Answered step by step

Verified Expert Solution

Question

1 Approved Answer

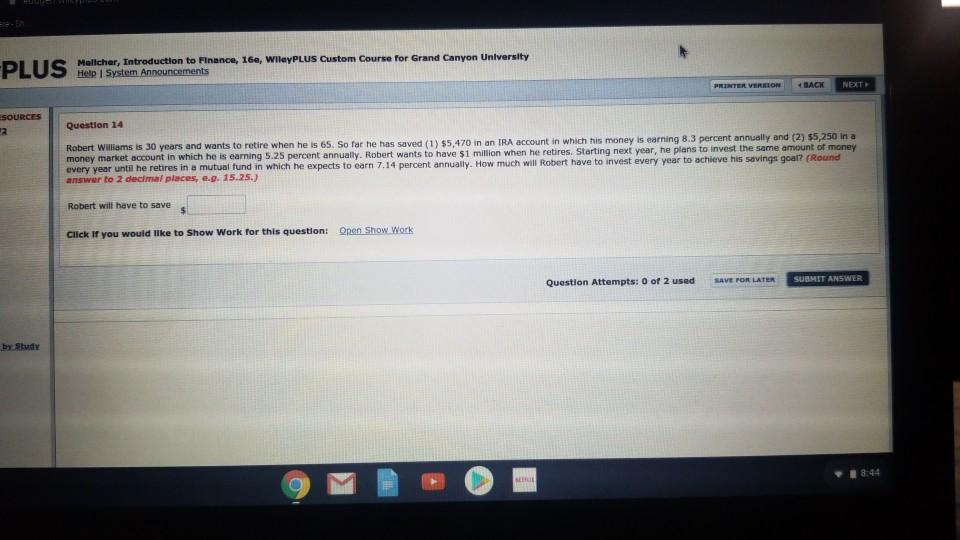

LU Mallcher, Introduction to Finance, 160, WileyPLUS Custom Course for Grand Canyon University Help System Announcements PRINTER VERSION BACK NEXTI SOURCES Question 14 Robert Williams

LU Mallcher, Introduction to Finance, 160, WileyPLUS Custom Course for Grand Canyon University Help System Announcements PRINTER VERSION BACK NEXTI SOURCES Question 14 Robert Williams is 30 years and wants to retire when he is 65. So far he has saved (1) $5.470 in an IRA account in which his money is earning 8.3 percent annually and (2) $5,250 in a money market account in which he is earning 5.25 percent annually. Robert wants to have $1 million when he retires, Starting next year, he plans to invest the same amount of money every year until he retires in a mutual fund in which he expects to earn 7.14 percent annually. How much will Robert have to invest every year to achieve his savings goal? (Round answer to 2 decimal places, .g. 15.25.) Robert will have to save Click If you would like to Show Work for this question: Open Show Work Question Attempts: 0 of 2 used SAVE FOR LATER SUBMIT ANSWER by Study 8:44

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started