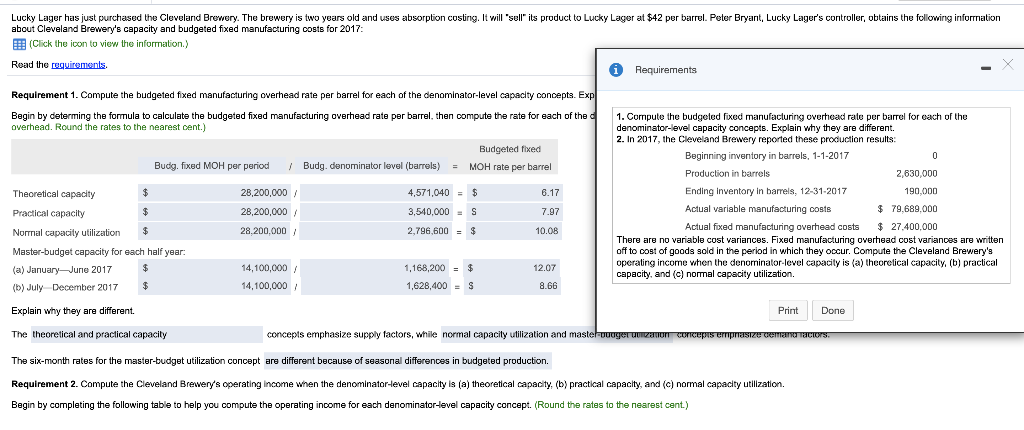

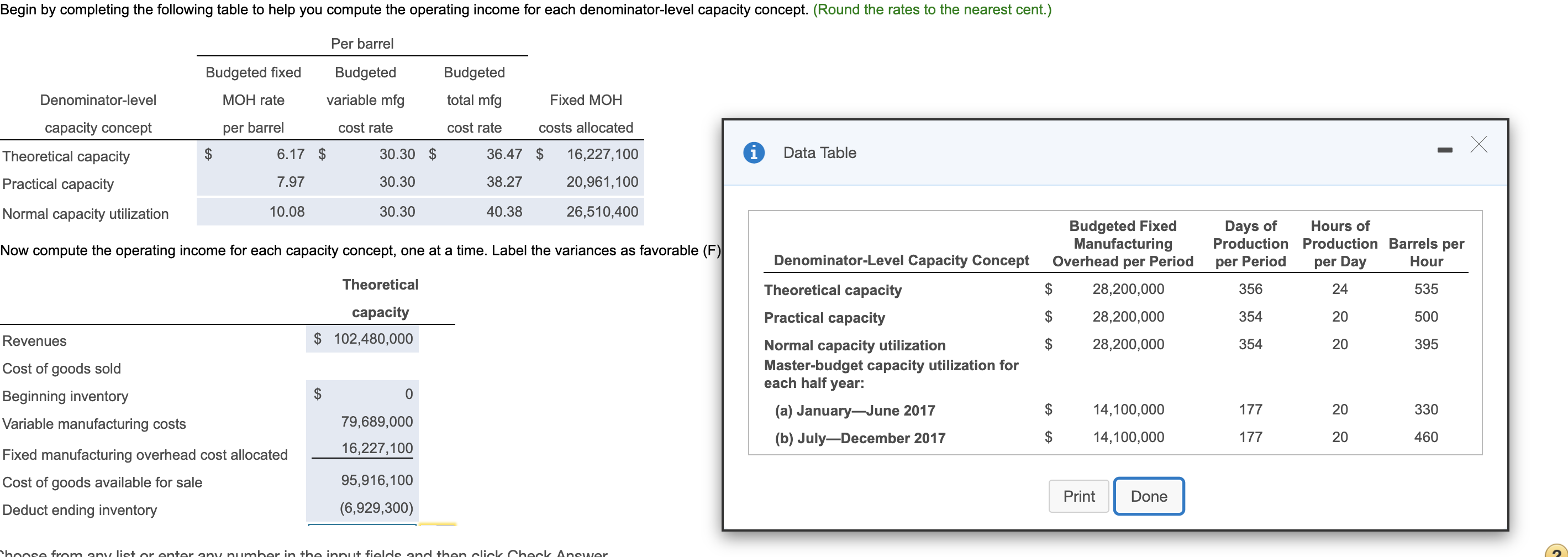

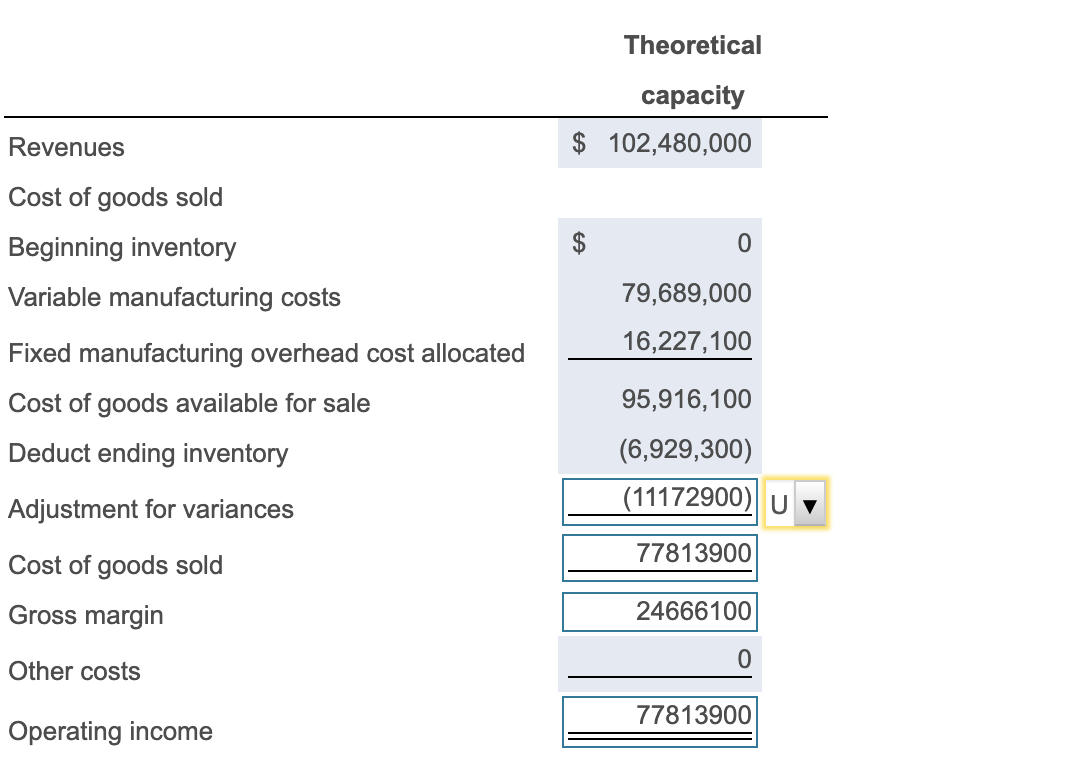

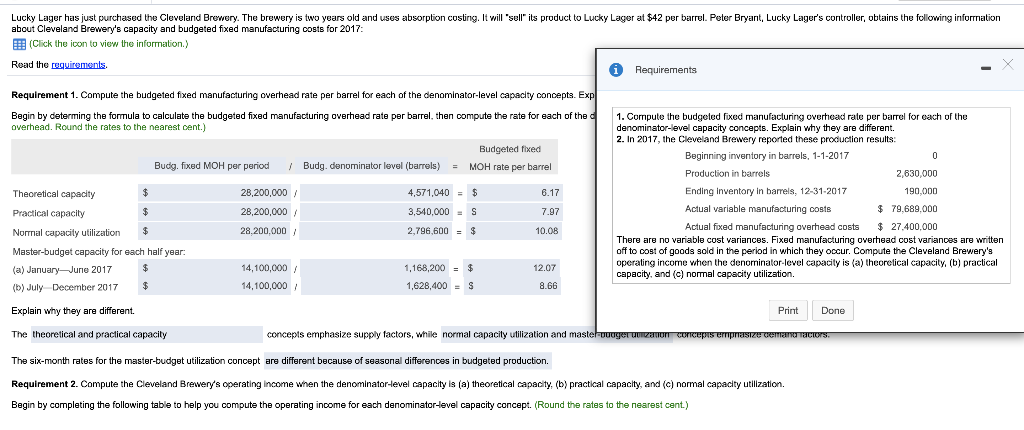

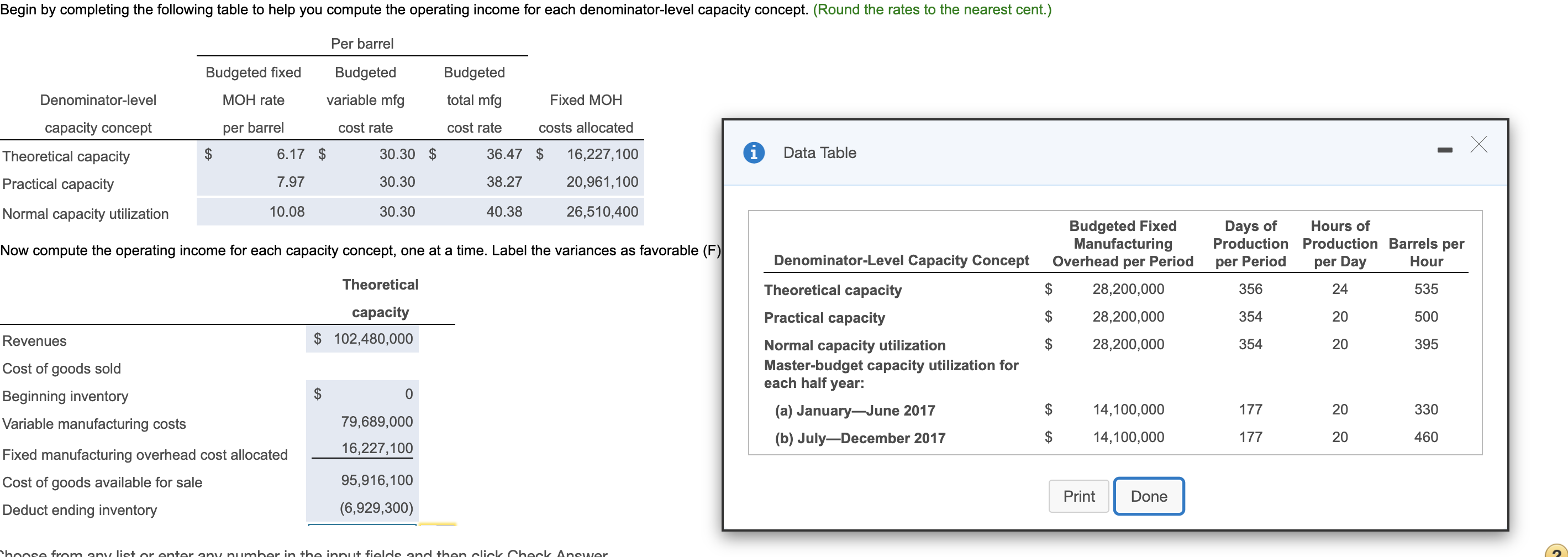

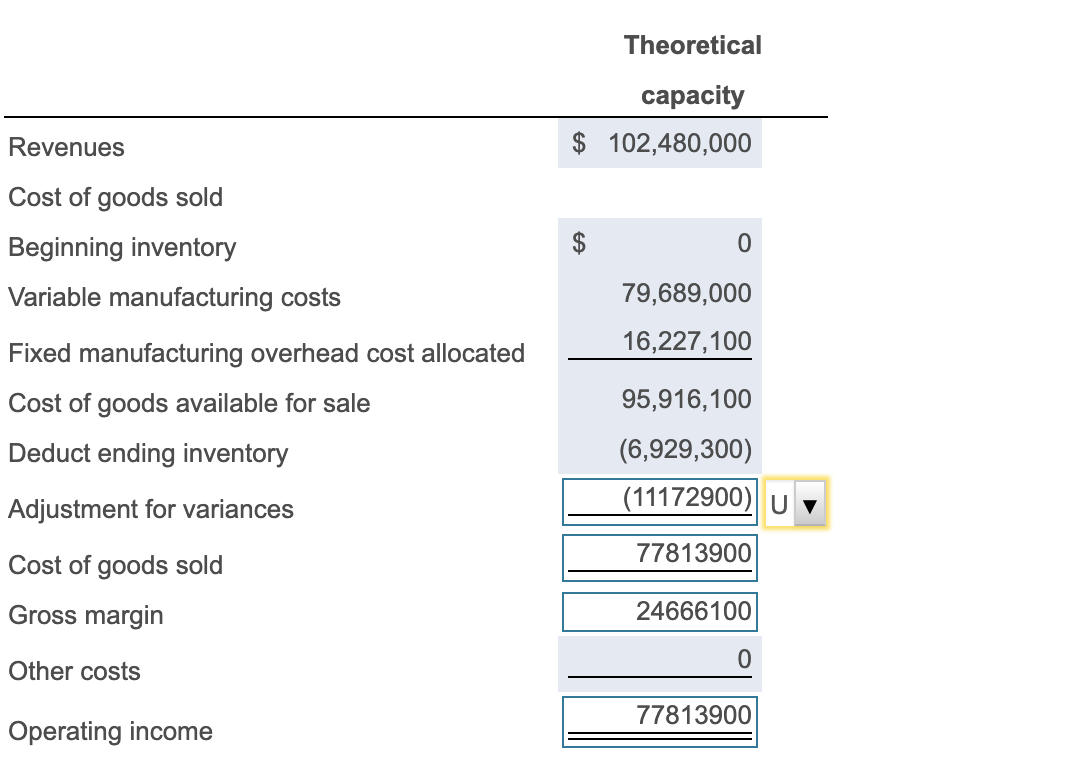

Lucky Lager has just purchased the Cleveland Brewery. The brewery is two years old and uses absorption costing. It will 'sell its product to Lucky Lager at $42 per barrel. Peter Bryant, Lucky Lager's controller, obtains the following information about Cleveland Brewery's capacity and budgeted fixed manufacturing costs for 2017: (Click the icon to view the information.) Read the requirements i Requirements Requirement 1. Compute the budgeted fixed manufacturing overhead rate per barrel for each of the denominator-level capacity concepts. Exp Begin by determing the formula to calculate the budgeted fixed manufacturing overhead rate per barrel, then compute the rate for each of the overhead. Round the rates to the nearest cent.) Budgeted fixed Budg. fixed MOH per period 1 Budg. denominator level (barrels) = MOH rate per barrel 28,200,000/ 6.17 4,571,040 = $ 3,540,000 = S 2,796,600 - $ 28,200,000/ 1. Compute the budgeted fixed manufacturing overhead rate per barrel for each of the denominator-level capacity concepts. Explain why they are different. 2. In 2017, the Cleveland Brewery reported these production results: Beginning inventory in barrels, 1-1-2017 0 0 Production in barrels 2,630,000 Ending Inventory in barrels, 12-31-2017 190,000 Actual variable manufacturing costs $ 79,689,000 Actual fixed manufacturing overhead costs $ 27.400,000 There are no variable cost variances. Fixed manufacturing overhead cost variances are written off to cost of goods sold in the period in which they occur. Compute the Cleveland Brewery's operating income when the denominator-level capacity is (a) theoretical capacity, (b) praclical capacity, and (c) normal capacity utilization. 