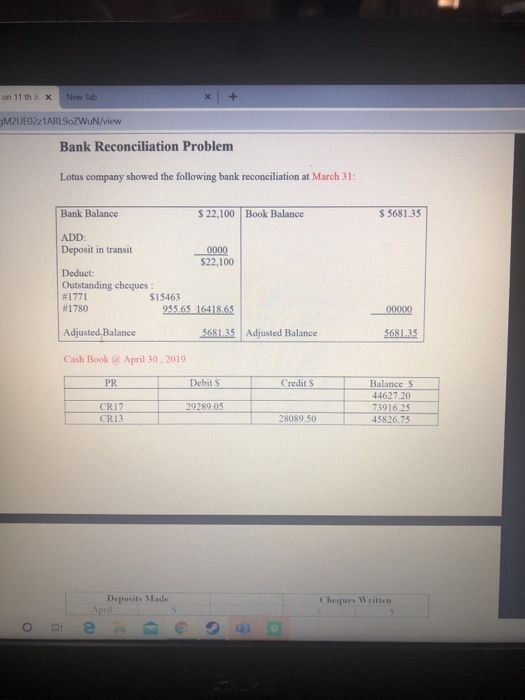

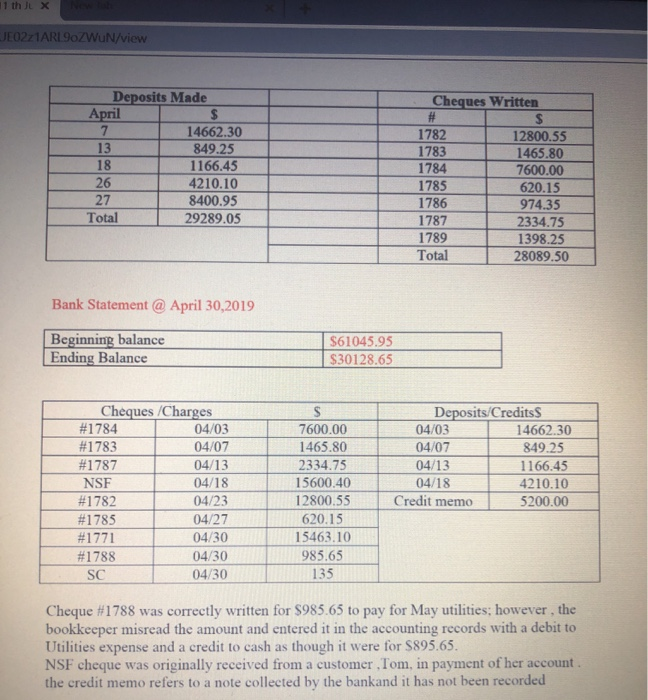

Lotus company showed the following bankronciliation March 31 $568135 Bank Balance $ 22,100 Book Balance ADD: Deposit in transit 0000 $22.100 Deduct: Outstanding cheques : SI56 170 955.65.1611865 Adjusted Balance $681,35 Adjusted Balance Cash Book April 30, 2019 PR Det Credits Pales CRIZ CRIB 29289 05 ROSSO Deposits Made April $ 2 14662.30 13 05 18 421010 27 8400193 Total 29290S Cher M 5 172 BOSS 1733 1784 7000 1785 1786 177 179 Total Bank Statement & April 302019 Beginning balance Ending Balance SS10.5 S10128.65 Cheques Charge -1784 000 -1N 0407 .1987 04/13 NSF 04/18 173 04:23 IN 1221 04/30 GEN 04/10 SC 04/30 5 7600.00 1468. 2334.75 150 1280055 620.15 1546310 085.65 115 Deportes 04/03 0407 04:13 11 018 10.10 Credit 5200.00 Cheque #1788 was correctly written for $985.65 to pay for May utilities, however, the bookkeeper misread the amount and entered it in the accounting records with a debito Utilities expense and credit to cash as though it were for $495.65 NSF cheque was originally received from a customer Tom, in payment of her account the credit momo refers to a note collected by the bankand it has not been recorded REQUIRED A Make a bank reconciliation for the company April 30, 2019 B Make an entry to correct the mistake made C. Show the emery of the credit meme on 11 th x New Tab M2UE0221ARL 9oZWuN/view Bank Reconciliation Problem Lotus company showed the following bank reconciliation at March 31: Bank Balance S 22,100 Book Balance $ 5681.35 ADD: Deposit in transit 0000 $22,100 Deduct: Outstanding cheques : #1771 $15463 #1780 935.65 16418.65 00000 Adjusted Balance 5681.35 Adjusted Balance 5681.35 Cash Book a April 30, 2019 PR Debit S Credits 29289.05 Balance s 44627.20 73916.25 45826,75 CRIT CRIB 28089.50 Deposits Made Cheques Written o e | | | X JE02Z1ARL9oZWUN/view Deposits Made April $ 7 14662.30 13 849.25 18 1166.45 26 4210.10 27 8400.95 Total 29289.05 Cheques Written # $ 1782 12800.55 1783 1465.80 1784 7600.00 1785 620.15 1786 974.35 1787 2334.75 1789 1398.25 Total 28089.50 Bank Statement @ April 30,2019 Beginning balance Ending Balance $61045.95 $30128.65 Cheques /Charges #1784 04/03 #1783 04/07 #1787 04/13 NSF 04/18 #1782 04/23 #1785 04/27 #1771 04/30 #1788 04/30 SC 04/30 7600.00 1465.80 2334.75 15600.40 12800.55 620.15 15463.10 985.65 135 Deposits/Credits 04/03 14662.30 04/07 849.25 04/13 1166.45 04/18 4210.10 Credit memo 5200.00 Cheque #1788 was correctly written for $985.65 to pay for May utilities; however, the bookkeeper misread the amount and entered it in the accounting records with a debit to Utilities expense and a credit to cash as though it were for $895.65. NSF cheque was originally received from a customer ,Tom, in payment of her account the credit memo refers to a note collected by the bankand it has not been recorded REQUIRED A. Make a bank reconciliation for the company at April 30, 2019 B. Make an entry to correct the mistake made. C. Show the entry of the credit memo