Answered step by step

Verified Expert Solution

Question

1 Approved Answer

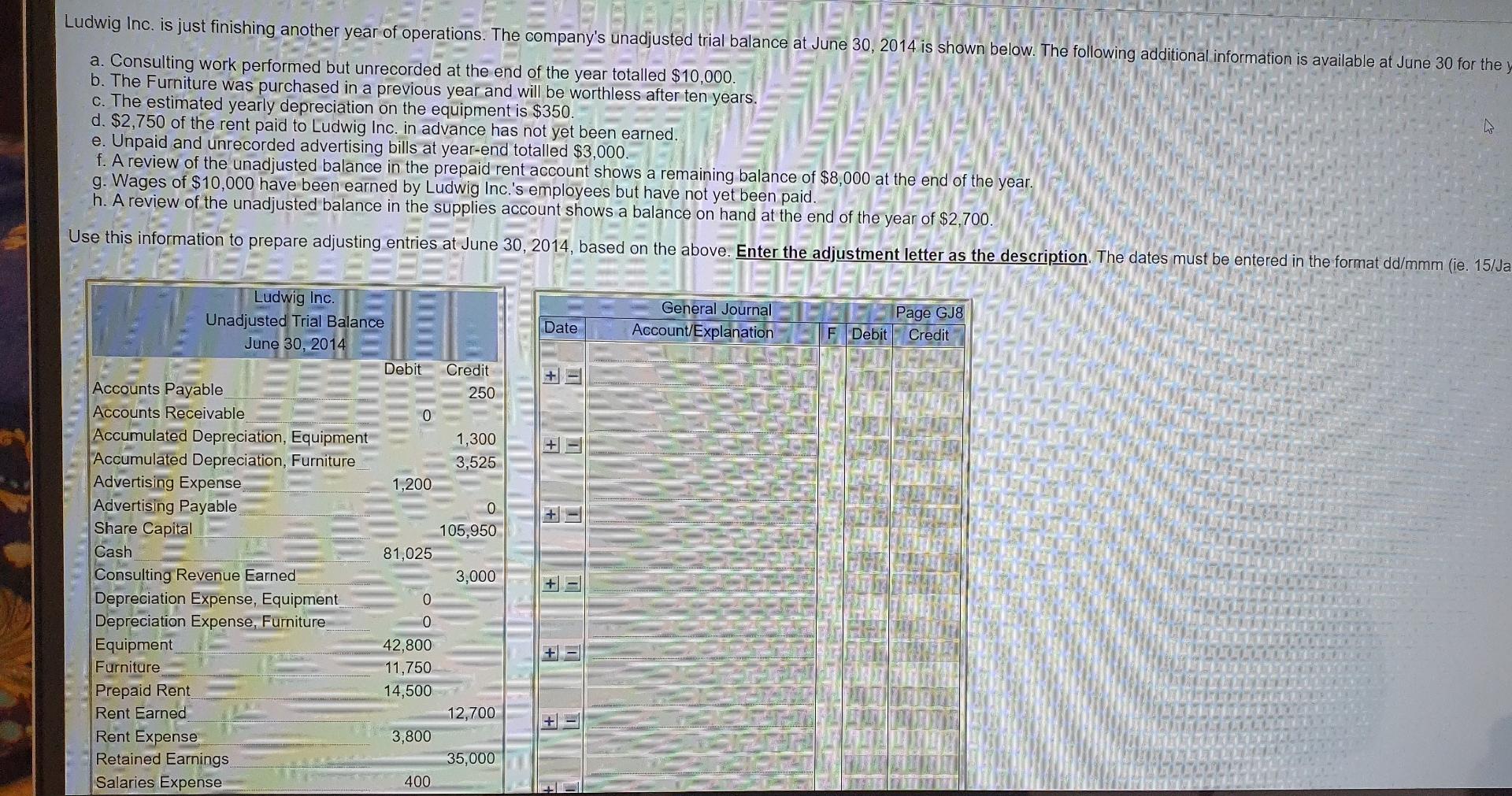

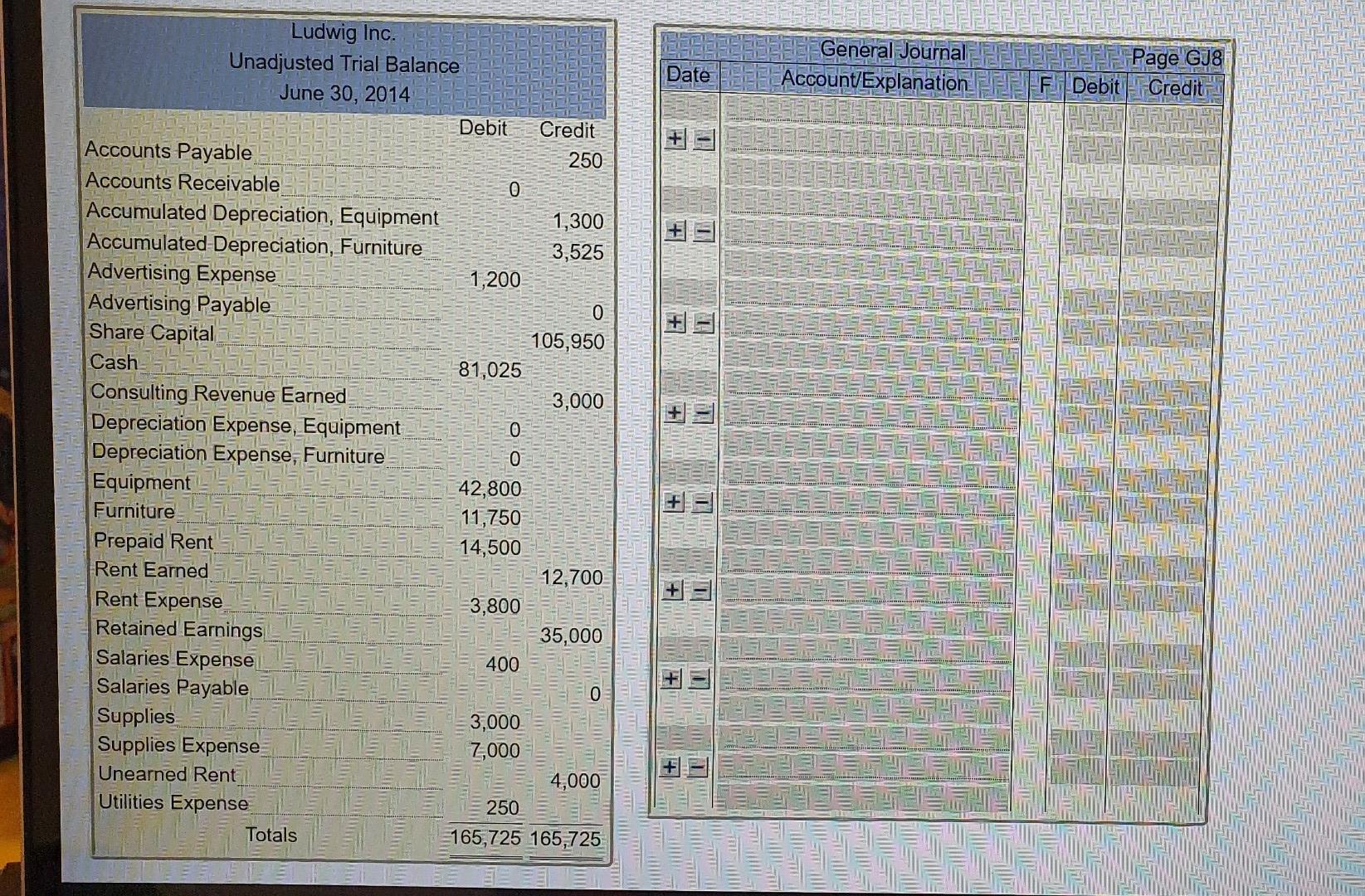

Ludwig Inc. is just finishing another year of operations. The company's unadjusted trial balance at June 30, 2014 is shown below. The following additional information