7.97 28,200.000 Theoretical capacity $ Practical capacity $ Normal capacity utilization $ Master-budget capacity for each half year: (a) January June 2017 $ (b) July December 2017 $ 10.08 14,100,000 14,100,000/ 1,168,200 = $ 1,628,400 = S 12.07 8.66 Explain why they are different. Print Done The theoretical and practical capacity concepts emphasize supply factors, while normal capacity utilization and mastel-ouager duizamor concepis emprasize cemara racios. The six-month rates for the master-budget utilization concept are different because of seasonal differences in budgeted production. Requirement 2. Compute the Cleveland Brewery's operating income when the denominator-level capacity is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization. Begin by completing the following table to help you compute the operating income for each denominator-level capacity concept. (Round the rates to the nearest cent.) Begin by completing the following table to help you compute the operating income for each denominator-level capacity concept. (Round the rates to the nearest cent.) Per barrel Budgeted fixed Budgeted Budgeted Denominator-level MOH rate variable mfg total mfg Fixed MOH per barrel cost rate cost rate costs allocated X capacity concept Theoretical capacity Practical capacity 6.17 $ 30.30 $ 36.47 $ i Data Table 16,227,100 20,961,100 7.97 30.30 38.27 Normal capacity utilization 10.08 30.30 40.38 26,510,400 Now compute the operating income for each capacity concept, one at a time. Label the variances as favorable (F) Days of Hours of Production Production Barrels per per Period per Day Hour Denominator-Level Capacity Concept Budgeted Fixed Manufacturing Overhead per