Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lucy currently owns a BMW car dealer in Hagerstown, MD. Her team has noticed that many of their new customers live in Chambersburg, PA. They

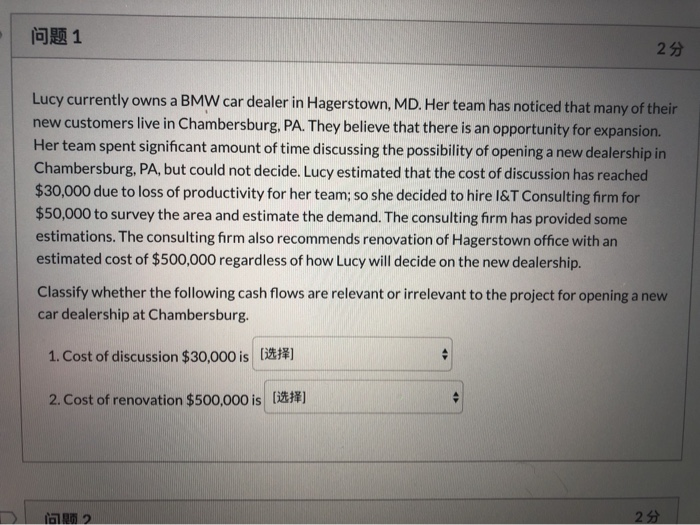

Lucy currently owns a BMW car dealer in Hagerstown, MD. Her team has noticed that many of their new customers live in Chambersburg, PA. They believe that there is an opportunity for expansion. Her team spent significant amount of time discussing the possibility of opening a new dealership in Chambersburg, PA, but could not decide. Lucy estimated that the cost of discussion has reached $30,000 due to loss of productivity for her team; so she decided to hire I&T Consulting firm for $50,000 to survey the area and estimate the demand. The consulting firm has provided some estimations. The consulting firm also recommends renovation of Hagerstown office with an estimated cost of $500,000 regardless of how Lucy will decide on the new dealership.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started