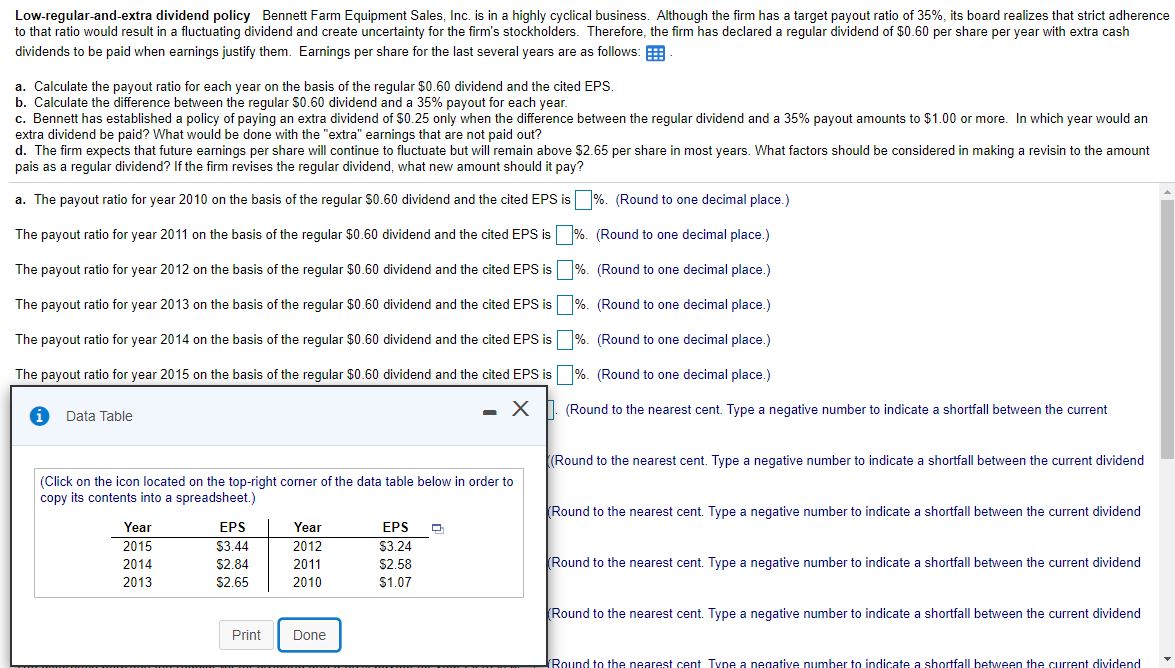

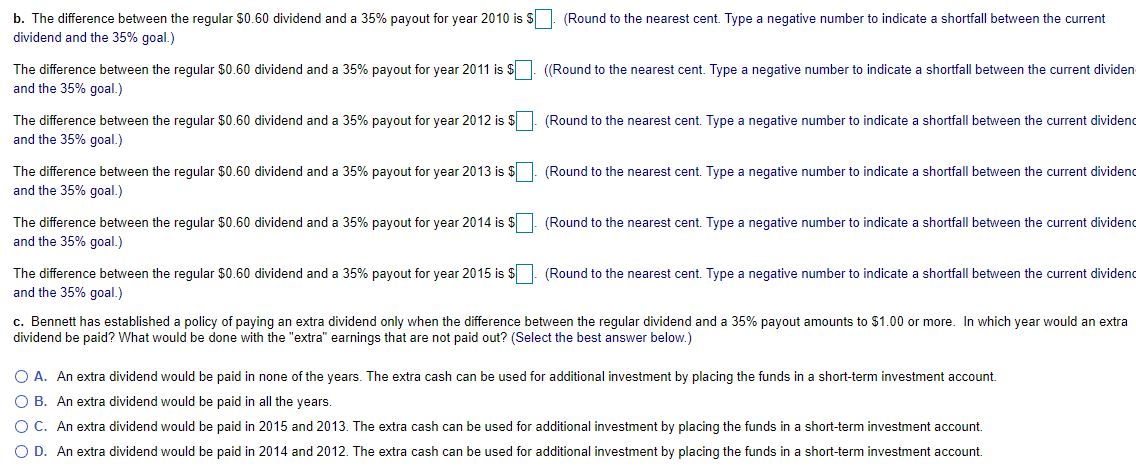

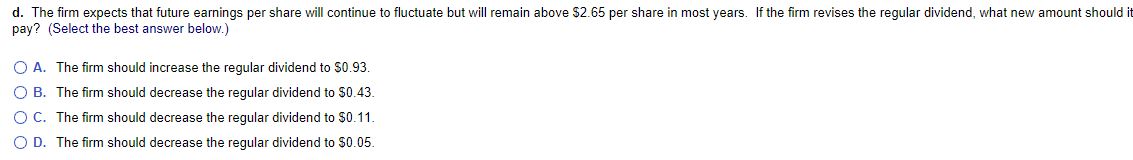

Low-regularandextra dividend policy Bennett Farm Equipment Sales, Inc. is in a highly cyclicat business Although the firm has a target payout ratio of 35%. its board realizes that strict adherence to that ratio would result in a uduating dividend and create uncertainty for the rm's stockholders. Therefore, the rm has deciared a regular dividend ot$0.60 per share per year with extra cash dividends to be paid when earnings justify them. Eamings per share {or the iast several years are as follows: a . 3. Calculate the payout ratio for each year on the basis ot the regutar $0.50 dividend and the cited EPS. b. Calculate the dierence between the regular $0.60 dividend and a 35% payout for each year. c. Bennett has established a policy of paying an extra dividend of $0.25 only when the difference between the regular dividend and a 35% payout amounts to $1 00 or more. In which year wouid an extra dividend be paid? What wouid be done with the "extra" earnings that are not paid out? d. The rm expects that future earnings per share will continue to uctuate but will remain above $2.65 per share in most years. What factors should be considered in making a revisin to the amount pais as a regular dividend? If the firm revises the regular dividend, what new amount shouid it pay? a. The payout ratio for year 2010 on the basis ofthe regular $0.60 dividend and the cited EPS is '31:. (Round to one decimal place.) The payout ratio for year 2011 on the basis of the reguiat $0.60 dividend and the cited EPS is %. (Round to one decimal place.) The payout ratio for year 2012 on the basis of the reguiar $0.60 dividend and the cited EPS is . (Round to one decimai place.) The payout ratio for year 2013 on the basis of the reguiar $0.60 dividend and the cited EPS is . (Round to one decimai place.) 'it: 'it: The payout ratio for year 2014 on the basis of the reguiar $0.60 dividend and the cited EPS is %. (Round to one decimai place.) % The payout ratio {or year 2015 on the basis of the regular $0.60 dividend and the cited EPS is . (Round to one decimai place.) 0 Data Table _ X I. (Round to the nearest cent. Type a negative number to indicate a shortfall between the current [Round to the nearest cent. Type a negative number to indicate a shortfall between the current dividend (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Round to the nearest cent. Type a negative number to indicate a shortfall between the cunent dividend Year EPS | Year EPS :11 2015 $3.44 2012 $3.24 2014 $234 2011 $253 _' nund to the nearest cent Type a negative number to indicate a shortfall between the current dividend 2013 $2.55 2010 $1.0? - und to the nearest