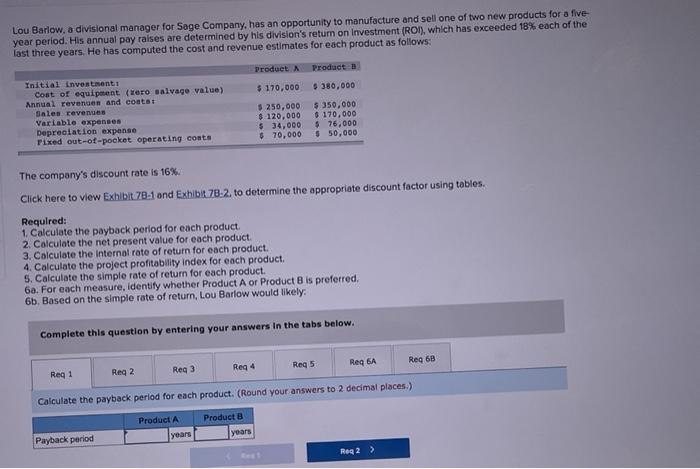

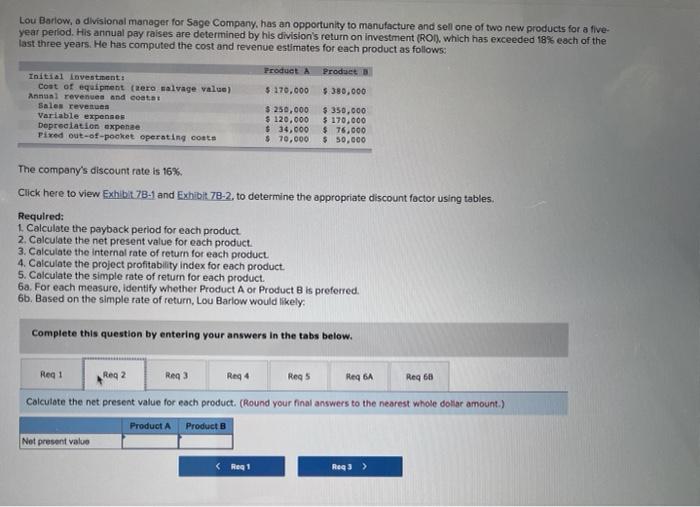

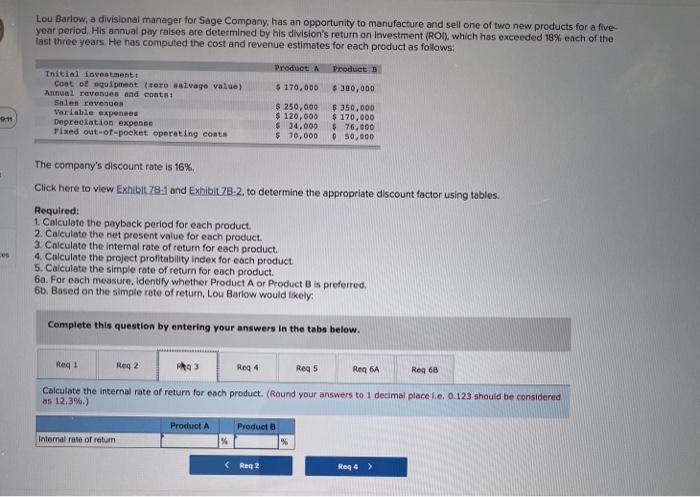

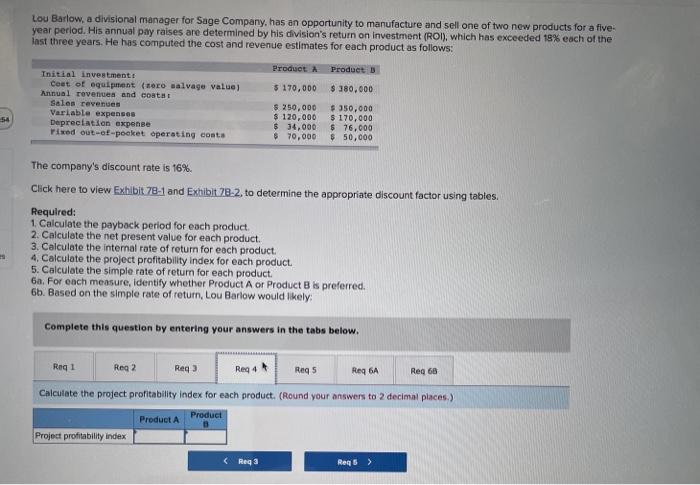

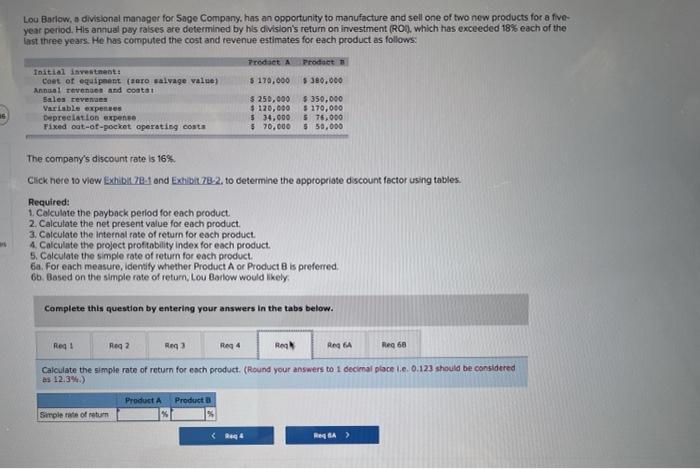

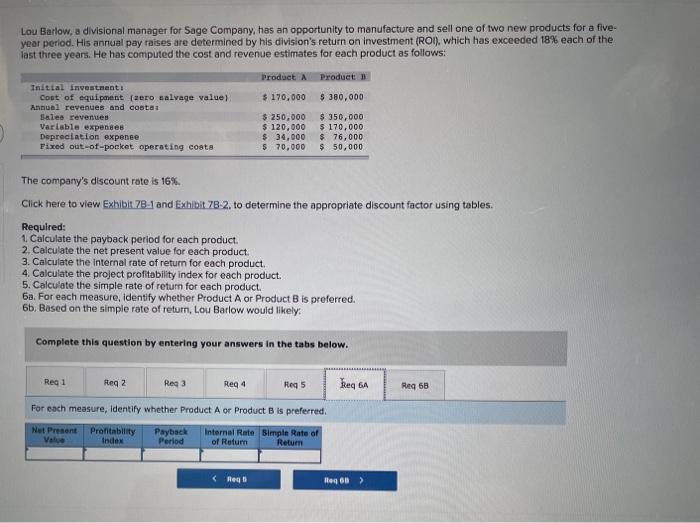

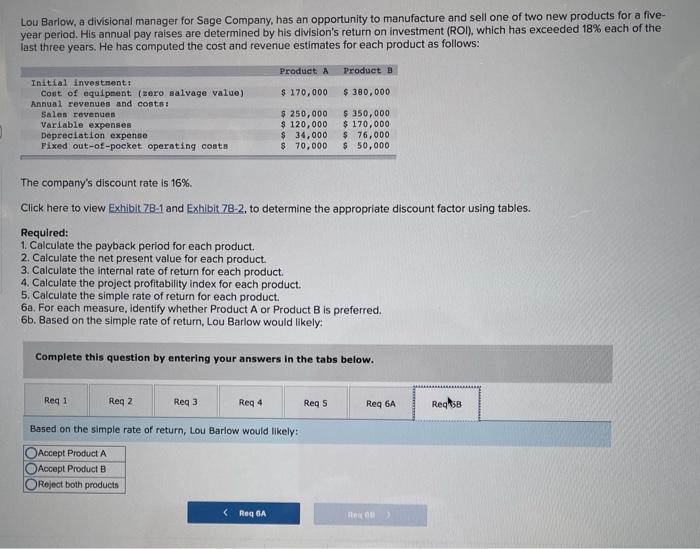

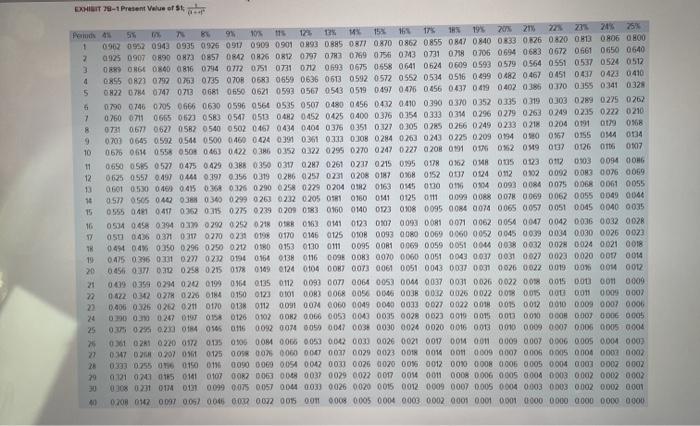

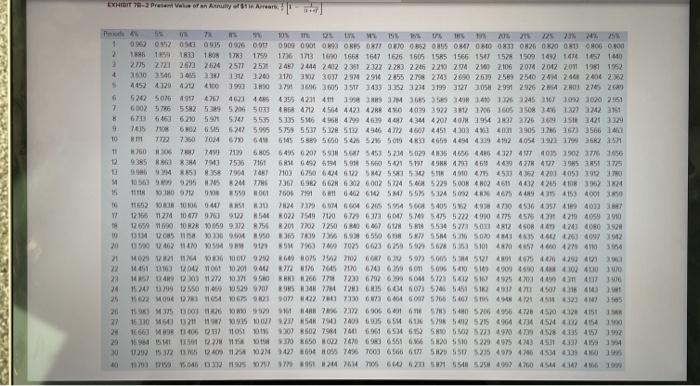

Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 18% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product Product B $ 380,000 Initial investment cost of equipment (tero salvage value) Annual revenge and contat Sales revenues Variable expenses Depreciation expense Fixed out-of-pocket operating conta $ 170,000 $ 250,000 $ 120,000 $ 34,000 $ 70,000 $ 350,000 $ 170,000 $ 76,000 $ 50,000 The company's discount rate is 16% Click here to view Exhibit.78.1 and Exhibit78-2. to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product 2. Calculate the net present value for each product. 3. Calculate the Internal rate of return for each product 4. Calculate the project profitability index for each product 5. Calculate the simple rate of return for each product 6. For each measure, identify whether Product A or Product is preferred 6b. Based on the simple rate of return, Lou Barlow would likely Complete this question by entering your answers in the tabs below. Reg 4 Reg 5 Reg 6A Reg 68 Req3 Reg 1 Reg 2 Calculate the payback period for each product. (Round your answers to 2 decimal places) Product A Product B yoans years Payback period Reg 2 > Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 18% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product Products $ 170.000 $ 380,000 Initial investment cost of equipment Rere salvage value) Annual revenues and costat Sales revenues Variable expenses Depreciation expenae Pixed out-of-pocket operating costs $ 250,000 $ 120,000 $ 34,000 $ 70,000 $ 350,000 $ 170,000 $ 76,000 $ 50,000 The company's discount rate is 16% Click here to view Exhibit 7B-1 and Exhibit78-2. to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product 2. Calculate the net present value for each product 3. Calculate the Internal rate of return for each product 4. Calculate the project profitability index for each product. 