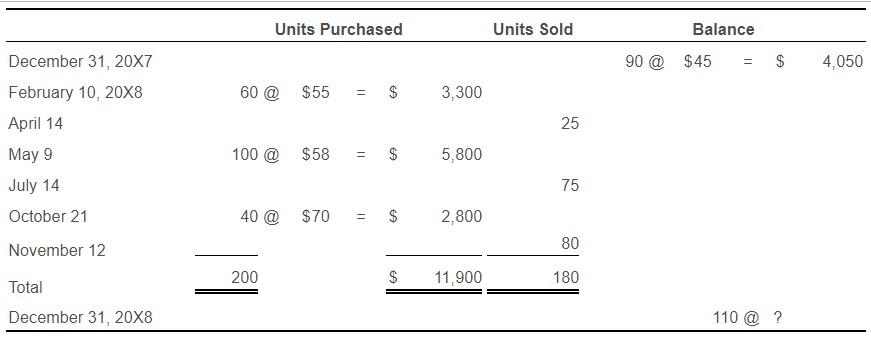

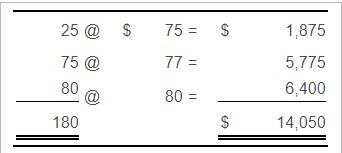

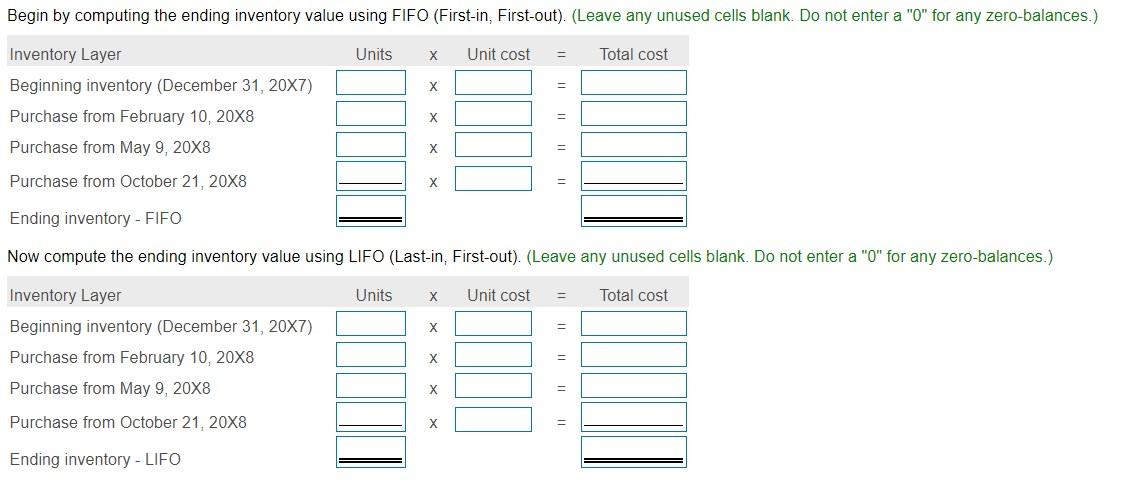

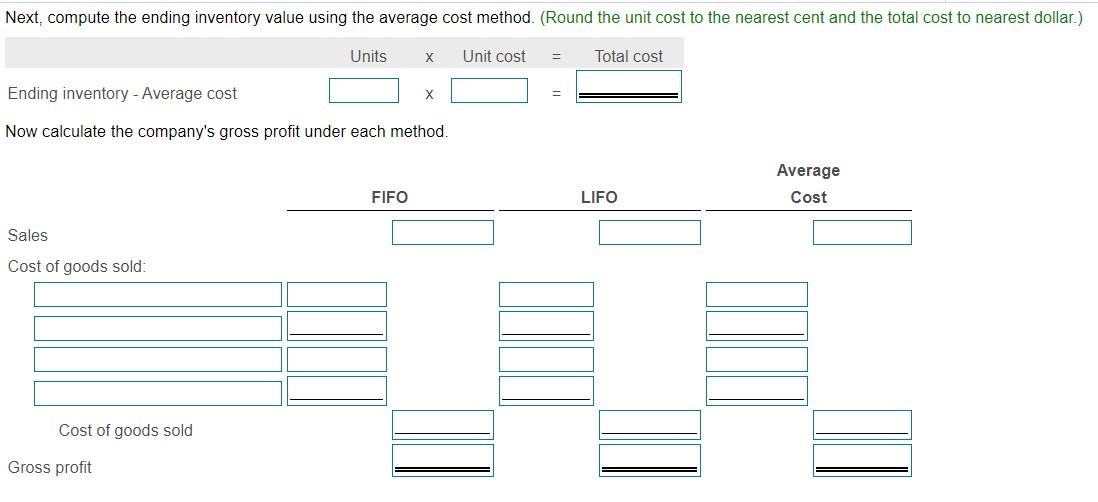

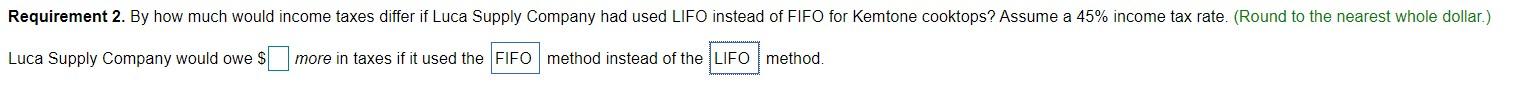

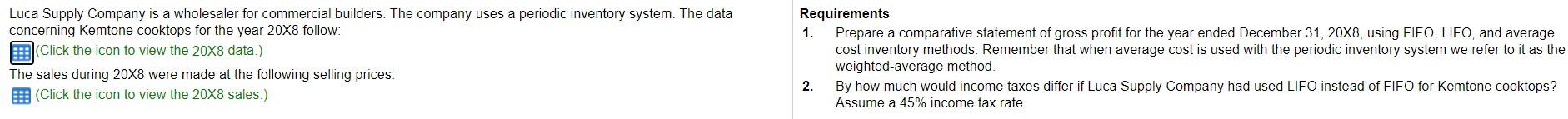

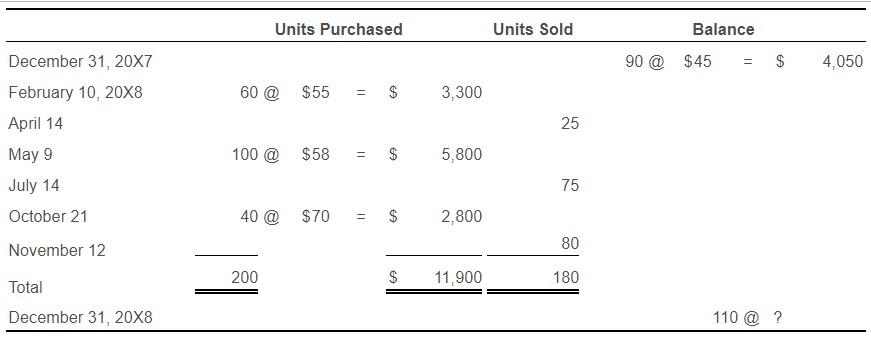

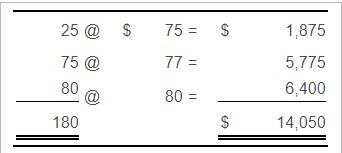

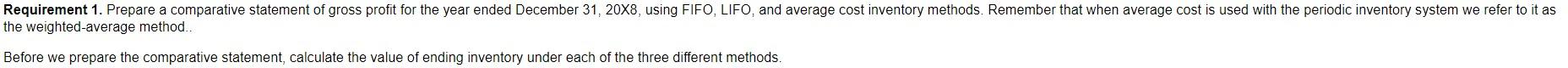

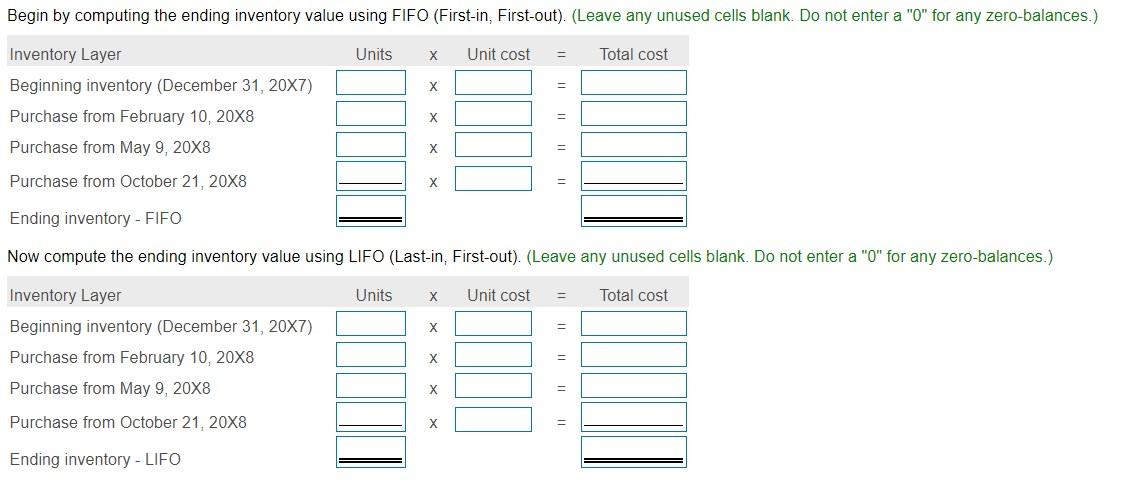

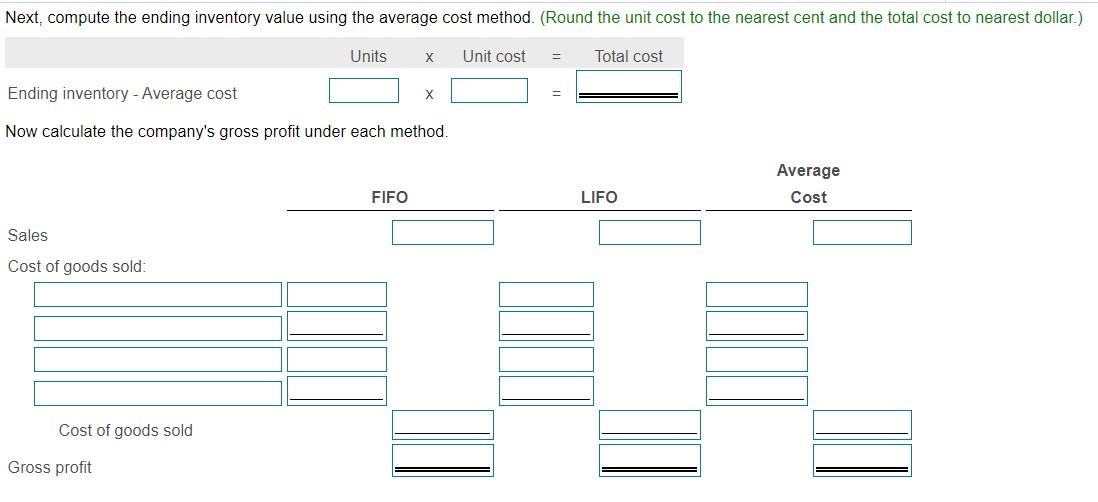

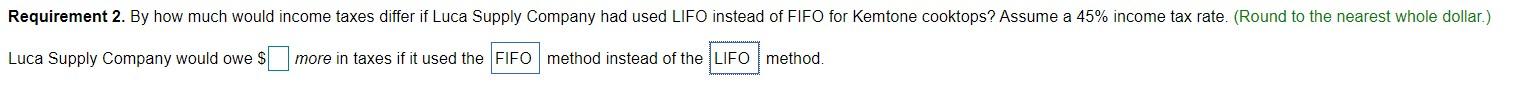

Luca Supply Company is a wholesaler for commercial builders. The company uses a periodic inventory system. The data concerning Kemtone cooktops for the year 20X8 follow: Click the icon to view the 20X8 data.) The sales during 20X8 were made at the following selling prices (Click the icon to view the 20X8 sales.) Requirements 1. Prepare a comparative statement of gross profit for the year ended December 31, 20X8, using FIFO, LIFO, and average cost inventory methods. Remember that when average cost is used with the periodic inventory system we refer to it as the weighted average method 2. By how