Period $ 28,200,000 Theoretical Theoretical capacity 356 24 535 Practical capacity 28,200,000 354 20 500 capacity $ 102,480,000 Revenues $ 28,200,000 354 20 395 Cost of goods sold Beginning inventory Variable manufacturing costs 0 Normal capacity utilization Master-budget capacity utilization for each half year: (a) JanuaryJune 2017 (b) JulyDecember 2017 14,100,000 177 20 330 79,689,000 16,227,100 $ 14,100,000 177 20 460 Fixed manufacturing overhead cost allocated Cost of goods available for sale 95,916,100 (6,929,300) Print Done Deduct ending inventory hoose from any list or enter any number in the input fields and then click Check Answer Theoretical capacity $ 102,480,000 Revenues Cost of goods sold 0 Beginning inventory Variable manufacturing costs Fixed manufacturing overhead cost allocated Cost of goods available for sale Deduct ending inventory 79,689,000 16,227,100 95,916,100 (6,929,300) Adjustment for variances (11172900) Uv 77813900 Cost of goods sold Gross margin 24666100 0 Other costs 77813900 Operating income Lucky Lager has just purchased the Cleveland Brewery. The brewery is two years old and uses absorption costing. It will 'sell its product to Lucky Lager at $42 per barrel. Peter Bryant, Lucky Lager's controller, obtains the following information about Cleveland Brewery's capacity and budgeted fixed manufacturing costs for 2017: (Click the icon to view the information.) Read the requirements i Requirements Requirement 1. Compute the budgeted fixed manufacturing overhead rate per barrel for each of the denominator-level capacity concepts. Exp Begin by determing the formula to calculate the budgeted fixed manufacturing overhead rate per barrel, then compute the rate for each of the overhead. Round the rates to the nearest cent.) Budgeted fixed Budg. fixed MOH per period 1 