5. Calculate the simple rate of return for each product. 6a. For each measure, Identity whether Product A or Product B is preferred. 66. Based on the simple rate of return, Lou Barlow would likely Complete this question by entering your answers in the tabs below. Reg 68 Reg1 Reg 2 Reg 3 Reg Regs Req 6A Calculate the net present value for each product. (Round your final answers to the nearest whole dollar amount.) Product Product B Not present value Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 18% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Products Initial investments Coat of equipment (tero salvage value) $ 170,000 $ 300,000 Annual revenues and coats Sales revenues $ 250,000 $ 350,000 Variable expenses $ 120,000 $ 170,000 Depreciation expense $ 34,000 $ 76,000 Fixed out-of-pocket operating conta $ 70,000 $ 50,000 9:11 The company's discount rate is 16% Click here to view Exhibit 78-1 and Exhibit 7B-2. to determine the appropriate discount factor using tables, Required: 1. Calculate the payback period for each product 2. Calculate the net present value for each product 3. Calculate the internal rate of return for each product. 4. Calculate the project profitability index for each product 5. Calculate the simple rate of return for each product. 6a. For each measure, Identify whether Product A or Product B is preferred. 6b. Based on the simple rate of return, Lou Barlow would likely: es Complete this question by entering your answers in the tabs below. Reg 68 Req1 Reg 2 Reg 4 Reg 5 Reg 6 Calculate the internal rate of return for each product. (Round your answers to 1 decimal place le. 0.123 should be considered as 12.3%) Product A Products Internal rate of retum % Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 18% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product Products $ 170,000 $ 380,000 Initial investment Coat of equipment nero salvage value) Annual revenues and conta Sales revenues Variable expenses Depreciation expense Fixed out-of-pocket operating conta 8 250,000 $ 120,000 $ 34,000 $ 70,000 $ 350,000 $ 170,000 $ 76,000 $ 50,000 The company's discount rate is 16%. Click here to view Exhibit 78-1 and Exhibit 78-2, to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each product. 