Answered step by step

Verified Expert Solution

Question

1 Approved Answer

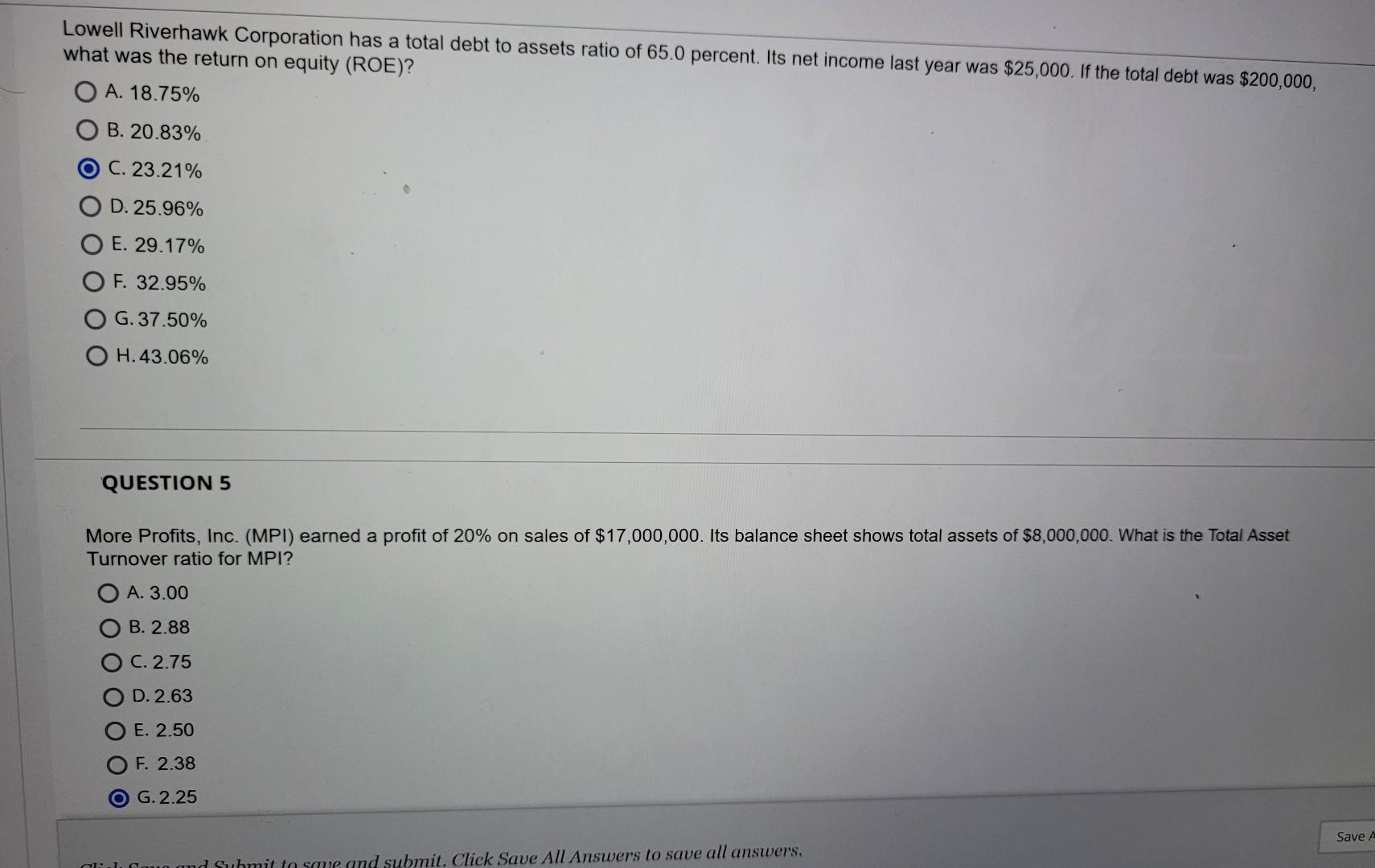

Lowell Riverhawk Corporation has a total debt to assets ratio of 65.0 percent. Its net income last year was $25,000. If the total debt was