Budg. denominator level (barrels) = MOH rate per barrel 28,200,000/ 6.17 4,571,040 = $ 3,540,000 = S 2,796,600 - $ 28,200,000/ 1. Compute the budgeted fixed manufacturing overhead rate per barrel for each of the denominator-level capacity concepts. Explain why they are different. 2. In 2017, the Cleveland Brewery reported these production results: Beginning inventory in barrels, 1-1-2017 0 0 Production in barrels 2,630,000 Ending Inventory in barrels, 12-31-2017 190,000 Actual variable manufacturing costs $ 79,689,000 Actual fixed manufacturing overhead costs $ 27.400,000 There are no variable cost variances. Fixed manufacturing overhead cost variances are written off to cost of goods sold in the period in which they occur. Compute the Cleveland Brewery's operating income when the denominator-level capacity is (a) theoretical capacity, (b) praclical capacity, and (c) normal capacity utilization. 7.97 28,200.000 Theoretical capacity $ Practical capacity $ Normal capacity utilization $ Master-budget capacity for each half year: (a) January June 2017 $ (b) July December 2017 $ 10.08 14,100,000 14,100,000/ 1,168,200 = $ 1,628,400 = S 12.07 8.66 Explain why they are different. Print Done The theoretical and practical capacity concepts emphasize supply factors, while normal capacity utilization and mastel-ouager duizamor concepis emprasize cemara racios. The six-month rates for the master-budget utilization concept are different because of seasonal differences in budgeted production. Requirement 2. Compute the Cleveland Brewery's operating income when the denominator-level capacity is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization. Begin by completing the following table to help you compute the operating income for each denominator-level capacity concept. (Round the rates to the