4. Calculate the project profitability index for each product. 5. Calculate the simple rate of return for each product. 6a. For each measure, identify whether Product A or Product B is preferred. 6b. Based on the simple rate of return, Lou Barlow would likely: Complete this question by entering your answers in the tabs below. Reg1 Req+ Reg 6 Reg 68 Reg 2 Req Reqs Calculate the project profitability Index for each product. (Round your answers to 2 decimal places) Product Product A Project profitability index Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 18% each of the last three years. He has computed the cost and revenue estimates for each product as follows. Trodat Product Initial investment: Coat of equipment (aero salvage value) $ 170,000 $390.000 Annual events and contat sales revenues $ 250.000 $ 350,000 Variable expenses $ 120,000 $ 170,000 Depreciation expense 5 34.000 5 75,000 Fixed out-of-pocket operating costs 5 70.000 550.000 The company's discount rate is 16% Click here to view Exhibit 7.1 and Exhibit 78.2. to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each product. 4 Calculate the project profitability index for each product. 5. Calculate the simple rate of return for each product. 6a. For each measure, Identify whether Product A or Product is preferred. 66. Based on the simple rate of return, Lou Barlow would likely Complete this question by entering your answers in the tabs below. Regt Reg 2 Reg4 ReN Reg Reg 60 Reg Calculate the simple rate of return for each product. (Round your answers to 1 decimal place le. 0.123 should be considered Product Product Simple of return Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 18% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B $ 170,000 Initial investment: Cost of equipment (zero salvage value) Annual revenues and costs: Sales revenues Variable expenses Depreciation expense Fixed out-of-pocket