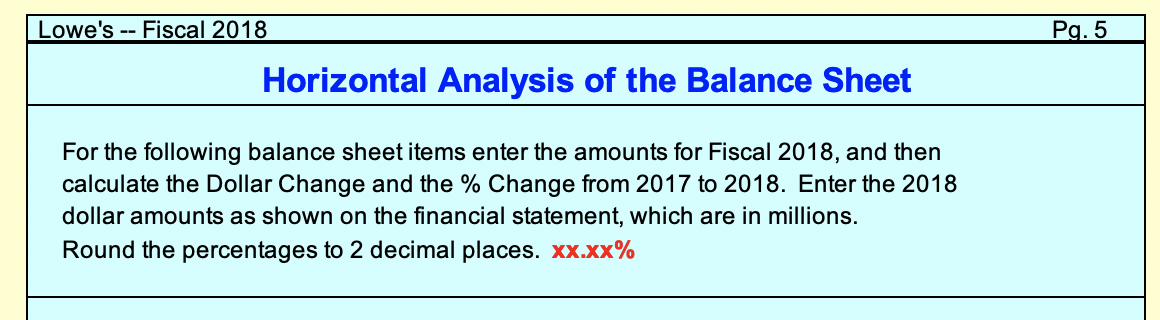

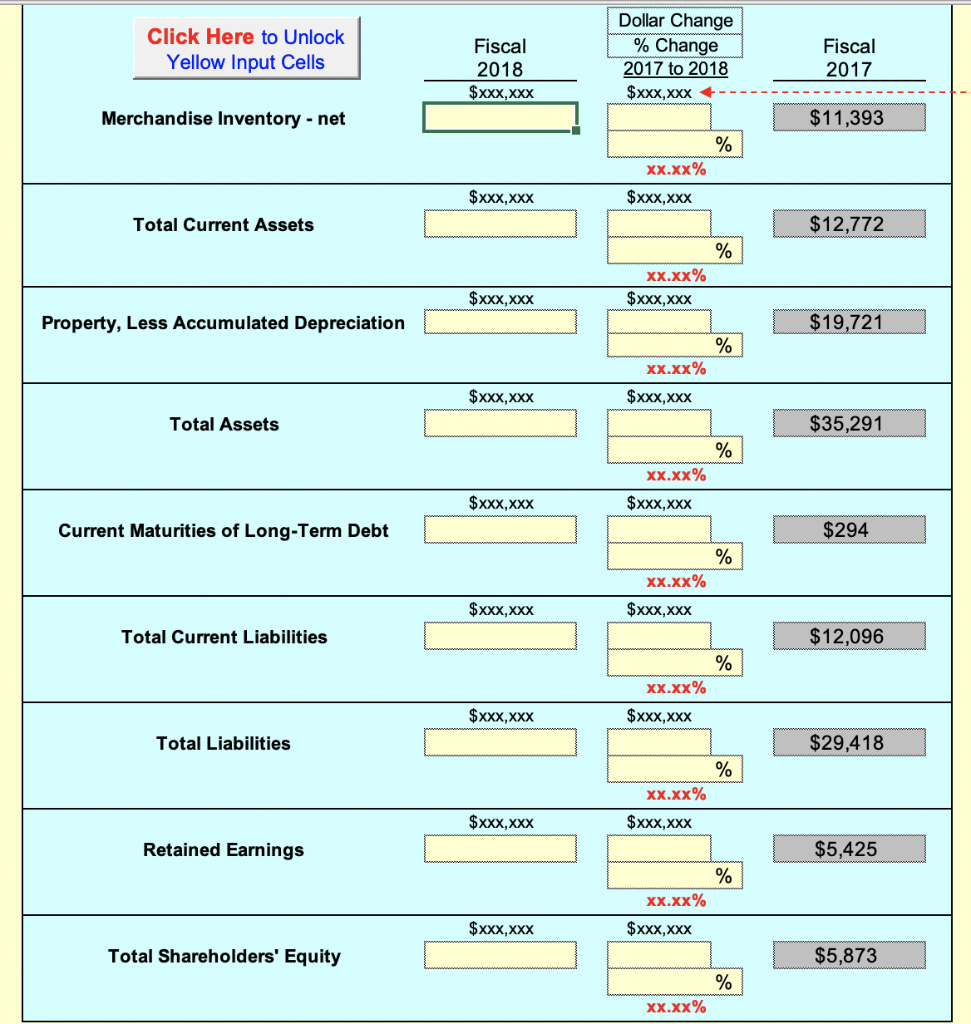

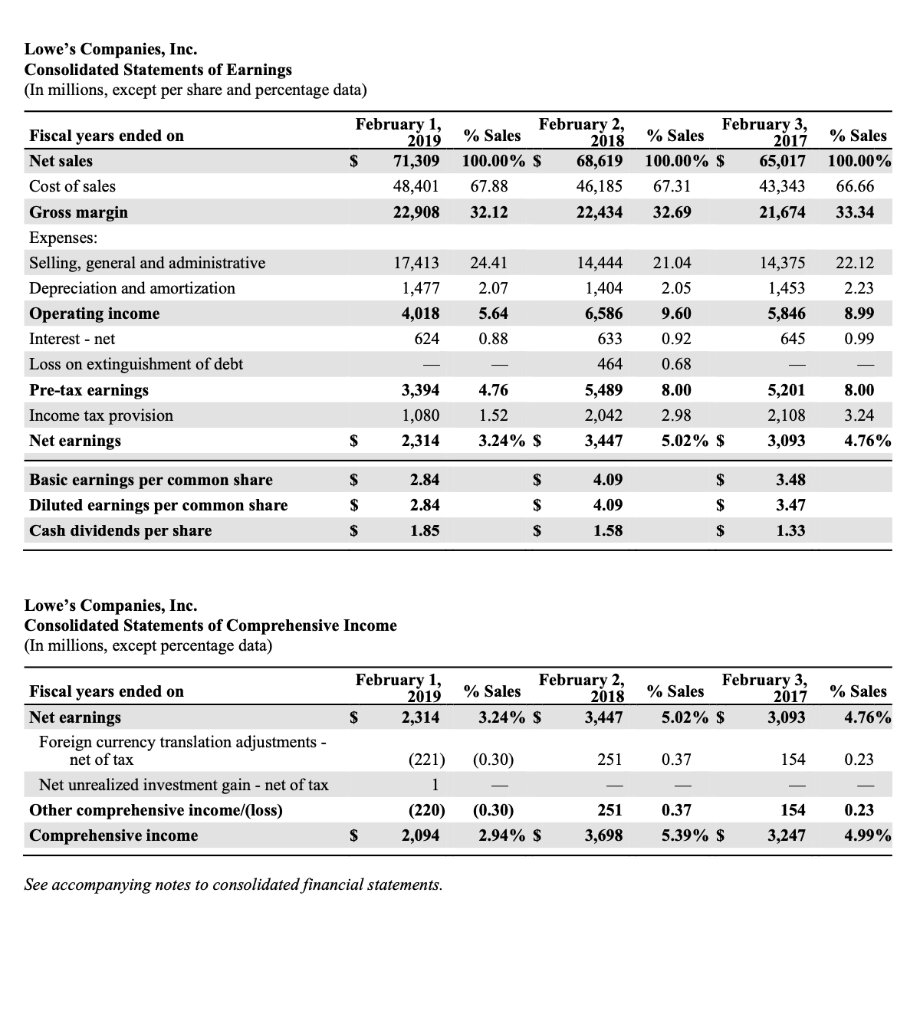

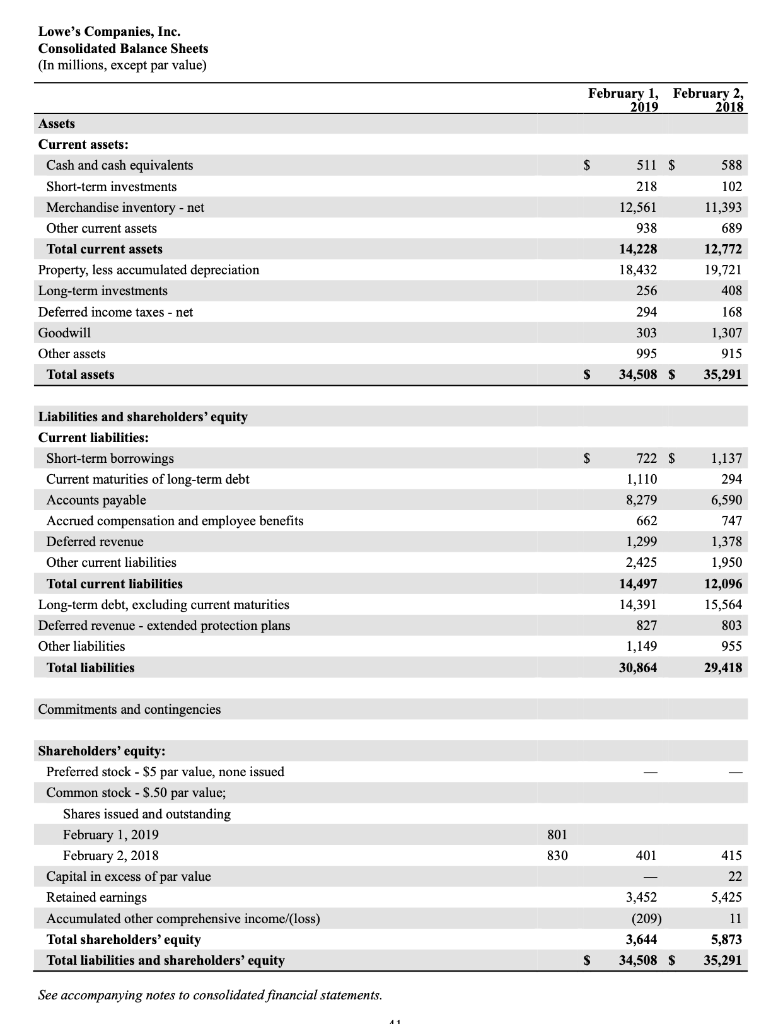

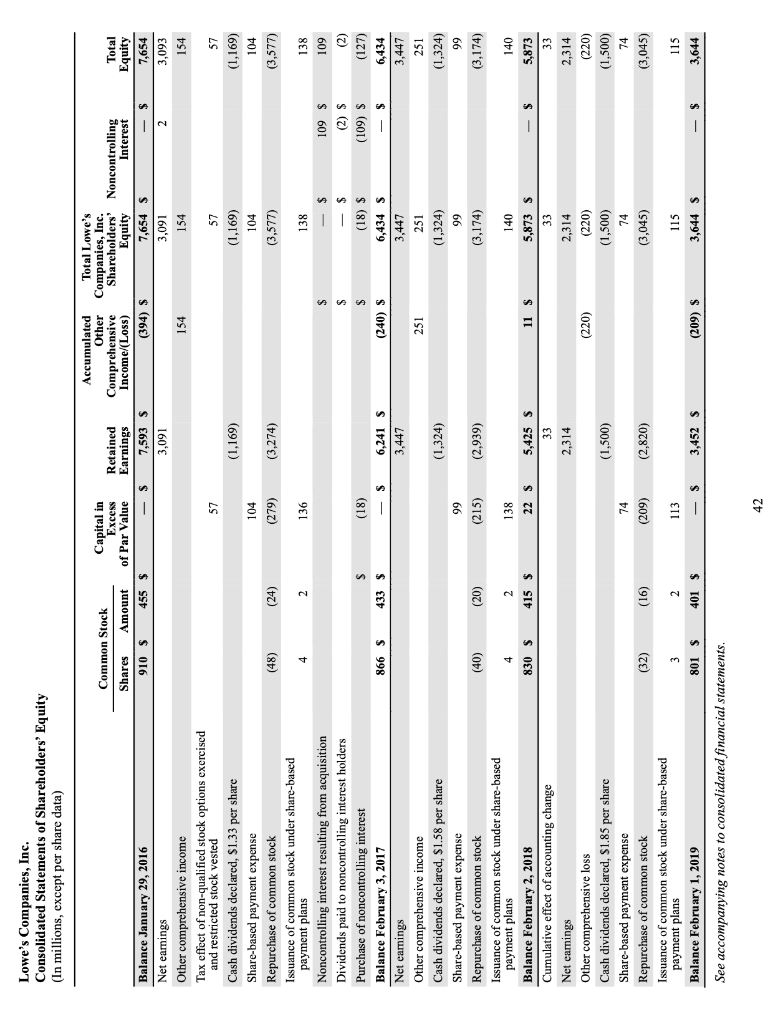

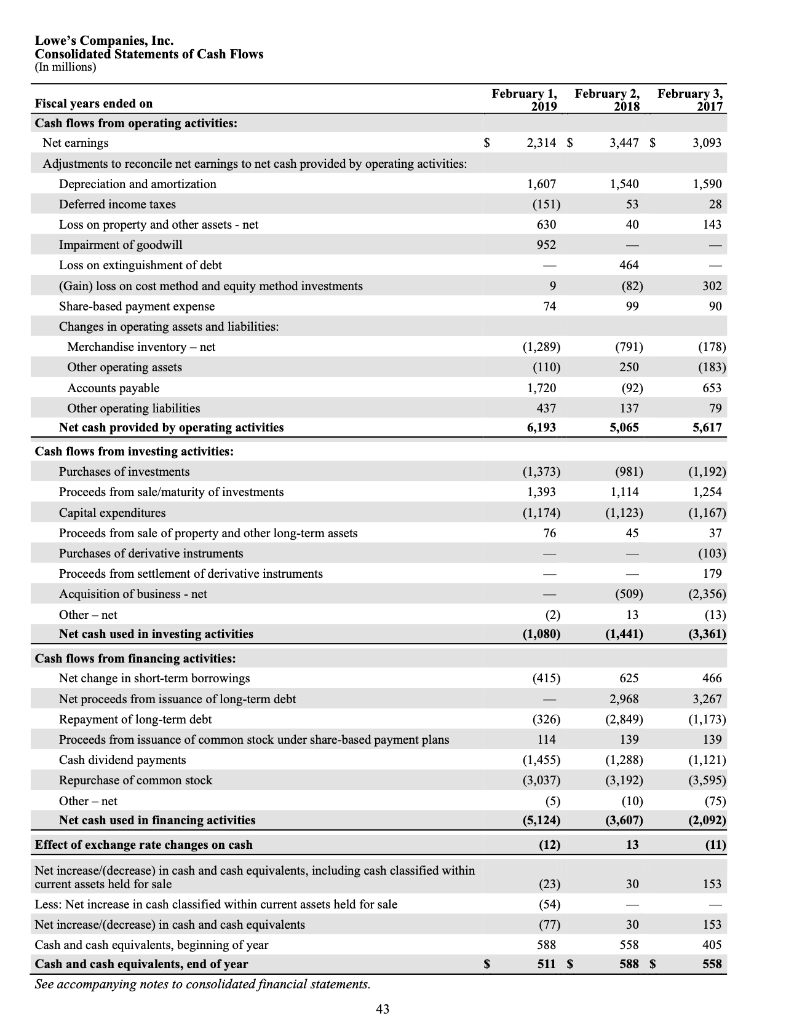

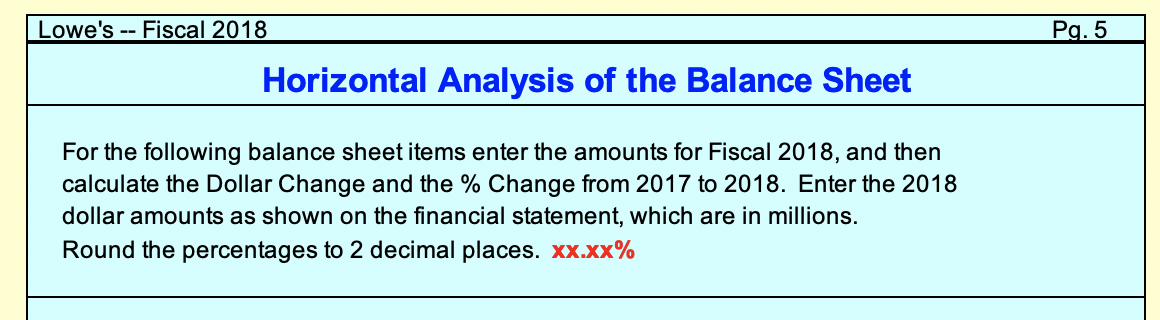

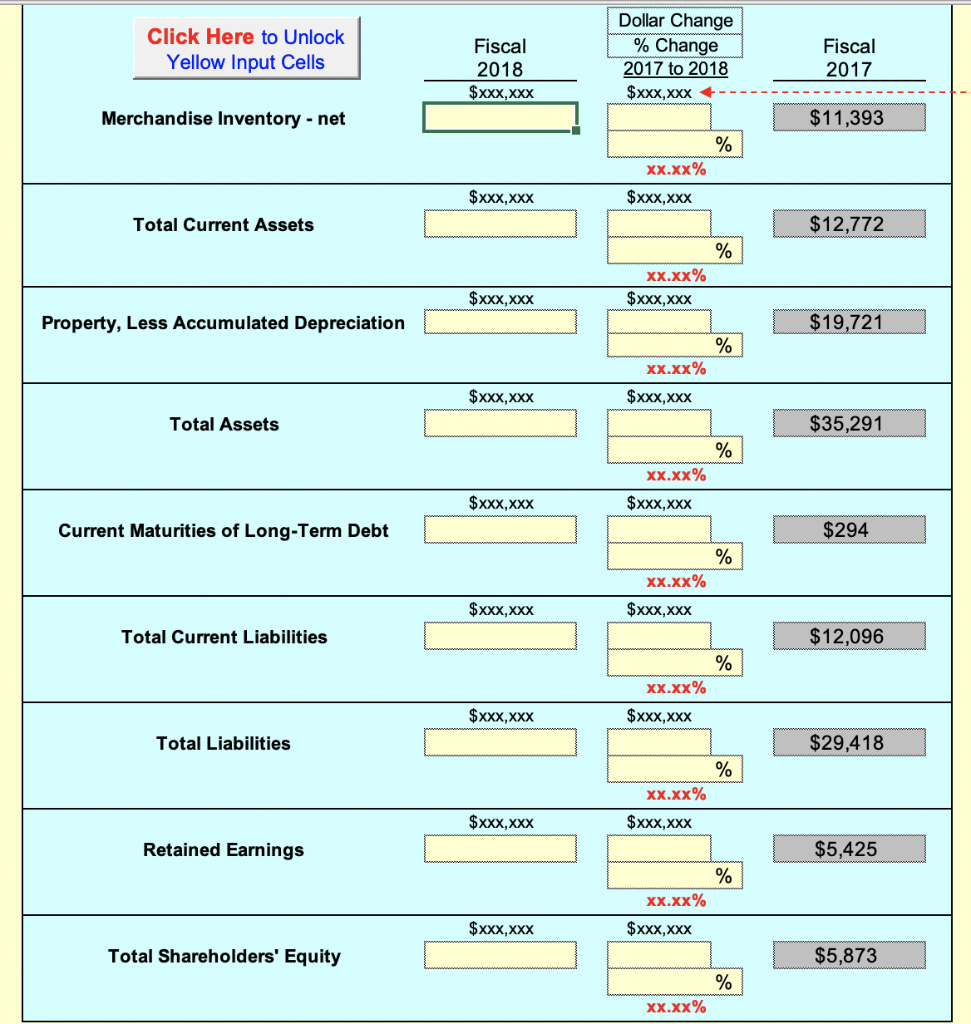

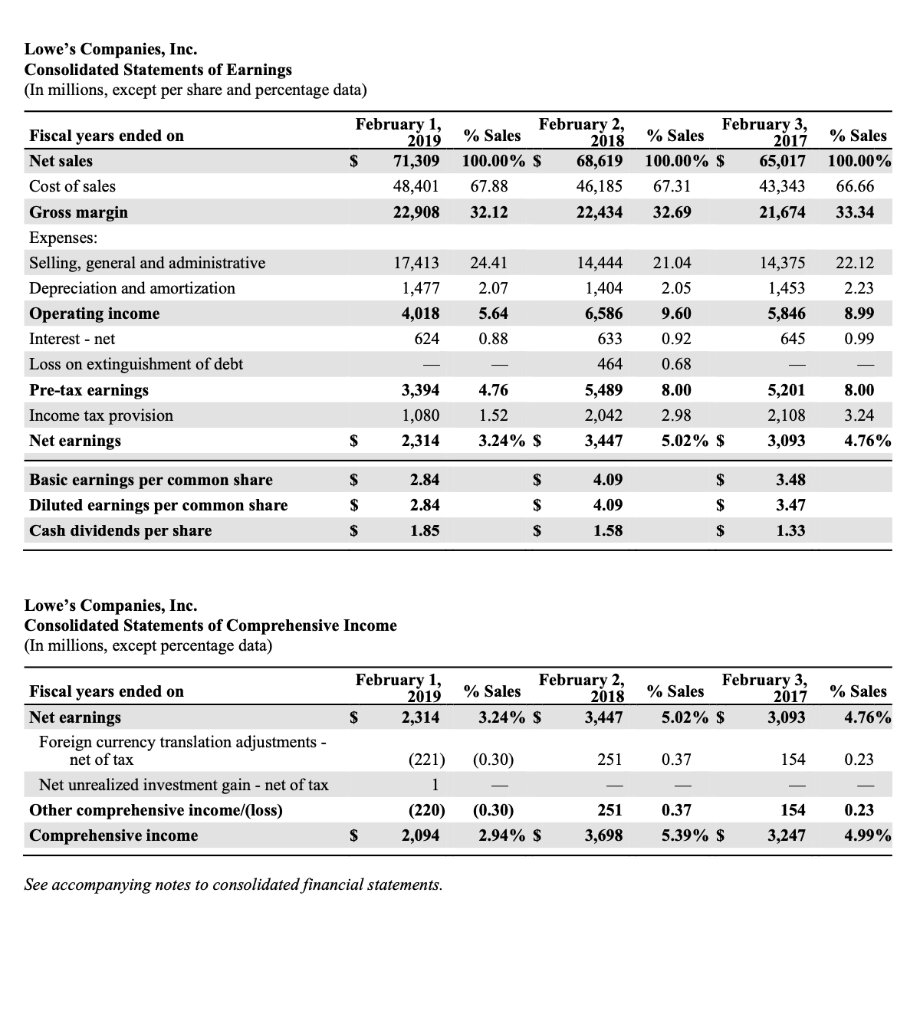

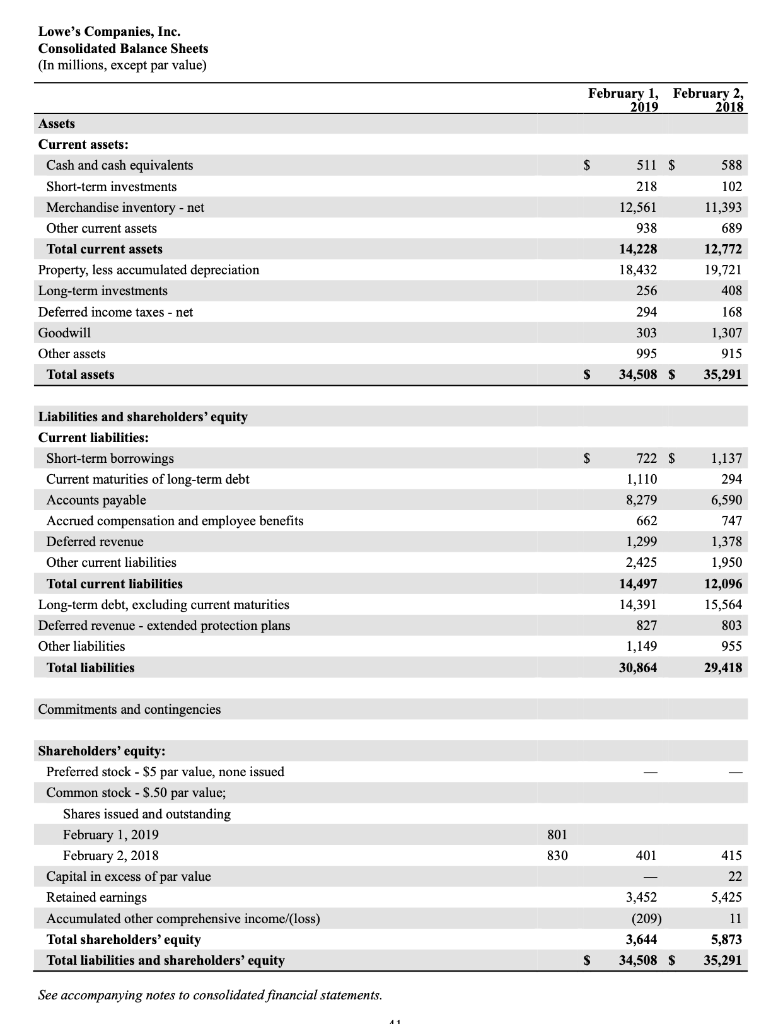

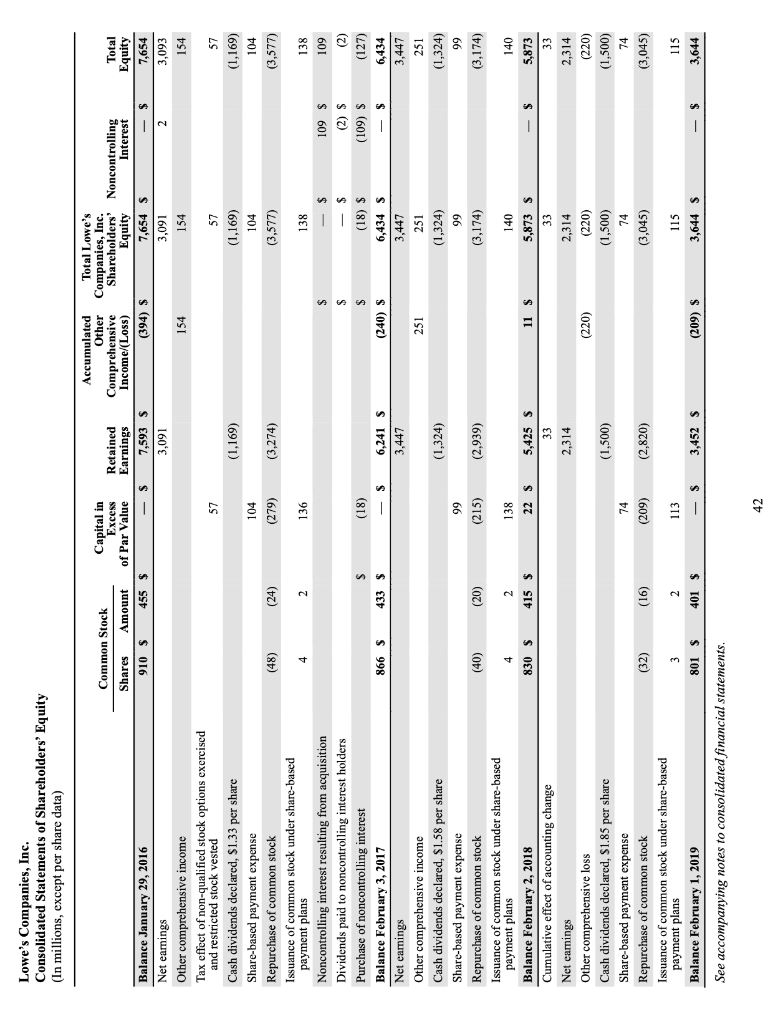

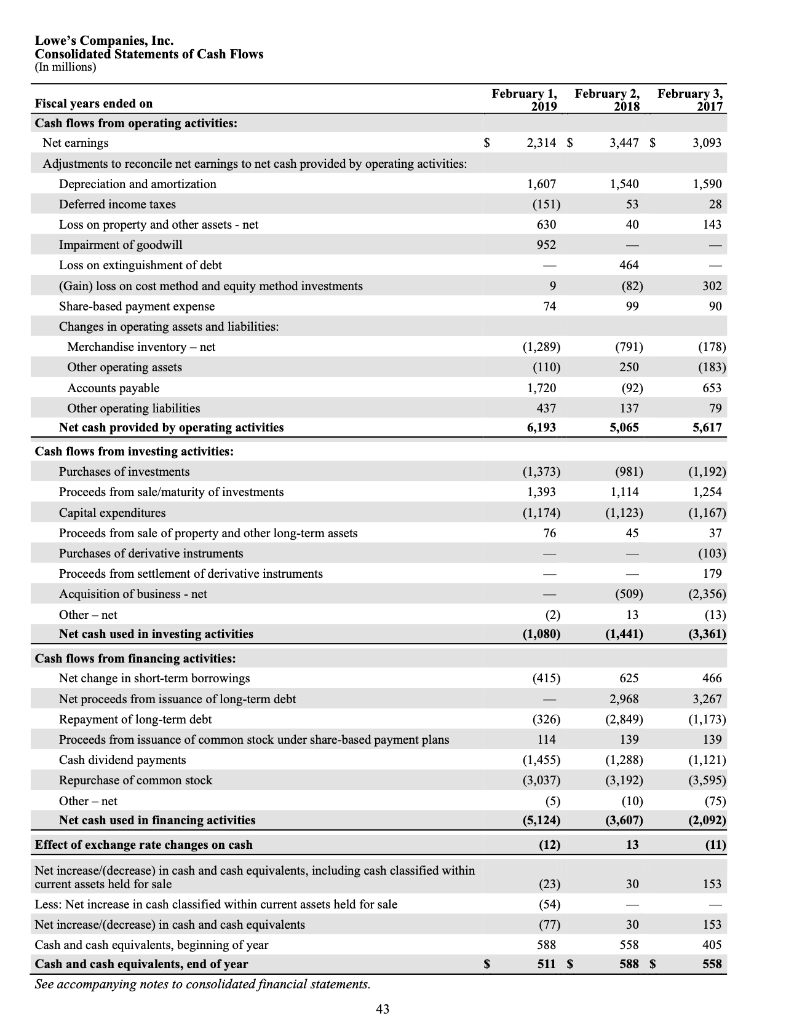

Lowe's -- Fiscal 2018 Pa. 5 Horizontal Analysis of the Balance Sheet For the following balance sheet items enter the amounts for Fiscal 2018, and then calculate the Dollar Change and the % Change from 2017 to 2018. Enter the 2018 dollar amounts as shown on the financial statement, which are in millions. Round the percentages to 2 decimal places. XX.XX% Click Here to Unlock Yellow Input Cells Fiscal 2018 $xxx,XXX Dollar Change % Change 2017 to 2018 $xxx, XXX Fiscal 2017 Merchandise Inventory - net $11,393 % xx.xx% $XXX,XXX $XXX,XXX Total Current Assets $12,772 % xx.xx% $xxx, XXX $XXX,XXX Property, Less Accumulated Depreciation $19,721 % Xx.xx% $XXX,XXX $XXX,XXX Total Assets $35,291 % XX.XX% $XXX, XXX $XXX,XXX Current Maturities of Long-Term Debt $294 % XX.xx% $xxx, XXX $xxx,XXX Total Current Liabilities $12,096 % xx.xx% $XXX,XXX $XXX,XXX Total Liabilities $29,418 % XX.XX% $XXX,XXX $xxx, XXX Retained Earnings $5,425 % XX.xx% $xxx,XXX $XXX,XXX Total Shareholders' Equity $5,873 % XX.XX% Lowe's Companies, Inc. Consolidated Statements of Earnings (In millions, except per share and percentage data) February 1, 0 Sales February 2, 20197 Sales 2018 $ 71,309 100.00% $ 68,619 48,40167.88 46,185 22,908 32.12 22,434 0% Sales February % Sales 100.00% $ 65,017 67.31 43,343 32.69 21,674 % Sales 100.00% 66.66 33.34 Fiscal years ended on Net sales Cost of sales Gross margin Expenses: Selling, general and administrative Depreciation and amortization Operating income Interest - net Loss on extinguishment of debt Pre-tax earnings Income tax provision Net earnings 17,413 1,477 4,018 624 - 3,394 1,080 2,314 24.41 2.07 5.64 0.88 - 4.76 1.52 3.24% $ 14,444 1,404 6,586 