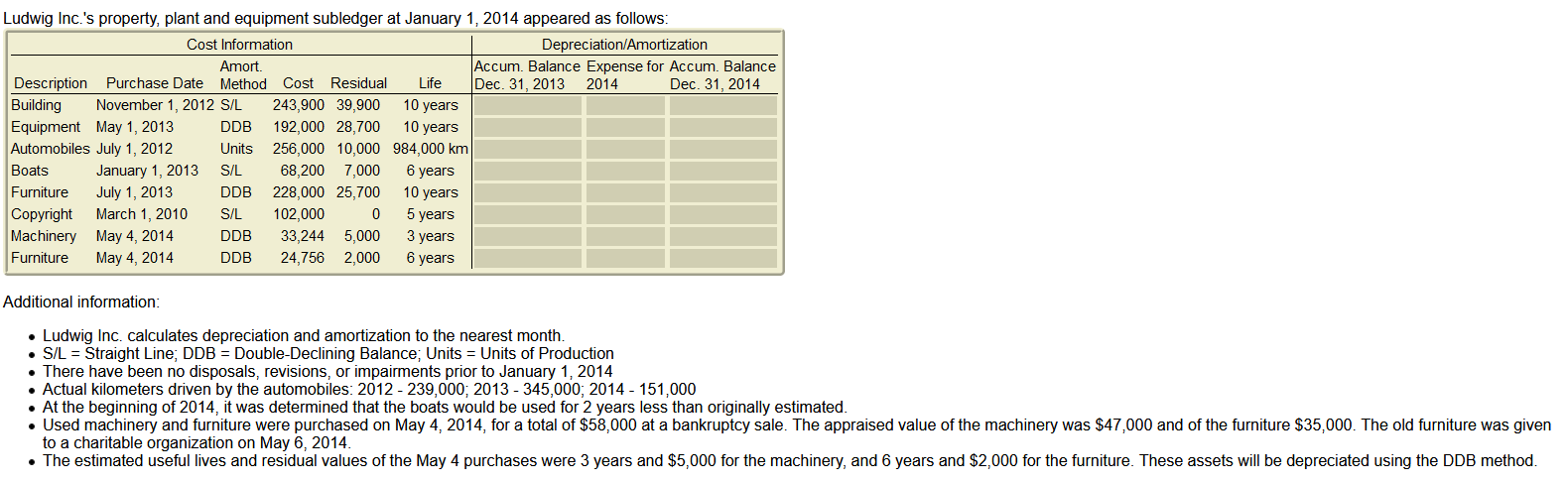

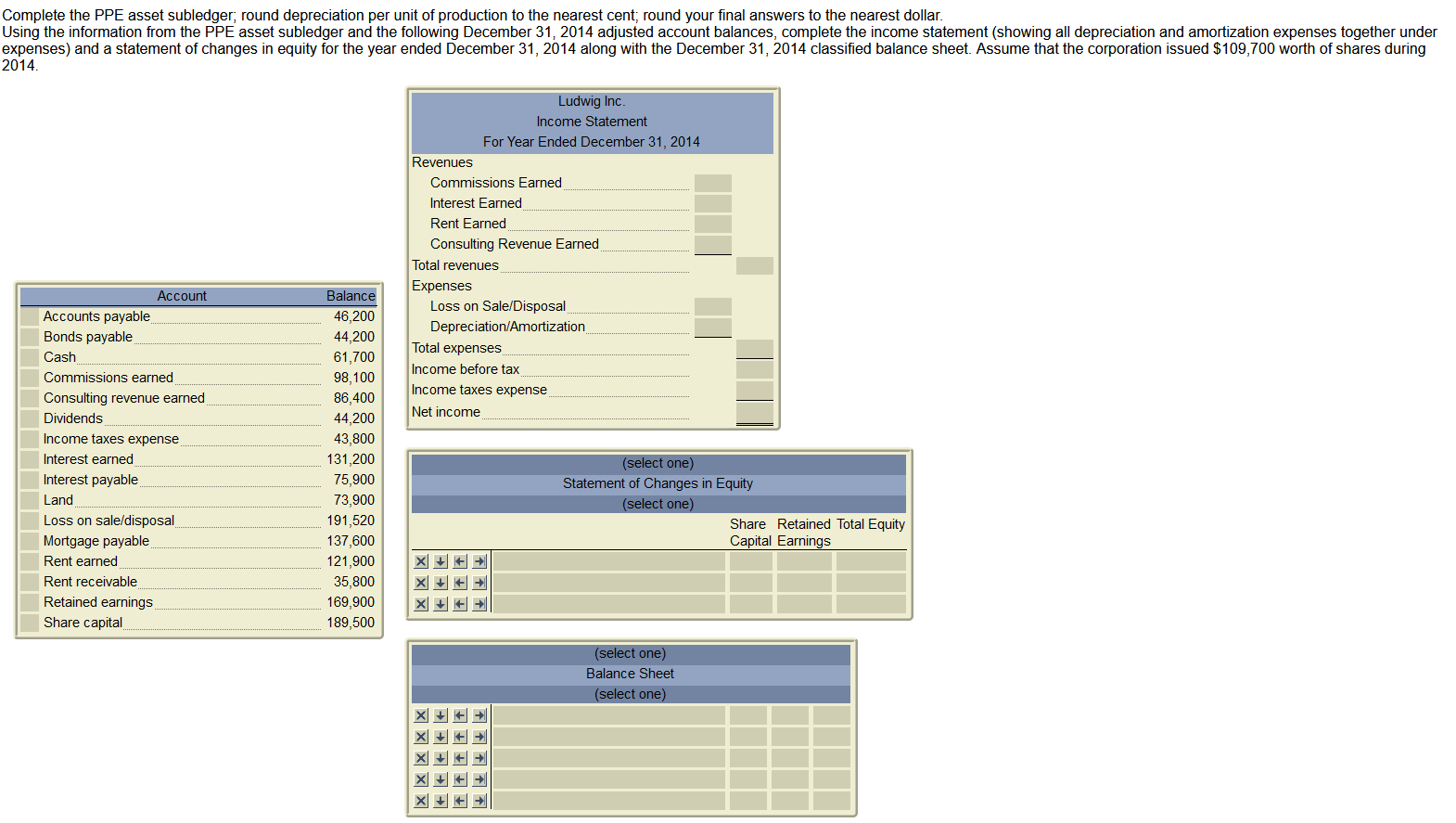

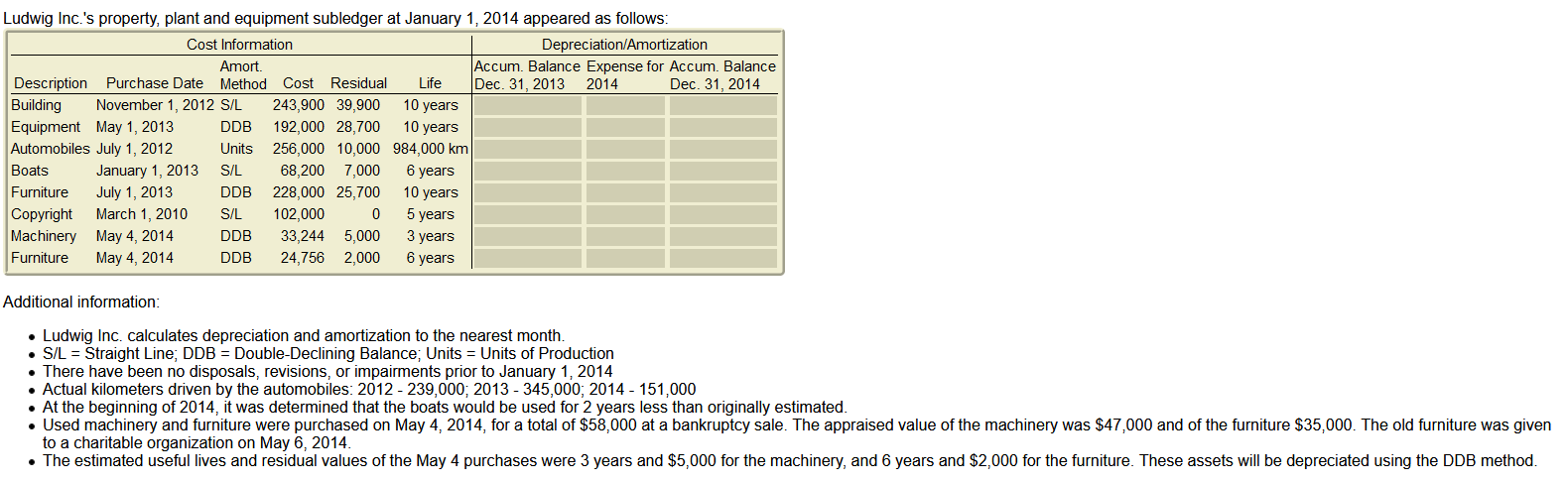

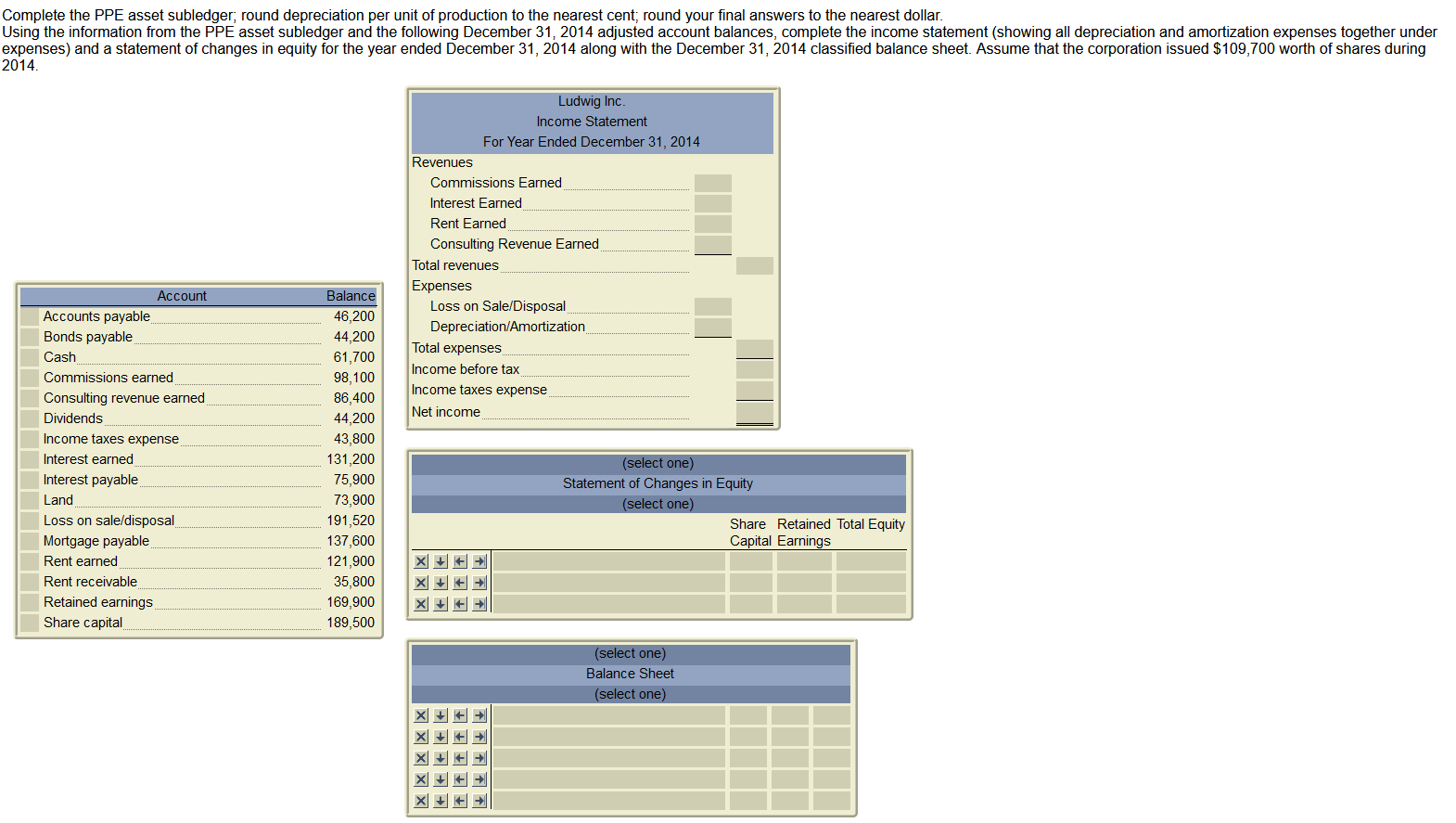

Ludwig Inc.'s property, plant and equipment subledger at January 1, 2014 appeared as follows: Cost Information Depreciation/Amortization Amort. Accum. Balance Expense for Accum. Balance Description Purchase Date Method Cost Residual Life Dec 31, 2013 2014 Dec. 31, 2014 Building November 1, 2012 S/L 243,900 39,900 10 years Equipment May 1, 2013 DDB 192,000 28,700 10 years Automobiles July 1, 2012 Units 256,000 10,000 984,000 km Boats January 1, 2013 S/L 68,200 7,000 6 years Furniture July 1, 2013 228,000 25,700 10 years Copyright March 1, 2010 S/L 102,000 0 Machinery May 4, 2014 DDB 33,244 5,000 3 years Furniture