Ludwig Inc. is just finishing another year of operations. The company's unadjusted trial balance at June 30, 2014 is shown below. The following additional information is available at June 30 for they company's Unajusted vial balance at June 20. san. to shown because a. Consulting work performed but unrecorded at the end of the year totalled $10,000. b. The Furniture was purchased in a previous year and will be worthless after ten years. c. The estimated yearly depreciation on the equipment is $350.- d. $2,750 of the rent paid to Ludwig Inc. in advance has not yet been earned. e. Unpaid and unrecorded advertising bills at year-end totalled $3,000. f. A review of the unadjusted balance in the prepaid rent account shows a remaining balance of $8,000 at the end of the year. g. Wages of $10,000 have been earned by Ludwig Inc.'s employees but have not yet been paid. h. A review of the unadjusted balance in the supplies account shows a balance on hand at the end of the year of $2,700. Use this information to prepare adjusting entries at June 30, 2014, based on the above. Enter the adjustment letter as the description. The dates must be entered in the format dd/mmm (ie. 15/Ja TEE atharina BELEGE A ESF General Journal Account/Explanation Date Page GJ8 F Debit Credit Ludwig Inc. Unadjusted Trial Balance June 30, 2014 Debit Credit Accounts Payable 250 Accounts Receivable 0 Accumulated Depreciation, Equipment 1,300 Accumulated Depreciation, Furniture 3,525 Advertising Expense 1,200 Advertising Payable 0 Share Capital 105,950 Cash 81,025 Consulting Revenue Earned 3,000 Depreciation Expense, Equipment 0 Depreciation Expense, Furniture 0 Equipment 42,800 Furniture 11,750 Prepaid Rent 14,500 Rent Earned 12,700 Rent Expense 3,800 Retained Earnings 35,000 Salaries Expense 400 + Date General Journal Account/Explanation FIFA Page GJS F Debit Credit + + Ludwig Inc. Unadjusted Trial Balance June 30, 2014 Debit Credit Accounts Payable 250 Accounts Receivable 0 Accumulated Depreciation, Equipment 1,300 | Accumulated Depreciation, Furniture 3,525 Advertising Expense 1,200 Advertising Payable 0 Share Capital 105,950 Cash 81,025 Consulting Revenue Earned 3,000 Depreciation Expense, Equipment 0 Depreciation Expense, Furniture Equipment 42,800 Furniture 11,750 Prepaid Rent 14,500 Rent Earned 12,700 Rent Expense 3,800 Retained Earnings 35,000 Salaries Expense 400 Salaries Payable Supplies 3,000 Supplies Expense 7,000 Unearned Rent 4,000 Utilities Expense 250 Totals 165,725 165,725 . o o o = 0 Ludwig Inc. is just finishing another year of operations. The company's unadjusted trial balance at June 30, 2014 is shown below. The following additional information is available at June 30 for they company's Unajusted vial balance at June 20. san. to shown because a. Consulting work performed but unrecorded at the end of the year totalled $10,000. b. The Furniture was purchased in a previous year and will be worthless after ten years. c. The estimated yearly depreciation on the equipment is $350.- d. $2,750 of the rent paid to Ludwig Inc. in advance has not yet been earned. e. Unpaid and unrecorded advertising bills at year-end totalled $3,000. f. A review of the unadjusted balance in the prepaid rent account shows a remaining balance of $8,000 at the end of the year. g. Wages of $10,000 have been earned by Ludwig Inc.'s employees but have not yet been paid. h. A review of the unadjusted balance in the supplies account shows a balance on hand at the end of the year of $2,700. Use this information to prepare adjusting entries at June 30, 2014, based on the above. Enter the adjustment letter as the description. The dates must be entered in the format dd/mmm (ie. 15/Ja TEE atharina BELEGE A ESF General Journal Account/Explanation Date Page GJ8 F Debit Credit Ludwig Inc. Unadjusted Trial Balance June 30, 2014 Debit Credit Accounts Payable 250 Accounts Receivable 0 Accumulated Depreciation, Equipment 1,300 Accumulated Depreciation, Furniture 3,525 Advertising Expense 1,200 Advertising Payable 0 Share Capital 105,950 Cash 81,025 Consulting Revenue Earned 3,000 Depreciation Expense, Equipment 0 Depreciation Expense, Furniture 0 Equipment 42,800 Furniture 11,750 Prepaid Rent 14,500 Rent Earned 12,700 Rent Expense 3,800 Retained Earnings 35,000 Salaries Expense 400 + Date General Journal Account/Explanation FIFA Page GJS F Debit Credit + + Ludwig Inc. Unadjusted Trial Balance June 30, 2014 Debit Credit Accounts Payable 250 Accounts Receivable 0 Accumulated Depreciation, Equipment 1,300 | Accumulated Depreciation, Furniture 3,525 Advertising Expense 1,200 Advertising Payable 0 Share Capital 105,950 Cash 81,025 Consulting Revenue Earned 3,000 Depreciation Expense, Equipment 0 Depreciation Expense, Furniture Equipment 42,800 Furniture 11,750 Prepaid Rent 14,500 Rent Earned 12,700 Rent Expense 3,800 Retained Earnings 35,000 Salaries Expense 400 Salaries Payable Supplies 3,000 Supplies Expense 7,000 Unearned Rent 4,000 Utilities Expense 250 Totals 165,725 165,725 . o o o = 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started