Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lucky, Inc, uses 1000 units of the component NJF1 every month to manufacture one of its products. This unit costs incurred to manufacture the component

Lucky, Inc, uses 1000 units of the component NJF1 every month to manufacture one of its products. This unit costs incurred to manufacture the component are as follows: Direct Materials=$65 Direct Labor=$50 Overhead=$100 Total=$215.

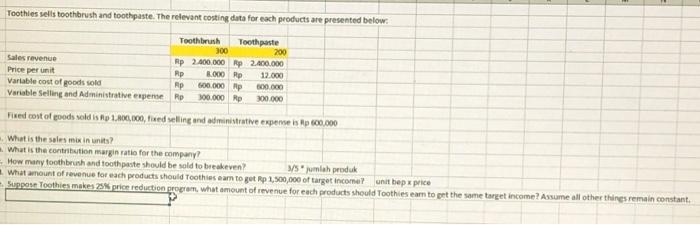

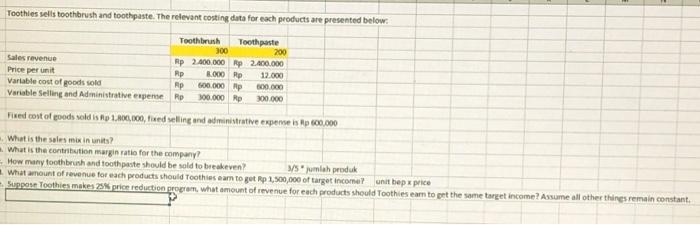

Toothles sells toothbrush and toothpaste. The relevant costing data for each products are presented below. Toothbrush Toothpaste 300 200 Sales revenue Rp 2.400.000 Rp 2.000.000 Price per unit Rp 3.000 Rp 12.000 Variable cost of goods sold Rp 500.000 Rp 600.000 Variable Selling and Administrative expense Rp 100.000 Rp 200.000 Fixed cost of goods sold is o 1.800,000, fixed selling and administrative expenses Rp 600.000 What is the sales mix in units? What is the contribution margin ratio for the company? How many toothbrush and toothpaste should be sold to breakeven? jumlah produk What amount of revenue for each products should Toothies eam to get Rp 1,500,000 of target Income unit bep x price Suppose Toothies makes 2price reduction program, what amount of revenue for each products should Toothies eam to get the same target income? Assume all other things remain constant Overhead costs are applied on the basis of direct labor dollars and consist of 60% variable costs and 40% fixed costs. A vendor has offered to supply the NJF1 component at a price of $190 per unit or $190000.

a. Should Lucky purchase the component from the outside vendor if its capacity remains idle?

b. Should Lucky purchase the component from the outside vendor if assume that $10000 of the total fixed overhead cost can be avoided?

c. Assume that none of the fixed overhead can be avoided. However, if the NJF1 are purchased from vendor, Lucky can use the released productive resources to generate additional income of $35000, should Lucky purchase the component from the outside vendor?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started