Answered step by step

Verified Expert Solution

Question

1 Approved Answer

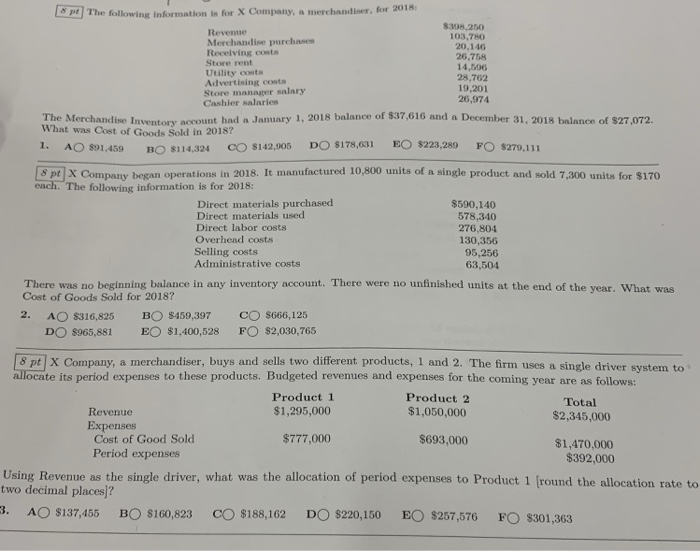

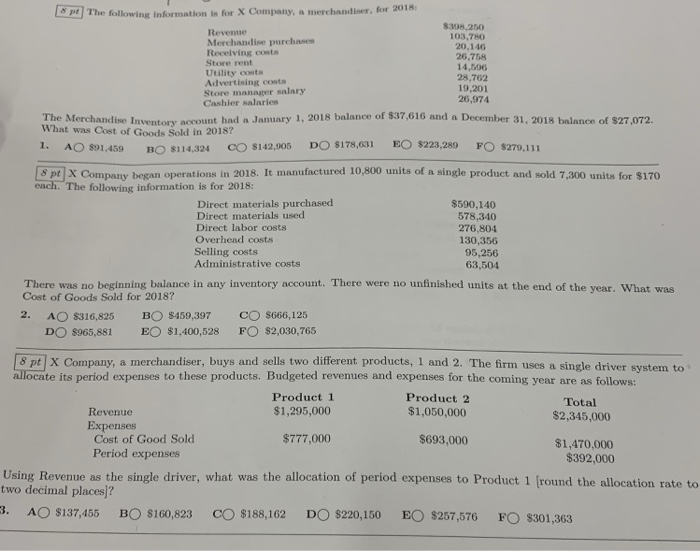

LPt]The following infomnation is for X Conpany, a merchandiserfor 201A: Revenue Merchandise purchases Receiving cont Store rent Utility costs Advertising costs Store mannger salary Cashier

LPt]The following infomnation is for X Conpany, a merchandiserfor 201A: Revenue Merchandise purchases Receiving cont Store rent Utility costs Advertising costs Store mannger salary Cashier salaries $308,250 103,780 20,146 26,758 14,506 28,762 19,201 26,974 of $37,616 and a December 31, 2018 balance of $27 Inventory account had a January 1, 2018 balance ,072. What was Cost of Goods Sold in 201 1. AO s91 ,459 BO$114,324 GJ S pt X Company began operations in 2018. It manufactured 10,800 units of a single product and sold 7,300 units for $170 $142,905 DO $178,631 EO $223,289 FO S279,111 The following information is for 2018: Direct materials purchased Direct materials used Direct labor costs Overhead costs Selling costs Administrative costs $590,140 578,340 276,804 130,356 95,256 63,504 There was no beginning balance in any inventory account. There were no unfinished units at the end of the year. What was Cost of Goods Sold for 2018? 2. A$316,825 DO $965,881 B8459,397 EO $1,400,528 C$666,125 FO $2,030,765 8 pt X Company, a merchandiser, buys and sells two different products, 1 and 2. The firm uses a single driver system to ocate its period expenses to these products. Budgeted revenues and expenses for the coming year are as follows: Product 1 $1,295,000 Product 2 $1,050,000 Total $2,345,000 Revenue Expenses Cost of Good Sold Period expenses $777,000 $693,000 $1,470,000 $392,000 Using Revenue as the single driver, what was the allocation of period expenses to Product 1 fround the allocation rate to two decimal places]? 3. AO $137,455 BO S160,823 CO $188,162 DO $220,150 EO $257,576 FO $301,363

LPt]The following infomnation is for X Conpany, a merchandiserfor 201A: Revenue Merchandise purchases Receiving cont Store rent Utility costs Advertising costs Store mannger salary Cashier salaries $308,250 103,780 20,146 26,758 14,506 28,762 19,201 26,974 of $37,616 and a December 31, 2018 balance of $27 Inventory account had a January 1, 2018 balance ,072. What was Cost of Goods Sold in 201 1. AO s91 ,459 BO$114,324 GJ S pt X Company began operations in 2018. It manufactured 10,800 units of a single product and sold 7,300 units for $170 $142,905 DO $178,631 EO $223,289 FO S279,111 The following information is for 2018: Direct materials purchased Direct materials used Direct labor costs Overhead costs Selling costs Administrative costs $590,140 578,340 276,804 130,356 95,256 63,504 There was no beginning balance in any inventory account. There were no unfinished units at the end of the year. What was Cost of Goods Sold for 2018? 2. A$316,825 DO $965,881 B8459,397 EO $1,400,528 C$666,125 FO $2,030,765 8 pt X Company, a merchandiser, buys and sells two different products, 1 and 2. The firm uses a single driver system to ocate its period expenses to these products. Budgeted revenues and expenses for the coming year are as follows: Product 1 $1,295,000 Product 2 $1,050,000 Total $2,345,000 Revenue Expenses Cost of Good Sold Period expenses $777,000 $693,000 $1,470,000 $392,000 Using Revenue as the single driver, what was the allocation of period expenses to Product 1 fround the allocation rate to two decimal places]? 3. AO $137,455 BO S160,823 CO $188,162 DO $220,150 EO $257,576 FO $301,363

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started