operating costs $ 250,000 $ 120,000 $ 34,000 $ 70,000 $ 380,000 $ 350,000 $ 170,000 $ 76,000 $ 50,000 The company's discount rate is 16%. Click here to view Exhibit 7B-1 and Exhibit 7B-2. to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each product 4. Calculate the project profitability Index for each product. 5. Calculate the simple rate of return for each product. 6a. For each measure, identify whether Product A or Product B is preferred. 6b. Based on the simple rate of return, Lou Barlow would likely: Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Req3 Reg 4 Reqs Req 6A ReqsB Based on the simple rate of return, Lou Barlow would likely: Accept Product A Accept Product B Reject both products ReqGA BUT 79-1 Present Value of St ME E D 8 Penud 4 5. 10 25% 123 MX 18 19 20 21 22 23 24% 15% 16% 17% 1 0902 092 0943 0935 0.926 091 0909 0901 093 0.885 081 08700862 0855 087 0840 0833 026 0820 01 0806 CHOO 2 0925 0907 0890 073 0857 OBA2 0826 0812 0797 0783 0769 0754 043 0731 078 0706 0694 0683 0672 0661 0650 0640 OR ONGE 0800 0816 0794 0720751 0731 072 0693 06750558 0641 0624 0.609 0.593 0579 0564 0551 0537 0524 0512 0855 0821 0797 076 0735 0708 063 0659 0636 0613 0592 0572 0552 0534 0516 0.299 0482 04670451 043 0423 0410 5 0822 0784 0747 0713 0681 0650 0621 0593 0567 0543 0519 0497 0475 0456 0437 0.479 0402 0386 0370 035 03410328 0790 0746 0/0 0666 0630 0596 0564 053 0507 0480 0456 042 04100390 0.370 0352 0335 0.319 0303 0289 0295 0202 7 0 760 0711 0665 0623 0583 0547 0513 042 0452 0425 0400 0376 0354 0333 0314 0296 0279 0263 0249 0235 0222 0210 0731 067 0627 0582 0540 0502 04670434 0406 0376 0351 0327 0.305 0285 0256 0249 0233 0218 0204 0191 079 08 9 0702 0645 0582 0.544 05000460 0424 0391 0361 033 0308 0284 0763 0243 0225 0.209 0194 00 0167 0155 014 0134 10 067 0614 0558 050 0463 0422 386 0352 0.322 0295 0270 0247 0227 0208 011011 042 049 04370126 0116 0107 11 0650 055 0527 0475 0.429 0388 03500317 027 0261 0217 02150195 0178 0362 048 005 0123 0112 0303 0094 GONG 12 0625 0557 0.19 0.441 0391 0356 0.319 0.286 0257 0231 0208 0187 0368 0152 07 0124 012 0.82 0092 0.093 0076 0069 13 0 601 050 0461 