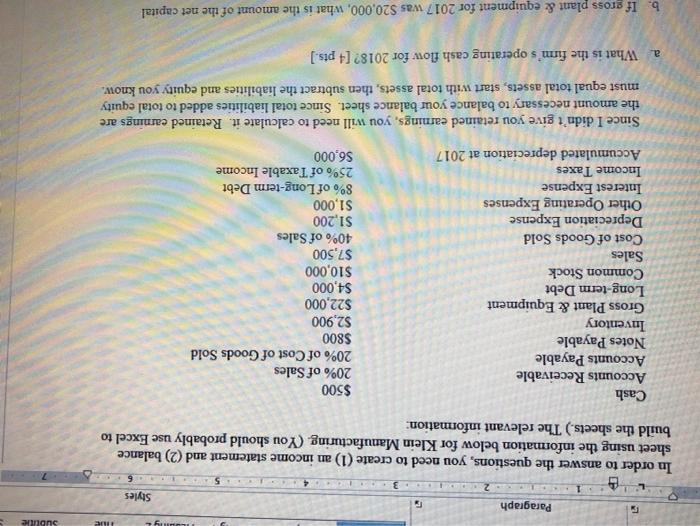

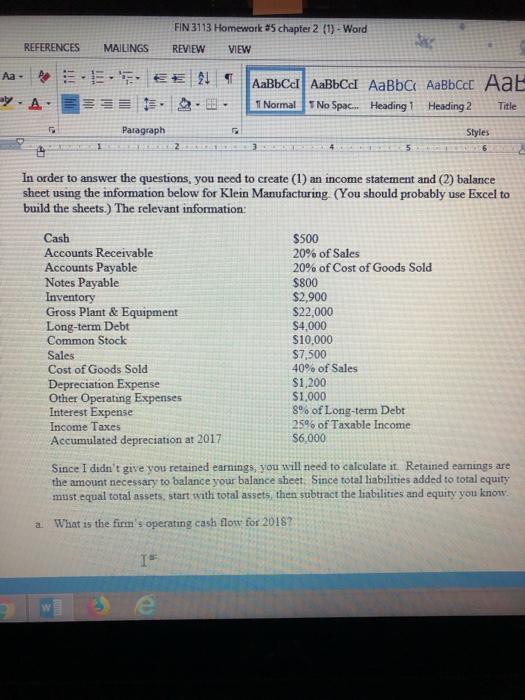

Louny Subtitle Paragraph Styles In order to answer the questions, you need to create (1) an income statement and (2) balance sheet using the information below for Klein Manufacturing (You should probably use Excel to build the sheets.) The relevant information: Cash Accounts Receivable Accounts Payable Notes Payable Inventory Gross Plant & Equipment Long-term Debt Common Stock Sales Cost of Goods Sold Depreciation Expense Other Operating Expenses Interest Expense Income Taxes Accumulated depreciation at 2017 $500 20% of Sales 20% of Cost of Goods Sold $800 $2,900 $22,000 $4,000 $10,000 $7,500 40% of Sales $1,200 $1,000 8% of Long-term Debt 25% of Taxable Income $6,000 Since I didn't give you retained earnings, you will need to calculate it. Retained earnings are the amount necessary to balance your balance sheet. Since total liabilities added to total equity must equal total assets, start with total assets, then subtract the liabilities and equity you know. a. What is the firm's operating cash flow for 2018? [4 pts.] b. If gross plant & equipment for 2017 was $20,000, what is the amount of the net capital FIN 3113 Homework 35 chapter 2 (1) - Word REVIEW VIEW REFERENCES MAILINGS Aa- DEEE 21 11 Normal TNo Spac... Heading 1 Heading 2 Title Paragraph Styles 1 In order to answer the questions, you need to create (1) an income statement and (2) balance sheet using the information below for Klein Manufacturing (You should probably use Excel to build the sheets.) The relevant information: Cash Accounts Receivable Accounts Payable Notes Payable Inventory Gross Plant & Equipment Long-term Debt Common Stock Sales Cost of Goods Sold Depreciation Expense Other Operating Expenses Interest Expense Income Taxes Accumulated depreciation at 2017 $500 20% of Sales 20% of Cost of Goods Sold $800 $2,900 $22,000 $4,000 $10,000 $7,500 40% of Sales $1,200 $1,000 8% of Long-term Debt 25% of Taxable Income S6.000 Since I didn't give you retained earnings, you will need to calculate it. Retained earnings are the amount necessary to balance your balance sheet. Since total liabilities added to total equity must equal total assets, start with total assets, then subtract the liabilities and equity you know What is the firm's operating cash flow for 2018? IS e