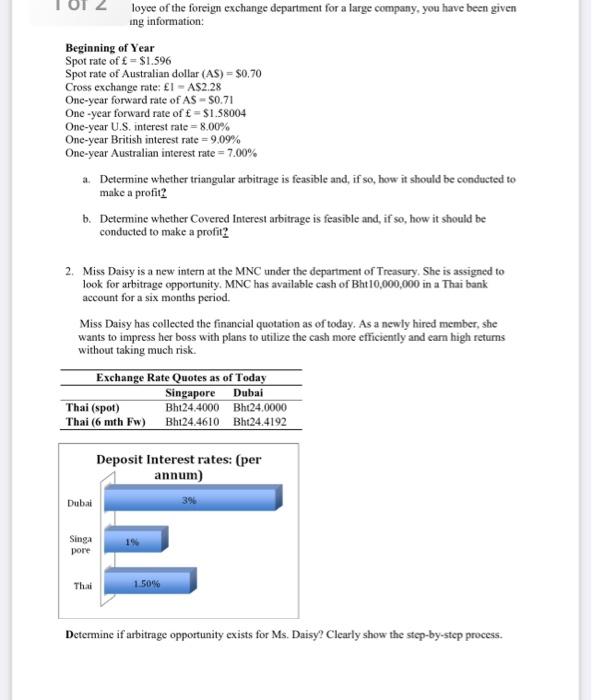

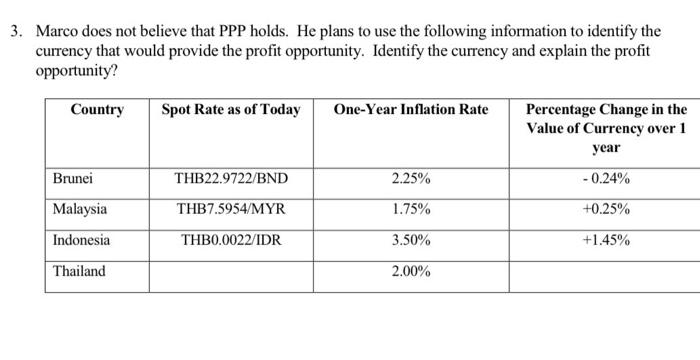

loyee of the foreign exchange department for a large company, you have been given ing information: Beginning of Year Spot rate of = $1.596 Spot rate of Australian dollar (AS) = $0,70 Cross exchange rate: 1 - A$2.28 One-year forward rate of AS - $0.71 One-year forward rate of t = $1.58004 One-year U.S. interest rate = 8.00% One-year British interest rate=9.09% One-year Australian interest rate = 7.00% a. Determine whether triangular arbitrage is feasible and, if so, how it should be conducted to make a profit2 b. Determine whether Covered Interest arbitrage is feasible and, if so, how it should be conducted to make a profit? 2. Miss Daisy is a new intern at the MNC under the department of Treasury. She is assigned to look for arbitrage opportunity. MNC has available cash of Bht 10,000,000 in a Thai bank account for a six months period. Miss Daisy has collected the financial quotation as of today. As a newly hired member, she wants to impress her boss with plans to utilize the cash more efficiently and eam high retums without taking much risk Exchange Rate Quotes as of Today Singapore Dubai Thai (spot) Bht24.4000 Bht24.0000 Thai (6 mth Fw) Bh124.4610 Bht24.4192 Deposit Interest rates: (per annum) Dubai 39 Singa pore 19 Thai 1.50% Determine if arbitrage opportunity exists for Ms. Daisy? Clearly show the step-by-step process. 3. Marco does not believe that PPP holds. He plans to use the following information to identify the currency that would provide the profit opportunity. Identify the currency and explain the profit opportunity? Country Spot Rate as of Today One-Year Inflation Rate Percentage Change in the Value of Currency over 1 year Brunei 2.25% -0.24% THB22.9722/BND THB7.5954/MYR Malaysia 1.75% +0.25% Indonesia THB0.0022/IDR 3.50% +1.45% Thailand 2.00% loyee of the foreign exchange department for a large company, you have been given ing information: Beginning of Year Spot rate of = $1.596 Spot rate of Australian dollar (AS) = $0,70 Cross exchange rate: 1 - A$2.28 One-year forward rate of AS - $0.71 One-year forward rate of t = $1.58004 One-year U.S. interest rate = 8.00% One-year British interest rate=9.09% One-year Australian interest rate = 7.00% a. Determine whether triangular arbitrage is feasible and, if so, how it should be conducted to make a profit2 b. Determine whether Covered Interest arbitrage is feasible and, if so, how it should be conducted to make a profit? 2. Miss Daisy is a new intern at the MNC under the department of Treasury. She is assigned to look for arbitrage opportunity. MNC has available cash of Bht 10,000,000 in a Thai bank account for a six months period. Miss Daisy has collected the financial quotation as of today. As a newly hired member, she wants to impress her boss with plans to utilize the cash more efficiently and eam high retums without taking much risk Exchange Rate Quotes as of Today Singapore Dubai Thai (spot) Bht24.4000 Bht24.0000 Thai (6 mth Fw) Bh124.4610 Bht24.4192 Deposit Interest rates: (per annum) Dubai 39 Singa pore 19 Thai 1.50% Determine if arbitrage opportunity exists for Ms. Daisy? Clearly show the step-by-step process. 3. Marco does not believe that PPP holds. He plans to use the following information to identify the currency that would provide the profit opportunity. Identify the currency and explain the profit opportunity? Country Spot Rate as of Today One-Year Inflation Rate Percentage Change in the Value of Currency over 1 year Brunei 2.25% -0.24% THB22.9722/BND THB7.5954/MYR Malaysia 1.75% +0.25% Indonesia THB0.0022/IDR 3.50% +1.45% Thailand 2.00%