633 464 5,489 2,042 3,447 21.04 2.05 9.60 0.92 0.68 8.00 2.98 5.02% 14,375 22.12 1,453 2.23 5,846 8.99 645 0.99 5,2018.00 2,108 3.24 3,093 4.76% $ $ 4.09 3.48 Basic earnings per common share Diluted earnings per common share Cash dividends per share 2.84 2.84 1.85 4.09 3.47 $ $ 1.58 $ 1.33 Lowe's Companies, Inc. Consolidated Statements of Comprehensive Income (In millions, except percentage data) February 1, 2019 % Sales February 2, 2018 % Sales February 3, 2011 % Sales 4.76% $ 2,314 3.24% $ 3,447 5.02% $ 3,093 Fiscal years ended on Net earnings Foreign currency translation adjustments - net of tax Net unrealized investment gain - net of tax Other comprehensive income/loss) Comprehensive income 251 154 0.23 (221) 1 (220) 2,094 (0.30) - (0.30) 2.94% $ 0.37 0.37 5.39% $ 251 3,698 154 3,247 0.23 4.99% S See accompanying notes to consolidated financial statements. Lowe's Companies, Inc. Consolidated Balance Sheets (In millions, except par value) February 1, February 2, 2019 2018 $ 588 102 Assets Current assets: Cash and cash equivalents Short-term investments Merchandise