Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lucas Company was issued a charter by the state of Indiana on January 15 of this year. The charter authorized the following: Common stock, $10

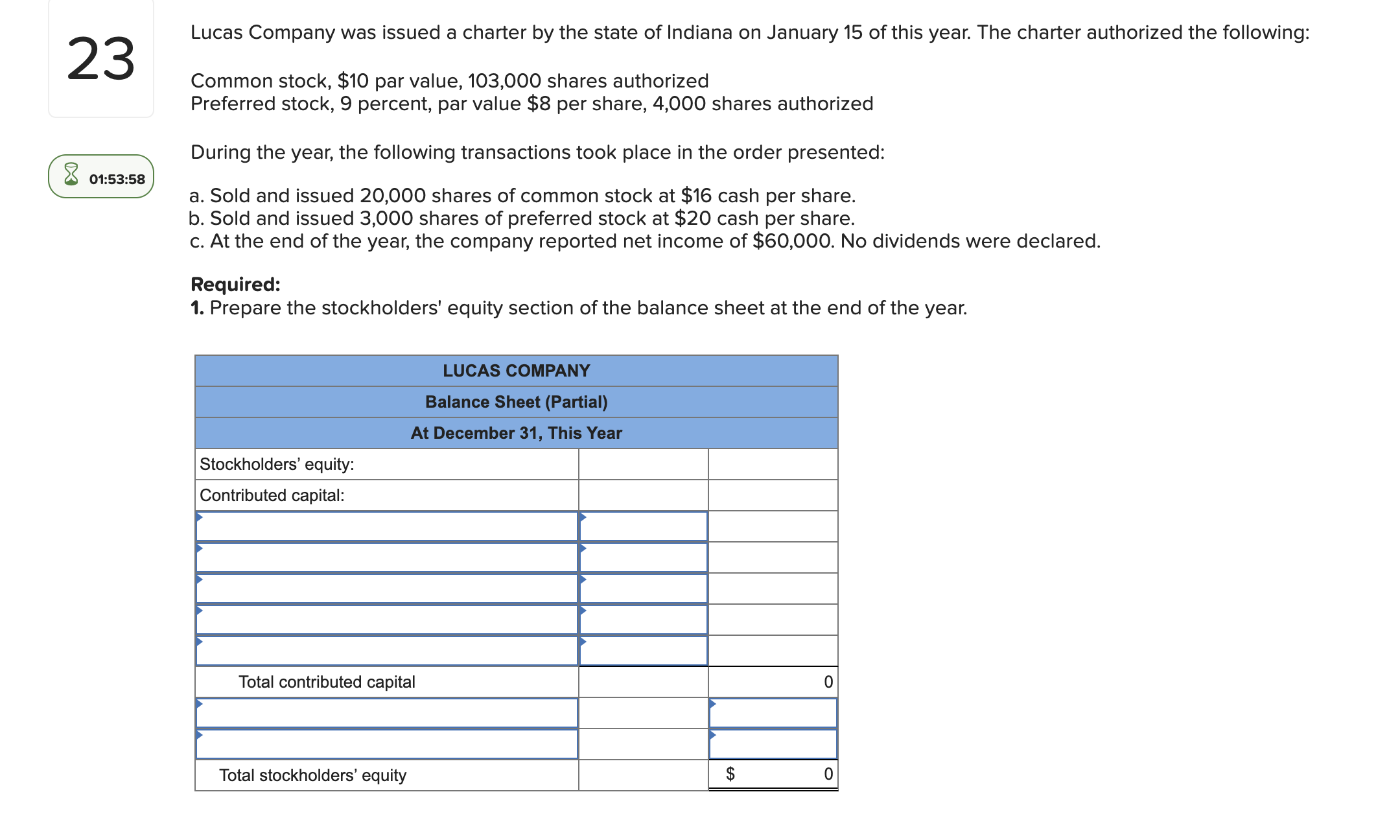

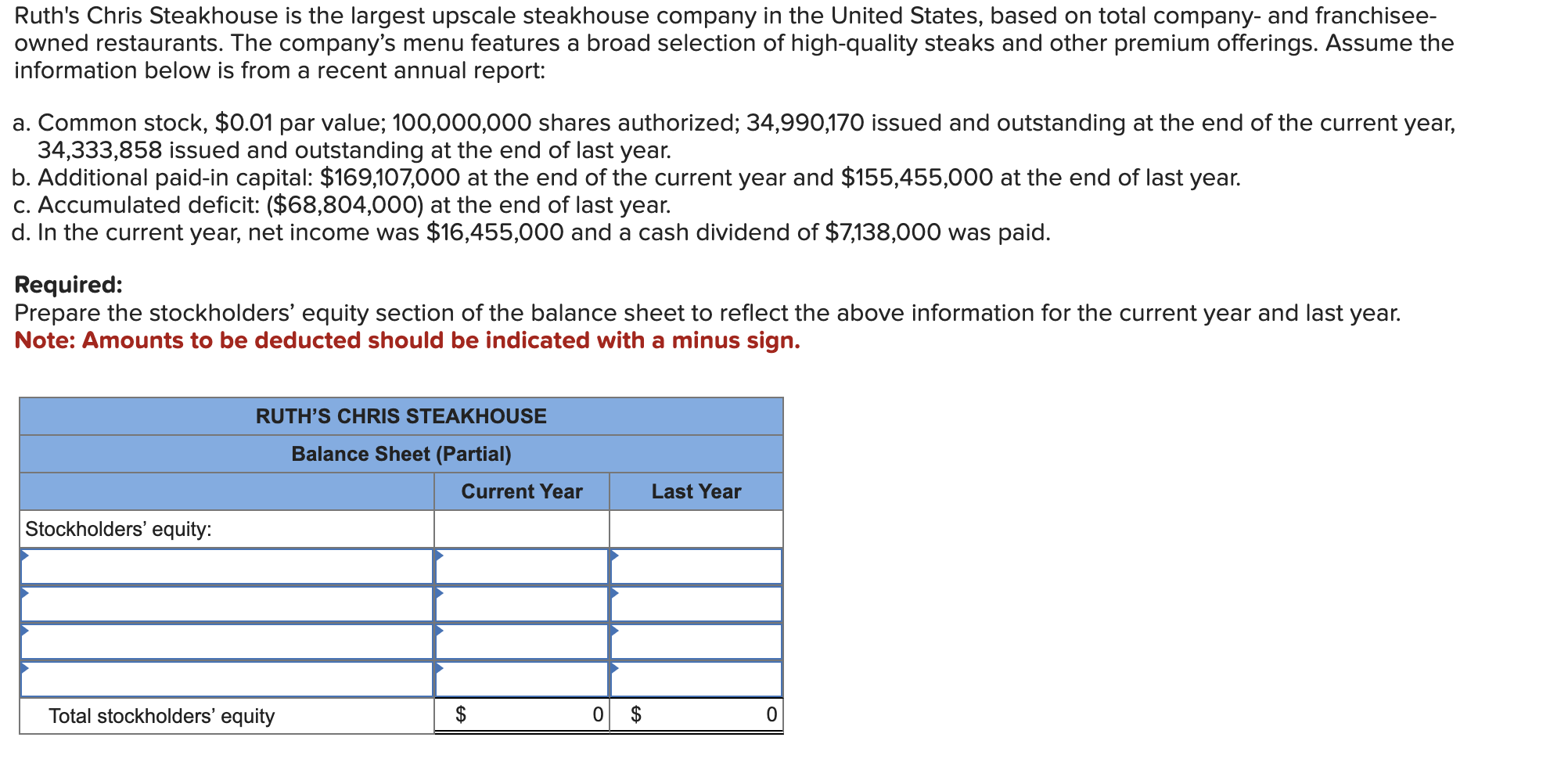

Lucas Company was issued a charter by the state of Indiana on January 15 of this year. The charter authorized the following: Common stock, $10 par value, 103,000 shares authorized Preferred stock, 9 percent, par value $8 per share, 4,000 shares authorized During the year, the following transactions took place in the order presented: a. Sold and issued 20,000 shares of common stock at $16 cash per share. b. Sold and issued 3,000 shares of preferred stock at $20 cash per share. c. At the end of the year, the company reported net income of $60,000. No dividends were declared. Required: 1. Prepare the stockholders' equity section of the balance sheet at the end of the year. Ruth's Chris Steakhouse is the largest upscale steakhouse company in the United States, based on total company- and franchiseeowned restaurants. The company's menu features a broad selection of high-quality steaks and other premium offerings. Assume the information below is from a recent annual report: a. Common stock, $0.01 par value; 100,000,000 shares authorized; 34,990,170 issued and outstanding at the end of the current year, 34,333,858 issued and outstanding at the end of last year. b. Additional paid-in capital: $169,107,000 at the end of the current year and $155,455,000 at the end of last year. c. Accumulated deficit: ($68,804,000) at the end of last year. d. In the current year, net income was $16,455,000 and a cash dividend of $7,138,000 was paid. Required: Prepare the stockholders' equity section of the balance sheet to reflect the above information for the current year and last year. Note: Amounts to be deducted should be indicated with a minus sign

