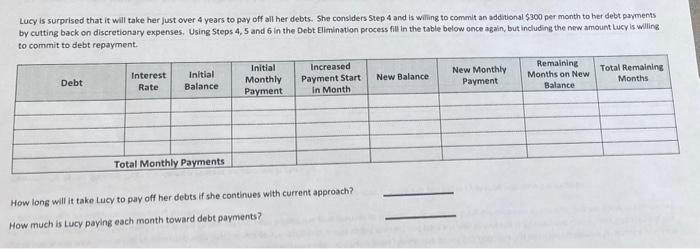

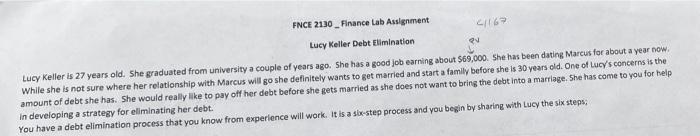

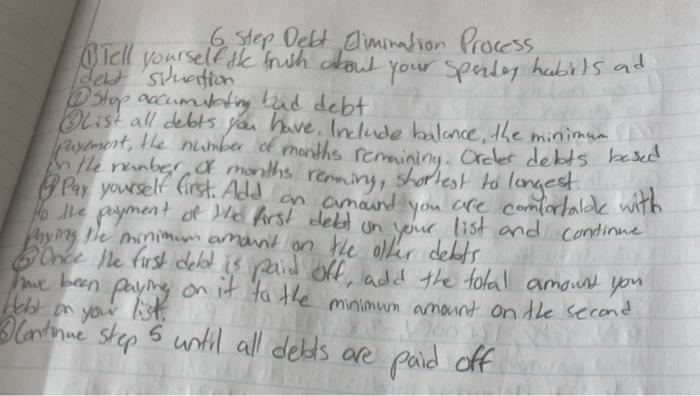

Lucy is surprised that it will take her just over 4 years to pay off all her debts. She considers Step 4 and is willing to commit an additional $300 per month to her debt payments by cutting back on discretionary expenses. Using Steps 4, 5 and 6 in the Debt Elimination process fill in the table below once again, but including the new amount Lucy is willing to commit to debt repayment Interest Rate Initial Balance Initial Monthly Payment Increased Payment Start in Month New Balance Debt New Monthly Payment Remaining Months on New Balance Total Remaining Months Total Monthly Payments How long will it take Lucy to pay off her debts if she continues with current approach? How much is Lucy paying each month toward debt payments? FNCE 2130_ Finance Lab Assignment C1162 Lucy Keller Debt Elimination Lucy Keller is 27 years old. She graduated from university a couple of years ago. She has a good job earning about $69,000. She has been dating Marcus for about a year now. While she is not sure where her relationship with Marcus will go she definitely wants to get married and start a family before she is 30 years old. One of Lucy's concerns is the amount of debt she has. She would really like to pay off her debt before she gets married as she does not want to bring the debt into a marriage. She has come to you for help in developing a strategy for eliminating her debt. You have a debt elimination process that you know from experience will work. It is a sb-step process and you begin by sharing with Lucy the six steps 6 step Debt Elimination Process, B Tell yourself the frush about your spendes habits ad 12 stop accumsaing bad debt Blist all debts you have include balance, the minimum in the number of months remming, shortest to longest. cayement, the number of months rermininy. Order debts based on amound you Ho the payment of the first dekst on your list and continue Paying the minimum amount on the other debts. 6 Once the first debt is paid off, add the total amount you, have been paying on it to the minimum amount on the second debt on your list Continue steps until all deeds are paid off Lucy is surprised that it will take her just over 4 years to pay off all her debts. She considers Step 4 and is willing to commit an additional $300 per month to her debt payments by cutting back on discretionary expenses. Using Steps 4, 5 and 6 in the Debt Elimination process fill in the table below once again, but including the new amount Lucy is willing to commit to debt repayment Interest Rate Initial Balance Initial Monthly Payment Increased Payment Start in Month New Balance Debt New Monthly Payment Remaining Months on New Balance Total Remaining Months Total Monthly Payments How long will it take Lucy to pay off her debts if she continues with current approach? How much is Lucy paying each month toward debt payments? FNCE 2130_ Finance Lab Assignment C1162 Lucy Keller Debt Elimination Lucy Keller is 27 years old. She graduated from university a couple of years ago. She has a good job earning about $69,000. She has been dating Marcus for about a year now. While she is not sure where her relationship with Marcus will go she definitely wants to get married and start a family before she is 30 years old. One of Lucy's concerns is the amount of debt she has. She would really like to pay off her debt before she gets married as she does not want to bring the debt into a marriage. She has come to you for help in developing a strategy for eliminating her debt. You have a debt elimination process that you know from experience will work. It is a sb-step process and you begin by sharing with Lucy the six steps 6 step Debt Elimination Process, B Tell yourself the frush about your spendes habits ad 12 stop accumsaing bad debt Blist all debts you have include balance, the minimum in the number of months remming, shortest to longest. cayement, the number of months rermininy. Order debts based on amound you Ho the payment of the first dekst on your list and continue Paying the minimum amount on the other debts. 6 Once the first debt is paid off, add the total amount you, have been paying on it to the minimum amount on the second debt on your list Continue steps until all deeds are paid off