045 0.368 0.326 0290 0258 0279 0204 0182 0163 045 000 0.116 09 0093 0084 00750068 0061 0055 16 0.577 0505 040 038 0340 0299 0263 0232 0205 0181 016008410125 00098 0.088 0078 0069 0062 0055 0049 0066 15 055 041 0417 0362 0.31 0275 0239 0209 0183 0160 0100123 0908 0095 084 0074 0065 0057 0051 0045 040 0035 16 0534 0.458 0.94 03 0290 0292 0218 88 0163 01410123 007 0093 0081 0071 0062 0054 0047 0042 0036 0032 0028 17 050 0435 0.371 03170270 0231 0198 01700146 0125 0108 0093 00800069 0.060 0052 005 0039 0.034 0,030 0026 0023 TR 049 048 0350 0296 0250 0212 01800153 0130 0111 0095 0081 0069 0059 0051 0014 0038 0032 0028 0024 0021 0018 19 0.475 0.396 0.331 027 022 0194 0164 0138 0116 0098 0083 0070 0000 0051 0043 0.037 0031 0.027 0023 002000170014 20 0.45 0.371 030 0258 02150178 0949 0124 0104 DORT 0073 0061 0051 0043 0037 0031 0026 0022 0.019 009 001 0012 0.009 0358 0294 0202 0199 0964 01350112 009) 007 0064 005 0044 0037 0031 0026_0022 0098 0.015 000 00110000 22 0422 0.22 027 0220 0184 01500123 0101 OOR) 0068 0056 000 0038 0032 0026 0022 0.09 0.01 000 000 0005 0007 0.406 0326 0202 0211 0110 0138 0112 0091 007 0060 0049 0040 0033 0027 0022 001 001500100100009 0007 0006 24 0.250 0.100247 019 0154 0126 0102 002 0.066 0053 0041 0075 0028 0020 019 0015 000 000 000 000 000 000 25 0.35 075 0.250 0184 085 0116 008 007 0059 0047 0038 0030 0024 0020 0016 0.013 0010 0009 0007 0006 0005 0004 24 0 021 0220 0172 01350106 005 006 0053 0.002 003) 0026 0021 0017 OM 0011 0009 0007 0006 0005 0004 0003 0347 00207 08 0175 005 007 0060 0067 0077 0029 0023 001 001 001 0009 007 0006 0005 0000 0000 0002 21 0393 0755 001500116 000 0069 0054 0042 003 0026 020 004 0012 001 0008 0006 0005 0000 0000 0002 0007 29 0.121 020 015 014 0107 002 0063 000 0037 0029 0022 0017 00s 001 0008 0006 2005 2004 0003 000200120002 0308 001M 0 0.099 0075 0057 004 003 0026 0020 0015 0012 0009 0007 0.005 0004 0.003 0.003 0.002 0.002 0001 0.708 012 0097 0.051 004 0022 0022 0015 007 008 0005 0004 0003 0002 0001 0001 0001 0000 0000 0000 0000 0000 LOT 10-3 Peter Wica of Arany are 1 2 VOL UE W 51 ZICE 008 ODORO (RO ORO WO EERO ORO IVO SRO 260.000 IKI 5180.7680 1060 