inventory - net Other current assets Total current assets Property, less accumulated depreciation Long-term investments Deferred income taxes - net Goodwill Other assets Total assets 511 $ 218 12,561 938 14,228 18,432 256 294 303 995 34,508 $ 11,393 689 12,772 19,721 408 168 1,307 915 35,291 $ 1,137 294 Liabilities and shareholders' equity Current liabilities: Short-term borrowings Current maturities of long-term debt Accounts payable Accrued compensation and employee benefits Deferred revenue Other current liabilities Total current liabilities Long-term debt, excluding current maturities Deferred revenue - extended protection plans Other liabilities Total liabilities 722 $ 1,110 8,279 662 1,299 2,425 14,497 14,391 827 1,149 30,864 6,590 747 1,378 1,950 12,096 15,564 803 955 29,418 Commitments and contingencies 801 Shareholders' equity: Preferred stock - $5 par value, none issued Common stock - $.50 par value; Shares issued and outstanding February 1, 2019 February 2, 2018 Capital in excess of par value Retained earnings Accumulated other comprehensive income/loss) Total shareholders' equity Total liabilities and shareholders' equity 830 401 415 3,452 (209) 3,644 34,508 $ 5,425 11 5,873 35,291 $ See accompanying notes to consolidated financial statements. Lowe's Companies, Inc. Consolidated Statements of Shareholders' Equity (In millions, except per share data) Capital in Excess of Par Value f Par Value - Noncontrolling Interest Accumulated Total Lowe's Other Companies, Inc. Comprehensive Shareholders' Income/(Loss) Equity (394) $ 7,654 3,091 154 154 Retained Earnings Earnings 7,593 $ 3,091 Total Equity 7,654 $ 3,093 154 57 57 (1,169) 104 (1,169) 104 (3,577) 57 (1,169) 104 (3,577) (279) (3,274) 136 138 109 $ (2) $ (109) $ - $ (18) - S 6,241 S (240) 3,447 Common Stock Shares Amount Balance January 29, 2016 910 $ 455 $ Net eamings Other comprehensive income Tax effect of non-qualified stock options exercised and restricted stock vested Cash dividends declared, $1.33 per share Share-based payment expense Repurchase of common stock (48) (24) Issuance of common stock under share-based payment plans 4 2 Noncontrolling interest resulting from