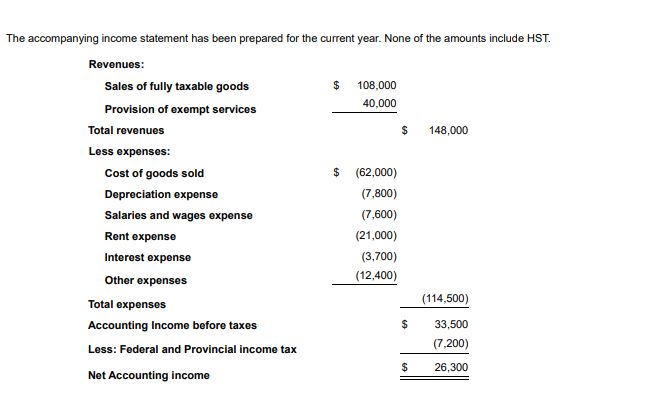

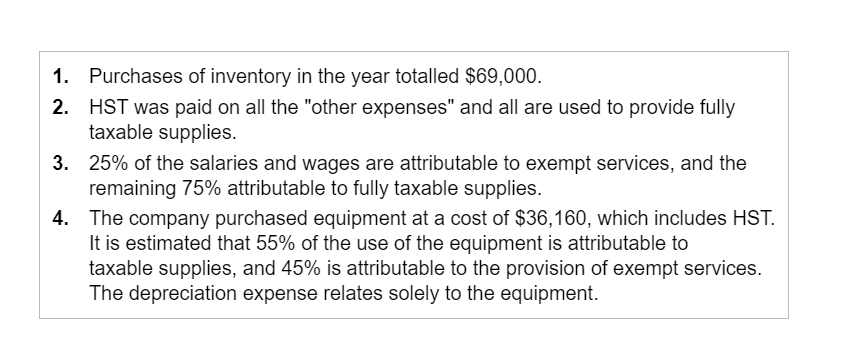

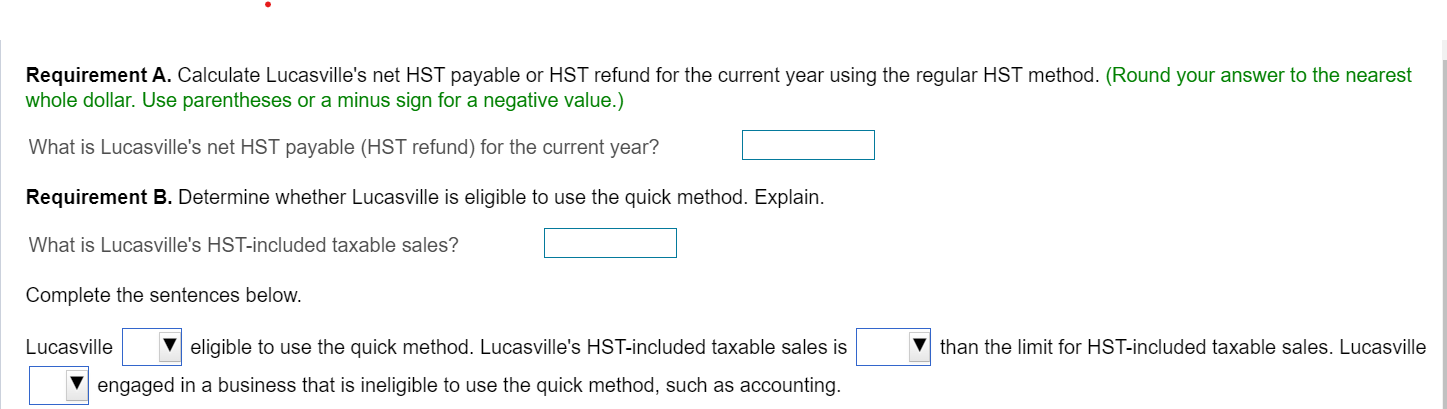

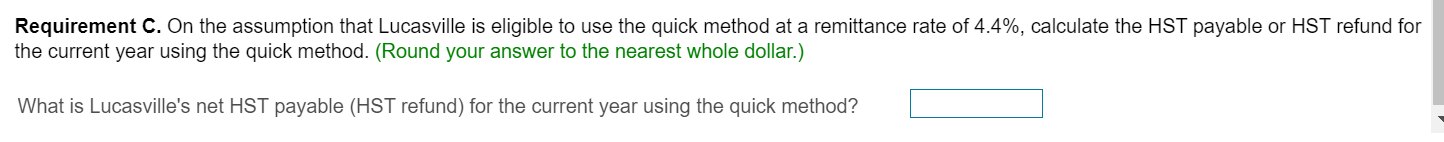

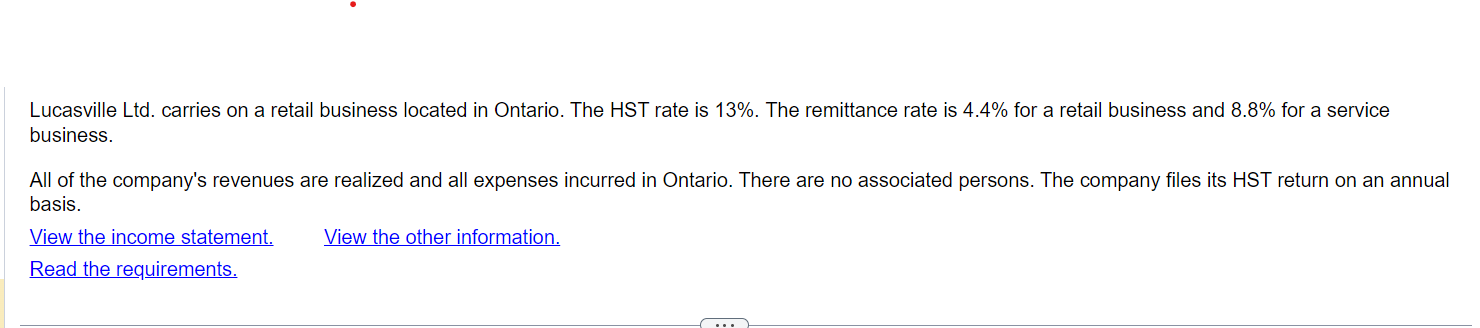

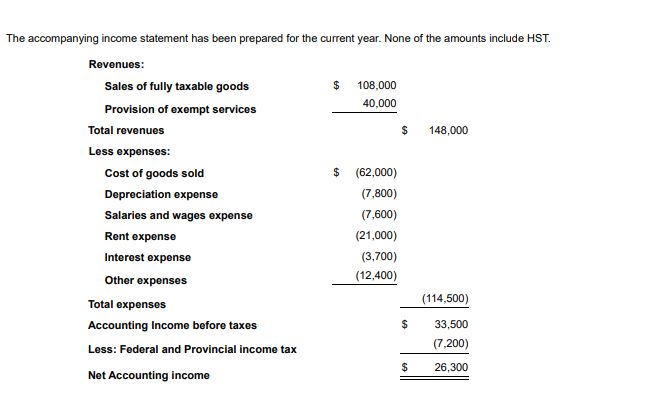

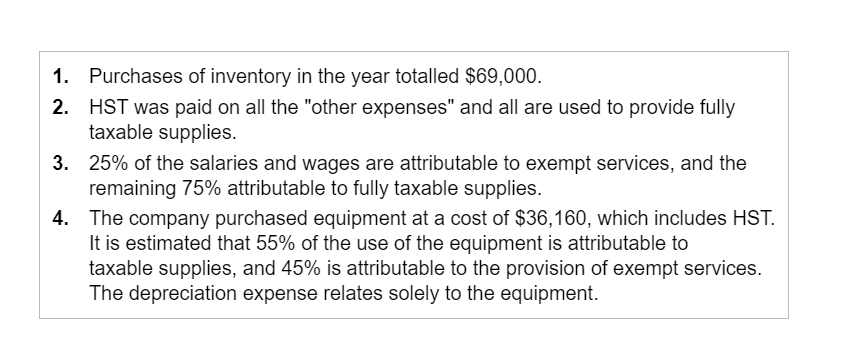

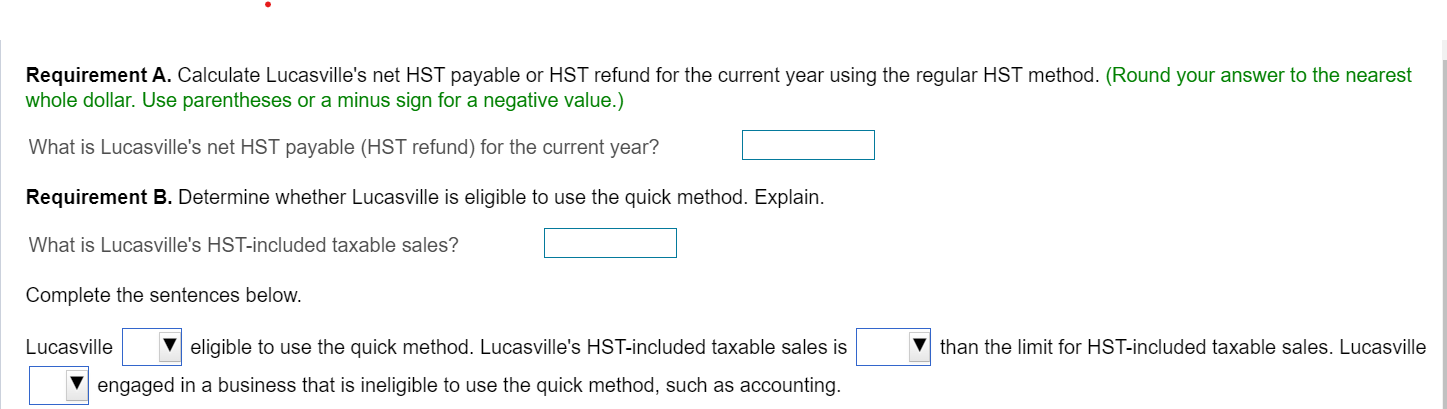

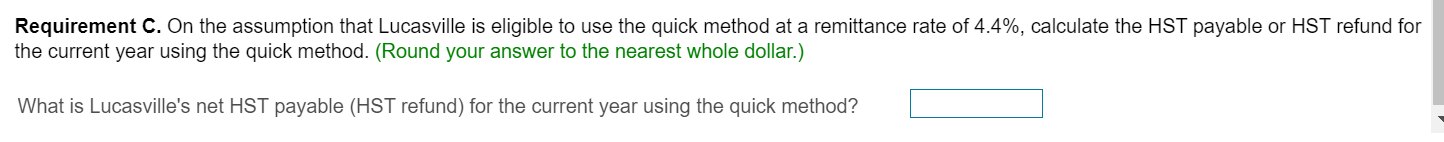

Lucasville Ltd. carries on a retail business located in Ontario. The HST rate is 13%. The remittance rate is 4.4% for a retail business and 8.8% for a service business. All of the company's revenues are realized and all expenses incurred in Ontario. There are no associated persons. The company files its HST return on an annual basis. View the income statement. Read the requirements. he accompanying income statement has been prepared for the current year. None of the amounts include HST. 1. Purchases of inventory in the year totalled $69,000. 2. HST was paid on all the "other expenses" and all are used to provide fully taxable supplies. 3. 25% of the salaries and wages are attributable to exempt services, and the remaining 75% attributable to fully taxable supplies. 4. The company purchased equipment at a cost of $36,160, which includes HST. It is estimated that 55% of the use of the equipment is attributable to taxable supplies, and 45% is attributable to the provision of exempt services. The depreciation expense relates solely to the equipment. Requirement A. Calculate Lucasville's net HST payable or HST refund for the current year using the regular HST method. