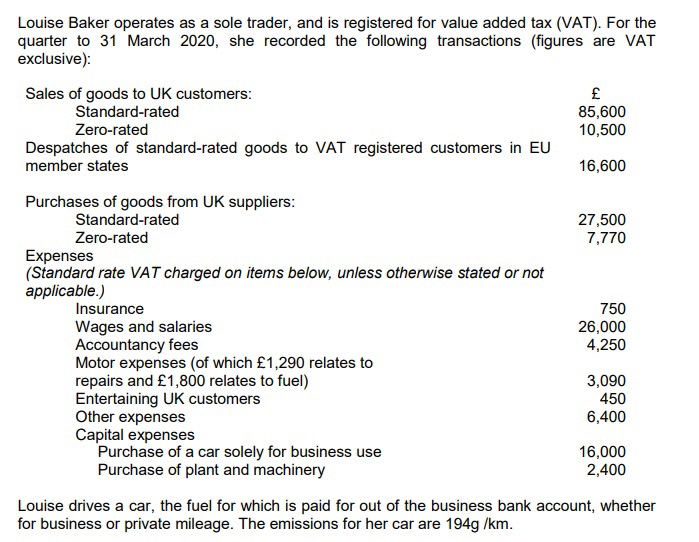

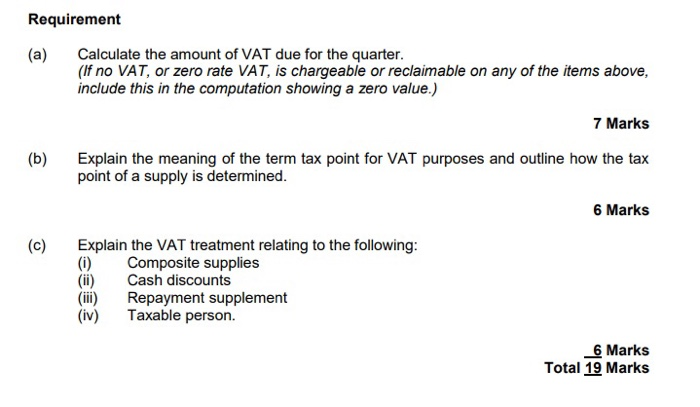

Louise Baker operates as a sole trader, and is registered for value added tax (VAT). For the quarter to 31 March 2020, she recorded the following transactions (figures are VAT exclusive) Sales of goods to UK customers: Standard-rated 85,600 Zero-rated 10,500 Despatches of standard-rated goods to VAT registered customers in EU member states 16,600 Purchases of goods from UK suppliers: Standard-rated 27,500 Zero-rated 7,770 Expenses (Standard rate VAT charged on items below, unless otherwise stated or not applicable.) Insurance 750 Wages and salaries 26,000 Accountancy fees 4,250 Motor expenses (of which 1,290 relates to repairs and 1,800 relates to fuel) 3,090 Entertaining UK customers 450 Other expenses 6,400 Capital expenses Purchase of a car solely for business use 16,000 Purchase of plant and machinery 2,400 Louise drives a car, the fuel for which is paid for out of the business bank account, whether for business or private mileage. The emissions for her car are 194g/km. Requirement (a) Calculate the amount of VAT due for the quarter. (If no VAT, or zero rate VAT, is chargeable or reclaimable on any of the items above, include this in the computation showing a zero value.) 7 Marks (b) Explain the meaning of the term tax point for VAT purposes and outline how the tax point of a supply is determined. 6 Marks (c) Explain the VAT treatment relating to the following: (i) Composite supplies Cash discounts Repayment supplement (iv) Taxable person. 6 Marks Total 19 Marks Louise Baker operates as a sole trader, and is registered for value added tax (VAT). For the quarter to 31 March 2020, she recorded the following transactions (figures are VAT exclusive) Sales of goods to UK customers: Standard-rated 85,600 Zero-rated 10,500 Despatches of standard-rated goods to VAT registered customers in EU member states 16,600 Purchases of goods from UK suppliers: Standard-rated 27,500 Zero-rated 7,770 Expenses (Standard rate VAT charged on items below, unless otherwise stated or not applicable.) Insurance 750 Wages and salaries 26,000 Accountancy fees 4,250 Motor expenses (of which 1,290 relates to repairs and 1,800 relates to fuel) 3,090 Entertaining UK customers 450 Other expenses 6,400 Capital expenses Purchase of a car solely for business use 16,000 Purchase of plant and machinery 2,400 Louise drives a car, the fuel for which is paid for out of the business bank account, whether for business or private mileage. The emissions for her car are 194g/km. Requirement (a) Calculate the amount of VAT due for the quarter. (If no VAT, or zero rate VAT, is chargeable or reclaimable on any of the items above, include this in the computation showing a zero value.) 7 Marks (b) Explain the meaning of the term tax point for VAT purposes and outline how the tax point of a supply is determined. 6 Marks (c) Explain the VAT treatment relating to the following: (i) Composite supplies Cash discounts Repayment supplement (iv) Taxable person. 6 Marks Total 19 Marks