nearest cent.) Begin by completing the following table to help you compute the operating income for each denominator-level capacity concept. (Round the rates to the nearest cent.) Per barrel Budgeted fixed Budgeted Budgeted Denominator-level MOH rate variable mfg total mfg Fixed MOH per barrel cost rate cost rate costs allocated X capacity concept Theoretical capacity Practical capacity 6.17 $ 30.30 $ 36.47 $ i Data Table 16,227,100 20,961,100 7.97 30.30 38.27 Normal capacity utilization 10.08 30.30 40.38 26,510,400 Now compute the operating income for each capacity concept, one at a time. Label the variances as favorable (F) Days of Hours of Production Production Barrels per per Period per Day Hour Denominator-Level Capacity Concept Budgeted Fixed Manufacturing Overhead per Period $ 28,200,000 Theoretical Theoretical capacity 356 24 535 Practical capacity 28,200,000 354 20 500 capacity $ 102,480,000 Revenues $ 28,200,000 354 20 395 Cost of goods sold Beginning inventory Variable manufacturing costs 0 Normal capacity utilization Master-budget capacity utilization for each half year: (a) JanuaryJune 2017 (b) JulyDecember 2017 14,100,000 177 20 330 79,689,000 16,227,100 $ 14,100,000 177 20 460 Fixed manufacturing overhead cost allocated Cost of goods available for sale 95,916,100 (6,929,300) Print Done Deduct ending inventory hoose from any list or enter any number in the input fields and then click Check Answer Theoretical capacity $ 102,480,000 Revenues Cost of goods sold 0 Beginning inventory Variable manufacturing costs Fixed manufacturing overhead cost allocated Cost of goods available for sale Deduct ending inventory 79,689,000 16,227,100 95,916,100 (6,929,300) Adjustment for variances (11172900) Uv 77813900 Cost of goods sold Gross margin 24666100 0 Other costs 77813900 Operating income