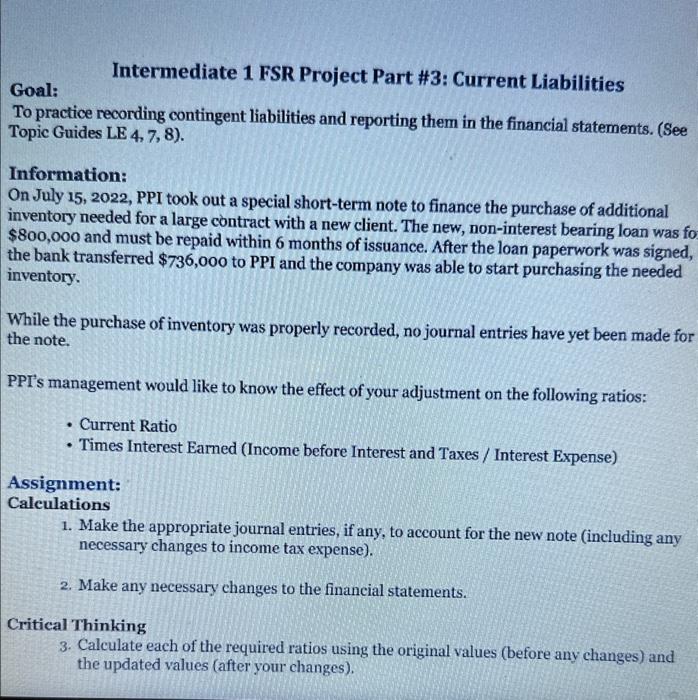

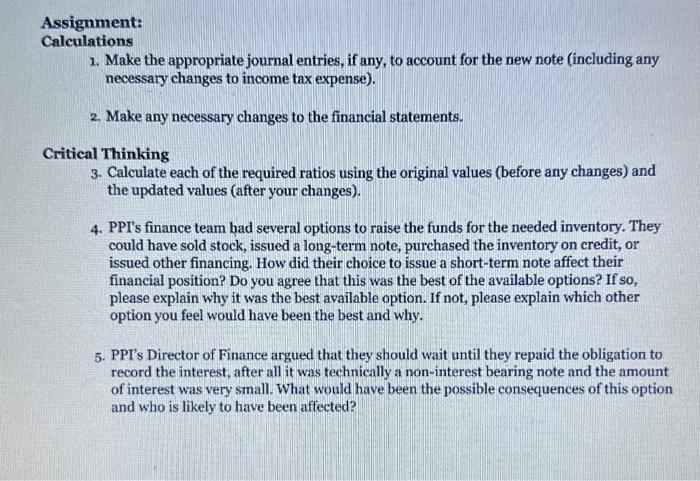

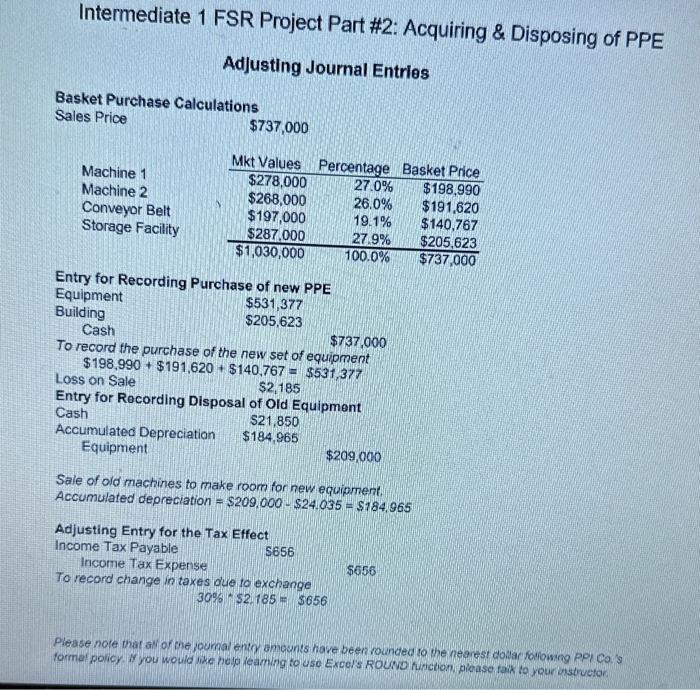

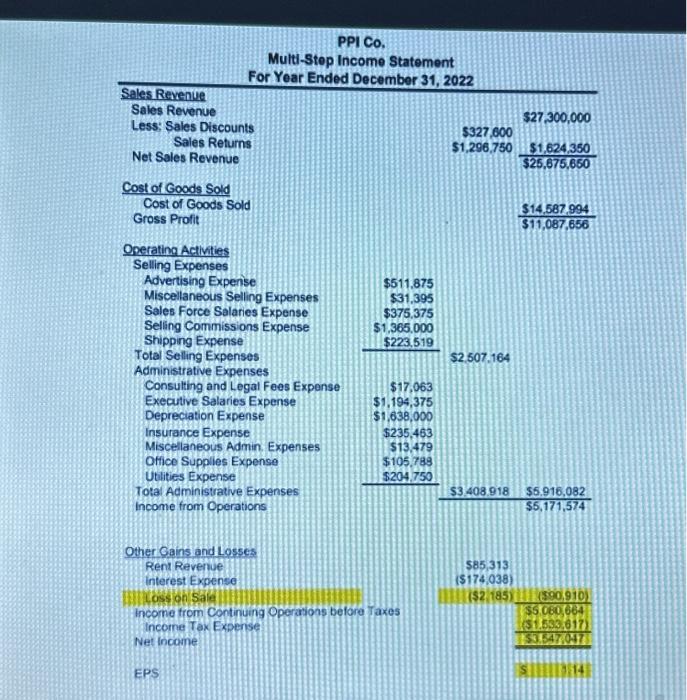

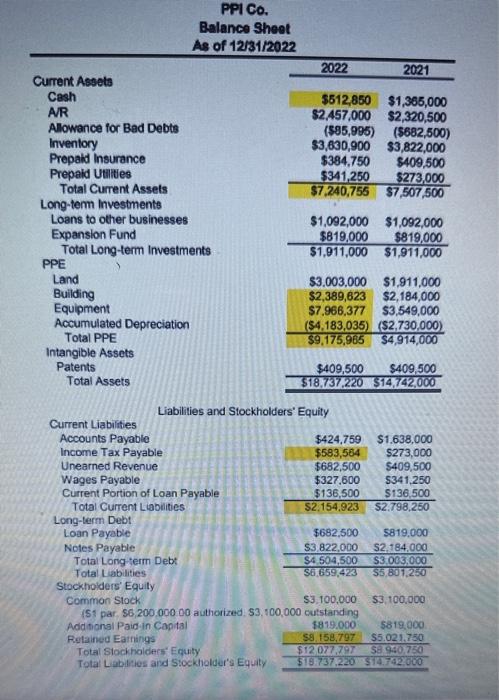

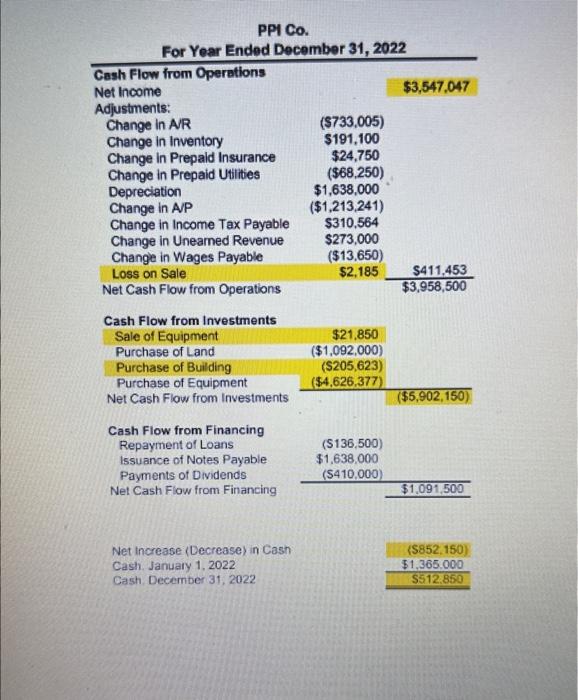

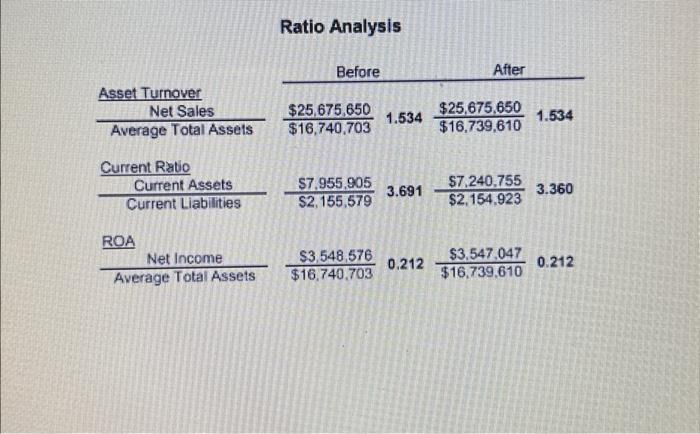

Luabilities and Stockholders' Equity Intermediate 1 FSR Project Part \#2: Acquiring \& Disposing of PPE Adjusting Journal Entries Basket Purchase Calculations Sales Price $737,000 Entry for Recording Purchase of new PPE Equipment Building $531,377 Cash $205,623 To record the purchase of the new set of $737,000 $198,990+$191,620+$140,767 of equipment Loss on Sale $2,185 Entry for Recording Disposal of Old Equipment Cash $21,850 Accumulated Depreciation $184,965 Equipment $209,000 Sale of old machines to make room for new equipment. Accumulated depreciation =$209,000$24,035=$184,965 Adjusting Entry for the Tax Effect Income Tax Payable Income Tax Expense $656 To record change in taxes due to exchange $656 30%$2.185=$656 PPI Co. For Year Ended December 31, 2022 Cash Flow from Operations Net income Adjustments: Change in AVR Change in Inventory Change in Prepaid Insurance Change in Prepaid Utilities Depreciation Change in AVP Change in Income Tax Payable Change in Unearned Revenue Change in Wages Payable Loss on Sale Net Cash Flow from Operations $3,547,047 Cash Flow from Investments Sale of Equipment Purchase of Land Purchase of Building Purchase of Equipment Net Cash Flow from Investments Cash Flow from Financing Repayment of Loans Issuance of Notes Payable Payments of Dividends Net Cash Flow from Financing Net Increase (Decrease) in Cash Cash. January 1, 2022 Cash. December 31, 2022 $21,850 ($1,092,000) (\$205,623) (\$4,626,377) ($5,902,150) (\$136,500) $1,638,000 (\$410.000) $1,091,500 ($852,150)$1,365,000$512.850 Ratio Analysis PPI Co. Multi-Step Income Statement For Year Ended December 31, 2022 Sales Revenue Sales Revenue Less: Sales Discounts Sales Returns Net Sales Revenue Cost of Goods Sold Cost of Goods Sold Gross Profit Operating Activities Selling Expenses Advertising Expense Misceilaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Total Selling Expenses Administrative Expenses Consulting and Legal Fees Expense Executive Salaries Expense Depreciation Expense Insurance Expense Miscellaneous Admin. Expenses Office Supplies Expense Utlities Expense Total Administrative Expenses income from Operations $327,600$1,296,750$27,300,000$25,675,650$1,624,350$11,087,656$14,587,994 Other Gains and Losses Rent Revenue interest Expense tossonsale income from Continuing Operasions before Taxes Incorne Tax Experise: Net income EPS $511,875 $31,395 $375,375 $1,365,000$2223,519 $2.507.164 $17,063 $1,194,375 $1,638,000 $235,463 $13,479 $105.789 $204.750 \begin{tabular}{|l|l} $3,408,918 & $5,916,082 \\ \hline & $5,171,574 \end{tabular} $85,313 (\$174,038) (\$2 185 ) 53547.047(5i533617)55.060664)(500,910) s.1III:14 Intermediate 1 FSR Project Part \#3: Current Liabilities Goal: To practice recording contingent liabilities and reporting them in the financial statements. (See Topic Guides LE 4, 7,8). Information: On July 15, 2022, PPI took out a special short-term note to finance the purchase of additional inventory needed for a large contract with a new client. The new, non-interest bearing loan was fo $800,000 and must be repaid within 6 months of issuance. After the loan paperwork was signed, the bank transferred $736,000 to PPI and the company was able to start purchasing the needed inventory. While the purchase of inventory was properly recorded, no journal entries have yet been made for the note. PPI's management would like to know the effect of your adjustment on the following ratios: - Current Ratio - Times Interest Earned (Income before Interest and Taxes / Interest Expense) Assignment: Calculations 1. Make the appropriate journal entries, if any, to account for the new note (including any necessary changes to income tax expense). 2. Make any necessary changes to the financial statements. Critical Thinking 3. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes). Calculations 1. Make the appropriate journal entries, if any, to account for the new note (including any necessary changes to income tax expense). 2. Make any necessary changes to the financial statements. Critical Thinking 3. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes). 4. PPI's finance team had several options to raise the funds for the needed inventory. They could have sold stock, issued a long-term note, purchased the inventory on credit, or issued other financing. How did their choice to issue a short-term note affect their financial position? Do you agree that this was the best of the available options? If so, please explain why it was the best available option. If not, please explain which other option you feel would have been the best and why. 5. PPI's Director of Finance argued that they should wait until they repaid the obligation to record the interest, after all it was technically a non-interest bearing note and the amount of interest was very small. What would have been the possible consequences of this option and who is likely to have been affected