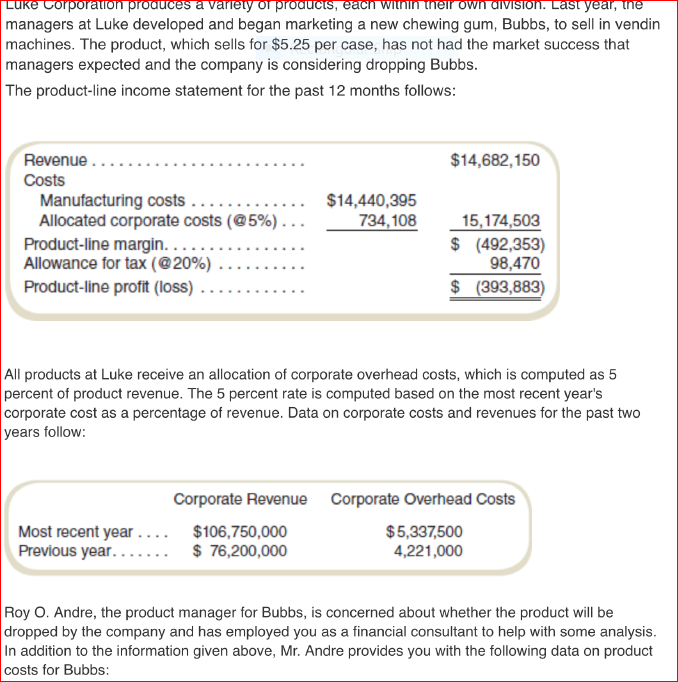

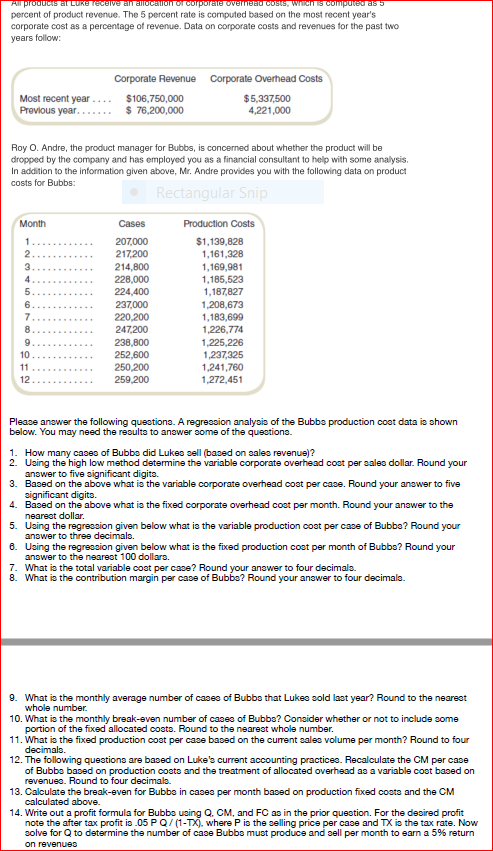

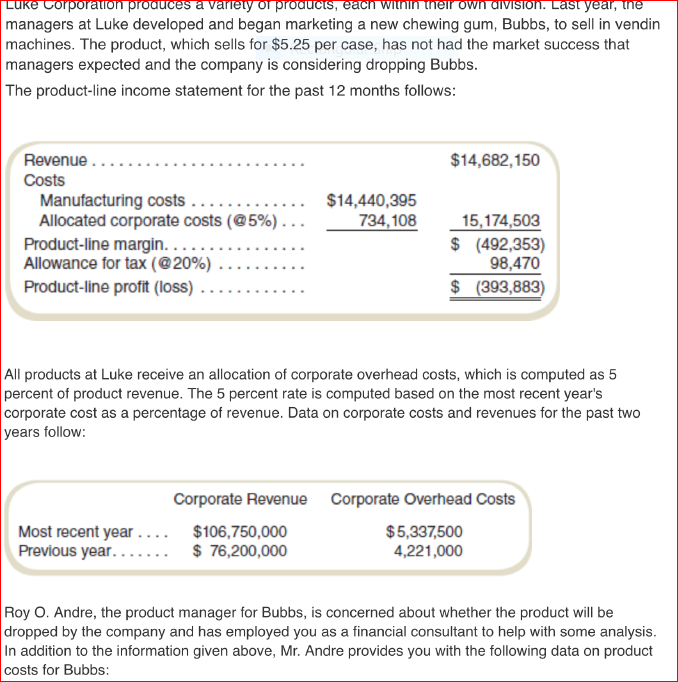

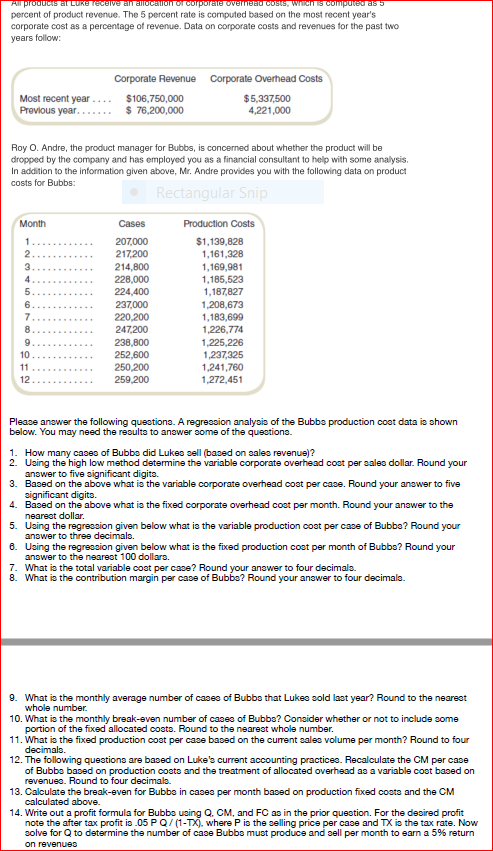

Luke Corporauon proauces a varnery of products, each wiinim ner own division. Last year,ne managers at Luke developed and began marketing a new chewing gum, Bubbs, to sell in vendin machines. The product, which sells for $5.25 per case, has not had the market success that managers expected and the company is considering dropping Bubbs The product-line income statement for the past 12 months follows Revenue Costs $14,682,150 . .__.. . ._.. .. Manufacturing costs Allocated corporate costs ( @5%).- . $14,440,395 734,108 15,174,503 $ (492,353) 98,470 $ (393,883) All products at Luke receive an allocation of corporate overhead costs, which is computed as 5 percent of product revenue. The 5 percent rate is computed based on the most recent year's corporate cost as a percentage of revenue. Data on corporate costs and revenues for the past two years follow Corporate Revenue Corporate Overhead Costs $5,337,500 4,221,000 Most recent year . .. . $106,750,000 Roy O. Andre, the product manager for Bubbs, is concerned about whether the product will be dropped by the company and has employed you as a financial consultant to help with some analysis In addition to the information given above, Mr. Andre provides you with the following data on product costs for Bubbs: percent of product revenue. The 5 percent rate is computed based on the most recent year's corporate cost as a percentage of revenue. Data on corporate costs and revenues for the past two years follow Corporate Revenue Most recent year Previous year Corporate Overhead Costs $5,337500 4,221,000 $106,750,000 $ 76,200,000 Roy O. Andre, the product manager for Bubbs, is concerned about whether the product will be dropped by the company and has employed you as a financial consultant to help with some analysis In addition to the information given above, Mr. Andre provides you with the following data on product costs for Bubbs: Production Costs 207,000 217,200 214,800 $1,139,828 1,161,328 1,169,981 1,187,827 1,208,673 1,183,699 1,226,774 1,225,226 1,237,325 1,241,760 1,272,451 237000 238,800 252,600 250,200 259,200 Pleaae anewer the following queetiona. A regreasion analysis of the Bubba production cost data is shown below. You may need the resulta to anwer some of the queetiona. 