acquisition Dividends paid to noncontrolling interest holders Purchase of noncontrolling interest S Balance February 3, 2017 866 $ 433 $ Net eamings Other comprehensive income Cash dividends declared, $1.58 per share Share-based payment expense Repurchase of common stock (40) (20) Issuance of common stock under share-based payment plans Balance February 2, 2018 830 $ 415 $ Cumulative effect of accounting change Net eamings Other comprehensive loss Cash dividends declared, $1.85 per share Share-based payment expense Repurchase of common stock (32) (16) Issuance of common stock under share-based payment plans 2 Balance February 1, 2019 801 $ 401 $ See accompanying notes to consolidated financial statements. - $ - $ (18) $ 6,434 s 3,447 251 (1,324) 99 (3,174) 138 109 (2) (127) 6,434 3,447 251 (1,324) 99 (3,174) 251 (1,324) (215) (2,939) 138 22 $ 5,425 $ 11 $ - $ 33 140 5,873 $ 33 2,314 (220) (1,500) 74 (3,045) 140 5,873 33 2,314 (220) (1,500) 2,314 (220) (1,500) 74 (2,820) (3,045) 3 74 (209) 113 - $ 115 3,452 S (209) S 115 3,644 S - $ 3,644 Lowe's Companies, Inc. Consolidated