Question

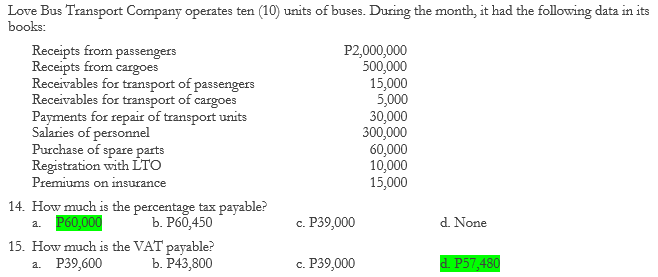

Love Bus Transport Company operates ten (10) units of buses. During the month, it had the following data in its books: Receipts from passengers

Love Bus Transport Company operates ten (10) units of buses. During the month, it had the following data in its books: Receipts from passengers Receipts from cargoes Receivables for transport of passengers Receivables for transport of cargoes Payments for repair of transport units Salaries of personnel Purchase of spare parts Registration with LTO Premiums on insurance 14. How much is the percentage tax payable? a. P60,000 b. P60,450 15. How much is the a. P39,600 VAT payable? b. P43,800 P2,000,000 500,000 15,000 5,000 30,000 300,000 c. P39,000 c. P39,000 60,000 10,000 15,000 d. None d. P57,480

Step by Step Solution

There are 3 Steps involved in it

Step: 1

14 Answer a The percentage tax is calculated by multiplying the total receipts from passengers a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial economics applications strategy and tactics

Authors: James r. mcguigan, R. Charles Moyer, frederick h. deb harris

12th Edition

9781133008071, 1439079234, 1133008070, 978-1439079232

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App