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for a negative value.) What is Lucasville's net HST payable (HST refund) for the current year? Requirement B. Determine whether Lucasville is eligible to use the quick method. Explain. What is Lucasville's HST-included taxable sales? Complete the sentences below. Lucasville eligible to use the quick method. Lucasville's HST-included taxable sales is than the limit for HST-included taxable sales. Lucasville engaged in a business that is ineligible to use the quick method, such as accounting. Requirement C. On the assumption that Lucasville is eligible to use the quick method at a remittance rate of 4.4%, calculate the HST payable or HST refund for the current year using the quick method. (Round your answer to the nearest whole dollar.) What is Lucasville's net HST payable (HST refund) for the current year using the quick method? Lucasville Ltd. carries on a retail business located in Ontario. The HST rate is 13%. The remittance rate is 4.4% for a retail business and 8.8% for a service business. All of the company's revenues are realized and all expenses incurred in Ontario. There are no associated persons. The company files its HST return on an annual basis. View the income statement. Read the requirements. he accompanying income statement has been prepared for the current year. None of the amounts include HST. 1. Purchases of inventory in the year totalled $69,000. 2. HST was paid on all the "other expenses" and all are used to provide fully taxable supplies. 3. 25% of the salaries and wages are attributable to exempt services, and the remaining 75% attributable to fully taxable supplies. 4. The company purchased equipment at a cost of $36,160, which includes HST. It is estimated that 55% of the use of the equipment is attributable to taxable supplies, and 45% is attributable to the provision of exempt services. The depreciation expense relates solely to the equipment. Requirement A. Calculate Lucasville's net HST payable or HST refund for the current year using the regular HST method. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for a negative value.) What is Lucasville's net HST payable (HST refund) for the current year? Requirement B. Determine whether Lucasville is eligible to use the quick method. Explain. What is Lucasville's HST-included taxable sales? Complete the sentences below. Lucasville eligible to use the quick method. Lucasville's HST-included taxable sales is than the limit for HST-included taxable sales. Lucasville engaged in a business that is ineligible to use the quick method, such as accounting. Requirement C. On the assumption that Lucasville is eligible to use the quick method at a remittance rate of 4.4%, calculate the HST payable or HST refund for the current year using the quick method. (Round your answer to the nearest whole dollar.) What is Lucasville's net HST payable (HST refund) for the current year using the quick method