much would income taxes differ if Luca Supply Company had used LIFO instead of FIFO for Kemtone cooktops ? Assume a 45% income tax rate. Units Purchased Units Sold Balance 90 @ $45 4,050 60 @ $55 = $ 3,300 December 31, 20X7 February 10, 20X8 April 14 May 9 July 14 25 100 @ $58 - $ 5,800 75 October 21 40 @ $70 $ 2,800 80 November 12 200 $ 11,900 180 Total December 31, 20X8 110 @ ? 25 @ $ 75 = $ 1,875 75 @ 77 = 5,775 6,400 80 80 = 180 $ 14,050 Requirement 1. Prepare a comparative statement of gross profit for the year ended December 31, 20X8, using FIFO, LIFO, and average cost inventory methods. Remember that when average cost is used with the periodic inventory system we refer to it as the weighted average method.. Before we prepare the comparative statement, calculate the value of ending inventory under each of the three different methods. Begin by computing the ending inventory value using FIFO (First-in, First-out). (Leave any unused cells blank. Do not enter a "0" for any zero-balances.) Units Unit cost Total cost Inventory Layer Beginning inventory (December 31, 20X7) Purchase from February 10, 20X8 X Purchase from May 9, 20X8 X Purchase from October 21, 20X8 X Ending inventory - FIFO Now compute the ending inventory value using LIFO (Last-in, First-out). (Leave any unused cells blank. Do not enter a "0" for any zero-balances.) Units X Unit cost Total cost X Inventory Layer Beginning inventory (December 31, 20X7) Purchase from February 10, 20X8 Purchase from May 9, 20X8 X X Purchase from October 21, 20X8 X Ending inventory - LIFO Next, compute the ending inventory value using the average cost method. (Round the unit cost to the nearest cent and the total cost to nearest dollar.) Units x Unit cost Total cost Ending inventory - Average cost Now calculate the company's gross profit under each method. Average Cost FIFO LIFO Sales Cost of goods sold: Cost of goods sold Gross profit Requirement 2. By how much would income taxes differ if Luca Supply Company had used LIFO instead of FIFO for Kemtone cooktops? Assume a 45% income tax rate. (Round to the nearest whole dollar.) Luca Supply Company would owe $ more in taxes if it used the FIFO method instead of the LIFO method