May 4, 2014 DDB 24,756 2,000 6 years DDB 5 years Additional information: Ludwig Inc. calculates depreciation and amortization to the nearest month. S/L = Straight Line, DDB = Double-Declining Balance; Units = Units of Production There have been no disposals, revisions, or impairments prior to January 1, 2014 Actual kilometers driven by the automobiles: 2012 - 239,000; 2013 - 345,000, 2014 - 151,000 At the beginning of 2014, it was determined that the boats would be used for 2 years less than originally estimated. Used machinery and furniture were purchased on May 4, 2014, for a total of $58,000 at a bankruptcy sale. The appraised value of the machinery was $47,000 and of the furniture $35,000. The old furniture was given to a charitable organization on May 6, 2014 The estimated useful lives and residual values of the May 4 purchases were 3 years and $5,000 for the machinery, and 6 years and $2,000 for the furniture. These assets will be depreciated using the DDB method. Complete the PPE asset subledger, round depreciation per unit of production to the nearest cent, round your final answers to the nearest dollar. Using the information from the PPE asset subledger and the following December 31, 2014 adjusted account balances, complete the income statement (showing all depreciation and amortization expenses together under expenses) and a statement of changes in equity for the year ended December 31, 2014 along with the December 31, 2014 classified balance sheet. Assume that the corporation issued $109,700 worth of shares during 2014 Ludwig Inc. Income Statement For Year Ended December 31, 2014 Revenues Commissions Earned Interest Earned Rent Earned Consulting Revenue Earned Total revenues Expenses Loss on Sale/Disposal Depreciation/Amortization Total expenses Income before tax Income taxes expense Net income Account Accounts payable Bonds payable Cash Commissions earned Consulting revenue earned Dividends Income taxes expense Interest earned Interest payable Land Loss on sale/disposal Mortgage payable Rent earned Rent receivable Retained earnings Share capital Balance 46,200 44,200 61,700 98,100 86,400 44,200 43,800 131,200 75,900 73,900 191,520 137,600 121,900 35,800 169,900 189,500 (select one) Statement of Changes in Equity (select one) Share Retained Total Equity Capital Earnings (select one) Balance Sheet (select one) XXXX