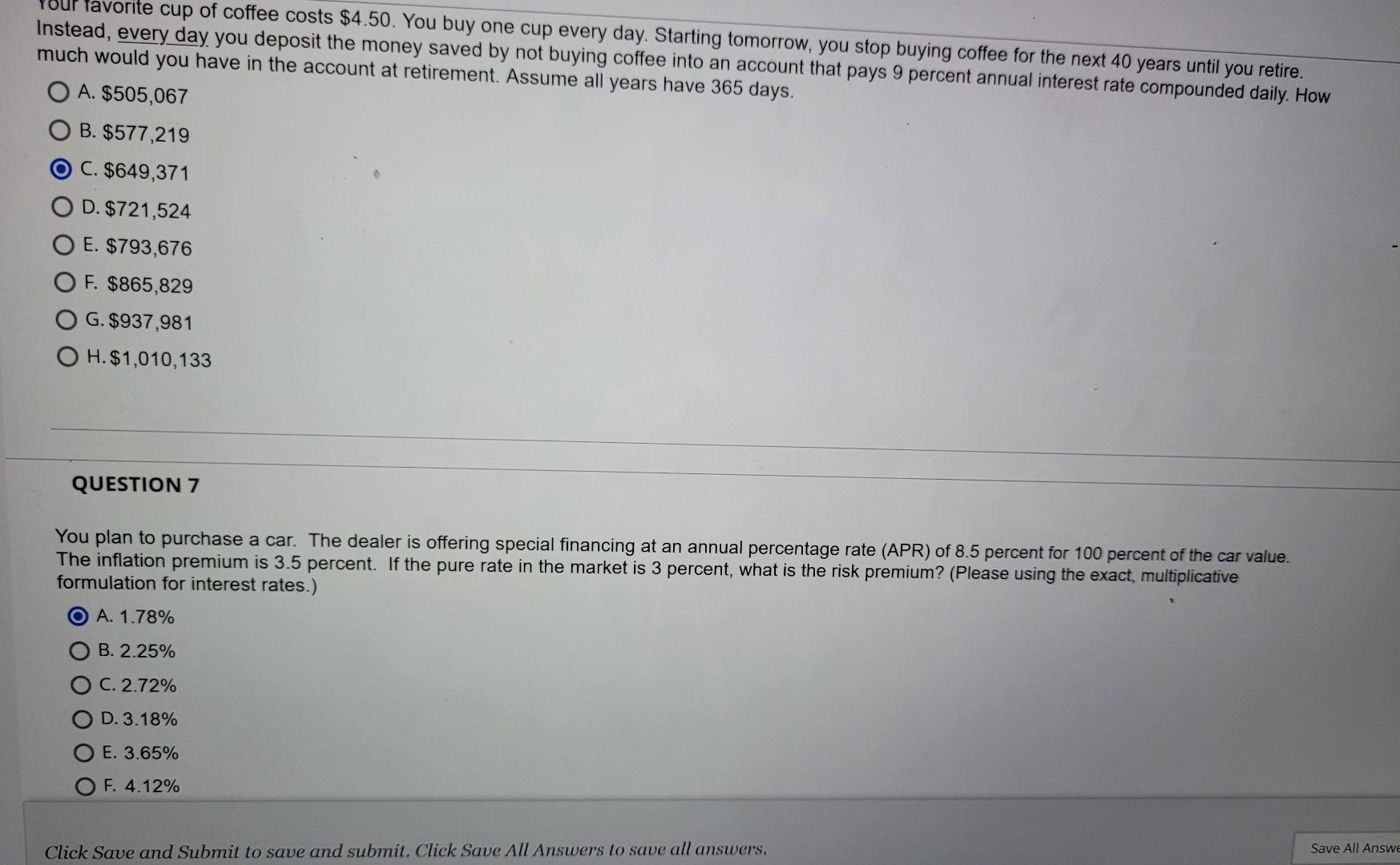

Lowell Riverhawk Corporation has a total debt to assets ratio of 65.0 percent. Its net income last year was $25,000. If the total debt was $200,000, what was the return on equity (ROE)? A. 18.75% B. 20.83% C. 23.21% D. 25.96% E. 29.17% F. 32.95% G. 37.50% H. 43.06% QUESTION 5 More Profits, Inc. (MPI) earned a profit of 20% on sales of $17,000,000. Its balance sheet shows total assets of $8,000,000. What is the Total Asset Turnover ratio for MPI? A. 3.00 B. 2.88 C. 2.75 D. 2.63 E. 2.50 F. 2.38 G. 2.25 rour ravorite cup of coffee costs $4.50. You buy one cup every day. Starting tomorrow, you stop buying coffee for the next 40 years until you retire. Instead, every day you deposit the money saved by not buying coffee into an account that pays 9 percent annual interest rate compounded daily. How much would you have in the account at retirement. Assume all years have 365 days. A. $505,067 B. $577,219 C. $649,371 D. $721,524 E. $793,676 F. $865,829 G. $937,981 H. $1,010,133 QUESTION 7 You plan to purchase a car. The dealer is offering special financing at an annual percentage rate (APR) of 8.5 percent for 100 percent of the car value. The inflation premium is 3.5 percent. If the pure rate in the market is 3 percent, what is the risk premium? (Please using the exact, multiplicative A. 1.78% B. 2.25% C. 2.72% D. 3.18% E. 3.65% F. 4.12% Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started