Lucas Company was issued a charter by the state of Indiana on January 15 of this year. The charter authorized the following: Common stock, $10 par value, 103,000 shares authorized Preferred stock, 9 percent, par value $8 per share, 4,000 shares authorized During the year, the following transactions took place in the order presented: a. Sold and issued 20,000 shares of common stock at $16 cash per share. b. Sold and issued 3,000 shares of preferred stock at $20 cash per share. c. At the end of the year, the company reported net income of $60,000. No dividends were declared. Required: 1. Prepare the stockholders' equity section of the balance sheet at the end of the year. Ruth's Chris Steakhouse is the largest upscale steakhouse company in the United States, based on total company- and franchiseeowned restaurants. The company's menu features a broad selection of high-quality steaks and other premium offerings. Assume the information below is from a recent annual report: a. Common stock, $0.01 par value; 100,000,000 shares authorized; 34,990,170 issued and outstanding at the end of the current year, 34,333,858 issued and outstanding at the end of last year. b. Additional paid-in capital: $169,107,000 at the end of the current year and $155,455,000 at the end of last year. c. Accumulated deficit: ($68,804,000) at the end of last year. d. In the current year, net income was $16,455,000 and a cash dividend of $7,138,000 was paid. Required: Prepare the stockholders' equity section of the balance sheet to reflect the above information for the current year and last year. Note: Amounts to be deducted should be indicated with a minus sign Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started