1. How many cases of Bubbe did Lukes ell (baed on salea revenue)? 2. Uaing the high low method determine the variable corporate overhead coet per aales dollar. Round your answer to five aignificant digits. 3. Based on the above what is the variable corporate overhead coat per case. Round your anewer to five aignificant digits. 4. Baed on the above what ia the fixed corporate overhead coet per month. Round your answer to the 5. Uaing the regreosion given below what is the variable production cost per cae of Bubba? Round your 6. Uaing the regreosion given below what is the fixed production coet per month of Bubbs? Round your 7. What is the total variable coat per caoe? Round neareat dollar answer to three decimals. answer to the nearest 100 dollars. your anawer to four decimala. 8. What is the contribution margin per case o f Bubbe? Round your anawer to four decimala. 9. What is the monthly average number of case of Bubbs that Lukea sold last year? Round to the neareot 10. What is the monthly break-even number of case of Bubbs? Coneider whether or not to include some 11. What is the fixed production coat per caae based on the current sales volume per month? Round to four 12. The following queations are based on Luke's current accounting practices. Recalculate the CM per case 13. Calculate the break-even for Bubba in case3 per month based on production fixed costa and the CM 14. Write out a profit formula for Bubbe uaing Q. CM, and FC as in the prior question. For the desired profit whole number portion of the fixed allocated coats. Round to the nearest whole number of Bubbe based on production costs and the treatment of allocated overhead as a variable cost baoed on revenue3. Round to four decimak. calculated abovwe. note the after tax profit is .05 PQ/(1- where P is the selling price per case and TX is the tax rate. Now 3olve for Q to determine the number of case Bubba must produce and aell per month to earn a 5% return