6060 E w AL 0 0 095 096 000 1991 TRX 173 1750 1736 173 1690 1655 1647 1676 1605 155 156 157 1578 1509 142 144 1457 1440 275 272 273 274 2577 25 2487 2414 2412 2351 2322 2283 2246 220 224 22.106 2074 2012 201 1981 1952 1170 32 3037 29M 2916 2455 2798 2743 2690 209 2589 2510 24M2401 2406 2.352 1452120 1212 3990 200 2 CEO Z ZZ TORZ 1942 92657 1667 ROE IE 66. HE SEE VE USE GOEDE WOENS S6 32 WOOD Y ICESEE 9 OCUE SE ESCRIBE HERE ISCE CHE LE BOSE SOBE 9 ME 60 OD 8C UV 75 CID 298) EOS OS ES ZUS RS 2009 B2EE STE SE NE MOZE CORE E HO 200 W 65 56 57 9 SELS SEUS INS 55 9999 SOY WT99SE ESE NE SOBE WOT EX COCT 1517 1091 96 IS BES LESS SS 9669 55979 CALL US WOLOR LE CHE NE TE 50 2647 SE 1659 6105 KS 035 659 O OCH 6 7 10 WIT 11 12 M WERE E 01 19 800S 625 S S 2009 29 299 2969 ALGORO IN Y 7499709 68056495 0207 55 57 545 5234 5029 436 46 46 477 474015902 3776 1656 9385R34 790 75367161 685 692 694598 5501 5157 458 40 461 469 427 473 35 375 *85) 835 794 7461 21036750 644 6122 502 51 490 471 4530 4392 4201 4050 1920 1056 929 2017 3550 OG 1605 7191 616462 61435M2 55 5324 04675 449 454153 4030 16:52 R 10106 0401 724 7X GM 6604 62055954 58 409 512 498 4730 456 457 419 4090 381 12.66 112M 10 47 973 9122 50 R0227549710 67296372 607 570)5475 572 90477 5754 4719 4059 3910 12651 690 10828 0169 932 8756201 7702 7250 6 BAB 6467 6 516 5534 5771 50 412 408 409 4080 3524 1 2085 1158 0900 64950 700 700 65506385 55 500 43 NS 2640973912 09046110991215 7025 0023 0250 550 5628 51 470 45 46 47 40365 HO2S 11/64 G 1000 979 608 7 75 70 60 59 54 495 479 400 16451 103 1042 100 10201 944m 816 764570 670 6190 o 505051) 400 4500 4000 HORS AR 12 X 11272403250 BRO 266 77 7230 6290 69 H 57235424925 46 47 15242 12950 1110529 92 95 1347747203685 684 073 52 5451 51 445074 35 IC 22 BE VE 5 24 27 28 20 0 IN CE M 5 095 2009 OCEL CHLOH 406 8 ENGI W tros ISI 25 WSORS CRES 9 1099069 Z MU SE FI DE NS 196) SIS IS S09 9 56 2 OSE SHE TOOL SEGUIDO 26 SI SE CI W ZS OS OIS 59 759 1963 1962 2098 COC SHOES SW 1993 KEIST Che S6 GZS OSS S 99155968692 to % ata 15 WC 0 SECT VESP 46 SS SS SS 429999 COOL WSOR 698 E ELES 26 MOTOCY WS ONLY 250 S SS LS LS 69OL CR 18 SECO COEL DT