cent. Type a negative numberto indicate a shortfall between the current dividend ' 'nunrl to the nearest nent Tune :4 neoati've nllmher tn indicate a .qhnrffall between the current dividend b. The difference between the regular $0.60 dividend and a 35% payout for year 2010 is $ dividend and the 35% goal.) The difference between the regu ar $0.60 dividend and a 35% payout for year 2011 is $ and the 35% goal.) The difference between the regu and the 35% goal.) The dierence between the regu and the 35% goal.) The dierence between the regu and the 35% goal.) The dierence between the regu and the 35% goal.) c. Bennett has established a po ar $0.60 dividend and a 35% payout for year 2012 is $ ar $0.60 dividend and a 35% payout for year 2013 is $ ar $0.60 dividend and a 35% payout for year 2014 is $ ar $0.60 dividend and a 35% payout for year 2015 is $ . (Round to the nearest cent. Type a negative number to indicate a shortfall between the current . ({Round to the nearest cent. Type a negative number to indicate a shortfall between the current dividen . {Round to the nearest cent. Type a negative number to indicate a shoI all between the current dividenc . [Round to the nearest cent. Type a negative number to indicate a shoI . [Round to the nearest cent. Type a negative numberto indicate a shor all between the cu rre nt dividenc 'fall between the current dividenc . [Round to the nearest cerrt. Type a negative number to indicate a shor ect the best answer below.) tall between the current dividen( icy of paying an extra dividend only when the difference between the regular dividend and a 35% payout amounts to $1.00 or more. In which year would an extra dividend be paid? What would be done with the "extra" earnings that ate not paid out? [Se 0 A. An extra dividend would be paid in none ofthe years. The extra cash can be used for additional investment by placing the funds in a shortterm investment account 0 B. An extra dividend would be paid in ail the years. 0 C. An extra dividend would be paid in 2015 and 2013. The extra cash can be used for additional investment by placing the funds in a shortterm investment account. 0 D. An extra dividend would be paid in 2014 and 2012. The extra cash can be used for additional investment by placing the funds in a shortterm investment account. d. The rm expects that future earnings per share will continue to uctuate but will remain above $2.65 per share in most years. if the rm revises the regular dividend, what new amount should it pay? (Select the best answer below.) 0 A. The rm should increase the (eguiar dividend to $0.93. 0 B. The rm should decrease the regular dividend to $0.43. 0 C. The rm should decrease the regular dividend to $0.11. 0 D. The rm should decrease the regular dividend to $0.05