Statements of Cash Flows (In millions) February 1, 2019 February 2, 2018 February 3, 2017 $ 2,314 $ 3,447 $ 3,093 1,540 1,590 28 1,607 (151) 630 952 40 464 (82) 99 74 90 (1,289) (110) 1,720 437 6,193 (791) 250 (92) 137 5,065 (178) (183) 653 79 5,617 Fiscal years ended on Cash flows from operating activities: Net earnings Adjustments to reconcile net earnings to net cash provided by operating activities: Depreciation and amortization Deferred income taxes Loss on property and other assets - net Impairment of goodwill Loss on extinguishment of debt (Gain) loss on cost method and equity method investments Share-based payment expense Changes in operating assets and liabilities: Merchandise inventory - net Other operating assets Accounts payable Other operating liabilities Net cash provided by operating activities Cash flows from investing activities: Purchases of investments Proceeds from sale/maturity of investments Capital expenditures Proceeds from sale of property and other long-term assets Purchases of derivative instruments Proceeds from settlement of derivative instruments Acquisition of business - net Other - net Net cash used in investing activities Cash flows from financing activities: Net change in short-term borrowings Net proceeds from issuance of long-term debt Repayment of long-term debt Proceeds from issuance of common stock under share-based payment plans Cash dividend payments Repurchase of common stock Other - net Net cash used in financing activities (1,373) 1,393 (1,174) (981) 1,114 (1,123) 45 (1,192) 1,254 (1,167) 37 (509) 13 (103) 179 (2,356) (13) (3,361) (1,080) (1,441) (415) 625 (326) 114 (1,455) (3,037) 2,968 (2,849) 139 (1,288) (3,192) (10) (3,607) 13 466 3,267 (1,173) 139 (1,121) (3,595) (5) (75) (2,092) (5,124) (12) Effect of exchange rate changes on cash (11) (23) Net increase/(decrease) in cash and cash equivalents, including cash classified within current assets held for sale Less: Net increase in cash classified within current assets held for sale Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year See accompanying notes to consolidated financial statements. 43 (54) (77) 588 511 $ 30 558 588 $ 1 53 405 558 $